Callable security procedure

... Callable securities provide an issuer (the corporation that issued the debt instrument) with the option to call back or redeem bonds prior to maturity. In some cases, a security may be partially called rather than fully called. To assure that all shareholders are treated fairly in a partial call eve ...

... Callable securities provide an issuer (the corporation that issued the debt instrument) with the option to call back or redeem bonds prior to maturity. In some cases, a security may be partially called rather than fully called. To assure that all shareholders are treated fairly in a partial call eve ...

Stock Trading Stock Trading

... PBHK Stock Trading is a “Native App” which provides you with a fast, convenient and secured securities trading platform. Together with the comprehensive market information, it assists you to capture your investment opportunities anytime and anywhere. Investment involves risk. For enquiry, please cal ...

... PBHK Stock Trading is a “Native App” which provides you with a fast, convenient and secured securities trading platform. Together with the comprehensive market information, it assists you to capture your investment opportunities anytime and anywhere. Investment involves risk. For enquiry, please cal ...

Chapter 15 - Salem State University

... A nonreciprocal transfer of nonmonetary assets between a corporation and its owners. Assets other than cash Usually securities of other companies Record at fair value of the asset transferred Gain or loss is recognized ...

... A nonreciprocal transfer of nonmonetary assets between a corporation and its owners. Assets other than cash Usually securities of other companies Record at fair value of the asset transferred Gain or loss is recognized ...

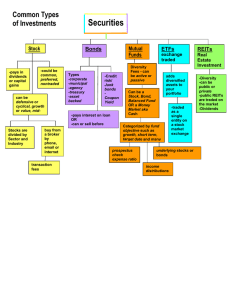

Stocks, Bonds, And Futures

... List the main reasons people choose to purchase stock. How do an investor purchase stock? How do corporate finances, investor expectations, and external forces influence stock prices? How does the futures market offer risks to sellers as well as to investors? ...

... List the main reasons people choose to purchase stock. How do an investor purchase stock? How do corporate finances, investor expectations, and external forces influence stock prices? How does the futures market offer risks to sellers as well as to investors? ...

Clarification on the offering securities via private placement at the

... private placement scheme, at the offering price of Baht 18 per share, in the total sum of no more than Baht 13,230,000,000, resulting in FPHT becoming a major shareholder of the Company with the shareholding of approximately 40 percent of the Company’s total voting rights after the subscription of t ...

... private placement scheme, at the offering price of Baht 18 per share, in the total sum of no more than Baht 13,230,000,000, resulting in FPHT becoming a major shareholder of the Company with the shareholding of approximately 40 percent of the Company’s total voting rights after the subscription of t ...

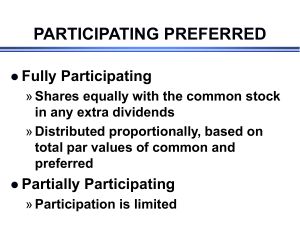

Video Q and A for Episode Two of No

... owners and may vote in matters affecting the company. Preferred stockholders do not have voting rights in the company but receive dividends before any return is paid to common stockholders. In the event of liquidation—that is, the company sells its assets and closes its doors—preferred stockholders ...

... owners and may vote in matters affecting the company. Preferred stockholders do not have voting rights in the company but receive dividends before any return is paid to common stockholders. In the event of liquidation—that is, the company sells its assets and closes its doors—preferred stockholders ...

Chapter 2.3

... 2. Shares of stock that a company can sell are known as __________________________ shares. The number of shares of stock a company can sell is listed in the company _____________________. Stocks that have been sold in the marketplace are known as ___________________ shares. Issued shares held by inv ...

... 2. Shares of stock that a company can sell are known as __________________________ shares. The number of shares of stock a company can sell is listed in the company _____________________. Stocks that have been sold in the marketplace are known as ___________________ shares. Issued shares held by inv ...

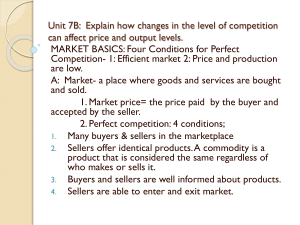

Unit 7B: Explain how changes in the level of

... interest in the company. 2. The stock holder receives one share on income paid out by the corporation or a dividend. 3. Corporations also raise capital by selling bonds or money the firm owes to people who lend it money. 4. Both stocks and bonds can be bought and sold in the stock markets. 5. The de ...

... interest in the company. 2. The stock holder receives one share on income paid out by the corporation or a dividend. 3. Corporations also raise capital by selling bonds or money the firm owes to people who lend it money. 4. Both stocks and bonds can be bought and sold in the stock markets. 5. The de ...

rainbow trading corporation spyglass trading. lp

... • Some short term trades using long index options or long put or call equity spreads • May execute long or short positions in stock ...

... • Some short term trades using long index options or long put or call equity spreads • May execute long or short positions in stock ...

short selling regulations

... the Exchange and an aggregate turnover of not less than HK$500 million during such period; and ...

... the Exchange and an aggregate turnover of not less than HK$500 million during such period; and ...

Securities and Exchange Commission v. Ralston Purina Co

... Is an offering of treasury stock to corporate employees within the exemption of §4(2) of the Securities Act of 1933? Holding No. Securities Act of 1933 §4(2) exempts only those offerings that are not a public offering. Absent special circumstances, stock sale to employees is a public offering. The U ...

... Is an offering of treasury stock to corporate employees within the exemption of §4(2) of the Securities Act of 1933? Holding No. Securities Act of 1933 §4(2) exempts only those offerings that are not a public offering. Absent special circumstances, stock sale to employees is a public offering. The U ...

Electrode Placement for Chest Leads, V1 to V6

... • The bid price: Price that a potential buyer is willing to spend to acquire the item. • Somewhere between these, a compromise is reached (similar to eBay). – NYSE and AMEX: auction style with a floor – NASDAQ: buying and selling negotiated through computers ...

... • The bid price: Price that a potential buyer is willing to spend to acquire the item. • Somewhere between these, a compromise is reached (similar to eBay). – NYSE and AMEX: auction style with a floor – NASDAQ: buying and selling negotiated through computers ...

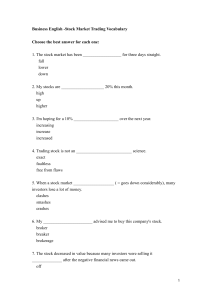

Business English -Stock Market Trading Vocabulary

... Choose the best answer for each one: 1. The stock market has been __________________ for three days straight. fall lower down 2. My stocks are ____________________ 20% this month. high up higher 3. I'm hoping for a 10% _____________________ over the next year. increasing increase increased 4. Tradin ...

... Choose the best answer for each one: 1. The stock market has been __________________ for three days straight. fall lower down 2. My stocks are ____________________ 20% this month. high up higher 3. I'm hoping for a 10% _____________________ over the next year. increasing increase increased 4. Tradin ...

Changes in Director`s Interest (S135)

... 420,000 ordinary shares of RM1.00 each representing 0.09% of the issued and paidup share capital of HIB. This announcement complies with Paragraphs 14.06 and 14.09 of the Main Market Listing Requirements of Bursa Malaysia Securities Berhad. This announcement is dated 17 January 2017. ...

... 420,000 ordinary shares of RM1.00 each representing 0.09% of the issued and paidup share capital of HIB. This announcement complies with Paragraphs 14.06 and 14.09 of the Main Market Listing Requirements of Bursa Malaysia Securities Berhad. This announcement is dated 17 January 2017. ...

Short (finance)

.png?width=300)

In finance, short selling (also known as shorting or going short) is the practice of selling securities or other financial instruments that are not currently owned, and subsequently repurchasing them (""covering""). In the event of an interim price decline, the short seller will profit, since the cost of (re)purchase will be less than the proceeds which were received upon the initial (short) sale. Conversely, the short position will be closed out at a loss in the event that the price of a shorted instrument should rise prior to repurchase. The potential loss on a short sale is theoretically unlimited in the event of an unlimited rise in the price of the instrument, however in practice the short seller will be required to post margin or collateral to cover losses, and any inability to do so on a timely basis would cause its broker or counterparty to liquidate the position. In the securities markets, the seller generally must borrow the securities in order to effect delivery in the short sale. In some cases, the short seller must pay a fee to borrow the securities and must additionally reimburse the lender for cash returns the lender would have received had the securities not been loaned out.Short selling is most commonly done with instruments traded in public securities, futures or currency markets, due to the liquidity and real-time price dissemination characteristic of such markets and because the instruments defined within each class are fungible.In practical terms, going short can be considered the opposite of the conventional practice of ""going long"", whereby an investor profits from an increase in the price of the asset. Mathematically, the return from a short position is equivalent to that of owning (being ""long"") a negative amount of the instrument. A short sale may be motivated by a variety of objectives. Speculators may sell short in the hope of realizing a profit on an instrument which appears to be overvalued, just as long investors or speculators hope to profit from a rise in the price of an instrument which appears undervalued. Traders or fund managers may hedge a long position or a portfolio through one or more short positions.