stock market project

... • A corporation is a business that has it’s own identity. • A corporation can be a private corporation meaning it is owned by an individual or a group. This corporation does not sell stock. • A public corporation means you can buy a piece of the corporation. This piece of ownership is called a share ...

... • A corporation is a business that has it’s own identity. • A corporation can be a private corporation meaning it is owned by an individual or a group. This corporation does not sell stock. • A public corporation means you can buy a piece of the corporation. This piece of ownership is called a share ...

chapter 4: buying and selling equities

... If the investor is unable or unwilling to provide additional cash or securities collateral, the broker will liquidate sufficient securities in the account to bring the account’s equity back up to 50%. Thus, during adverse market conditions, margin calls can have the effect of forcing investors t ...

... If the investor is unable or unwilling to provide additional cash or securities collateral, the broker will liquidate sufficient securities in the account to bring the account’s equity back up to 50%. Thus, during adverse market conditions, margin calls can have the effect of forcing investors t ...

Does the Stock Market Have Any Socially Beneficial Aspects?

... The two largest American exchanges on which stocks are bought and sold are the New York Stock Exchange (NYSE) and the National Association of Securities Dealers Automated Quotations (NASDAQ) ...

... The two largest American exchanges on which stocks are bought and sold are the New York Stock Exchange (NYSE) and the National Association of Securities Dealers Automated Quotations (NASDAQ) ...

ROYAL BANK OF SCOTLAND GROUP PLC (Form: 6-K

... Shares") of the Company at a subscription price of 239.6882 pence per New Ordinary Share. The shares have been sold in the market. The subscription price was determined by reference to the average market price during a period since the Company's Full Year 2016 results on 24 February 2017. The shares ...

... Shares") of the Company at a subscription price of 239.6882 pence per New Ordinary Share. The shares have been sold in the market. The subscription price was determined by reference to the average market price during a period since the Company's Full Year 2016 results on 24 February 2017. The shares ...

Marcus Corporation has a capital budget of $5 million and wants to

... A company’s dividend policy decision should not be influenced by which of the following? Constraints imposed by the firm's bond indenture. The fact that much of the firm's equipment has been leased rather than purchased The firm's ability to accelerate investment projects. The firm's ability to dela ...

... A company’s dividend policy decision should not be influenced by which of the following? Constraints imposed by the firm's bond indenture. The fact that much of the firm's equipment has been leased rather than purchased The firm's ability to accelerate investment projects. The firm's ability to dela ...

RMS Policy - Adinath Capital Services Limited

... is reversed by the end of the day by making a contra sale (or purchase) of the exact same quantity, thereby nullifying the original position. 2.2) Delivery Trades: The net purchase or sale of a scrip in a client account that is settled by way of a delivery on T+2. Delivery in respect of sale transac ...

... is reversed by the end of the day by making a contra sale (or purchase) of the exact same quantity, thereby nullifying the original position. 2.2) Delivery Trades: The net purchase or sale of a scrip in a client account that is settled by way of a delivery on T+2. Delivery in respect of sale transac ...

RMS Policy ESTEE ADVISORS PRIVATE LTD. RMS PROCESS

... is reversed by the end of the day by making a contra sale (or purchase) of the exact same quantity, thereby nullifying the original position. 2.2) Delivery Trades: The net purchase or sale of a scrip in a client account that is settled by way of a delivery on T+2. Delivery in respect of sale transac ...

... is reversed by the end of the day by making a contra sale (or purchase) of the exact same quantity, thereby nullifying the original position. 2.2) Delivery Trades: The net purchase or sale of a scrip in a client account that is settled by way of a delivery on T+2. Delivery in respect of sale transac ...

chapter 2 : markets and instruments

... Money market securities are called “cash equivalents” because of their great liquidity. The prices of money market securities are very stable, and they can be converted to cash (i.e., sold) on very short notice and with very low transaction costs. ...

... Money market securities are called “cash equivalents” because of their great liquidity. The prices of money market securities are very stable, and they can be converted to cash (i.e., sold) on very short notice and with very low transaction costs. ...

Chapter 12: Market Microstructure and Strategies

... – Dealers: trade for their own account or also facilitate customer orders (broker/dealer). ...

... – Dealers: trade for their own account or also facilitate customer orders (broker/dealer). ...

Gift of Publicly Listed Securities Form (Dec 2015)

... I understand that I will receive a Gift-in-Kind tax receipt for these securities from Big Brothers Big Sisters of Toronto for the closing price, on the date these securities are received in BBBST’s account. These securities have been donated to BBBST without restriction and can be sold by BBBST at a ...

... I understand that I will receive a Gift-in-Kind tax receipt for these securities from Big Brothers Big Sisters of Toronto for the closing price, on the date these securities are received in BBBST’s account. These securities have been donated to BBBST without restriction and can be sold by BBBST at a ...

Hockey is Nothing Like Investing

... particular business. What could be simpler than buying below that and selling above it? The problem with today is that many stocks are hanging around our reasonable sense of fair value and are not coming down to levels we think represent a margin of safety. And we are sick and tired of it, dammit. ...

... particular business. What could be simpler than buying below that and selling above it? The problem with today is that many stocks are hanging around our reasonable sense of fair value and are not coming down to levels we think represent a margin of safety. And we are sick and tired of it, dammit. ...

Advantages and disadvantages of investing in the Stock

... 150,000 shares. A share holder who owned 100 shares will now own 150 shares worth the same. The company does not receive any funds, and hence, there is no change in the value of the firm. The only change is that the company will transfer the value of the new shares from revenue reserves to share cap ...

... 150,000 shares. A share holder who owned 100 shares will now own 150 shares worth the same. The company does not receive any funds, and hence, there is no change in the value of the firm. The only change is that the company will transfer the value of the new shares from revenue reserves to share cap ...

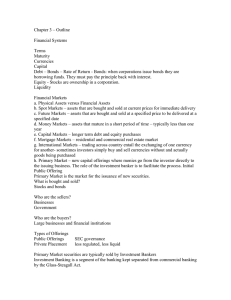

Chapter 3 – Outline

... b. Spot Markets – assets that are bought and sold at current prices for immediate delivery c. Future Markets – assets that are bought and sold at a specified price to be delivered at a specified date d. Money Markets – assets that mature in a short period of time – typically less than one year e. Ca ...

... b. Spot Markets – assets that are bought and sold at current prices for immediate delivery c. Future Markets – assets that are bought and sold at a specified price to be delivered at a specified date d. Money Markets – assets that mature in a short period of time – typically less than one year e. Ca ...

smgclassroompresentation[1]

... Mutual funds may be traded Closed-ended funds may be traded just like the stocks traded on the NYSE, NASDAQ and American Stock Exchanges. ...

... Mutual funds may be traded Closed-ended funds may be traded just like the stocks traded on the NYSE, NASDAQ and American Stock Exchanges. ...

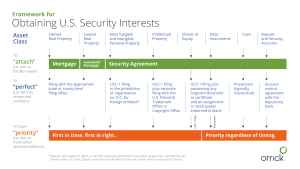

Obtaining US Security Interests

... UCC-1 filing plus possessing any original instrument or certificate and an assignment or stock power endorsed in blank ...

... UCC-1 filing plus possessing any original instrument or certificate and an assignment or stock power endorsed in blank ...

Short (finance)

.png?width=300)

In finance, short selling (also known as shorting or going short) is the practice of selling securities or other financial instruments that are not currently owned, and subsequently repurchasing them (""covering""). In the event of an interim price decline, the short seller will profit, since the cost of (re)purchase will be less than the proceeds which were received upon the initial (short) sale. Conversely, the short position will be closed out at a loss in the event that the price of a shorted instrument should rise prior to repurchase. The potential loss on a short sale is theoretically unlimited in the event of an unlimited rise in the price of the instrument, however in practice the short seller will be required to post margin or collateral to cover losses, and any inability to do so on a timely basis would cause its broker or counterparty to liquidate the position. In the securities markets, the seller generally must borrow the securities in order to effect delivery in the short sale. In some cases, the short seller must pay a fee to borrow the securities and must additionally reimburse the lender for cash returns the lender would have received had the securities not been loaned out.Short selling is most commonly done with instruments traded in public securities, futures or currency markets, due to the liquidity and real-time price dissemination characteristic of such markets and because the instruments defined within each class are fungible.In practical terms, going short can be considered the opposite of the conventional practice of ""going long"", whereby an investor profits from an increase in the price of the asset. Mathematically, the return from a short position is equivalent to that of owning (being ""long"") a negative amount of the instrument. A short sale may be motivated by a variety of objectives. Speculators may sell short in the hope of realizing a profit on an instrument which appears to be overvalued, just as long investors or speculators hope to profit from a rise in the price of an instrument which appears undervalued. Traders or fund managers may hedge a long position or a portfolio through one or more short positions.

![smgclassroompresentation[1]](http://s1.studyres.com/store/data/021802581_1-1933bb9c9a7cfb38987e81a50d5e9b34-300x300.png)