Newsletter - Sharemarket Game

... Charlotte was very active, buying and selling multiple times in a lot of different stocks. Strategy: “I set myself the goal of topping my school and doing well in the competition. To achieve this, I needed stocks which would move a lot in a short time. I researched the list of stocks and broke th ...

... Charlotte was very active, buying and selling multiple times in a lot of different stocks. Strategy: “I set myself the goal of topping my school and doing well in the competition. To achieve this, I needed stocks which would move a lot in a short time. I researched the list of stocks and broke th ...

Traded loans (borderline between securities and other financial

... maintained: that is, the loan should be reclassified as a security only if there is evidence of a market and there are quotations in the market. This change of category of financial instrument is achieved via a change in classification entry in the other changes in the volume of assets account and n ...

... maintained: that is, the loan should be reclassified as a security only if there is evidence of a market and there are quotations in the market. This change of category of financial instrument is achieved via a change in classification entry in the other changes in the volume of assets account and n ...

USE Insider Trading Rules-2009

... d) has access to unpublished price sensitive information from any of the persons mentioned in (a) or (b) above; e) all corporations, partnerships, trusts or other entities owned or controlled by any of the above persons. 3) Definition of price sensitive information Information is deemed to be price ...

... d) has access to unpublished price sensitive information from any of the persons mentioned in (a) or (b) above; e) all corporations, partnerships, trusts or other entities owned or controlled by any of the above persons. 3) Definition of price sensitive information Information is deemed to be price ...

Form 4 Statement of Changes in Beneficial Ownership of Securities

... There are no Derivative Securities Explanation of Responses (1) This Form 4 is filed by Elliott Associates, L.P. (the "Reporting Person"). The Reporting Person may be deemed to be a member of a Section 13(d) group that collectively beneficially owns more than 10% of the Issuer's outstanding shares o ...

... There are no Derivative Securities Explanation of Responses (1) This Form 4 is filed by Elliott Associates, L.P. (the "Reporting Person"). The Reporting Person may be deemed to be a member of a Section 13(d) group that collectively beneficially owns more than 10% of the Issuer's outstanding shares o ...

Stocks

... IPO occurs when a private company sells stocks to the public for the first time. Company needs to file with SEC (Securities Exchange Commission) to go public ...

... IPO occurs when a private company sells stocks to the public for the first time. Company needs to file with SEC (Securities Exchange Commission) to go public ...

Question 1 Over the past quarter XYZ company`s performance has

... Yes the investment should be as it would be available at discounted price due to higher market interest rate, and when the announcement will be made of reduction of 2% it is expected that market value of bond will go up. The company should hold it till the decision is made to have capital gain. It w ...

... Yes the investment should be as it would be available at discounted price due to higher market interest rate, and when the announcement will be made of reduction of 2% it is expected that market value of bond will go up. The company should hold it till the decision is made to have capital gain. It w ...

REAL ESTATE JUMBO JUNGLE Many home buyers sell stock

... of America Merrill Lynch has a “loan-management account” that offers clients a line of credit based on their Merrill Lynch taxable brokerage portfolio holdings. The funds can go toward numerous uses, including a mortgage down payment. Customers with substantial holdings currently may get interest ra ...

... of America Merrill Lynch has a “loan-management account” that offers clients a line of credit based on their Merrill Lynch taxable brokerage portfolio holdings. The funds can go toward numerous uses, including a mortgage down payment. Customers with substantial holdings currently may get interest ra ...

AFR Statement on SEC Final Rules Concerning Asset

... meaningful transparency and consistency of ratings across asset classes. The new requirements for asset-backed securities also have significant loopholes, particularly since they do not appear to cover privately issued structured finance products and certain significant asset classes. We hope the SE ...

... meaningful transparency and consistency of ratings across asset classes. The new requirements for asset-backed securities also have significant loopholes, particularly since they do not appear to cover privately issued structured finance products and certain significant asset classes. We hope the SE ...

Interest Rate Parity

... two members from amongst the officials of the ministers of central government dealing with Finance and Law. Two members who are professional and have experience or special knowledge relating to securities market. One member from RBI. ...

... two members from amongst the officials of the ministers of central government dealing with Finance and Law. Two members who are professional and have experience or special knowledge relating to securities market. One member from RBI. ...

Chapter 3 Demand, Supply, and Equilibrium

... A market is an institution or mechanism which brings together buyers and sellers of particular goods and services. ◦ May be local, national, or international. ◦ In order to be competitive, markets must have large numbers of buyers and sellers. ...

... A market is an institution or mechanism which brings together buyers and sellers of particular goods and services. ◦ May be local, national, or international. ◦ In order to be competitive, markets must have large numbers of buyers and sellers. ...

Surgutneftegas`s preferred shares: take a closer look!

... Warning: risk of loss. Investments in stock and any other securities may result in losses. Investments in bonds and debt instruments may result in losses due to reduced value of bonds, and unexpected loss, which may arise from full or partial default of the issuer (the enterprise's refusal to servic ...

... Warning: risk of loss. Investments in stock and any other securities may result in losses. Investments in bonds and debt instruments may result in losses due to reduced value of bonds, and unexpected loss, which may arise from full or partial default of the issuer (the enterprise's refusal to servic ...

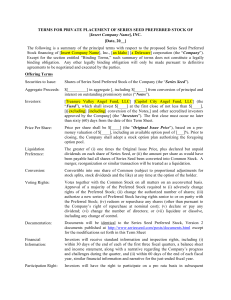

TERMS FOR PRIVATE PLACEMENT OF SERIES SEED

... within 30 days of the end of each of the first three fiscal quarters, a balance sheet and income statement, along with a narrative regarding the Company’s progress and challenges during the quarter, and (ii) within 60 days of the end of each fiscal year, similar financial information and narrative f ...

... within 30 days of the end of each of the first three fiscal quarters, a balance sheet and income statement, along with a narrative regarding the Company’s progress and challenges during the quarter, and (ii) within 60 days of the end of each fiscal year, similar financial information and narrative f ...

Process for donating stocks to the Russian Orthodox Church of the

... variations based on the type of stock, as well as the processes that various brokerage houses use. However, the general steps should be very similar. This document is NOT intended to provide any financial or tax advice, but simply outlines the general steps. It is the responsibility of every donor t ...

... variations based on the type of stock, as well as the processes that various brokerage houses use. However, the general steps should be very similar. This document is NOT intended to provide any financial or tax advice, but simply outlines the general steps. It is the responsibility of every donor t ...

Short (finance)

.png?width=300)

In finance, short selling (also known as shorting or going short) is the practice of selling securities or other financial instruments that are not currently owned, and subsequently repurchasing them (""covering""). In the event of an interim price decline, the short seller will profit, since the cost of (re)purchase will be less than the proceeds which were received upon the initial (short) sale. Conversely, the short position will be closed out at a loss in the event that the price of a shorted instrument should rise prior to repurchase. The potential loss on a short sale is theoretically unlimited in the event of an unlimited rise in the price of the instrument, however in practice the short seller will be required to post margin or collateral to cover losses, and any inability to do so on a timely basis would cause its broker or counterparty to liquidate the position. In the securities markets, the seller generally must borrow the securities in order to effect delivery in the short sale. In some cases, the short seller must pay a fee to borrow the securities and must additionally reimburse the lender for cash returns the lender would have received had the securities not been loaned out.Short selling is most commonly done with instruments traded in public securities, futures or currency markets, due to the liquidity and real-time price dissemination characteristic of such markets and because the instruments defined within each class are fungible.In practical terms, going short can be considered the opposite of the conventional practice of ""going long"", whereby an investor profits from an increase in the price of the asset. Mathematically, the return from a short position is equivalent to that of owning (being ""long"") a negative amount of the instrument. A short sale may be motivated by a variety of objectives. Speculators may sell short in the hope of realizing a profit on an instrument which appears to be overvalued, just as long investors or speculators hope to profit from a rise in the price of an instrument which appears undervalued. Traders or fund managers may hedge a long position or a portfolio through one or more short positions.