UNITED THERAPEUTICS Corp (Form: 4, Received: 02/13/2017 17

... Exercise price and number of shares/awards has been adjusted to reflect the issuer's two-for-one stock split on September 22, 2009. This transaction was executed in multiple trades at prices ranging from $163.70 to $164.67. The price reported above reflects the weighted average price. The reporting ...

... Exercise price and number of shares/awards has been adjusted to reflect the issuer's two-for-one stock split on September 22, 2009. This transaction was executed in multiple trades at prices ranging from $163.70 to $164.67. The price reported above reflects the weighted average price. The reporting ...

Ch 14 Problems - U of L Class Index

... 3- MAM Industries has a preferred stock issue outstanding which pays an annual dividend of $3.25 per share and currently has a market price of $25 per share. Compute the cost of preferred stock. (13%) 4- Suppose MAM’s capital structure is 30% debt, 10% preferred stock, and 60% equity. Using your ans ...

... 3- MAM Industries has a preferred stock issue outstanding which pays an annual dividend of $3.25 per share and currently has a market price of $25 per share. Compute the cost of preferred stock. (13%) 4- Suppose MAM’s capital structure is 30% debt, 10% preferred stock, and 60% equity. Using your ans ...

NSE DGs pronouncement today may determine market direction

... In the wake of improved market activity on the floor of the Nigerian Stock Exchange (NSE) which led to a recorded four percent gain in just one week, Ndi Okereke-Onyiuke, director-general of the Nigerian Stock Exchange, will today appraise the Exchange’s 2009 performance and review activities of the ...

... In the wake of improved market activity on the floor of the Nigerian Stock Exchange (NSE) which led to a recorded four percent gain in just one week, Ndi Okereke-Onyiuke, director-general of the Nigerian Stock Exchange, will today appraise the Exchange’s 2009 performance and review activities of the ...

File - BSC Economics

... a) A corporation's stock is traded in an over-the-counter market. b) People buy shares in a mutual fund. c) A pension fund manager buys commercial paper in the secondary market. d) An insurance company buys shares of common stock in the over-the-counter markets. e) None of the above. 9) Which of the ...

... a) A corporation's stock is traded in an over-the-counter market. b) People buy shares in a mutual fund. c) A pension fund manager buys commercial paper in the secondary market. d) An insurance company buys shares of common stock in the over-the-counter markets. e) None of the above. 9) Which of the ...

ACTA DE DIRECTORIO Nº 2547 (18

... - As of 01.30.09, 19,484,459 face value shares for a total amount of ARS 25,257,064. - As of 02.18.09, 20,378,986 face value shares for a total amount of ARS 26,428,034. The President next stated that considering the reasons for reacquisition of stock still prevailed, it was convenient for the Compa ...

... - As of 01.30.09, 19,484,459 face value shares for a total amount of ARS 25,257,064. - As of 02.18.09, 20,378,986 face value shares for a total amount of ARS 26,428,034. The President next stated that considering the reasons for reacquisition of stock still prevailed, it was convenient for the Compa ...

Panasonic Manufacturing Malaysia Berhad Maintain NEUTRAL

... (+0.1%yoy) which is a significant 60% of total assets. In addition, all of its subsidiaries are in net cash positions, hence intercompany lending is unnecessary at this juncture. Approximately 80% or RM500m of the cash is placed in fixed deposit instruments at local financial institutions (FIs) yiel ...

... (+0.1%yoy) which is a significant 60% of total assets. In addition, all of its subsidiaries are in net cash positions, hence intercompany lending is unnecessary at this juncture. Approximately 80% or RM500m of the cash is placed in fixed deposit instruments at local financial institutions (FIs) yiel ...

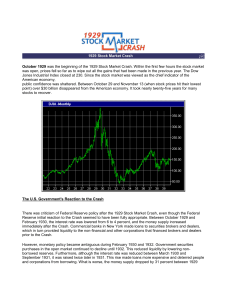

1929 Stock Market Crash ¡@ October 1929 was the beginning of the

... September 1931, it was raised twice later in 1931. This rise made loans more expensive and deterred people and corporations from borrowing. What is worse, the money supply dropped by 31 percent between 1929 ...

... September 1931, it was raised twice later in 1931. This rise made loans more expensive and deterred people and corporations from borrowing. What is worse, the money supply dropped by 31 percent between 1929 ...

Sam Strother and Shawna Tibbs are senior vice

... Forces current stock price based on dividends expected more than 3 years in the future. i. Suppose Temp Force is expected to experience zero growth during the first 3 years and then to resume its steady- state growth of 6% in the fourth year. What is the stocks value now? What is its expected divide ...

... Forces current stock price based on dividends expected more than 3 years in the future. i. Suppose Temp Force is expected to experience zero growth during the first 3 years and then to resume its steady- state growth of 6% in the fourth year. What is the stocks value now? What is its expected divide ...

Share capital increase to service stock option plan

... 666,500 shares with a par value of Euro 1 each, carrying normal dividend rights; the increase is to exclude preemption rights, as provided by paragraphs 5 and 6 of Art. 2441 of the Italian Civil Code, and will depend on payment of a subscription price, inclusive of a premium, of at least Euro 13.80 ...

... 666,500 shares with a par value of Euro 1 each, carrying normal dividend rights; the increase is to exclude preemption rights, as provided by paragraphs 5 and 6 of Art. 2441 of the Italian Civil Code, and will depend on payment of a subscription price, inclusive of a premium, of at least Euro 13.80 ...

HELBOR EMPREENDIMENTOS S.A. Publicly

... the market and the current number of shares held in treasury, the Company may at its sole discretion and under the terms of the Share Buyback Program, acquire up to 5,112,311 (five million, one hundred and twelve and three hundred and eleven) shares, corresponding up to 1.984% of the total shares is ...

... the market and the current number of shares held in treasury, the Company may at its sole discretion and under the terms of the Share Buyback Program, acquire up to 5,112,311 (five million, one hundred and twelve and three hundred and eleven) shares, corresponding up to 1.984% of the total shares is ...

Market Capitalisation– The overall market capitalisation remained

... The offer period for Vision Investments Limited (VIL) is now open and any person who wishes to purchase shares in VIL can contact one of the three licensed stockbroking firms. A copy of the Information Memorandum (IM) can be obtained to view details of the VIL offer. VIL will formally list on the SP ...

... The offer period for Vision Investments Limited (VIL) is now open and any person who wishes to purchase shares in VIL can contact one of the three licensed stockbroking firms. A copy of the Information Memorandum (IM) can be obtained to view details of the VIL offer. VIL will formally list on the SP ...

Worksheet on buying on margin and selling short. Buying on Margin

... ___________________________________________ $3,000 Stock | $1,200 Debt ...

... ___________________________________________ $3,000 Stock | $1,200 Debt ...

FISSION URANIUM CORP. (the “Company”) CERTIFICATE TO

... In connection with the abridgment of the time periods (the “Abridgment”) by the Company for notifying various regulatory authorities, exchanges and depositories of the record date and meeting date for the Company’s annual general meeting of shareholders to be held on June 29, 2017 (the “Meeting”), a ...

... In connection with the abridgment of the time periods (the “Abridgment”) by the Company for notifying various regulatory authorities, exchanges and depositories of the record date and meeting date for the Company’s annual general meeting of shareholders to be held on June 29, 2017 (the “Meeting”), a ...

KSE crossed all time high owing to 12 year low inflation figure

... This report is for information purposes only and does not constitutes an offer, or invitation to make an offer, to buy or sell any securities. All facts and figures have been taken from the sources that are considered reliable. This report is prepared for the use of Spectrum Securities clients and S ...

... This report is for information purposes only and does not constitutes an offer, or invitation to make an offer, to buy or sell any securities. All facts and figures have been taken from the sources that are considered reliable. This report is prepared for the use of Spectrum Securities clients and S ...

FREE Sample Here

... Which of the following statements is not true about the law of one price a. investors prefer more wealth to less b. investments that offer the same return in all states must pay the risk-free rate c. if two investment opportunities offer equivalent outcomes, they must have the same price d. investor ...

... Which of the following statements is not true about the law of one price a. investors prefer more wealth to less b. investments that offer the same return in all states must pay the risk-free rate c. if two investment opportunities offer equivalent outcomes, they must have the same price d. investor ...

Chapter 20, Section I

... A bull market is when investors buy in anticipation that stock prices will go up. A bear market is when investors sell in anticipation that stock prices will go down. Many factors go into the performance of stocks. Profits and expectations of success are one area: another is the overall economic cli ...

... A bull market is when investors buy in anticipation that stock prices will go up. A bear market is when investors sell in anticipation that stock prices will go down. Many factors go into the performance of stocks. Profits and expectations of success are one area: another is the overall economic cli ...

Main Market – key eligibility criteria

... The Main Market is the London Stock Exchange’s flagship market for large, established companies and our regulated market for listed securities. Issuers of securities admitted to trading on the Main Market are also admitted to the UK Listing Authority’s Official List. There are two listing segments – ...

... The Main Market is the London Stock Exchange’s flagship market for large, established companies and our regulated market for listed securities. Issuers of securities admitted to trading on the Main Market are also admitted to the UK Listing Authority’s Official List. There are two listing segments – ...

Equity Investment Approach - Retirement Income Management

... factors come into focus in the screening process including the size of the company, dividend growth, return on equity, sales growth, cash flow growth, earnings growth, earnings momentum/surprise, and debt levels. Standard & Poors Quality Rankings (sales, earnings, and dividends) are also utilized as ...

... factors come into focus in the screening process including the size of the company, dividend growth, return on equity, sales growth, cash flow growth, earnings growth, earnings momentum/surprise, and debt levels. Standard & Poors Quality Rankings (sales, earnings, and dividends) are also utilized as ...

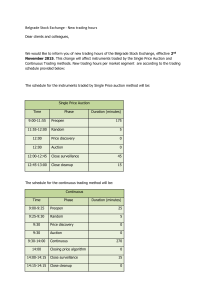

Belgrade Stock Exchange - New trading hours Dear clients and

... November 2015. This change will affect instruments traded by the Single Price Auction and Continuous Trading methods. New trading hours per market segment are according to the trading schedule provided below: ...

... November 2015. This change will affect instruments traded by the Single Price Auction and Continuous Trading methods. New trading hours per market segment are according to the trading schedule provided below: ...

Short (finance)

.png?width=300)

In finance, short selling (also known as shorting or going short) is the practice of selling securities or other financial instruments that are not currently owned, and subsequently repurchasing them (""covering""). In the event of an interim price decline, the short seller will profit, since the cost of (re)purchase will be less than the proceeds which were received upon the initial (short) sale. Conversely, the short position will be closed out at a loss in the event that the price of a shorted instrument should rise prior to repurchase. The potential loss on a short sale is theoretically unlimited in the event of an unlimited rise in the price of the instrument, however in practice the short seller will be required to post margin or collateral to cover losses, and any inability to do so on a timely basis would cause its broker or counterparty to liquidate the position. In the securities markets, the seller generally must borrow the securities in order to effect delivery in the short sale. In some cases, the short seller must pay a fee to borrow the securities and must additionally reimburse the lender for cash returns the lender would have received had the securities not been loaned out.Short selling is most commonly done with instruments traded in public securities, futures or currency markets, due to the liquidity and real-time price dissemination characteristic of such markets and because the instruments defined within each class are fungible.In practical terms, going short can be considered the opposite of the conventional practice of ""going long"", whereby an investor profits from an increase in the price of the asset. Mathematically, the return from a short position is equivalent to that of owning (being ""long"") a negative amount of the instrument. A short sale may be motivated by a variety of objectives. Speculators may sell short in the hope of realizing a profit on an instrument which appears to be overvalued, just as long investors or speculators hope to profit from a rise in the price of an instrument which appears undervalued. Traders or fund managers may hedge a long position or a portfolio through one or more short positions.