Lecture 2

... Expectations regarding the future price of the stock given the information contained in f is equal to the expected price given the current price. ...

... Expectations regarding the future price of the stock given the information contained in f is equal to the expected price given the current price. ...

Stocks Are Not The New Bonds

... bonds, to their investment portfolios. Pools of investment-grade ...

... bonds, to their investment portfolios. Pools of investment-grade ...

Chapter 9 Behavioral Finance and Technical Analysis

... Changes in fundamentals can wipe out any arbitrage profits, making the strategy risky. ...

... Changes in fundamentals can wipe out any arbitrage profits, making the strategy risky. ...

DISADVANTAGES of ISSUING BONDS LG4

... • Splits cause no change in the firm’s ownership structure and no change in the investment’s value. • Firms can never be forced to spilt their stocks. ...

... • Splits cause no change in the firm’s ownership structure and no change in the investment’s value. • Firms can never be forced to spilt their stocks. ...

Uncle Sam Can`t Touch These `Tax-Free Dividends`

... To ensure that you receive these emails, please add us to your address book. Disclosure: StreetAuthority does not own any of the securities mentioned in this article. In accordance with company policies, StreetAuthority always provides readers with at least 48 hours advance notice before buying or s ...

... To ensure that you receive these emails, please add us to your address book. Disclosure: StreetAuthority does not own any of the securities mentioned in this article. In accordance with company policies, StreetAuthority always provides readers with at least 48 hours advance notice before buying or s ...

Curb Your Mind – Understanding Why Investors Don`t Achieve Their

... and their fortunes evaporate. They failed to realize they had already won the lottery and did not cash in the ticket. Note, this is also common with oil and real estate holdings (especially in Texas.) Slow Drip - 2000-2002 - Many people sold out of stocks during a painful three-year decline in marke ...

... and their fortunes evaporate. They failed to realize they had already won the lottery and did not cash in the ticket. Note, this is also common with oil and real estate holdings (especially in Texas.) Slow Drip - 2000-2002 - Many people sold out of stocks during a painful three-year decline in marke ...

Convertibles During High Inflation

... of shares. The hybrid nature of the securities offers investors the principal protection and income characteristics of bonds with the opportunity for higher returns if the issuer’s stock price rises. This discussion also includes convertible preferred shares, which have similar characteristics. Ther ...

... of shares. The hybrid nature of the securities offers investors the principal protection and income characteristics of bonds with the opportunity for higher returns if the issuer’s stock price rises. This discussion also includes convertible preferred shares, which have similar characteristics. Ther ...

Trading Issues and Enhanced Regulatory Disclosures

... http://www.businessweek.com/news/2011-11-10/eu-nations-back-shortsale-law-over-u-k-s-legality-concerns.html. ...

... http://www.businessweek.com/news/2011-11-10/eu-nations-back-shortsale-law-over-u-k-s-legality-concerns.html. ...

Weekly Commentary 08-27-12 PAA

... * The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market. * Gold represents theLondonafternoon gold price fix as report ...

... * The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market. * Gold represents theLondonafternoon gold price fix as report ...

Blackstone Real Estate Income Trust, Inc.

... On May 30, 2017, Blackstone Real Estate Income Trust, Inc. (the “Company”) declared distributions for each applicable class of its common stock in the amount per share set forth below: ...

... On May 30, 2017, Blackstone Real Estate Income Trust, Inc. (the “Company”) declared distributions for each applicable class of its common stock in the amount per share set forth below: ...

Sumitomo Corporation Announces the Exercise Price of Stock Options

... number of shares subject to such new share acquisition rights. The Exercise Price shall be JPY 1,124. When the Company issues new shares at a price below the market price following the issuance of new share acquisition rights, the Exercise Price shall be adjusted using the following formula, roundin ...

... number of shares subject to such new share acquisition rights. The Exercise Price shall be JPY 1,124. When the Company issues new shares at a price below the market price following the issuance of new share acquisition rights, the Exercise Price shall be adjusted using the following formula, roundin ...

Ch.1 - 13ed Overview of Fin Mgmt

... Country risk. Depends on the country’s economic, political, and social environment. Exchange rate risk. Non-dollar denominated investment’s value depends on what happens to exchange rate. Exchange rates affected ...

... Country risk. Depends on the country’s economic, political, and social environment. Exchange rate risk. Non-dollar denominated investment’s value depends on what happens to exchange rate. Exchange rates affected ...

FridayMarch7thMeeting - Sites at Lafayette

... The environment group - originally won $19 billion dollars from Chevron for human rights and environmental violations, which Chevron had refused to pay. ...

... The environment group - originally won $19 billion dollars from Chevron for human rights and environmental violations, which Chevron had refused to pay. ...

ING to sell 33 million shares in NN Group

... ordinary shares in NN Group. NN Group will not be issuing or selling shares as part of this transaction, and will not receive any proceeds from the offering. The transaction reduces ING Group’s stake in NN Group from 25.8% to 16.2% of outstanding shares (net of treasury shares). The shares will be o ...

... ordinary shares in NN Group. NN Group will not be issuing or selling shares as part of this transaction, and will not receive any proceeds from the offering. The transaction reduces ING Group’s stake in NN Group from 25.8% to 16.2% of outstanding shares (net of treasury shares). The shares will be o ...

PDF - BTR Capital Management

... from stocks had approximated ten percent per year. The stock market had been rising at nearly twice that rate, and the most commonly stated expectations of future investment returns were huge. Some observers, including we at BTR, preached caution. But the most typical response we heard was that we ...

... from stocks had approximated ten percent per year. The stock market had been rising at nearly twice that rate, and the most commonly stated expectations of future investment returns were huge. Some observers, including we at BTR, preached caution. But the most typical response we heard was that we ...

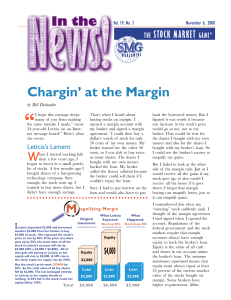

Chargin` at the Margin

... buy stock. For example, Leticia wanted to buy $4,000 worth of stock on margin. She first had to deposit $2,000 of equity (cash) before her broker would loan her the other $2,000. In a sense, the margin is like a minimum down payment. The Federal Reserve sets this minimum, which today requires invest ...

... buy stock. For example, Leticia wanted to buy $4,000 worth of stock on margin. She first had to deposit $2,000 of equity (cash) before her broker would loan her the other $2,000. In a sense, the margin is like a minimum down payment. The Federal Reserve sets this minimum, which today requires invest ...

The Great Depression - What Crashed and Why?

... products. American farmers were left with piles of surplus crops and no market. The world market left its mark on the American economy in other ways. Congress had set tariffs, or taxes on imported products. The tariffs made it very hard for other countries to sell their goods in the U.S. With the lo ...

... products. American farmers were left with piles of surplus crops and no market. The world market left its mark on the American economy in other ways. Congress had set tariffs, or taxes on imported products. The tariffs made it very hard for other countries to sell their goods in the U.S. With the lo ...

companhia energética de minas gerais – cemig

... the “Company”), pursuant to Section 157, §4° of Law No. 6,404, dated December 15, 1976, as amended, and the Brazilian Securities and Exchange Commission (Comissão de Valores Mobiliários) (“CVM”) Rule No. 358, dated January 3rd, 2002, as amended, in addition to the material fact dated September 29, 2 ...

... the “Company”), pursuant to Section 157, §4° of Law No. 6,404, dated December 15, 1976, as amended, and the Brazilian Securities and Exchange Commission (Comissão de Valores Mobiliários) (“CVM”) Rule No. 358, dated January 3rd, 2002, as amended, in addition to the material fact dated September 29, 2 ...

AC ALTERNATIVES® Equity Market Neutral

... Alternative mutual funds often hold a variety of non-traditional investments, and also often employ more complex trading strategies than traditional mutual funds. Each of these different alternative asset classes and investment strategies have unique risks making them more suitable for investors wit ...

... Alternative mutual funds often hold a variety of non-traditional investments, and also often employ more complex trading strategies than traditional mutual funds. Each of these different alternative asset classes and investment strategies have unique risks making them more suitable for investors wit ...

How to Choose Stocks | CompareCards.com

... high Price to Earnings ratio compared to others? What is their operating profit %? Do they pay a dividend? ...

... high Price to Earnings ratio compared to others? What is their operating profit %? Do they pay a dividend? ...

Short (finance)

.png?width=300)

In finance, short selling (also known as shorting or going short) is the practice of selling securities or other financial instruments that are not currently owned, and subsequently repurchasing them (""covering""). In the event of an interim price decline, the short seller will profit, since the cost of (re)purchase will be less than the proceeds which were received upon the initial (short) sale. Conversely, the short position will be closed out at a loss in the event that the price of a shorted instrument should rise prior to repurchase. The potential loss on a short sale is theoretically unlimited in the event of an unlimited rise in the price of the instrument, however in practice the short seller will be required to post margin or collateral to cover losses, and any inability to do so on a timely basis would cause its broker or counterparty to liquidate the position. In the securities markets, the seller generally must borrow the securities in order to effect delivery in the short sale. In some cases, the short seller must pay a fee to borrow the securities and must additionally reimburse the lender for cash returns the lender would have received had the securities not been loaned out.Short selling is most commonly done with instruments traded in public securities, futures or currency markets, due to the liquidity and real-time price dissemination characteristic of such markets and because the instruments defined within each class are fungible.In practical terms, going short can be considered the opposite of the conventional practice of ""going long"", whereby an investor profits from an increase in the price of the asset. Mathematically, the return from a short position is equivalent to that of owning (being ""long"") a negative amount of the instrument. A short sale may be motivated by a variety of objectives. Speculators may sell short in the hope of realizing a profit on an instrument which appears to be overvalued, just as long investors or speculators hope to profit from a rise in the price of an instrument which appears undervalued. Traders or fund managers may hedge a long position or a portfolio through one or more short positions.