Foundation Medicine, Inc.

... The sales reported in this Form 4 were effected pursuant to a Rule 10b5-1 trading plan adopted by the reporting person on August 19, ...

... The sales reported in this Form 4 were effected pursuant to a Rule 10b5-1 trading plan adopted by the reporting person on August 19, ...

The Future Value of a Dollar (FVD)

... The Major Functions of Money include: 1. medium of exchange – It must be accepted by everyone as a payment for goods and services. In the past in addition to currency materials including gold, silver and salt have been used as medium of exchange. 2. standard of value – When something is a measure of ...

... The Major Functions of Money include: 1. medium of exchange – It must be accepted by everyone as a payment for goods and services. In the past in addition to currency materials including gold, silver and salt have been used as medium of exchange. 2. standard of value – When something is a measure of ...

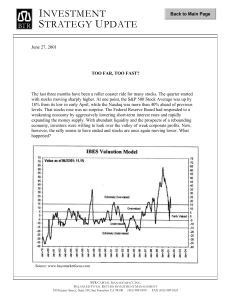

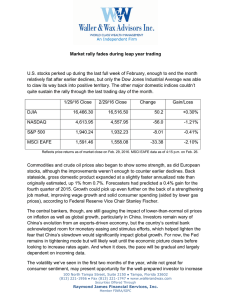

INVESTMENT STRATEGY UPDATE

... evolution of the Internet will continue bringing major change to our daily lives -- only differently than was originally envisioned by stock market bubble investors, the dot-com entrepreneurs, and the venture capitalists who backed them. Regarding valuations, we are well aware that the stock market ...

... evolution of the Internet will continue bringing major change to our daily lives -- only differently than was originally envisioned by stock market bubble investors, the dot-com entrepreneurs, and the venture capitalists who backed them. Regarding valuations, we are well aware that the stock market ...

31. On December 1, you borrow $210,000 to buy a house. The

... 33. Interest rates or rates of return on investments that have not been adjusted for the effects of inflation are called _____ rates. nominal 34. You own a bond that has a 7 percent coupon and matures in 12 years. You purchased this bond at par value when it was originally issued. If the current mar ...

... 33. Interest rates or rates of return on investments that have not been adjusted for the effects of inflation are called _____ rates. nominal 34. You own a bond that has a 7 percent coupon and matures in 12 years. You purchased this bond at par value when it was originally issued. If the current mar ...

Cooperative phenomena Theory of Social Imitation

... 19th century Irish Stock Exchange Deals done 'matched bargain basis' members of exchange bring buyers and sellers together ...

... 19th century Irish Stock Exchange Deals done 'matched bargain basis' members of exchange bring buyers and sellers together ...

APPLICATION FOR LuSE MEMBERSHIP

... A trading member may participate in all the activities of the exchange except that the member shall not clear or settle it’s own transactions or the transactions of others (for which purposes he shall appoint a full member) ...

... A trading member may participate in all the activities of the exchange except that the member shall not clear or settle it’s own transactions or the transactions of others (for which purposes he shall appoint a full member) ...

20 Dec 15 AGNC stock price appreciation in 2016

... report. By freeing up about $7 billion, the opportunity for increased earnings will spur the dividend growth and stock price appreciation. The choice of not readjusting the balance between their investments and their hedge fund would cost the company billions in earnings in 2016. Without the likelih ...

... report. By freeing up about $7 billion, the opportunity for increased earnings will spur the dividend growth and stock price appreciation. The choice of not readjusting the balance between their investments and their hedge fund would cost the company billions in earnings in 2016. Without the likelih ...

(T+2) Settlement Cycle Introductory Materials

... No, there is no impact on traders. Buyers can sell securities directly upon executing transactions with no need to wait for completing the settlement of securities. Also, sellers gain purchasing power that enables them to buy new securities directly upon executing transactions with no need to wait f ...

... No, there is no impact on traders. Buyers can sell securities directly upon executing transactions with no need to wait for completing the settlement of securities. Also, sellers gain purchasing power that enables them to buy new securities directly upon executing transactions with no need to wait f ...

Geren. Con.SU.J:t1nlil

... an employee receives the stock at a certain value. As the employee works hard for the success of the company, the value of that stock will increase and the employee thus shares iu the company's success. However, mandatory expensing, as proposed by the FASB, would require a value to be placed on a st ...

... an employee receives the stock at a certain value. As the employee works hard for the success of the company, the value of that stock will increase and the employee thus shares iu the company's success. However, mandatory expensing, as proposed by the FASB, would require a value to be placed on a st ...

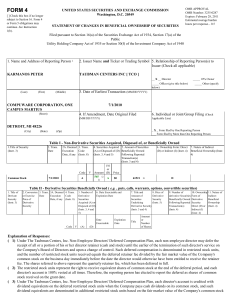

TAUBMAN CENTERS INC (Form: 4, Received: 07/01/2010 16:04:49)

... ( 1) Under The Taubman Centers, Inc. Non-Employee Directors' Deferred Compensation Plan, each non-employee director may defer the receipt of all or a portion of his or her director retainer (cash and stock) until the earlier of the termination of such director's service on the Company's Board of Dir ...

... ( 1) Under The Taubman Centers, Inc. Non-Employee Directors' Deferred Compensation Plan, each non-employee director may defer the receipt of all or a portion of his or her director retainer (cash and stock) until the earlier of the termination of such director's service on the Company's Board of Dir ...

Listed Index Fund International Bond (Citi WGBI) Monthly

... - Because ETFs invest in securities whose prices fluctuate, the market price or base value may decrease due to shifts in the underling index or foreign exchange market, fluctuations in the price of constituent securities, bankruptcy or deterioration in the financial conditions of constituent securit ...

... - Because ETFs invest in securities whose prices fluctuate, the market price or base value may decrease due to shifts in the underling index or foreign exchange market, fluctuations in the price of constituent securities, bankruptcy or deterioration in the financial conditions of constituent securit ...

Corporate Valuation, Tool Kit

... Gives owner of option the right to buy a share of the company’s stock at a specified price (called the strike price or exercise price) even if the actual stock price is higher. Usually can’t exercise the option for several years (called the vesting ...

... Gives owner of option the right to buy a share of the company’s stock at a specified price (called the strike price or exercise price) even if the actual stock price is higher. Usually can’t exercise the option for several years (called the vesting ...

4 - Cengage

... If the investor purchases between 20% and 50% of the outstanding stock of the investee, the investor is considered to have significant influence over the investee and the investment is accounted for using the equity method. ...

... If the investor purchases between 20% and 50% of the outstanding stock of the investee, the investor is considered to have significant influence over the investee and the investment is accounted for using the equity method. ...

Economics 330 Money and Banking Lecture 18

... Traded on Exchanges: Global competition Regulated by CFTC Success of Futures Over Forwards 1. Futures more liquid: standardized, can be traded again, delivery of range of securities 2. Delivery of range of securities prevents corner 3. Mark to market and margin requirements: avoids default risk 4. D ...

... Traded on Exchanges: Global competition Regulated by CFTC Success of Futures Over Forwards 1. Futures more liquid: standardized, can be traded again, delivery of range of securities 2. Delivery of range of securities prevents corner 3. Mark to market and margin requirements: avoids default risk 4. D ...

Causes of the Great Depression

... • 5) Credit begins drying up so less people buying companies’ product leading to decrease sales • 6) Professional investors sense danger and begin selling stocks ...

... • 5) Credit begins drying up so less people buying companies’ product leading to decrease sales • 6) Professional investors sense danger and begin selling stocks ...

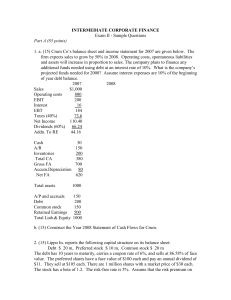

A corporate bond maturing in 5 years carries a 10% coupon rate and

... a. What is the after-tax cost of debt, preferred stock and common stock? b. What is the weighted average cost of capital for the firm, if the current capital structure based on market values is the optimal capital structure? 3. (5) Roland & Company has a new management team that has developed an ope ...

... a. What is the after-tax cost of debt, preferred stock and common stock? b. What is the weighted average cost of capital for the firm, if the current capital structure based on market values is the optimal capital structure? 3. (5) Roland & Company has a new management team that has developed an ope ...

Short (finance)

.png?width=300)

In finance, short selling (also known as shorting or going short) is the practice of selling securities or other financial instruments that are not currently owned, and subsequently repurchasing them (""covering""). In the event of an interim price decline, the short seller will profit, since the cost of (re)purchase will be less than the proceeds which were received upon the initial (short) sale. Conversely, the short position will be closed out at a loss in the event that the price of a shorted instrument should rise prior to repurchase. The potential loss on a short sale is theoretically unlimited in the event of an unlimited rise in the price of the instrument, however in practice the short seller will be required to post margin or collateral to cover losses, and any inability to do so on a timely basis would cause its broker or counterparty to liquidate the position. In the securities markets, the seller generally must borrow the securities in order to effect delivery in the short sale. In some cases, the short seller must pay a fee to borrow the securities and must additionally reimburse the lender for cash returns the lender would have received had the securities not been loaned out.Short selling is most commonly done with instruments traded in public securities, futures or currency markets, due to the liquidity and real-time price dissemination characteristic of such markets and because the instruments defined within each class are fungible.In practical terms, going short can be considered the opposite of the conventional practice of ""going long"", whereby an investor profits from an increase in the price of the asset. Mathematically, the return from a short position is equivalent to that of owning (being ""long"") a negative amount of the instrument. A short sale may be motivated by a variety of objectives. Speculators may sell short in the hope of realizing a profit on an instrument which appears to be overvalued, just as long investors or speculators hope to profit from a rise in the price of an instrument which appears undervalued. Traders or fund managers may hedge a long position or a portfolio through one or more short positions.