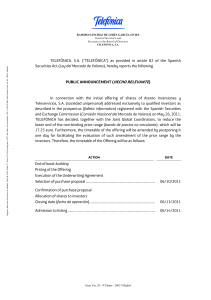

TELEFÓNICA, S.A. (“TELEFÓNICA”) as provided in article 82 of the

... constitute an offer, solicitation or sale in any jurisdiction in which, or to any persons to whom, such an offer, solicitation or sale is unlawful. The information contained in this Communication is being disclosed in accordance with Rule 135c under the U.S. Securities Act of 1933, as amended (the " ...

... constitute an offer, solicitation or sale in any jurisdiction in which, or to any persons to whom, such an offer, solicitation or sale is unlawful. The information contained in this Communication is being disclosed in accordance with Rule 135c under the U.S. Securities Act of 1933, as amended (the " ...

INSIDER TRADING RWM abides by national and local laws, rules

... RWM abides by national and local laws, rules and regulations, including all applicable guidelines issued by the Philippine Stock Exchange (PSE). It is therefore illegal to buy or sell securities of any company, including RWM’s, based on material non-public information, unless exempted under the law. ...

... RWM abides by national and local laws, rules and regulations, including all applicable guidelines issued by the Philippine Stock Exchange (PSE). It is therefore illegal to buy or sell securities of any company, including RWM’s, based on material non-public information, unless exempted under the law. ...

Financial Markets and Institutions

... – Outstanding shares of established publicly owned companies that are traded: the secondary market ...

... – Outstanding shares of established publicly owned companies that are traded: the secondary market ...

CSE RULE 11 – Trading of Other Listed Securities

... The Exchange may designate securities listed on an exchange recognized in a jurisdiction in Canada as eligible for trading as Other Listed Securities provided such securities are not suspended or subject to a regulatory halt. ...

... The Exchange may designate securities listed on an exchange recognized in a jurisdiction in Canada as eligible for trading as Other Listed Securities provided such securities are not suspended or subject to a regulatory halt. ...

securities investment services

... The price of securities may go up or down, investors may lose all his funds under certain circumstances. The risk of loss in leveraged trading can be substantial. Investors may sustain losses in excess of your initial margin funds. Placing contingent orders, such as “stop order” or “limit order”, wi ...

... The price of securities may go up or down, investors may lose all his funds under certain circumstances. The risk of loss in leveraged trading can be substantial. Investors may sustain losses in excess of your initial margin funds. Placing contingent orders, such as “stop order” or “limit order”, wi ...

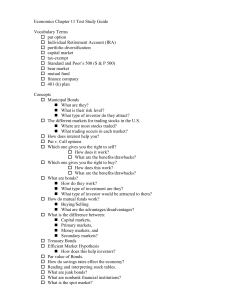

Economics Chapter 11 Test Study Guide

... Vocabulary Terms put option Individual Retirement Account (IRA) portfolio diversification capital market tax-exempt Standard and Poor’s 500 (S & P 500) bear market mutual fund finance company 401 (k) plan Concepts Municipal Bonds What are they? What is their risk level? W ...

... Vocabulary Terms put option Individual Retirement Account (IRA) portfolio diversification capital market tax-exempt Standard and Poor’s 500 (S & P 500) bear market mutual fund finance company 401 (k) plan Concepts Municipal Bonds What are they? What is their risk level? W ...

Which is NOT a basic function of money?

... Advantage- Mutual funds are more stable because you are investing in several companies instead of just one. So if one company performs poorly, the others may still be doing well enough that you do not lose money. Disadvantage- Return on investments is typically lower than well performing single st ...

... Advantage- Mutual funds are more stable because you are investing in several companies instead of just one. So if one company performs poorly, the others may still be doing well enough that you do not lose money. Disadvantage- Return on investments is typically lower than well performing single st ...

SECURITIES OPERATIONS

... Traders (members) hold seats. (Specialists, Floor traders, Odd Lot traders) Sale of seats must be approved (Pre-qualifications must be met.) Transactions tend to be centralized; advantageous for price discovery ...

... Traders (members) hold seats. (Specialists, Floor traders, Odd Lot traders) Sale of seats must be approved (Pre-qualifications must be met.) Transactions tend to be centralized; advantageous for price discovery ...

Closure of share capital increase Saint

... District of Columbia), Australia, Canada or Japan. This press release and the information it contains do not constitute an offer to sell or subscribe or a solicitation of an order to buy or subscribe for securities. The distribution of this press release may be restricted by law or regulations in ce ...

... District of Columbia), Australia, Canada or Japan. This press release and the information it contains do not constitute an offer to sell or subscribe or a solicitation of an order to buy or subscribe for securities. The distribution of this press release may be restricted by law or regulations in ce ...

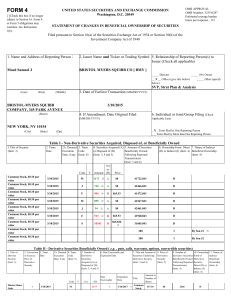

BRISTOL MYERS SQUIBB CO (Form: 4, Received

... ( 2) Adjustment reflects additional shares acquired upon the vesting of market share units due to the performance factor. ( 3) Shares withheld for payment of taxes upon vesting of awards. ( 4) Represents vesting of one-quarter of market share units granted on March 10, 2014. ( 5) The price reported ...

... ( 2) Adjustment reflects additional shares acquired upon the vesting of market share units due to the performance factor. ( 3) Shares withheld for payment of taxes upon vesting of awards. ( 4) Represents vesting of one-quarter of market share units granted on March 10, 2014. ( 5) The price reported ...

Intercontinental Exchange, Inc. (Form: 4, Received: 03/14

... person's ownership of four additional shares of common stock for each share of common stock owned as of that date, as reflected in the totals listed on this Form 4. The total number of shares of common stock was adjusted by five shares to account for a rounding error and the stock split. The common ...

... person's ownership of four additional shares of common stock for each share of common stock owned as of that date, as reflected in the totals listed on this Form 4. The total number of shares of common stock was adjusted by five shares to account for a rounding error and the stock split. The common ...

Department of Economics - Midlands State University

... students to financial mathematics and highlights major issues involved in making investment and financial decisions. It enables each student to be able to analyze various investment vehicles such as common stock, fixed income securities (bonds, preferred stock) and derivative securities (options, fu ...

... students to financial mathematics and highlights major issues involved in making investment and financial decisions. It enables each student to be able to analyze various investment vehicles such as common stock, fixed income securities (bonds, preferred stock) and derivative securities (options, fu ...

How Stocks Promote Growth

... • Sell partial ownership of the company – Instant cash to pay for expansion of business! – Cost of failure falls on investors, decreasing the risk of loss for the original owner, making them more likely to take the chance. – However, shareholders will also take a cut of the profits – often more than ...

... • Sell partial ownership of the company – Instant cash to pay for expansion of business! – Cost of failure falls on investors, decreasing the risk of loss for the original owner, making them more likely to take the chance. – However, shareholders will also take a cut of the profits – often more than ...

authorisation to purchase and hold own shares, in accordance with

... price and the reserve available for this purpose; b) the ordinary shares may be purchased at a minimum unit price of 1.00 euro (one euro, zero cents) and at a maximum price of not more than 10% above the average of the reference price for the three days the Stock Exchange is open prior to the transa ...

... price and the reserve available for this purpose; b) the ordinary shares may be purchased at a minimum unit price of 1.00 euro (one euro, zero cents) and at a maximum price of not more than 10% above the average of the reference price for the three days the Stock Exchange is open prior to the transa ...

Trading Nokia: The Roles of the Helsinki vs. the New York Stock

... between its price formation processes in the different markets becomes an important and interesting issue. Is perhaps one market leading the other in incorporating new information into the price of the stock? Discovering such patterns ...

... between its price formation processes in the different markets becomes an important and interesting issue. Is perhaps one market leading the other in incorporating new information into the price of the stock? Discovering such patterns ...

Agenda 3/9/10

... 7. A problem arose if the stock began to fall in price, causing the broker to issue a margin call, demanding the investor repay the loan at once. ...

... 7. A problem arose if the stock began to fall in price, causing the broker to issue a margin call, demanding the investor repay the loan at once. ...

Foreign Exchange (FX) Market

... Network of financial institutions and brokers in which individuals, businesses, banks, and governments buy and sell the currencies of different countries The liquidity of the market provides businesses with access to international markets for goods and services by providing foreign currency necessar ...

... Network of financial institutions and brokers in which individuals, businesses, banks, and governments buy and sell the currencies of different countries The liquidity of the market provides businesses with access to international markets for goods and services by providing foreign currency necessar ...

The primary objective of business financial

... c. minimize the chance of losses. d. maximize shareholder wealth (i.e. stock price). 2. Theoretically, stock price is not directly determined by a. the risk associated with expected cash flows. b. the net income or loss reported on the income statement. c. the size of expected cash flows. d. the tim ...

... c. minimize the chance of losses. d. maximize shareholder wealth (i.e. stock price). 2. Theoretically, stock price is not directly determined by a. the risk associated with expected cash flows. b. the net income or loss reported on the income statement. c. the size of expected cash flows. d. the tim ...

File

... When does the seller issue a credit note? 1. If goods are returned for any reason- e.g. Faulty or damaged 2. Overcharging- Incorrect pricing/ calculation error 3. If the buyer was invoiced for goods that were not delivered What is the use of a credit note? 1. Keep a permanent record of transactions ...

... When does the seller issue a credit note? 1. If goods are returned for any reason- e.g. Faulty or damaged 2. Overcharging- Incorrect pricing/ calculation error 3. If the buyer was invoiced for goods that were not delivered What is the use of a credit note? 1. Keep a permanent record of transactions ...

Short (finance)

.png?width=300)

In finance, short selling (also known as shorting or going short) is the practice of selling securities or other financial instruments that are not currently owned, and subsequently repurchasing them (""covering""). In the event of an interim price decline, the short seller will profit, since the cost of (re)purchase will be less than the proceeds which were received upon the initial (short) sale. Conversely, the short position will be closed out at a loss in the event that the price of a shorted instrument should rise prior to repurchase. The potential loss on a short sale is theoretically unlimited in the event of an unlimited rise in the price of the instrument, however in practice the short seller will be required to post margin or collateral to cover losses, and any inability to do so on a timely basis would cause its broker or counterparty to liquidate the position. In the securities markets, the seller generally must borrow the securities in order to effect delivery in the short sale. In some cases, the short seller must pay a fee to borrow the securities and must additionally reimburse the lender for cash returns the lender would have received had the securities not been loaned out.Short selling is most commonly done with instruments traded in public securities, futures or currency markets, due to the liquidity and real-time price dissemination characteristic of such markets and because the instruments defined within each class are fungible.In practical terms, going short can be considered the opposite of the conventional practice of ""going long"", whereby an investor profits from an increase in the price of the asset. Mathematically, the return from a short position is equivalent to that of owning (being ""long"") a negative amount of the instrument. A short sale may be motivated by a variety of objectives. Speculators may sell short in the hope of realizing a profit on an instrument which appears to be overvalued, just as long investors or speculators hope to profit from a rise in the price of an instrument which appears undervalued. Traders or fund managers may hedge a long position or a portfolio through one or more short positions.