The Economy in the late 1920s

... • Climbing stock prices encouraged widespread speculation – the practice of making high-risk investments in hopes of getting high gains. • Before WWI only wealthy played stock market. • Press reported stories of ordinary people who made fortunes. ...

... • Climbing stock prices encouraged widespread speculation – the practice of making high-risk investments in hopes of getting high gains. • Before WWI only wealthy played stock market. • Press reported stories of ordinary people who made fortunes. ...

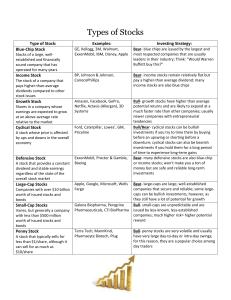

Types of Stocks

... much faster rate than other companies; usually newer companies with entrepreneurial tendencies Bull/Bear- cyclical stocks can be bullish investments if you try to time them by buying before an upswing or shorting before a downturn; cyclical stocks can also be bearish investments if you hold them for ...

... much faster rate than other companies; usually newer companies with entrepreneurial tendencies Bull/Bear- cyclical stocks can be bullish investments if you try to time them by buying before an upswing or shorting before a downturn; cyclical stocks can also be bearish investments if you hold them for ...

Financial system

... • In addition to financial assets, investors may buy equities – stocks representing ownership shares in corporations • Markets are competitive because there are a large # of buyers & sellers • Investor confidence is important for market stability – stocks tend to be much higher risk investments • S ...

... • In addition to financial assets, investors may buy equities – stocks representing ownership shares in corporations • Markets are competitive because there are a large # of buyers & sellers • Investor confidence is important for market stability – stocks tend to be much higher risk investments • S ...

TO THE SPANISH NATIONAL SECURITIES MARKET

... through the issue of 242,424,244 shares of BBVA, each with a par value of forty-nine euro cents (€0.49), of the same class and series as the shares currently in circulation and represented by book entries (hereinafter the “New Shares”). ...

... through the issue of 242,424,244 shares of BBVA, each with a par value of forty-nine euro cents (€0.49), of the same class and series as the shares currently in circulation and represented by book entries (hereinafter the “New Shares”). ...

Collective Investments

... Investment Trusts Investment trusts are public limited companies which invest in the shares of other companies in an attempt to make profits for their own shareholders. Unlike unit trusts and OEICs, their share price depends on market demand and therefore does not necessarily reflect the value of th ...

... Investment Trusts Investment trusts are public limited companies which invest in the shares of other companies in an attempt to make profits for their own shareholders. Unlike unit trusts and OEICs, their share price depends on market demand and therefore does not necessarily reflect the value of th ...

Inside Information and Resumption of Trading

... materials owned by Rui Hai Company* (瑞海公司) located in the area of Tianjin Port International Logistics Centre in the Binhai New Area of Tianjin (the “Accident”). The municipal committee and the municipal government of Tianjin have been coordinating the rescue and dealing with the aftermath on-site. ...

... materials owned by Rui Hai Company* (瑞海公司) located in the area of Tianjin Port International Logistics Centre in the Binhai New Area of Tianjin (the “Accident”). The municipal committee and the municipal government of Tianjin have been coordinating the rescue and dealing with the aftermath on-site. ...

Exercise of last warrants at specific issue price

... ("Jubilee" or "Company") Exercise of last warrants at the specific issue price Jubilee, the AIM-quoted and AltX-listed Mine-to-Metals specialist announces that it has received the final notification to exercise all outstanding warrants priced at 2.0p and 2.5p being, 625 000 warrants at a price of 2. ...

... ("Jubilee" or "Company") Exercise of last warrants at the specific issue price Jubilee, the AIM-quoted and AltX-listed Mine-to-Metals specialist announces that it has received the final notification to exercise all outstanding warrants priced at 2.0p and 2.5p being, 625 000 warrants at a price of 2. ...

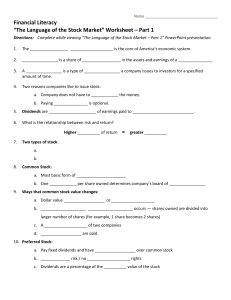

Language of the SM Notes

... 13. Income Stock: Company retains small portion of ____________________ a. Steady stream of _________________ such as ____________________ companies b. Beta less than _____________ 14. Value Stock: Have a ___________ market price considering historical ____________________ records and value of _____ ...

... 13. Income Stock: Company retains small portion of ____________________ a. Steady stream of _________________ such as ____________________ companies b. Beta less than _____________ 14. Value Stock: Have a ___________ market price considering historical ____________________ records and value of _____ ...

The Summary of Financials Explained

... The investor is able to compare the EPS from year to year. Of course, companies strive to increase the EPS annually. P/E Ratio This is the abbreviation for price/earnings ratio. This expresses the market price of the share as a multiple of the EPS and is calculated as follows: Market price per share ...

... The investor is able to compare the EPS from year to year. Of course, companies strive to increase the EPS annually. P/E Ratio This is the abbreviation for price/earnings ratio. This expresses the market price of the share as a multiple of the EPS and is calculated as follows: Market price per share ...

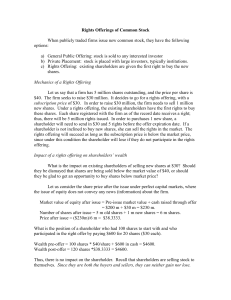

Rights Offerings of Common Stock

... rights offering, their wealth will be unaffected as long as they sell the rights they receive. Negative stock price reaction to rights offerings In the real world, there is a negative stock price reaction to rights offerings. We understand from the above discussion that the discount in the subscript ...

... rights offering, their wealth will be unaffected as long as they sell the rights they receive. Negative stock price reaction to rights offerings In the real world, there is a negative stock price reaction to rights offerings. We understand from the above discussion that the discount in the subscript ...

download

... Thursday effect for the whole period. A number of possible explanations for these results are considered, including the impact of: closed market effects; the time zone hypothesis, market size and price; the January Effect; and the possibility of mis-measured risk. However, it is believed that the mo ...

... Thursday effect for the whole period. A number of possible explanations for these results are considered, including the impact of: closed market effects; the time zone hypothesis, market size and price; the January Effect; and the possibility of mis-measured risk. However, it is believed that the mo ...

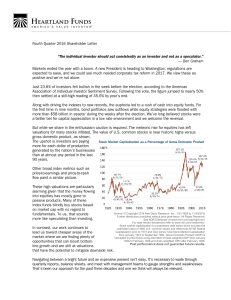

November 2013 - Dana Investment Advisors

... increased additions to stock funds and by reading comments in the press that small investors are feeling comfortable owning stocks again. Many of these same people until recently vowed never to own stocks again. Does that mean it’s time to head for the exits? Have we reached extreme levels in stock ...

... increased additions to stock funds and by reading comments in the press that small investors are feeling comfortable owning stocks again. Many of these same people until recently vowed never to own stocks again. Does that mean it’s time to head for the exits? Have we reached extreme levels in stock ...

- Cambridge Capital Group

... Group versus many other investment managers who utilize mutual funds and ETFs that are, by and large, barred from making these bold repositioning investment decisions which leaves the responsibility to the investor. We began planning for this setback in July 2015 by assisting many of our future clie ...

... Group versus many other investment managers who utilize mutual funds and ETFs that are, by and large, barred from making these bold repositioning investment decisions which leaves the responsibility to the investor. We began planning for this setback in July 2015 by assisting many of our future clie ...

Notice of Issue Price and Selling Price for Offering in Japan [PDF

... for the purpose of publicly announcing that the Company has determined matters relating to the issuance of new shares and the secondary offering of its shares and not for the purpose of soliciting investment or engaging in any other similar activities. This press release is not an offer of securitie ...

... for the purpose of publicly announcing that the Company has determined matters relating to the issuance of new shares and the secondary offering of its shares and not for the purpose of soliciting investment or engaging in any other similar activities. This press release is not an offer of securitie ...

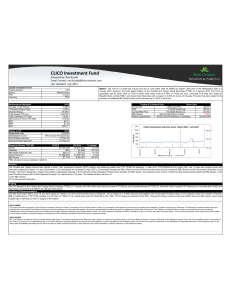

CLICO Investment Fund

... maturities ranging from years 1-10 and Government 11-20 Year Bonds on exchange for their STIP’s. Government acquired the RBL Shares and the Government Securities and has vested the RBL Shares and the Government Securities in the Trustee. The fund is designed to enable Unit holders to participate ind ...

... maturities ranging from years 1-10 and Government 11-20 Year Bonds on exchange for their STIP’s. Government acquired the RBL Shares and the Government Securities and has vested the RBL Shares and the Government Securities in the Trustee. The fund is designed to enable Unit holders to participate ind ...

Past performance does not guarantee future results.

... Past performance does not guarantee future results. An investor should consider the Funds’ investment objectives, risks, and charges and expenses carefully before investing or sending money. This and other important information can be found in the Funds’ prospectus. To obtain a prospectus, please ca ...

... Past performance does not guarantee future results. An investor should consider the Funds’ investment objectives, risks, and charges and expenses carefully before investing or sending money. This and other important information can be found in the Funds’ prospectus. To obtain a prospectus, please ca ...

Savings and Investment

... 4. Floor broker (buyer) signals the transaction back to the clerk. Then a floor reporter – an employee of the exchange – collects the information about the transaction and inputs it into the ticker system. 5. The sale appears on the price board, and a confirmation is relayed back to your account exe ...

... 4. Floor broker (buyer) signals the transaction back to the clerk. Then a floor reporter – an employee of the exchange – collects the information about the transaction and inputs it into the ticker system. 5. The sale appears on the price board, and a confirmation is relayed back to your account exe ...

Document

... This study aimed at suggesting a model for the main determinants of the bid-ask spread in the Amman Stock Exchange. Daily trading data for 50 selected companies, during a 6 years’ time period from 2001 to 2006, was collected from ASE publications. The suggested explanatory variables (security's spec ...

... This study aimed at suggesting a model for the main determinants of the bid-ask spread in the Amman Stock Exchange. Daily trading data for 50 selected companies, during a 6 years’ time period from 2001 to 2006, was collected from ASE publications. The suggested explanatory variables (security's spec ...

Operating Instruction nº 54/2017 INITIAL

... Bursátil (MAB). During the opening auction, orders shall be allowed that entail prices within a 50% static range of the reference price. The dynamic range shall be of 8%. The price resulting from this auction shall be considered to be the static price. From the next session on, the static range shal ...

... Bursátil (MAB). During the opening auction, orders shall be allowed that entail prices within a 50% static range of the reference price. The dynamic range shall be of 8%. The price resulting from this auction shall be considered to be the static price. From the next session on, the static range shal ...

Short (finance)

.png?width=300)

In finance, short selling (also known as shorting or going short) is the practice of selling securities or other financial instruments that are not currently owned, and subsequently repurchasing them (""covering""). In the event of an interim price decline, the short seller will profit, since the cost of (re)purchase will be less than the proceeds which were received upon the initial (short) sale. Conversely, the short position will be closed out at a loss in the event that the price of a shorted instrument should rise prior to repurchase. The potential loss on a short sale is theoretically unlimited in the event of an unlimited rise in the price of the instrument, however in practice the short seller will be required to post margin or collateral to cover losses, and any inability to do so on a timely basis would cause its broker or counterparty to liquidate the position. In the securities markets, the seller generally must borrow the securities in order to effect delivery in the short sale. In some cases, the short seller must pay a fee to borrow the securities and must additionally reimburse the lender for cash returns the lender would have received had the securities not been loaned out.Short selling is most commonly done with instruments traded in public securities, futures or currency markets, due to the liquidity and real-time price dissemination characteristic of such markets and because the instruments defined within each class are fungible.In practical terms, going short can be considered the opposite of the conventional practice of ""going long"", whereby an investor profits from an increase in the price of the asset. Mathematically, the return from a short position is equivalent to that of owning (being ""long"") a negative amount of the instrument. A short sale may be motivated by a variety of objectives. Speculators may sell short in the hope of realizing a profit on an instrument which appears to be overvalued, just as long investors or speculators hope to profit from a rise in the price of an instrument which appears undervalued. Traders or fund managers may hedge a long position or a portfolio through one or more short positions.