what is the “upstairs market?” the causes of market impact for block

... The upstairs market is a network of broker trading desks and institutional investors where block trades are matched. Unlike trades that are paired at an exchange (or ATS), these trades are typically negotiated via phone. Once a trade has been consummated it is “printed” on a marketplace. In order fo ...

... The upstairs market is a network of broker trading desks and institutional investors where block trades are matched. Unlike trades that are paired at an exchange (or ATS), these trades are typically negotiated via phone. Once a trade has been consummated it is “printed” on a marketplace. In order fo ...

Summary Verbal Instructions PO tax on seller

... you specify the number of units that you would like to sell at the specified Offer price. You can sell as many units as you have available. • How do Sellers make money in this experiment? By selling units at a price greater than your costs plus tax per unit. • An Offer price can be any price between ...

... you specify the number of units that you would like to sell at the specified Offer price. You can sell as many units as you have available. • How do Sellers make money in this experiment? By selling units at a price greater than your costs plus tax per unit. • An Offer price can be any price between ...

FIN 303 Chap 9 Fall 2009

... In equilibrium, stock prices are stable and there is no general tendency for people to buy versus to sell. In equilibrium, two conditions hold: The current market stock price equals what the “marginal investor” thinks it is worth. ...

... In equilibrium, stock prices are stable and there is no general tendency for people to buy versus to sell. In equilibrium, two conditions hold: The current market stock price equals what the “marginal investor” thinks it is worth. ...

the secondary market - Sharemarket Game

... expensively and also name some countries where you think they would be produced more cheaply. 3. What effect does an increase in the price of oil have on the price of plane tickets? What would this do to demand for overseas travel? ...

... expensively and also name some countries where you think they would be produced more cheaply. 3. What effect does an increase in the price of oil have on the price of plane tickets? What would this do to demand for overseas travel? ...

Investments: Analysis and Behavior

... There are millions of investors, analysts, portfolio managers, advisors, etc. participating in the investment process. Many will appear to be top performers (at least for the shortterm) Who is lucky and who is good? How can you tell? ...

... There are millions of investors, analysts, portfolio managers, advisors, etc. participating in the investment process. Many will appear to be top performers (at least for the shortterm) Who is lucky and who is good? How can you tell? ...

CR 37/2014 Title: Capital Increase and Private Offering of Shares to

... The Management Board of Integer.pl SA with its registered office in Cracow ("Issuer") informs that on 14 April 2014 the Issuer's Management Board adopted Resolution No. 1 on the increase of the Company's share capital through the issue of series L shares while excluding subscription rights of the ex ...

... The Management Board of Integer.pl SA with its registered office in Cracow ("Issuer") informs that on 14 April 2014 the Issuer's Management Board adopted Resolution No. 1 on the increase of the Company's share capital through the issue of series L shares while excluding subscription rights of the ex ...

Capitalization - Gretchen Hurt

... intended to be a recommendation to purchase or sell any of the stocks, mutual funds, or other securities that may be referenced. The securities of companies referenced or featured in the seminar materials are for illustrative purposes only and are not to be considered endorsed or recommended for pur ...

... intended to be a recommendation to purchase or sell any of the stocks, mutual funds, or other securities that may be referenced. The securities of companies referenced or featured in the seminar materials are for illustrative purposes only and are not to be considered endorsed or recommended for pur ...

Dividend Strategies Drive Returns

... a compressed period and sought to make a few changes that took advantage of the valuation gap between stock prices and underlying fundamental values. However, our strategy does not require that we take advantage of market volatility in order to realize good long-term results. Our investment team is ...

... a compressed period and sought to make a few changes that took advantage of the valuation gap between stock prices and underlying fundamental values. However, our strategy does not require that we take advantage of market volatility in order to realize good long-term results. Our investment team is ...

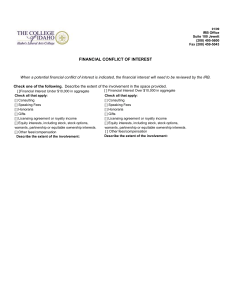

FinancialDisclosure

... When a potential financial conflict of interest is indicated, the financial interest will need to be reviewed by the IRB. Check one of the following. Describe the extent of the involvement in the space provided. [ ]Financial Interest Under $10,000 in aggregate Check all that apply: [ ] Consulting [ ...

... When a potential financial conflict of interest is indicated, the financial interest will need to be reviewed by the IRB. Check one of the following. Describe the extent of the involvement in the space provided. [ ]Financial Interest Under $10,000 in aggregate Check all that apply: [ ] Consulting [ ...

Third Quarter – Revenge of the Nerds

... months after we last used it in this publication, but he did get two things right in this famous line: October is a bad month for the stock market, and speculation is dangerous at any time of the year. The table below shows the average monthly percentage changes in the NASDAQ since 1971. October is ...

... months after we last used it in this publication, but he did get two things right in this famous line: October is a bad month for the stock market, and speculation is dangerous at any time of the year. The table below shows the average monthly percentage changes in the NASDAQ since 1971. October is ...

download

... securities you do not own Your broker borrows the securities from another client and sells them in the market in the usual way ...

... securities you do not own Your broker borrows the securities from another client and sells them in the market in the usual way ...

group A DSE Siayam FM

... procedures to get listing at DSE ( Exchange). The present process/way of listing, in short, may describe as follows: Every company intending to enlist its securities to DSE by issuing its securities through IPO is required to appoint Issue Manager to proceed with the listing process of the company ...

... procedures to get listing at DSE ( Exchange). The present process/way of listing, in short, may describe as follows: Every company intending to enlist its securities to DSE by issuing its securities through IPO is required to appoint Issue Manager to proceed with the listing process of the company ...

Ch 22-23 The Great Depression

... Ramifications of the Stock Market • Banks in a Tailspin – Banks weakened in two ways: • 1st, Banks had lent money to stock speculators. • 2nd, Many banks had invested depositors money into the stock market themselves. • Known as “double dipping”= Loses your money and their money……. ...

... Ramifications of the Stock Market • Banks in a Tailspin – Banks weakened in two ways: • 1st, Banks had lent money to stock speculators. • 2nd, Many banks had invested depositors money into the stock market themselves. • Known as “double dipping”= Loses your money and their money……. ...

Reading The Stock Market Table

... Explain that this will happen. The market depends on what is happening in the world, in the USA and also what is occurring in the business sector. Remind them that investing in the stock market has a certain amount of risk. You can make money with your money, but you can also loose money. Remind the ...

... Explain that this will happen. The market depends on what is happening in the world, in the USA and also what is occurring in the business sector. Remind them that investing in the stock market has a certain amount of risk. You can make money with your money, but you can also loose money. Remind the ...

Short (finance)

.png?width=300)

In finance, short selling (also known as shorting or going short) is the practice of selling securities or other financial instruments that are not currently owned, and subsequently repurchasing them (""covering""). In the event of an interim price decline, the short seller will profit, since the cost of (re)purchase will be less than the proceeds which were received upon the initial (short) sale. Conversely, the short position will be closed out at a loss in the event that the price of a shorted instrument should rise prior to repurchase. The potential loss on a short sale is theoretically unlimited in the event of an unlimited rise in the price of the instrument, however in practice the short seller will be required to post margin or collateral to cover losses, and any inability to do so on a timely basis would cause its broker or counterparty to liquidate the position. In the securities markets, the seller generally must borrow the securities in order to effect delivery in the short sale. In some cases, the short seller must pay a fee to borrow the securities and must additionally reimburse the lender for cash returns the lender would have received had the securities not been loaned out.Short selling is most commonly done with instruments traded in public securities, futures or currency markets, due to the liquidity and real-time price dissemination characteristic of such markets and because the instruments defined within each class are fungible.In practical terms, going short can be considered the opposite of the conventional practice of ""going long"", whereby an investor profits from an increase in the price of the asset. Mathematically, the return from a short position is equivalent to that of owning (being ""long"") a negative amount of the instrument. A short sale may be motivated by a variety of objectives. Speculators may sell short in the hope of realizing a profit on an instrument which appears to be overvalued, just as long investors or speculators hope to profit from a rise in the price of an instrument which appears undervalued. Traders or fund managers may hedge a long position or a portfolio through one or more short positions.