Answers to Concepts Review and Critical

... simply easier and less risky to sell from an investment bank’s perspective. The two main reasons are that very large amounts of debt securities can be sold to a relatively small number of buyers, particularly large institutional buyers such as pension funds and insurance companies, and debt securiti ...

... simply easier and less risky to sell from an investment bank’s perspective. The two main reasons are that very large amounts of debt securities can be sold to a relatively small number of buyers, particularly large institutional buyers such as pension funds and insurance companies, and debt securiti ...

Appropriate Technology Post Harvest Handling and Storage

... The cooking tomato commonly known as Pomme d’Amour is considered the most important vegetable grown in the northern part of the island of Mauritius and is an important part of the traditional diet. Almost all the crop is grown by small farmers for their family and to sell in the local markets with t ...

... The cooking tomato commonly known as Pomme d’Amour is considered the most important vegetable grown in the northern part of the island of Mauritius and is an important part of the traditional diet. Almost all the crop is grown by small farmers for their family and to sell in the local markets with t ...

Emerging Markets Equity

... economy. With a number of emerging markets facing elections in the coming year, managers are becoming more attracted to stocks that should reap the rewards of changing political priorities in countries such as India, where there is likely to be an increased focus on infrastructure development. ...

... economy. With a number of emerging markets facing elections in the coming year, managers are becoming more attracted to stocks that should reap the rewards of changing political priorities in countries such as India, where there is likely to be an increased focus on infrastructure development. ...

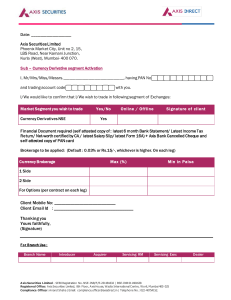

Policy for dealing with Conflicts of Interest

... 3. We will ensure that our personal interest does not, at any time conflict with our duty to our clients and client’s interest always takes primacy in our advice, investment decisions and transactions; 4. We will make appropriate disclosure to the clients of possible source or potential areas of con ...

... 3. We will ensure that our personal interest does not, at any time conflict with our duty to our clients and client’s interest always takes primacy in our advice, investment decisions and transactions; 4. We will make appropriate disclosure to the clients of possible source or potential areas of con ...

Duff Young - Ontario Securities Commission

... extreme fund flows. Many people earned awful individual returns and began a deep disdain for the industry that refused to deal with the crisis of its systemic ‘expectations gap’ between advertised fund performance and individual experience. I felt it was the crime of the new century. Performance mea ...

... extreme fund flows. Many people earned awful individual returns and began a deep disdain for the industry that refused to deal with the crisis of its systemic ‘expectations gap’ between advertised fund performance and individual experience. I felt it was the crime of the new century. Performance mea ...

Søknadsskjema for godkjenning av obligasjoner og

... Commercial mortgages are not included in the portfolio (see page number in the pre-sale-report). The number of loans in the portfolio: Currency ...

... Commercial mortgages are not included in the portfolio (see page number in the pre-sale-report). The number of loans in the portfolio: Currency ...

INTERPRETATION AND METHODOLOGY Financial ratios Return

... The value of Total assets are calculated from the last audited annual financial report. ...

... The value of Total assets are calculated from the last audited annual financial report. ...

Selling Shares in Quicken

... If you sell your entire holding in a company, specifying lots is irrelevant. Instead, just tick the box ...

... If you sell your entire holding in a company, specifying lots is irrelevant. Instead, just tick the box ...

open joint stock company “dixy group” announces results of its

... implementing measures in any Member State, the “Prospectus Directive”) is addressed solely to qualified investors (within the meaning of the Prospectus Directive) in that Member State. This document is not an offer for sale nor a solicitation of an offer to buy any securities in the United States. T ...

... implementing measures in any Member State, the “Prospectus Directive”) is addressed solely to qualified investors (within the meaning of the Prospectus Directive) in that Member State. This document is not an offer for sale nor a solicitation of an offer to buy any securities in the United States. T ...

Date of Submission: 17-11-2014 FIN 460 Section: 02 Submitted by

... 1. ‘BLI Securities Ltd.’ maintains Margin A/C for their clients. A client of ‘BLI Securities Ltd.’ can borrow Tk. 500,000 minimum from Margin A/C. But the maximum limit is not defined. 2. ‘BLI Securities Ltd.’ does not provide it’s investors any privilege of borrowing loans for personal purpose from ...

... 1. ‘BLI Securities Ltd.’ maintains Margin A/C for their clients. A client of ‘BLI Securities Ltd.’ can borrow Tk. 500,000 minimum from Margin A/C. But the maximum limit is not defined. 2. ‘BLI Securities Ltd.’ does not provide it’s investors any privilege of borrowing loans for personal purpose from ...

Behavioral Finance

... Overconfidence • Investors view themselves as more able to value securities than they actually are. • Investors tend to over-weight their forecasts relative to those of others. ...

... Overconfidence • Investors view themselves as more able to value securities than they actually are. • Investors tend to over-weight their forecasts relative to those of others. ...

CASE 2

... In the world of skateboard attire, instinct and marketing savvy are prerequisites to success. Moogy Ellis had both. During 2013, his international skateboarding company, Ryan, rocketed to $900 million in sales after 10 years in business. His fashion line covered the skateboarders from head to toe wi ...

... In the world of skateboard attire, instinct and marketing savvy are prerequisites to success. Moogy Ellis had both. During 2013, his international skateboarding company, Ryan, rocketed to $900 million in sales after 10 years in business. His fashion line covered the skateboarders from head to toe wi ...

Dentsu Announces Determination of Issue Price

... announcing that Dentsu Inc. has resolved matters relating to (i) an issuance of new shares, (ii) a disposal of treasury shares and (iii) a secondary offering of shares and it is not for the purpose of soliciting investment, etc. inside or outside Japan. In addition, this press release is not an offe ...

... announcing that Dentsu Inc. has resolved matters relating to (i) an issuance of new shares, (ii) a disposal of treasury shares and (iii) a secondary offering of shares and it is not for the purpose of soliciting investment, etc. inside or outside Japan. In addition, this press release is not an offe ...

PowerPoint for Chapter 5

... • Skimming pricing Setting higher initial selling prices due to uniqueness of product Appeals to customers who want to be the first to own the product and are willing to pay more Later when novelty wears off, lowers the price Legal ...

... • Skimming pricing Setting higher initial selling prices due to uniqueness of product Appeals to customers who want to be the first to own the product and are willing to pay more Later when novelty wears off, lowers the price Legal ...

Investing in shares - Bridges. Financial advice makes a difference

... • The price of any particular share can fall unexpectedly and dramatically without much or any notice, however, the practice of diversification can lessen this risk. So if one does fail, the value of your overall portfolio should only be affected minimally. For more information please refer to the ...

... • The price of any particular share can fall unexpectedly and dramatically without much or any notice, however, the practice of diversification can lessen this risk. So if one does fail, the value of your overall portfolio should only be affected minimally. For more information please refer to the ...

PowerPoint - Columbia University

... and $8 per share in dividends. Immediately after paying dividends the prices of securities A, B, and C are respectively $40, $40, and $40 per share. No new shares are issued during the year. Question: How would you reinvest the $160 in dividends to continue a passive investment strategy? Answer: Buy ...

... and $8 per share in dividends. Immediately after paying dividends the prices of securities A, B, and C are respectively $40, $40, and $40 per share. No new shares are issued during the year. Question: How would you reinvest the $160 in dividends to continue a passive investment strategy? Answer: Buy ...

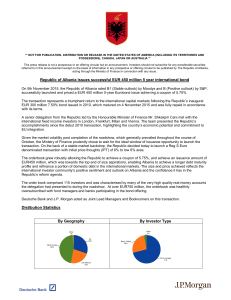

Republic of Albania issues successful EUR 450 million 5 year

... not be offered or sold in the United States absent registration or an exemption from registration under the Securities Act. The Republic of Albania, acting through the Ministry of Finance has not registered and does not intend to register any portion of any offering of securities in the United State ...

... not be offered or sold in the United States absent registration or an exemption from registration under the Securities Act. The Republic of Albania, acting through the Ministry of Finance has not registered and does not intend to register any portion of any offering of securities in the United State ...

Short (finance)

.png?width=300)

In finance, short selling (also known as shorting or going short) is the practice of selling securities or other financial instruments that are not currently owned, and subsequently repurchasing them (""covering""). In the event of an interim price decline, the short seller will profit, since the cost of (re)purchase will be less than the proceeds which were received upon the initial (short) sale. Conversely, the short position will be closed out at a loss in the event that the price of a shorted instrument should rise prior to repurchase. The potential loss on a short sale is theoretically unlimited in the event of an unlimited rise in the price of the instrument, however in practice the short seller will be required to post margin or collateral to cover losses, and any inability to do so on a timely basis would cause its broker or counterparty to liquidate the position. In the securities markets, the seller generally must borrow the securities in order to effect delivery in the short sale. In some cases, the short seller must pay a fee to borrow the securities and must additionally reimburse the lender for cash returns the lender would have received had the securities not been loaned out.Short selling is most commonly done with instruments traded in public securities, futures or currency markets, due to the liquidity and real-time price dissemination characteristic of such markets and because the instruments defined within each class are fungible.In practical terms, going short can be considered the opposite of the conventional practice of ""going long"", whereby an investor profits from an increase in the price of the asset. Mathematically, the return from a short position is equivalent to that of owning (being ""long"") a negative amount of the instrument. A short sale may be motivated by a variety of objectives. Speculators may sell short in the hope of realizing a profit on an instrument which appears to be overvalued, just as long investors or speculators hope to profit from a rise in the price of an instrument which appears undervalued. Traders or fund managers may hedge a long position or a portfolio through one or more short positions.