Broad Market Gains Power Historic Rally

... From stocks to bonds to commodities, world financial markets have rallied in unison during the first half of 2014, a feat not seen in more than 20 years and a reflection of investors' optimism that central-bank policies will boost growth. Six closely tracked gauges of world stock, bond and commodity ...

... From stocks to bonds to commodities, world financial markets have rallied in unison during the first half of 2014, a feat not seen in more than 20 years and a reflection of investors' optimism that central-bank policies will boost growth. Six closely tracked gauges of world stock, bond and commodity ...

The Stock Market Boom

... Although the stock market has the reputation of being a risky investment, it did not appear that way in the 1920s. With the mood of the country exuberant, the stock market seemed an infallible investment in the future. As more people invested in the stock market, stock prices began to rise. This was ...

... Although the stock market has the reputation of being a risky investment, it did not appear that way in the 1920s. With the mood of the country exuberant, the stock market seemed an infallible investment in the future. As more people invested in the stock market, stock prices began to rise. This was ...

NATIONAL INSTRUMENTS CORP (Form: 4, Received: 05/02/2017

... 6. Ownership Form: Direct 7. Nature of Indirect (D) or Indirect (I) (Instr. 4) Beneficial Ownership (Instr. ...

... 6. Ownership Form: Direct 7. Nature of Indirect (D) or Indirect (I) (Instr. 4) Beneficial Ownership (Instr. ...

Golden rules of investing in stock market

... argue the fact that a certain amount of skill and research is necessary to make good long-term investment decisions. It is no different with trading. Take the time to learn what works and what does not. Learn from past mistakes and allow yourself to succeed. Use a trading base of capital that you ar ...

... argue the fact that a certain amount of skill and research is necessary to make good long-term investment decisions. It is no different with trading. Take the time to learn what works and what does not. Learn from past mistakes and allow yourself to succeed. Use a trading base of capital that you ar ...

Media Prima Berhad

... distribution only under such circumstances as may be permitted by applicable law. Readers should be fully aware that this report is for information purposes only. The opinions contained in this report are based on information obtained or derived from sources that we believe are reliable. MIDF AMANAH ...

... distribution only under such circumstances as may be permitted by applicable law. Readers should be fully aware that this report is for information purposes only. The opinions contained in this report are based on information obtained or derived from sources that we believe are reliable. MIDF AMANAH ...

Buy Price higher than Sell Price on SSG or Portfolio/Stock

... Sales, profits and earnings will be uneven (or trending down) for the last few years. In section 2 on the back, it's likely that Pre-tax Profit, Return on Equity (or both) will be trending down, or Even at best. Section 3 may look normal, but you're likely to see a Reward/Risk figure of less than 1 ...

... Sales, profits and earnings will be uneven (or trending down) for the last few years. In section 2 on the back, it's likely that Pre-tax Profit, Return on Equity (or both) will be trending down, or Even at best. Section 3 may look normal, but you're likely to see a Reward/Risk figure of less than 1 ...

Instructions: Exercises for seminar no. 1, 7 Sept.

... there are no taxes and that the company does not need to borrow. The company is considering to undertake its first real investment project. It must make a choice in period zero of the output quantity to produce, Q ≥ 0, which will require a quantity C(Q) of an input factor. There are no other costs. ...

... there are no taxes and that the company does not need to borrow. The company is considering to undertake its first real investment project. It must make a choice in period zero of the output quantity to produce, Q ≥ 0, which will require a quantity C(Q) of an input factor. There are no other costs. ...

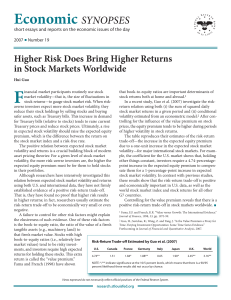

Higher Risk Does Bring Higher Returns in Stock Markets Worldwide

... that book-to-equity ratios are important determinants of market volatility—that is, the size of fluctuations in stock returns both at home and abroad.1 In a recent study, Guo et al. (2007) investigate the riskstock returns—to gauge stock market risk. When riskreturn relation using both (i) the sum o ...

... that book-to-equity ratios are important determinants of market volatility—that is, the size of fluctuations in stock returns both at home and abroad.1 In a recent study, Guo et al. (2007) investigate the riskstock returns—to gauge stock market risk. When riskreturn relation using both (i) the sum o ...

Are Stocks Expensive? - Zevin Asset Management

... Of course, investors buy companies for what they are expected to earn in the coming ten years, not for what they have earned over the past ten years. Looking at historical average earnings is a simplification intended as a guide for the more difficult task of forecasting future earnings. Looking for ...

... Of course, investors buy companies for what they are expected to earn in the coming ten years, not for what they have earned over the past ten years. Looking at historical average earnings is a simplification intended as a guide for the more difficult task of forecasting future earnings. Looking for ...

Investing in shares - Australian Executor Trustees

... Part of the revenue will generally be kept by the company to reinvest into the business (for example to develop better technology, to buy other business, or to expand into new markets). Through these activities, it is hoped that over time the value of the company grows, and this will have a positive ...

... Part of the revenue will generally be kept by the company to reinvest into the business (for example to develop better technology, to buy other business, or to expand into new markets). Through these activities, it is hoped that over time the value of the company grows, and this will have a positive ...

1. value: 3.00 points Investors expect the market rate of return this

... Suppose investors believe the stock will sell for $53 at year-end. Is the stock a good or bad buy? What will investors do? ...

... Suppose investors believe the stock will sell for $53 at year-end. Is the stock a good or bad buy? What will investors do? ...

Sample Exercises Chapter 11

... of stock that are outstanding. 2) Rich Co. issues $2 million, 10-year, 8% bonds at 97, with interest payable on July 1 and January 1. a) Prepare the journal entry to record the sale of these bonds on January 1, 2008. b) Assuming instead that the above bonds sold for 104, prepare the journal entry to ...

... of stock that are outstanding. 2) Rich Co. issues $2 million, 10-year, 8% bonds at 97, with interest payable on July 1 and January 1. a) Prepare the journal entry to record the sale of these bonds on January 1, 2008. b) Assuming instead that the above bonds sold for 104, prepare the journal entry to ...

01-03-2017 Weekly Market Review

... Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed by Private Capital Grou ...

... Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed by Private Capital Grou ...

Third Quarter – “The Stock Market: A Zero

... But, is the stock market a zero-sum game? Does one investor’s gain equal another’s loss? Is investing simply a process of transferring money from the losers to the winners? The simple and accurate answer is no. While it is certainly possible to lose money in the stock market on individual trades of ...

... But, is the stock market a zero-sum game? Does one investor’s gain equal another’s loss? Is investing simply a process of transferring money from the losers to the winners? The simple and accurate answer is no. While it is certainly possible to lose money in the stock market on individual trades of ...

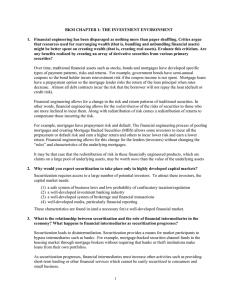

CHAPTER 1 : THE INVESTMENT ENVIRONMENT

... the company issuing the bond (borrowing the money) in the form of higher coupon payments. Shares of a company’s stock entitle the investor to percentage of the earnings - either paid as dividends or retained by the company for the investors benefit. If the investor cannot easily sell the stock (if t ...

... the company issuing the bond (borrowing the money) in the form of higher coupon payments. Shares of a company’s stock entitle the investor to percentage of the earnings - either paid as dividends or retained by the company for the investors benefit. If the investor cannot easily sell the stock (if t ...

Short (finance)

.png?width=300)

In finance, short selling (also known as shorting or going short) is the practice of selling securities or other financial instruments that are not currently owned, and subsequently repurchasing them (""covering""). In the event of an interim price decline, the short seller will profit, since the cost of (re)purchase will be less than the proceeds which were received upon the initial (short) sale. Conversely, the short position will be closed out at a loss in the event that the price of a shorted instrument should rise prior to repurchase. The potential loss on a short sale is theoretically unlimited in the event of an unlimited rise in the price of the instrument, however in practice the short seller will be required to post margin or collateral to cover losses, and any inability to do so on a timely basis would cause its broker or counterparty to liquidate the position. In the securities markets, the seller generally must borrow the securities in order to effect delivery in the short sale. In some cases, the short seller must pay a fee to borrow the securities and must additionally reimburse the lender for cash returns the lender would have received had the securities not been loaned out.Short selling is most commonly done with instruments traded in public securities, futures or currency markets, due to the liquidity and real-time price dissemination characteristic of such markets and because the instruments defined within each class are fungible.In practical terms, going short can be considered the opposite of the conventional practice of ""going long"", whereby an investor profits from an increase in the price of the asset. Mathematically, the return from a short position is equivalent to that of owning (being ""long"") a negative amount of the instrument. A short sale may be motivated by a variety of objectives. Speculators may sell short in the hope of realizing a profit on an instrument which appears to be overvalued, just as long investors or speculators hope to profit from a rise in the price of an instrument which appears undervalued. Traders or fund managers may hedge a long position or a portfolio through one or more short positions.