download soal

... 6. Calculate the expected returns for the stock. Its current price is $ 125. Its next expected dividend is $ 21. And you expect to sell it for $ 137 in one year. 7. An analyst projects that a stock will pay a $ 2 dividend next year and that it will sell for $40 at year-end. If the required rate of r ...

... 6. Calculate the expected returns for the stock. Its current price is $ 125. Its next expected dividend is $ 21. And you expect to sell it for $ 137 in one year. 7. An analyst projects that a stock will pay a $ 2 dividend next year and that it will sell for $40 at year-end. If the required rate of r ...

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

... *The remainder of this cover page shall be filled out for a reporting person's initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter the disclosures provided in a prior cover page. The information requir ...

... *The remainder of this cover page shall be filled out for a reporting person's initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter the disclosures provided in a prior cover page. The information requir ...

download

... go round, especially in an era of globalisation when capital can flow freely to and from almost everywhere. Money is always looking for places where it will be most profitable and earn the greatest return on investment. As an individual, you can put your money on deposit in a bank, and as long as th ...

... go round, especially in an era of globalisation when capital can flow freely to and from almost everywhere. Money is always looking for places where it will be most profitable and earn the greatest return on investment. As an individual, you can put your money on deposit in a bank, and as long as th ...

Alpha Era International Holdings Limited 合寶豐年控股

... cheque(s) from the Company’s Hong Kong Branch Share Registrar, Tricor Investor Services Limited, at Level 22, Hopewell Centre, 183 Queen’s Road East, Hong Kong from 9:00 a.m. to 1:00 p.m. on Friday, 14 July, 2017. If you are an individual who are eligible for personal collection, you must not author ...

... cheque(s) from the Company’s Hong Kong Branch Share Registrar, Tricor Investor Services Limited, at Level 22, Hopewell Centre, 183 Queen’s Road East, Hong Kong from 9:00 a.m. to 1:00 p.m. on Friday, 14 July, 2017. If you are an individual who are eligible for personal collection, you must not author ...

DOC - Douglas Dynamics Investor Relations

... [X] Rule 13d-1(b) [ ] Rule 13d-1(c) [ ] Rule 13d-1(d) *The remainder of this cover page shall be filled out for a reporting person's initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter the disclosures ...

... [X] Rule 13d-1(b) [ ] Rule 13d-1(c) [ ] Rule 13d-1(d) *The remainder of this cover page shall be filled out for a reporting person's initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter the disclosures ...

for Financing by Seconds of Radio–TV Advertisements

... contract with originator (IRIB) on exercising date of securities. 5- If the seconds of advertisement are considered as copyright and transferred to investors in form of Manfa’ah transaction or Manfa’ah reconciliation, there would be no kind of ownership and investors would only have the right to tra ...

... contract with originator (IRIB) on exercising date of securities. 5- If the seconds of advertisement are considered as copyright and transferred to investors in form of Manfa’ah transaction or Manfa’ah reconciliation, there would be no kind of ownership and investors would only have the right to tra ...

Technical analysis

... ◦ Credit balances result when investors sell stocks and leave the proceeds with their brokers, expecting to reinvest them shortly ...

... ◦ Credit balances result when investors sell stocks and leave the proceeds with their brokers, expecting to reinvest them shortly ...

How Wall Street Works

... values because they had a rapid expansion strategy that achieved remarkable sales growth by opening 100s of new outlets. Wall Street players that can influence the price of a stock: The market analysts – because so many people use their opinions as guidance The mutual fund and hedge fund managers – ...

... values because they had a rapid expansion strategy that achieved remarkable sales growth by opening 100s of new outlets. Wall Street players that can influence the price of a stock: The market analysts – because so many people use their opinions as guidance The mutual fund and hedge fund managers – ...

Comment on a National Securities Regulator

... persons. Both are national self-regulatory organizations (“SROs”) which obtain their regulatory jurisdiction in each province by that province’s securities commission. What that means is that each provincial securities commission enters into a recognition Order or similar instrument, setting out the ...

... persons. Both are national self-regulatory organizations (“SROs”) which obtain their regulatory jurisdiction in each province by that province’s securities commission. What that means is that each provincial securities commission enters into a recognition Order or similar instrument, setting out the ...

Securities Trading Policy

... • for an individual – a fine of up to $220,000 and a jail term of up to 5 years; and • for a corporation – a fine of up to $1,100,000. In addition, the insider trader, and any other persons involved in the contravention, may also be liable to compensate third parties for any resulting loss. 2.3 Exam ...

... • for an individual – a fine of up to $220,000 and a jail term of up to 5 years; and • for a corporation – a fine of up to $1,100,000. In addition, the insider trader, and any other persons involved in the contravention, may also be liable to compensate third parties for any resulting loss. 2.3 Exam ...

When push comes to shove - Arthveda Fund Management Pvt. Ltd.

... it is, may begin in 2013 itself. On the election effect, Thakkar is more optimistic than many. He believes things won’t be as bad as most people think even if the poll outcome is not decisive. “In the past we have had fractured mandates but India still managed to grow at 5-6 per cent,” he points out ...

... it is, may begin in 2013 itself. On the election effect, Thakkar is more optimistic than many. He believes things won’t be as bad as most people think even if the poll outcome is not decisive. “In the past we have had fractured mandates but India still managed to grow at 5-6 per cent,” he points out ...

Introduction

... buy or sell an asset at a certain time in the future for a certain price • By contrast in a spot contract there is an agreement to buy or sell the asset immediately (or within a very short period of time) ...

... buy or sell an asset at a certain time in the future for a certain price • By contrast in a spot contract there is an agreement to buy or sell the asset immediately (or within a very short period of time) ...

Student Handbook - Unit Trust Corporation

... Let me take this opportunity, to commend the efforts of your principals and teachers as they give of their time and energy to ensure that you complete the game’s exercises and provide guidance in areas where you may experience difficulties. Please note that the members of staff of the Unit Trust Cor ...

... Let me take this opportunity, to commend the efforts of your principals and teachers as they give of their time and energy to ensure that you complete the game’s exercises and provide guidance in areas where you may experience difficulties. Please note that the members of staff of the Unit Trust Cor ...

NYSE National, Inc. Schedule of Fees and Rebates As Of

... The “taker” fee of $0.0003 per share for any marketable order that removes liquidity will be charged to any ETP Holder that executes at least 50,000 shares of liquidity-adding volume during a calendar month. An ETP Holder that does not execute at least 50,000 shares of liquidity-adding volume during ...

... The “taker” fee of $0.0003 per share for any marketable order that removes liquidity will be charged to any ETP Holder that executes at least 50,000 shares of liquidity-adding volume during a calendar month. An ETP Holder that does not execute at least 50,000 shares of liquidity-adding volume during ...

low rates, plus inflation, makes dividend stocks more attractive

... As an example, we compared the stock of General Mills (the venerable food and cereal maker; ticker: GIS) with what you could reasonably expect from a high-quality corporate bond maturing in five years. In our analysis, we looked at General Mills stock returns over rolling five-year periods going bac ...

... As an example, we compared the stock of General Mills (the venerable food and cereal maker; ticker: GIS) with what you could reasonably expect from a high-quality corporate bond maturing in five years. In our analysis, we looked at General Mills stock returns over rolling five-year periods going bac ...

Lesson: The Great Depression

... solve the Great Depression •Hoover initially supported the laissefaire philosophy ...

... solve the Great Depression •Hoover initially supported the laissefaire philosophy ...

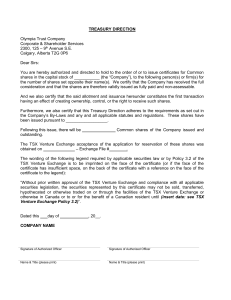

treasury direction - Olympia Trust Company

... o Prior to the issuance of any securities, Olympia will verify the signatures of the authorized signing officers against the Certificate of Incumbency that is on file. o Olympia will not issue securities wherein the treasury direction instructs Olympia to register the securities to the same person t ...

... o Prior to the issuance of any securities, Olympia will verify the signatures of the authorized signing officers against the Certificate of Incumbency that is on file. o Olympia will not issue securities wherein the treasury direction instructs Olympia to register the securities to the same person t ...

Short (finance)

.png?width=300)

In finance, short selling (also known as shorting or going short) is the practice of selling securities or other financial instruments that are not currently owned, and subsequently repurchasing them (""covering""). In the event of an interim price decline, the short seller will profit, since the cost of (re)purchase will be less than the proceeds which were received upon the initial (short) sale. Conversely, the short position will be closed out at a loss in the event that the price of a shorted instrument should rise prior to repurchase. The potential loss on a short sale is theoretically unlimited in the event of an unlimited rise in the price of the instrument, however in practice the short seller will be required to post margin or collateral to cover losses, and any inability to do so on a timely basis would cause its broker or counterparty to liquidate the position. In the securities markets, the seller generally must borrow the securities in order to effect delivery in the short sale. In some cases, the short seller must pay a fee to borrow the securities and must additionally reimburse the lender for cash returns the lender would have received had the securities not been loaned out.Short selling is most commonly done with instruments traded in public securities, futures or currency markets, due to the liquidity and real-time price dissemination characteristic of such markets and because the instruments defined within each class are fungible.In practical terms, going short can be considered the opposite of the conventional practice of ""going long"", whereby an investor profits from an increase in the price of the asset. Mathematically, the return from a short position is equivalent to that of owning (being ""long"") a negative amount of the instrument. A short sale may be motivated by a variety of objectives. Speculators may sell short in the hope of realizing a profit on an instrument which appears to be overvalued, just as long investors or speculators hope to profit from a rise in the price of an instrument which appears undervalued. Traders or fund managers may hedge a long position or a portfolio through one or more short positions.