the presentation

... worth. • Gained majority control, replaced management, distributed cash, sold assets. ...

... worth. • Gained majority control, replaced management, distributed cash, sold assets. ...

Explanation of Restrictions Applicable to Securities of

... any partnership or corporation if: (a) organized or incorporated under the laws of any foreign jurisdiction; and (b) formed by a U.S. person principally for the purpose of investing in securities not registered under the Securities Act, unless it is organized or incorporated, and owned, by accredite ...

... any partnership or corporation if: (a) organized or incorporated under the laws of any foreign jurisdiction; and (b) formed by a U.S. person principally for the purpose of investing in securities not registered under the Securities Act, unless it is organized or incorporated, and owned, by accredite ...

Regional Equity Market Integration in South America

... and sellers interact with one another in a diverse market. Nonetheless, there are challenges to the integration process. These include: a lack of free flow of capital among the three countries, jurisdiction-related differences among the domestic markets, technical issues in the sophistication level ...

... and sellers interact with one another in a diverse market. Nonetheless, there are challenges to the integration process. These include: a lack of free flow of capital among the three countries, jurisdiction-related differences among the domestic markets, technical issues in the sophistication level ...

investors choice letter to shareholders

... To the shareholders of Paychex, Inc.: Paychex, Inc. has established an Investors Choice Dividend Reinvestment and Direct Stock Purchase and Sale Plan (the “Plan”) for the convenience to our investors and shareholders. The Plan offers you an affordable alternative for buying and selling common stock ...

... To the shareholders of Paychex, Inc.: Paychex, Inc. has established an Investors Choice Dividend Reinvestment and Direct Stock Purchase and Sale Plan (the “Plan”) for the convenience to our investors and shareholders. The Plan offers you an affordable alternative for buying and selling common stock ...

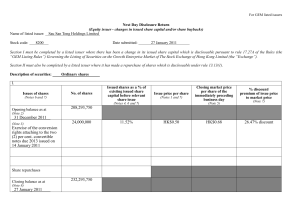

appendix 8a - Sau San Tong

... Please set out all changes in issued share capital requiring disclosure pursuant to rule 17.27A together with the relevant dates of issue. Each category will need to be disclosed individually with sufficient information to enable the user to identify the relevant category in the listed issuer’s Mont ...

... Please set out all changes in issued share capital requiring disclosure pursuant to rule 17.27A together with the relevant dates of issue. Each category will need to be disclosed individually with sufficient information to enable the user to identify the relevant category in the listed issuer’s Mont ...

The NSE Market Segmentation - The Nigerian Stock Exchange

... Introduce Large, Mid and Small Cap classifications, and Growth and Income classifications for equities. ...

... Introduce Large, Mid and Small Cap classifications, and Growth and Income classifications for equities. ...

RBGD23 Insert 7_10_17_Fact Sheet

... An investment in this unmanaged unit investment trust should be made with an understanding of the risks involved with owning common stocks, such as an economic recession and the possible deterioration of either the financial condition of the issuers of the equity securities or the general condition ...

... An investment in this unmanaged unit investment trust should be made with an understanding of the risks involved with owning common stocks, such as an economic recession and the possible deterioration of either the financial condition of the issuers of the equity securities or the general condition ...

Corporate Finance

... with results of the standard CAPM. How does investor’s optimal portfolio depend on her tax rates? What happens when the dividend and capital gain tax rates are equal? How many mutual funds are needed in the equilibrium? Specify these mutual funds. 8. (5 bonus points) Suppose that Apple is trading at ...

... with results of the standard CAPM. How does investor’s optimal portfolio depend on her tax rates? What happens when the dividend and capital gain tax rates are equal? How many mutual funds are needed in the equilibrium? Specify these mutual funds. 8. (5 bonus points) Suppose that Apple is trading at ...

Econ 4550/6550 International Trade Assignment 5/Solutions 1

... markets, MR P , because to sell an extra unit of output, the firm must lower the price of all units, not just the marginal one. 3. There are some shops in Japan that sell Japanese goods imported back from the US at a discount over the prices charged by other Japanese shops. How is this possible? ...

... markets, MR P , because to sell an extra unit of output, the firm must lower the price of all units, not just the marginal one. 3. There are some shops in Japan that sell Japanese goods imported back from the US at a discount over the prices charged by other Japanese shops. How is this possible? ...

0001193125-17-038153

... The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (howe ...

... The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (howe ...

Mineral Mountain Resources Closes Private Placements for Gross

... without limitation, the use of proceeds from the Brokered Offering and the Non-Brokered Offering, are forwardlooking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words “expects”, “ plans”, “could” or “should” ...

... without limitation, the use of proceeds from the Brokered Offering and the Non-Brokered Offering, are forwardlooking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words “expects”, “ plans”, “could” or “should” ...

Winter 2015 - RBC Wealth Management

... About the same time oil prices began to weaken. Since then, oil has dropped by almost 60%. Outsized moves have also occurred in the US dollar, the Canadian Dollar and other world currencies and the whole commodity complex. Interest rates have not gone up – they have dropped massively and in some cou ...

... About the same time oil prices began to weaken. Since then, oil has dropped by almost 60%. Outsized moves have also occurred in the US dollar, the Canadian Dollar and other world currencies and the whole commodity complex. Interest rates have not gone up – they have dropped massively and in some cou ...

1 WORKDAY, INC. POLICY ON HEDGING IN SECURITIES The

... Investing in Workday’s securities provides an opportunity to share in the future growth of Workday. Investment in Workday and sharing in the growth of Workday, however, does not mean short-range speculation based on fluctuations in the market. Therefore, you may not trade in options, warrants, puts ...

... Investing in Workday’s securities provides an opportunity to share in the future growth of Workday. Investment in Workday and sharing in the growth of Workday, however, does not mean short-range speculation based on fluctuations in the market. Therefore, you may not trade in options, warrants, puts ...

Short (finance)

.png?width=300)

In finance, short selling (also known as shorting or going short) is the practice of selling securities or other financial instruments that are not currently owned, and subsequently repurchasing them (""covering""). In the event of an interim price decline, the short seller will profit, since the cost of (re)purchase will be less than the proceeds which were received upon the initial (short) sale. Conversely, the short position will be closed out at a loss in the event that the price of a shorted instrument should rise prior to repurchase. The potential loss on a short sale is theoretically unlimited in the event of an unlimited rise in the price of the instrument, however in practice the short seller will be required to post margin or collateral to cover losses, and any inability to do so on a timely basis would cause its broker or counterparty to liquidate the position. In the securities markets, the seller generally must borrow the securities in order to effect delivery in the short sale. In some cases, the short seller must pay a fee to borrow the securities and must additionally reimburse the lender for cash returns the lender would have received had the securities not been loaned out.Short selling is most commonly done with instruments traded in public securities, futures or currency markets, due to the liquidity and real-time price dissemination characteristic of such markets and because the instruments defined within each class are fungible.In practical terms, going short can be considered the opposite of the conventional practice of ""going long"", whereby an investor profits from an increase in the price of the asset. Mathematically, the return from a short position is equivalent to that of owning (being ""long"") a negative amount of the instrument. A short sale may be motivated by a variety of objectives. Speculators may sell short in the hope of realizing a profit on an instrument which appears to be overvalued, just as long investors or speculators hope to profit from a rise in the price of an instrument which appears undervalued. Traders or fund managers may hedge a long position or a portfolio through one or more short positions.