Lecture 17

... • Placing a limit order is being a sitting duck. If more in-the-know investors realize stock price is higher than in your sell order, they will buy from you at your price. In an expected value sense, your orders can be filled only in this unfortunate case. • Problem is enhanced by decimal trading. W ...

... • Placing a limit order is being a sitting duck. If more in-the-know investors realize stock price is higher than in your sell order, they will buy from you at your price. In an expected value sense, your orders can be filled only in this unfortunate case. • Problem is enhanced by decimal trading. W ...

Polaris Seed Round Term Sheet

... The holders of the Preferred may request two demand and unlimited S-3 registrations subject to minimum proceeds limitations. The holders of the Preferred will also be entitled to "piggy-back" registration rights on registrations of the Company, subject to customary underwriters' cutback. The Company ...

... The holders of the Preferred may request two demand and unlimited S-3 registrations subject to minimum proceeds limitations. The holders of the Preferred will also be entitled to "piggy-back" registration rights on registrations of the Company, subject to customary underwriters' cutback. The Company ...

Document

... I am writing in reference to the Portals Roundtable the Securities and Exchange Commission (SEC) held on May 23, 2001. The SEC needs to be careful not to create the impression that it is considering regulation of Internet portals. Internet portals do not fall within the jurisdiction of the SEC. Abse ...

... I am writing in reference to the Portals Roundtable the Securities and Exchange Commission (SEC) held on May 23, 2001. The SEC needs to be careful not to create the impression that it is considering regulation of Internet portals. Internet portals do not fall within the jurisdiction of the SEC. Abse ...

pages 471–472

... B. As the bull market continued to go up, many investors bought stocks on margin, making a small cash down payment. This was considered safe as long as stock prices continued to rise. If the stock began to fall, the broker could issue a margin call demanding that the investor repay the loan immediat ...

... B. As the bull market continued to go up, many investors bought stocks on margin, making a small cash down payment. This was considered safe as long as stock prices continued to rise. If the stock began to fall, the broker could issue a margin call demanding that the investor repay the loan immediat ...

Securities Purchase Ad

... of market volatility are critical in making a profitable trade. Nevertheless, opportunity may slip away due to insufficient fund in your investment account. ICBC (Asia) is pleased to introduce our new Securities Purchase Ad-hoc Facility. It allows you to grasp every investment opportunity for higher ...

... of market volatility are critical in making a profitable trade. Nevertheless, opportunity may slip away due to insufficient fund in your investment account. ICBC (Asia) is pleased to introduce our new Securities Purchase Ad-hoc Facility. It allows you to grasp every investment opportunity for higher ...

FOR IMMEDIATE RELEASE What do stock markets tell us about

... International investors can make significant US Dollar returns from betting on movements on national stock markets. Recent research by academics at the Cass Business School, the Bank of England and City University Hong Kong uses data for more than 40 markets observed over 30 years to show that avera ...

... International investors can make significant US Dollar returns from betting on movements on national stock markets. Recent research by academics at the Cass Business School, the Bank of England and City University Hong Kong uses data for more than 40 markets observed over 30 years to show that avera ...

CHAPTER 16

... 8. The Toman Corporation would like to pay a cash dividend to its stockholders but does not have cash available currently. The corporation has decided to issue a $1 per share scrip dividend to its 100,000 shares of outstanding common stock. The date of declaration is September 1, 2001. The date of p ...

... 8. The Toman Corporation would like to pay a cash dividend to its stockholders but does not have cash available currently. The corporation has decided to issue a $1 per share scrip dividend to its 100,000 shares of outstanding common stock. The date of declaration is September 1, 2001. The date of p ...

FM11 Ch 07 Show

... Both yields are constant over time, with the high dividend yield (19%) offsetting the negative capital gains yield. ...

... Both yields are constant over time, with the high dividend yield (19%) offsetting the negative capital gains yield. ...

Equities and Indexes

... GenElec (GE) 0.40 2.43 14.68 74,123,574 16.75 16.35 16.44 -0.26 $0.10/Quarter ...

... GenElec (GE) 0.40 2.43 14.68 74,123,574 16.75 16.35 16.44 -0.26 $0.10/Quarter ...

DENZIO L IKUNGWA - Institute of Bankers in Malawi

... outstanding at the same time and one of them is usually designated to be the one with the highest priority. If the company has only enough money to meet the dividend schedule on one of the preferred issues, it makes the dividend payments on the prior preferred. Therefore, prior preferred have less c ...

... outstanding at the same time and one of them is usually designated to be the one with the highest priority. If the company has only enough money to meet the dividend schedule on one of the preferred issues, it makes the dividend payments on the prior preferred. Therefore, prior preferred have less c ...

Retail Treasury Bonds Tranche 18 FAQs September 6

... Q. An individual who heard about the RTBs only for the first time expressed concern that offer period is for a limited time. In case she decides after Sept. 20, 2016, will she still be able to buy and from where? A. They can still buy RTBs after the offer period but through the secondary market alre ...

... Q. An individual who heard about the RTBs only for the first time expressed concern that offer period is for a limited time. In case she decides after Sept. 20, 2016, will she still be able to buy and from where? A. They can still buy RTBs after the offer period but through the secondary market alre ...

Probability of College Football Underdogs Winning Against the

... It may be psychologically comforting to buy what you know or bet on your favorite team but it is admittedly neither rational nor economically optimal. Although famed investor Peter Lynch told investors to “buy what you know”, this flawed wisdom leads to unnecessary risk and suboptimal portfolios. 2) ...

... It may be psychologically comforting to buy what you know or bet on your favorite team but it is admittedly neither rational nor economically optimal. Although famed investor Peter Lynch told investors to “buy what you know”, this flawed wisdom leads to unnecessary risk and suboptimal portfolios. 2) ...

Determination of Forward and Futures Prices

... Similarly, the value of a short forward contract is ƒ =(K – F )e–rT ...

... Similarly, the value of a short forward contract is ƒ =(K – F )e–rT ...

2 - JustAnswer

... stockholders receive if their stock is cumulative and nonparticipating? (b) As of 12/31/11, it is desired to distribute $400,000 in dividends. How much will the preferred stockholders receive if their stock is cumulative and participating up to 11% in total? (c) On 12/31/11, the preferred stockholde ...

... stockholders receive if their stock is cumulative and nonparticipating? (b) As of 12/31/11, it is desired to distribute $400,000 in dividends. How much will the preferred stockholders receive if their stock is cumulative and participating up to 11% in total? (c) On 12/31/11, the preferred stockholde ...

Hydrogen Future Corp (Form: PRER14C, Received: 03/02/2015 15:44:22)

... stock and (iv) all directors and officers as a group. Except as otherwise indicated, each of the stockholders listed below has sole voting and investment power over the shares beneficially owned. Please read the footnotes to the table carefully, as the numbers and percentages calculated therein take ...

... stock and (iv) all directors and officers as a group. Except as otherwise indicated, each of the stockholders listed below has sole voting and investment power over the shares beneficially owned. Please read the footnotes to the table carefully, as the numbers and percentages calculated therein take ...

Filed by Titanium Metals Corporation pursuant to Rule 425 under

... all of the outstanding 4,024,820 6.625% Convertible Preferred Securities, Beneficial Unsecured Convertible Securities, liquidation preference $50 per security, including the associated guarantee (the "BUCS") issued by TIMET Capital Trust I. The exchange of BUCS for shares of Series A Preferred Stock ...

... all of the outstanding 4,024,820 6.625% Convertible Preferred Securities, Beneficial Unsecured Convertible Securities, liquidation preference $50 per security, including the associated guarantee (the "BUCS") issued by TIMET Capital Trust I. The exchange of BUCS for shares of Series A Preferred Stock ...

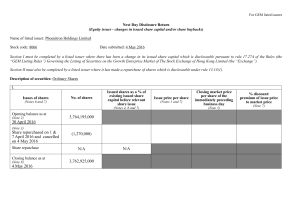

Next Day Disclosure Returns

... Please set out all changes in issued share capital requiring disclosure pursuant to rule 17.27A together with the relevant dates of issue. Each category will need to be disclosed individually with sufficient information to enable the user to identify the relevant category in the listed issuer’s Mont ...

... Please set out all changes in issued share capital requiring disclosure pursuant to rule 17.27A together with the relevant dates of issue. Each category will need to be disclosed individually with sufficient information to enable the user to identify the relevant category in the listed issuer’s Mont ...

What Do Financial Market Indicators Tell Us?

... affect decisions about consumer spending, educational loans, and retirement plans. Financial markets are important in everyday life because making good business decisions is difficult without understanding how key financial indicators behave. Popular financial indicators usually fall into four categ ...

... affect decisions about consumer spending, educational loans, and retirement plans. Financial markets are important in everyday life because making good business decisions is difficult without understanding how key financial indicators behave. Popular financial indicators usually fall into four categ ...

The share that taps into high yields from North America, at a 13pc

... “Canadian firms have a strong dividend tradition,” said Richard Hughes, who co-manages the M&G Charifund, an open-ended portfolio designed for charities, and which has a stake in the Middlefield trust. “There is also a culture of effective corporate governance in Canada. I’m a strong believer in the ...

... “Canadian firms have a strong dividend tradition,” said Richard Hughes, who co-manages the M&G Charifund, an open-ended portfolio designed for charities, and which has a stake in the Middlefield trust. “There is also a culture of effective corporate governance in Canada. I’m a strong believer in the ...

Short (finance)

.png?width=300)

In finance, short selling (also known as shorting or going short) is the practice of selling securities or other financial instruments that are not currently owned, and subsequently repurchasing them (""covering""). In the event of an interim price decline, the short seller will profit, since the cost of (re)purchase will be less than the proceeds which were received upon the initial (short) sale. Conversely, the short position will be closed out at a loss in the event that the price of a shorted instrument should rise prior to repurchase. The potential loss on a short sale is theoretically unlimited in the event of an unlimited rise in the price of the instrument, however in practice the short seller will be required to post margin or collateral to cover losses, and any inability to do so on a timely basis would cause its broker or counterparty to liquidate the position. In the securities markets, the seller generally must borrow the securities in order to effect delivery in the short sale. In some cases, the short seller must pay a fee to borrow the securities and must additionally reimburse the lender for cash returns the lender would have received had the securities not been loaned out.Short selling is most commonly done with instruments traded in public securities, futures or currency markets, due to the liquidity and real-time price dissemination characteristic of such markets and because the instruments defined within each class are fungible.In practical terms, going short can be considered the opposite of the conventional practice of ""going long"", whereby an investor profits from an increase in the price of the asset. Mathematically, the return from a short position is equivalent to that of owning (being ""long"") a negative amount of the instrument. A short sale may be motivated by a variety of objectives. Speculators may sell short in the hope of realizing a profit on an instrument which appears to be overvalued, just as long investors or speculators hope to profit from a rise in the price of an instrument which appears undervalued. Traders or fund managers may hedge a long position or a portfolio through one or more short positions.