* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Student Handbook - Unit Trust Corporation

Special-purpose acquisition company wikipedia , lookup

Interbank lending market wikipedia , lookup

Private money investing wikipedia , lookup

Securities fraud wikipedia , lookup

Mark-to-market accounting wikipedia , lookup

Stock trader wikipedia , lookup

Capital gains tax in Australia wikipedia , lookup

Exchange rate wikipedia , lookup

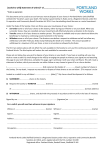

k a oo b d n Stu d H t n e II Contents Welcome 3 About The Game 4 Rules 5 Investment Instrument Information 7 Calculation of Broker’s Fees 9 Specimen Sheets Initial Portfolio Statement 10 Portfolio Change Request 11 Acquisition of Assets Portfolio Change Request 12 Disposal of Assets 1 II 2 Welcome November 17th, 2006 Dear Students Thank you for your interest in participating in this our 15th edition of the Schools’ Investment Game. The Schools’ Investment Game represents our ongoing commitment to investor education regarding financial literacy. The game was created to enhance the knowledge learned in the classroom and provide them with the practical exposure to the money and capital market. When the game commenced in 1992, we could have never envisioned the tremendous impact it would have had in the development of so many young persons. To date, in excess of Seven Thousand (7,000) students have participated in the game representing over 40 schools. Some of these students have progressed into careers in the financial industry and we are proud to have been a part in the nurturing of these young minds into highly capable young men and women. Let me take this opportunity, to commend the efforts of your principals and teachers as they give of their time and energy to ensure that you complete the game’s exercises and provide guidance in areas where you may experience difficulties. Please note that the members of staff of the Unit Trust Corporation will be made available to offer any assistance to the respective teams if necessary. To you the participating students, we hope that your experience be a rewarding and enjoyable one. ENJOY! Gayle Daniel-Worrell Vice President Marketing and International Business 3 About the Game As is customary with all games, a sound knowledge of the rules is necessary though not a sufficient condition for winning. We therefore provide you with a set of guidelines, which you will find useful in helping to shape your investment strategy. Included in this booklet are specimen sheets of the initial portfolio statement and of the acquisition and disposal of assets. Please examine each one carefully as this will assist you in minimizing the amount of errors made throughout the duration of the game. You will also find information on all the instruments to be used as well as a guide to the calculation of brokers’ fees. 4 Rules • The game will be conducted from November 27th, 2006 to April 27th, 2007 • A school will be able to submit as many teams as desired • Each team will consist of a maximum of 5 students and a minimum of 3 students • Teams will/can invest in the following instruments: - Unit Scheme - Growth & Income Fund - Second Unit Scheme - Money Market Fund - Fixed Deposit - Savings Account - Company Shares traded on The T&T Stock Market - Chaconia Income & Growth Fund - Us Dollar Money Market Fund Each team will be allotted a notional sum of twenty thousand dollars ($20,000.00) for investment. Teams must invest in all of the seven (7) instruments in any proportion but no more than eighty per cent (80%) of investable funds may be in one instrument. may be in one instrument. In addition not less than TT five hundred dollars (TT $500) may be invested in any one instrument. Competitors will indicate their initial investment choices, as shown, on the attached specimen initial portfolio statement. Changes to investment will be made on the Disposal of Assets and the Acquisition of Assets sheets accordingly At the completion of the game, the team with the highest return will be adjudged the winner. Interest rates on Savings & Fixed Deposits will be determined by the Unit Trust Corporation and will be based on the best current market rates for the dollar amount invested. Dividends earned from investments in Company stocks and the Unit Trust’s First Unit Scheme will be 5 determined from historical data for the period and will be applied at the end of the period. Since income is credited quarterly in the Unit Trust’s Second Scheme and the US Dollar Money Market Fund, the accrued income will be calculated at the end of the quarter Prices for the Chaconia Income and Growth Fund (US Dollar Denominated Fund) are quoted along with the unit prices in the daily newspapers. The following prizes will be awarded to first, second, third and fourth place winners only: First Prize: $1,000.00 in Supplies and Equipment and a Challenge Trophy Second Prize: $6,000.00 in Supplies and Equipment and a Trophy Third Prize: $4,000.00 in Supplies and Equipment and a Trophy Fourth Prize: $2,000.00 in Supplies and Equipment and a Trophy Accounts will be opened in the First Unit Scheme - Growth and Income Fund. For all winning teams (First to Fourth place), the sum of Two Hundred dollars ($200) woth of units will be awarded. There will also be prizes for the monthly winners along with prizes for the teachers of the winning teams. 6 Investment Information Sheet A. FIRST UNIT SCHEME: Prices fluctuate on a daily basis. Units are purchased at the offer price and redeemed at the bid price. Daily prices of the First Unit Scheme are published in the daily newspapers and the Unit Trust Corporation Website: www.ttutc.com B. SECOND UNIT SCHEME: The price is $20.00 per unit The Interest Rate for September 2006 - 5.75% The Interest Rate for October 2006 - 5.75% The Interest Rate For November 2006 - 5.75% C. FIXED DEPOSIT: Deposits may be placed for varying maturity periods: 3 months at a rate of 3.00% per annum A break-rate will be applied if the fixed deposit is broken before the selected maturity period and will be equivalent to the regular savings rate of 1.5% D. SAVINGS DEPOSIT: Rate: 1.5% E. TRINIDAD & TOBAGO STOCK MARKET: The daily newspapers (Trinidad Guardian, Newsday and Trinidad Express) give details on the prices of stocks currently being traded on the Trinidad & Tobago Stock Exchange. The price paid for any stock will be the closing price of the last trading day 7 Shares may be sold at any time. Any increase in the closing price of the share at the time of selling will constitute the capital gain and will form part of the return on investment. Dividends earned will be determined from historical data and applied at the end of the period. A charge of 1.625% broker’s fee is applicable whenever shares are bought or sold. Broker’s fees = number of shares x price per share x .01625 When purchasing shares, total capital needed = Number of shares x price per share + broker’s fees. When disposing of shares, net proceeds from the disposal = number of shares x price per share - broker’s fees F. CHACONIA INCOME AND GROWTH FUND The price of the Chaconia Fund is quoted in US$ and is found in the daily papers together with the quoted unit price. In calculating the value of funds required to purchase shares in this fund, an exchange rate of TT$6.15 to US$1 is to be used throughout the game. Dividends and Capital gains will be applied at the end of the period. e.g.: To purchase 100 Shares in Chaconia at a price of US $11.69 The TT equivalent: $11.69 x 6.15 x 100 = $7, 189.35 G. US DOLLAR MONEY MARKET FUND: The price of the US dollar Money Market Fund is quoted in US$ and is set at a fixed unit price of US$20.00. In calculating the value of funds required to purchase units in this fund, an exchange rate of TT$ 6.15 to US$1 to be used throughout the game. Since income is credited quarterly in this Fund, the accrued income will be calculated at the end of each calendar quarter. 8 Calculation of Broker Fees ACQUISITION OF STOCK MARKET SHARES Calculation of Broker’s Fees Name of Stock: WITCO No. of shares to be purchased: 70, Price per share: $24.00 Broker’s Fees = No. of shares x price per share x .01625 = 70 x $24.00 x 0.01625 = $27.30 Total Investment Value (Capital needed for purchase of shares) = No. of shares x price per share + Broker’s Fees = 70 x 24.00 + 27.30 = $1, 707.30 Net Value of Investment = No. of shares x price per share = 70 x 24 = $1, 680.00 DISPOSAL OF STOCK MARKET SHARES Calculation of Broker’s Fees Name of stock: WITCO No. of Shares to be sold: 50 Price per share: $24.00 Broker’s Fees: = No. of shares x price per share x .01625 = 50 x 24.00 x 0.01625 = $19.50 Net proceeds for Disposal (Funds available for acquisition of other assets) = No. of shares x price per share - brokers fees = 50 x 24.00 - 19.50 = $1, 180.00 Please note that when buying and selling shares the price used is always the closing quotation of the date of the transaction i.e. Wednesday’s trading which will appear in the Thursday’s daily newspapers. Incorrect share prices result in inaccurate broker’s fees, net investment value, total investment value and net proceeds from liquidation. 9 10 Savings Deposit First Unit Scheme Second Unit Scheme Ansa McAL Chaconia US$ Money Market SV SI S2 SM CH UM $20.00 US 20 SV - SAVINGS DEPOSIT FD - FIXED DEPOSIT S2 - SECOND UNIT SCHEME SM - STOCK MARKET SI - FIRST UNIT SCHEME CH - CHACONIA UM - US DOLLAR MONEY MARKET FUND $12.00 $9.82 US 100 $20.00 $11.45 - 300 235 180.96 - - Fixed Deposit FD - Transaction detailsNo. of units/shares Unit/share price Code Date: SCHOOL CODE: 0000 SCHOOL NAME: - - $58.50 - - - - Brokers fees Trinidad And Tobago Unit Trust Corporation Investment Game Initial Portfolio Statement $6.15 TT $6.15 TT - - - - - Exchange rate 6.50% - - 8% - 3% 6.25% Interest Rate $20,000.00 $2,400.00 $5,892.00 $3,658.50 $4,700.00 $2,072.00 $777.50 $500.00 11/10/02 11/10/02 11/10/02 11/ 10/02 11/10/02 11/10/02 11/10/02 Total value invested Transaction date dd/mm/yy 11/04/03 Maturity date dd/mm/yy SPECIMEN 11 1 Ansa McAL First Unit Scheme SM S1 SV - SAVINGS DEPOSIT FD - FIXED DEPOSIT S2 - SECOND UNIT SCHEME SM - STOCK MARKET SI - FIRST UNIT SCHEME CH - CHACONIA UM - US DOLLAR MONEY MARKET FUND 80.96 100 Transaction details No. of units/shares Code Disposal of Assets Date: SCHOOL CODE: 0000 SCHOOL NAME: $10.90 $14.00 Unit/share price - $22.40 Brokers fees Trinidad And Tobago Unit Trust Corporation Investment Game Portfolio Change Request - Exchange rate - Interest rate $2,259.71 $882.46 $1,377.25 Net proceeds from liquidation dd/mm/yy Transaction date SPECIMEN 12 - $20.00 - - 100 Savings Deposit Second Unit Scheme SV - SAVINGS DEPOSIT FD - FIXED DEPOSIT S2 - SECOND UNIT SCHEME SM - STOCK MARKET SI - FIRST UNIT SCHEME CH - CHACONIA UM - US DOLLAR MONEY MARKET FUND SV S2 Code Brokers fees Unit/share price No. of units/shares Transaction details Acquisition of Assets SCHOOL CODE: 0000 SCHOOL NAME: Date: Trinidad And Tobago Unit Trust Corporation Investment Game Portfolio Change Request Interest rate 8% 3% Exchange rate - $2,259.71 $259.71 $2,000.00 Total value invested Transaction date dd/mmlyy Maturity date dd/mm/yy SPECIMEN 13