* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Obtaining US Security Interests

United States housing bubble wikipedia , lookup

Debtors Anonymous wikipedia , lookup

Land banking wikipedia , lookup

Floating charge wikipedia , lookup

Securitization wikipedia , lookup

Short (finance) wikipedia , lookup

Geneva Securities Convention wikipedia , lookup

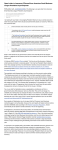

Framework for Obtaining U.S. Security Interests Asset Class Owned Real Property Leased Real Property Most Tangible and Intangible Personal Property Leasehold Mortgage Security Agreement Intellectual Property Shares of Equity Debt Instruments Cash Deposit and Security Accounts To “attach” (i.e. win vs. the Borrower) To “perfect” (i.e. win vs. unsecured creditors) Mortgage Filing with the appropriate state or county level filing office UCC-1 filing in the jurisdiction of organization (or D.C. for foreign entities)* UCC-1 filing plus separate filing with the U.S. Patent & Trademark Office or Copyright Office UCC-1 filing plus possessing any original instrument or certificate and an assignment or stock power endorsed in blank Possession (typically impractical) Account control agreement with the depository bank To have “priority” (i.e. win vs. most other secured creditors) First in time, first in right. *Special rules apply for rights in: aircraft, railroads, government securities, judgments, commercial tort claims, letters of credit, goods covered by certificates of title and certain other unique asset classes. Priority regardless of timing.