Stock Market - ovient project

... company gets those proceeds. This adds to the company’s value, making the price of each stock rise a little. When people sell their stock, the price per share goes down a little, contrary to people buying shares. ...

... company gets those proceeds. This adds to the company’s value, making the price of each stock rise a little. When people sell their stock, the price per share goes down a little, contrary to people buying shares. ...

Q2 2008 Market Commentary (Excerpt)

... seeing now on a daily basis in individual stocks and economic sectors is absolutely unprecedented with some daily stock price movements on the same scale as what happened during the infamous "Black Monday" stock market crash of 1987. This unprecedented volatility is the direct result of large scale ...

... seeing now on a daily basis in individual stocks and economic sectors is absolutely unprecedented with some daily stock price movements on the same scale as what happened during the infamous "Black Monday" stock market crash of 1987. This unprecedented volatility is the direct result of large scale ...

2.03 Federal Reserve & Stock Market

... your business which can be used to build new plants and facilities, pay down debt, or acquire another company. smart owner will keep at least 51% of the stock, which will allow them to retain control of the day to day activities controlling shareholder ...

... your business which can be used to build new plants and facilities, pay down debt, or acquire another company. smart owner will keep at least 51% of the stock, which will allow them to retain control of the day to day activities controlling shareholder ...

stock market crash of 1929

... Prices began to decline in September and early October, but speculation continued, fueled in many cases by individuals who had borrowed money to buy shares—a practice that could be sustained only as long as stock prices continued rising. On October 18 the market went into a free fall, and the wild r ...

... Prices began to decline in September and early October, but speculation continued, fueled in many cases by individuals who had borrowed money to buy shares—a practice that could be sustained only as long as stock prices continued rising. On October 18 the market went into a free fall, and the wild r ...

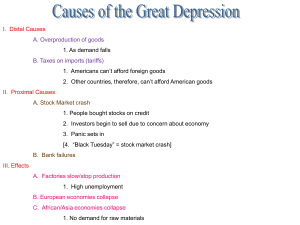

Slide 1 - West Ada

... II. Proximal Causes A. Stock Market crash 1. People bought stocks on credit 2. Investors begin to sell due to concern about economy 3. Panic sets in [4. “Black Tuesday” = stock market crash] B. Bank failures III. Effects A. Factories slow/stop production 1. High unemployment B. European economies co ...

... II. Proximal Causes A. Stock Market crash 1. People bought stocks on credit 2. Investors begin to sell due to concern about economy 3. Panic sets in [4. “Black Tuesday” = stock market crash] B. Bank failures III. Effects A. Factories slow/stop production 1. High unemployment B. European economies co ...

Three Years Down

... Monday was a rout [retreat] for the banking pool, which was still supposed to be "on guard." If it did any net buying at all, which is doubtful, the market paid little attention. Leading stocks broke through the support levels as soon as trading started and kept sinking all day.... When the market f ...

... Monday was a rout [retreat] for the banking pool, which was still supposed to be "on guard." If it did any net buying at all, which is doubtful, the market paid little attention. Leading stocks broke through the support levels as soon as trading started and kept sinking all day.... When the market f ...

Download attachment

... may instruct his broker Ariff to buy 100 share of Renong Steel costing him ...

... may instruct his broker Ariff to buy 100 share of Renong Steel costing him ...

The Stock Exchange Corner

... Bonds – which are documents acknowledging a debt by the issuer of the bonds to the holders of the bonds - are valued by reference to the rate of interest paid to the holders of the bonds. The Government can raise money at the lowest rate of interest; publicly owned bodies may have to pay a little mo ...

... Bonds – which are documents acknowledging a debt by the issuer of the bonds to the holders of the bonds - are valued by reference to the rate of interest paid to the holders of the bonds. The Government can raise money at the lowest rate of interest; publicly owned bodies may have to pay a little mo ...

Key Vocabulary List

... Opportunity costs-Economic choices where resources could have been used to create another item or used for another purpose. Stocks- Shares of ownership in a company. Stock market-A place (physical or virtual) where stocks or shares in a company are bought and sold. Trading- The buying and selling of ...

... Opportunity costs-Economic choices where resources could have been used to create another item or used for another purpose. Stocks- Shares of ownership in a company. Stock market-A place (physical or virtual) where stocks or shares in a company are bought and sold. Trading- The buying and selling of ...

Document

... On October 24th investors began selling stocks at an increasing rate, plunging the value of the stock market. Bankers stepped in to buy stocks and stop the devaluation of the market. But by October 29th,the market experienced such a flurry of selling that it plunged even harder. ...

... On October 24th investors began selling stocks at an increasing rate, plunging the value of the stock market. Bankers stepped in to buy stocks and stop the devaluation of the market. But by October 29th,the market experienced such a flurry of selling that it plunged even harder. ...

Week10.2 Stocks - B-K

... Market Cap – Value of the company = price x (# shares) P/E – Price/earnings ratio = price / EPS – The higher the P/E, the more the market thinks the company’s profits will grow ...

... Market Cap – Value of the company = price x (# shares) P/E – Price/earnings ratio = price / EPS – The higher the P/E, the more the market thinks the company’s profits will grow ...

Stocks and the Stock Market

... receives on the amount he or she originally invested in the company Paid only when a company makes a profit 2. Sell the stock You make money by selling it for more than what you paid for it You buy stock hoping that the price will increase so they can sell it for a profit ...

... receives on the amount he or she originally invested in the company Paid only when a company makes a profit 2. Sell the stock You make money by selling it for more than what you paid for it You buy stock hoping that the price will increase so they can sell it for a profit ...

Short (finance)

.png?width=300)

In finance, short selling (also known as shorting or going short) is the practice of selling securities or other financial instruments that are not currently owned, and subsequently repurchasing them (""covering""). In the event of an interim price decline, the short seller will profit, since the cost of (re)purchase will be less than the proceeds which were received upon the initial (short) sale. Conversely, the short position will be closed out at a loss in the event that the price of a shorted instrument should rise prior to repurchase. The potential loss on a short sale is theoretically unlimited in the event of an unlimited rise in the price of the instrument, however in practice the short seller will be required to post margin or collateral to cover losses, and any inability to do so on a timely basis would cause its broker or counterparty to liquidate the position. In the securities markets, the seller generally must borrow the securities in order to effect delivery in the short sale. In some cases, the short seller must pay a fee to borrow the securities and must additionally reimburse the lender for cash returns the lender would have received had the securities not been loaned out.Short selling is most commonly done with instruments traded in public securities, futures or currency markets, due to the liquidity and real-time price dissemination characteristic of such markets and because the instruments defined within each class are fungible.In practical terms, going short can be considered the opposite of the conventional practice of ""going long"", whereby an investor profits from an increase in the price of the asset. Mathematically, the return from a short position is equivalent to that of owning (being ""long"") a negative amount of the instrument. A short sale may be motivated by a variety of objectives. Speculators may sell short in the hope of realizing a profit on an instrument which appears to be overvalued, just as long investors or speculators hope to profit from a rise in the price of an instrument which appears undervalued. Traders or fund managers may hedge a long position or a portfolio through one or more short positions.