prezentacija ljubljanske borze

... Alternative market for shares (MTF). Full integration of the LJSE in the EU market place: Remote members, foreign vendors, foreign investors, new ...

... Alternative market for shares (MTF). Full integration of the LJSE in the EU market place: Remote members, foreign vendors, foreign investors, new ...

The Causes of the Great Depression

... By 1929 10% of American households owned stocks Buyers engaged in speculation, betting market would climb Buyer then sold stock, making money quickly ...

... By 1929 10% of American households owned stocks Buyers engaged in speculation, betting market would climb Buyer then sold stock, making money quickly ...

Dhaka Stock Exchange

... I/we hereby declare that I/we have already placed the concerned securities, along with the relevant irrevocable sale/dispose of order with my/our above named stock-broker (document enclosed) for execution at prevailing market price, and that I/we shall submit details of the proposed sell/transfer of ...

... I/we hereby declare that I/we have already placed the concerned securities, along with the relevant irrevocable sale/dispose of order with my/our above named stock-broker (document enclosed) for execution at prevailing market price, and that I/we shall submit details of the proposed sell/transfer of ...

06-finance - Eric Rasmusen

... immediately reselling it to the public. An IPO requires filing a 10-K FORM with the SECURITIES AND EXCHANGE COMMISSION (SEC) and issuing a PROSPECTUS, both of which have detailed financial information. ...

... immediately reselling it to the public. An IPO requires filing a 10-K FORM with the SECURITIES AND EXCHANGE COMMISSION (SEC) and issuing a PROSPECTUS, both of which have detailed financial information. ...

The Roaring Twenties to The Great Depression

... “Margin buying”- The practice where people could buy a stock while only putting down 10% and borrowing the rest. Many would sell the stock at a higher price and pay off the money they borrowed. This worked ok until a “margin call”. (Click on “crash” on the wiki) “Speculation”- The practice of buying ...

... “Margin buying”- The practice where people could buy a stock while only putting down 10% and borrowing the rest. Many would sell the stock at a higher price and pay off the money they borrowed. This worked ok until a “margin call”. (Click on “crash” on the wiki) “Speculation”- The practice of buying ...

CHAPTER 10: Equity Markets

... Market makers are dealers who regularly quote bids and ask prices in a security and trade for their own account at these prices and at their own risk. Specialists are members of the exchange who combine the attributes of both dealers and order clerks; they have an obligation to maintain both bid and ...

... Market makers are dealers who regularly quote bids and ask prices in a security and trade for their own account at these prices and at their own risk. Specialists are members of the exchange who combine the attributes of both dealers and order clerks; they have an obligation to maintain both bid and ...

Ride The Seller220512

... Looking back, we saw a similar surge in buyer activity late last year, when the two rate cuts in November and December saw a return of buyer confidence. Over Christmas and into January and February, transaction numbers rose and the glut of stock that had collected on the market almost completely cle ...

... Looking back, we saw a similar surge in buyer activity late last year, when the two rate cuts in November and December saw a return of buyer confidence. Over Christmas and into January and February, transaction numbers rose and the glut of stock that had collected on the market almost completely cle ...

Lecture 02 - Basics of Investing I

... – Aggregate value of combining several stocks together and intended to represent entire or portion of the stock market ...

... – Aggregate value of combining several stocks together and intended to represent entire or portion of the stock market ...

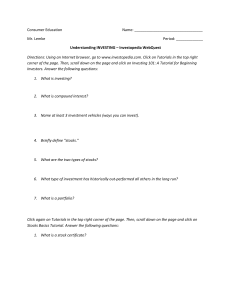

Unit 5 - Understanding Investing WebQuest

... 6. What is a “small-cap” stock and why might someone consider investing in a “small-cap” stock? ...

... 6. What is a “small-cap” stock and why might someone consider investing in a “small-cap” stock? ...

Stocks and Bonds - NUS Investment Society

... You are a creditor, not an owner. You are paid off even before tax! If company defaults, you can sue them into bankruptcy. On bankruptcy, you have higher ...

... You are a creditor, not an owner. You are paid off even before tax! If company defaults, you can sue them into bankruptcy. On bankruptcy, you have higher ...

SWEDISH SECURITIES DEALERS ASSOCIATION European

... European Commission (EC) Consultation on Taxation of the Financial Sector. The Swedish Securities Dealers Association (SSDA, register id 7777147632-40) represents the common interest of banks and investment firms active on the Swedish securities market. The mission of SSDA is the maintaining of a so ...

... European Commission (EC) Consultation on Taxation of the Financial Sector. The Swedish Securities Dealers Association (SSDA, register id 7777147632-40) represents the common interest of banks and investment firms active on the Swedish securities market. The mission of SSDA is the maintaining of a so ...

Warm Up - cloudfront.net

... Objective: Students will be able to assess ways to be a wise investor in the stock market and in other personal investment options. ...

... Objective: Students will be able to assess ways to be a wise investor in the stock market and in other personal investment options. ...

0538453990_268808

... Cross-8e: Question with Sample Answer Chapter 29: Investor Protection and Corporate ...

... Cross-8e: Question with Sample Answer Chapter 29: Investor Protection and Corporate ...

Hyperdynamics Announces $4 Million Registered Direct Common

... The offering was conducted pursuant to the Company's effective shelf registration statement previously filed with the Securities and Exchange Commission. Hyperdynamics intends to use the net proceeds for general corporate purposes including expansion and acceleration of the Company's exploration pro ...

... The offering was conducted pursuant to the Company's effective shelf registration statement previously filed with the Securities and Exchange Commission. Hyperdynamics intends to use the net proceeds for general corporate purposes including expansion and acceleration of the Company's exploration pro ...

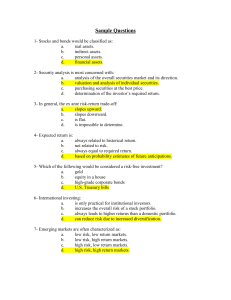

Penny Stocks: Low-priced stocks that typically sell

... Assets: What a company or an individual owns or controls. Examples: buildings, equipment, property, a car or cash. Can also include intangible assets, such as patents and trademarks. Blue Chip Stocks: Refers to stocks of leading companies with a solid record of healthy dividend payments, good manage ...

... Assets: What a company or an individual owns or controls. Examples: buildings, equipment, property, a car or cash. Can also include intangible assets, such as patents and trademarks. Blue Chip Stocks: Refers to stocks of leading companies with a solid record of healthy dividend payments, good manage ...

Dematerialise your shares

... traded on the stock exchanges compulsorily in demat mode. Hence, by holding in demat mode, you can freely buy or sell the shares at market value. The other benefits available to you include: 1. Avoids possibility of bad delivery. 2. Eliminates loss of shares through theft, misplacement, mutilation o ...

... traded on the stock exchanges compulsorily in demat mode. Hence, by holding in demat mode, you can freely buy or sell the shares at market value. The other benefits available to you include: 1. Avoids possibility of bad delivery. 2. Eliminates loss of shares through theft, misplacement, mutilation o ...

Stock Market

... Feelings of confidence where high during this time. It was not necessary to have a lot of money to play the stock market. You could buy stocks on credit, just as you could by a car or a washing machine. All that you needed was a small cash down payment, usually 10 percent (this was called buying on ...

... Feelings of confidence where high during this time. It was not necessary to have a lot of money to play the stock market. You could buy stocks on credit, just as you could by a car or a washing machine. All that you needed was a small cash down payment, usually 10 percent (this was called buying on ...

Stock Market Crash of 1929

... Prices began to decline in September and early October, but speculation continued, fueled in many cases by individuals who had borrowed money to buy shares—a practice that could be sustained only as long as stock prices continued rising. On October 18 the market went into a free fall, and the wild r ...

... Prices began to decline in September and early October, but speculation continued, fueled in many cases by individuals who had borrowed money to buy shares—a practice that could be sustained only as long as stock prices continued rising. On October 18 the market went into a free fall, and the wild r ...

Investment vocabulary

... Bear market: A term that describes a prolonged period of declining stock prices. Blue chip: A well-known corporation with a long history of growth and profits; higher quality relative to smaller or less established organizations. Bond: A legal document that is a promise to repay borrowed principal a ...

... Bear market: A term that describes a prolonged period of declining stock prices. Blue chip: A well-known corporation with a long history of growth and profits; higher quality relative to smaller or less established organizations. Bond: A legal document that is a promise to repay borrowed principal a ...

Short (finance)

.png?width=300)

In finance, short selling (also known as shorting or going short) is the practice of selling securities or other financial instruments that are not currently owned, and subsequently repurchasing them (""covering""). In the event of an interim price decline, the short seller will profit, since the cost of (re)purchase will be less than the proceeds which were received upon the initial (short) sale. Conversely, the short position will be closed out at a loss in the event that the price of a shorted instrument should rise prior to repurchase. The potential loss on a short sale is theoretically unlimited in the event of an unlimited rise in the price of the instrument, however in practice the short seller will be required to post margin or collateral to cover losses, and any inability to do so on a timely basis would cause its broker or counterparty to liquidate the position. In the securities markets, the seller generally must borrow the securities in order to effect delivery in the short sale. In some cases, the short seller must pay a fee to borrow the securities and must additionally reimburse the lender for cash returns the lender would have received had the securities not been loaned out.Short selling is most commonly done with instruments traded in public securities, futures or currency markets, due to the liquidity and real-time price dissemination characteristic of such markets and because the instruments defined within each class are fungible.In practical terms, going short can be considered the opposite of the conventional practice of ""going long"", whereby an investor profits from an increase in the price of the asset. Mathematically, the return from a short position is equivalent to that of owning (being ""long"") a negative amount of the instrument. A short sale may be motivated by a variety of objectives. Speculators may sell short in the hope of realizing a profit on an instrument which appears to be overvalued, just as long investors or speculators hope to profit from a rise in the price of an instrument which appears undervalued. Traders or fund managers may hedge a long position or a portfolio through one or more short positions.