Common clauses and stipulations in loan agreements

... of the clauses as described below, the parties should check the wording of each particular clause before concluding a contract. In addition, the clauses may lead to different legal consequences under each underlying jurisdiction. The cross-collateral clause. Under a cross-collateral clause, the lend ...

... of the clauses as described below, the parties should check the wording of each particular clause before concluding a contract. In addition, the clauses may lead to different legal consequences under each underlying jurisdiction. The cross-collateral clause. Under a cross-collateral clause, the lend ...

General - Website

... 75% guarantee of bank borrowings between £1,000 and £1,000,000: Decision to lend and on terms are with the lender. CARE each lenders terms may be different. Residential security cannot be used. Small and Medium Sized Enterprises with turnover up to £25 million; Guarantee premium of 2%. Availab ...

... 75% guarantee of bank borrowings between £1,000 and £1,000,000: Decision to lend and on terms are with the lender. CARE each lenders terms may be different. Residential security cannot be used. Small and Medium Sized Enterprises with turnover up to £25 million; Guarantee premium of 2%. Availab ...

Douglass. Rob has focused on these narkets fron the point of

... floating rates were over 2O%, whereas today, they are below 7%. In the same time fixed rates have ranged betweet 8% and L6%. In considering whether to borrow on a fixed rate basis, a borrower ï¡il1 if possible take into account a number of facËors. These will include the absolute level of interest r ...

... floating rates were over 2O%, whereas today, they are below 7%. In the same time fixed rates have ranged betweet 8% and L6%. In considering whether to borrow on a fixed rate basis, a borrower ï¡il1 if possible take into account a number of facËors. These will include the absolute level of interest r ...

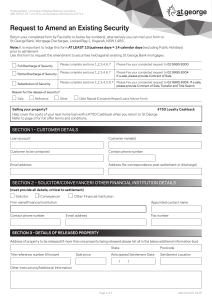

St George

... • Offer only available for applications received under the Advantage Package for new home loan borrowings of $150,000 or more. Annual fee, currently $395, applies • At least one borrower on the new home loan must be the same as that on the previous loan • You must hold a St.George transaction acc ...

... • Offer only available for applications received under the Advantage Package for new home loan borrowings of $150,000 or more. Annual fee, currently $395, applies • At least one borrower on the new home loan must be the same as that on the previous loan • You must hold a St.George transaction acc ...

Heikki Vitie

... The strong capital base of cooperative banks serves as a strong buffer against the financial crisis. • Long-term view does not require doing business with the minimum possible level of capital, but maintaining higher capital adequacy is acceptable. • Drastic economic downturns affect bank's earnings ...

... The strong capital base of cooperative banks serves as a strong buffer against the financial crisis. • Long-term view does not require doing business with the minimum possible level of capital, but maintaining higher capital adequacy is acceptable. • Drastic economic downturns affect bank's earnings ...

Final Residential RE Seminar

... The debt Coverage ratio is The relationship between Net Operating Income (NOI) and Annual Debt Service (ADS). Often used as an Underwriting criterion for Income Property mortgage loans (NOI/ADS). Annual debt service is the cash required to pay out interest as well as principal on a debt . Example: A ...

... The debt Coverage ratio is The relationship between Net Operating Income (NOI) and Annual Debt Service (ADS). Often used as an Underwriting criterion for Income Property mortgage loans (NOI/ADS). Annual debt service is the cash required to pay out interest as well as principal on a debt . Example: A ...

debt capital markets

... At just over $75.0 billion, syndicated ABL volume in 2016 trailed year-ago totals of roughly $85.0 billion. At the outset, we saw more unreported sole-lender deals and underreported clubbed deals for 1) traditional issuers in the middle market and 2) larger issuers that historically would have relie ...

... At just over $75.0 billion, syndicated ABL volume in 2016 trailed year-ago totals of roughly $85.0 billion. At the outset, we saw more unreported sole-lender deals and underreported clubbed deals for 1) traditional issuers in the middle market and 2) larger issuers that historically would have relie ...

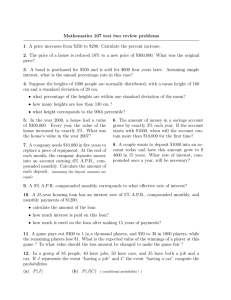

test two review problems

... 9. A 9% A.P.R. compounded monthly corresponds to what effective rate of interest? 10. A 25-year housing loan has an interest rate of 5% A.P.R., compounded monthly, and monthly payments of $1200. • calculate the amount of the loan • how much interest is paid on this loan? • how much is owed on the lo ...

... 9. A 9% A.P.R. compounded monthly corresponds to what effective rate of interest? 10. A 25-year housing loan has an interest rate of 5% A.P.R., compounded monthly, and monthly payments of $1200. • calculate the amount of the loan • how much interest is paid on this loan? • how much is owed on the lo ...

Practice 5

... 8. Compare two loans for $5,000. The 5-year loan has a 5% simple interest rate. The 6-year loan has a 4% simple interest rate. Which loan costs less? _____________________________________ ...

... 8. Compare two loans for $5,000. The 5-year loan has a 5% simple interest rate. The 6-year loan has a 4% simple interest rate. Which loan costs less? _____________________________________ ...

18 - Finance

... year. Short-term debt may be either secured or unsecured and can be obtained from a variety of sources. Some of these sources are spontaneous such as trade credit and accruals while others such as bank credit, commercial paper and loans obtained against receivables or inventories are negotiated. Int ...

... year. Short-term debt may be either secured or unsecured and can be obtained from a variety of sources. Some of these sources are spontaneous such as trade credit and accruals while others such as bank credit, commercial paper and loans obtained against receivables or inventories are negotiated. Int ...

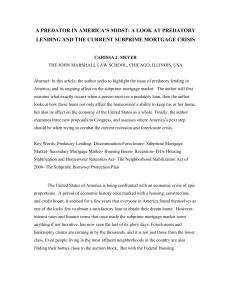

a predator in america`s midst: a look at predatory lending

... All good things must come to an end, and so must all economic bubbles. In 2005, construction halted, home prices began to fall, people stop buying and selling homes, mortgage rates went up, and the bubble began to burst. A slow in the economy can often lead to job loss, reduced consumer spending, f ...

... All good things must come to an end, and so must all economic bubbles. In 2005, construction halted, home prices began to fall, people stop buying and selling homes, mortgage rates went up, and the bubble began to burst. A slow in the economy can often lead to job loss, reduced consumer spending, f ...

Chapter 12 Business and Consumer Loans Section 3

... Common for a payment to be made on a loan before it is due Example: Refinance a debt to a lower rate Rule used by U.S. government and most states and financial institutions Payment first applied to any interest owed Balance is used to reduce principal ...

... Common for a payment to be made on a loan before it is due Example: Refinance a debt to a lower rate Rule used by U.S. government and most states and financial institutions Payment first applied to any interest owed Balance is used to reduce principal ...

Banks and Credit PowerPoint

... Money includes currency and bank account balances, which can be turned into currency. ...

... Money includes currency and bank account balances, which can be turned into currency. ...

Banks and Credit ppt

... Money includes currency and bank account balances, which can be turned into currency. ...

... Money includes currency and bank account balances, which can be turned into currency. ...

Determinants of the Incidence of Loan Modifications

... even when controlling for individual race and presence of 2d lien – data which are difficult to incorporate into national models Suggests the importance of incorporating neighborhood race, foreclosure rates and neighborhood level price trends, data which is or could be readily available, into nation ...

... even when controlling for individual race and presence of 2d lien – data which are difficult to incorporate into national models Suggests the importance of incorporating neighborhood race, foreclosure rates and neighborhood level price trends, data which is or could be readily available, into nation ...

Secured Transactions: The Power of Collateral

... and have access to some credit by virtue of their real estate holdings; poor farmers, who are often tenants, have to use their own savings to finance the additional investment required to raise their incomes. But neither rich nor poor farmers have the easy access to credit enjoyed by their Canadian ...

... and have access to some credit by virtue of their real estate holdings; poor farmers, who are often tenants, have to use their own savings to finance the additional investment required to raise their incomes. But neither rich nor poor farmers have the easy access to credit enjoyed by their Canadian ...

What does it mean? Common terms for home ownership factsheet

... only a portion of the rate paid on the home loan. Mortgage originator - A person who organises a loan from another source (e.g. a mortgage trust fund). Mortgage payment - A regularly scheduled payment that usually includes both principal and interest. Mortgage protection insurance - Insurance taken ...

... only a portion of the rate paid on the home loan. Mortgage originator - A person who organises a loan from another source (e.g. a mortgage trust fund). Mortgage payment - A regularly scheduled payment that usually includes both principal and interest. Mortgage protection insurance - Insurance taken ...

286.5-451 Loans on direct reduction plan -

... dues, interest, and premium, shall be credited upon the semiannual reduction plan. At the end of each semiannual period, the dues paid, and any dividends credited, shall be credited upon the loan. (c) All payments made on the loan shall first be credited to payment of interest and premium, and the b ...

... dues, interest, and premium, shall be credited upon the semiannual reduction plan. At the end of each semiannual period, the dues paid, and any dividends credited, shall be credited upon the loan. (c) All payments made on the loan shall first be credited to payment of interest and premium, and the b ...

Topics – Student Loan Market – Financial Risk – Enrollment Risk

... Legislative Impact on Student Loans ...

... Legislative Impact on Student Loans ...

The ABCs of Hardships and Loans

... into plan assets to meet payroll or pay other bills and then pay it back later. This is never permitted. Another common problem in tough economic times is when an employer withholds salary deferrals from employees’ pay intending to deposit the money in its 401(k) or SIMPLE IRA plan, but does not. Th ...

... into plan assets to meet payroll or pay other bills and then pay it back later. This is never permitted. Another common problem in tough economic times is when an employer withholds salary deferrals from employees’ pay intending to deposit the money in its 401(k) or SIMPLE IRA plan, but does not. Th ...

Microsoft Word - TempDoc1.doc

... This is to certify that I have verified the books of accounts of M/s……………….…………….. (Name of the Company and address) with Registered Office at ………………………and certify as under: 1. That the Company has utilized the funds (State the details of Term Loan/Working Capital/Other facilities and their purpose, ...

... This is to certify that I have verified the books of accounts of M/s……………….…………….. (Name of the Company and address) with Registered Office at ………………………and certify as under: 1. That the Company has utilized the funds (State the details of Term Loan/Working Capital/Other facilities and their purpose, ...

Permian Basin Brochure Lenders.indd

... 4. Close on the purchase of your home. 5. Enjoy your new home and all the benefits of homeownership! You also are eligible to participate in a FREE homebuyer education class offered by the Odessa Housing Finance Corporation. To take advantage of this ...

... 4. Close on the purchase of your home. 5. Enjoy your new home and all the benefits of homeownership! You also are eligible to participate in a FREE homebuyer education class offered by the Odessa Housing Finance Corporation. To take advantage of this ...

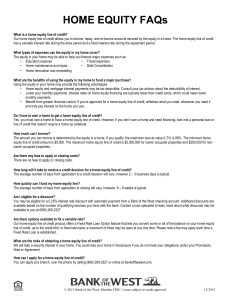

HOME EQUITY FAQs - Bank of the West

... • Benefit from greater financial control. If you’re approved for a home equity line of credit, withdraw what you need, whenever you need it and only pay interest on the funds you use. Do I have to own a home to get a home equity line of credit? Yes, you must own a home to have a home equity line of ...

... • Benefit from greater financial control. If you’re approved for a home equity line of credit, withdraw what you need, whenever you need it and only pay interest on the funds you use. Do I have to own a home to get a home equity line of credit? Yes, you must own a home to have a home equity line of ...

Economics - Spring Branch ISD

... accounts that pay a higher rate of interest than do savings and checking accounts. 10. True or false; Funds placed in a CD, cannot be removed until the end of a certain time period, such as one or two years. 11. The first bankers in history were goldsmiths. ...

... accounts that pay a higher rate of interest than do savings and checking accounts. 10. True or false; Funds placed in a CD, cannot be removed until the end of a certain time period, such as one or two years. 11. The first bankers in history were goldsmiths. ...

Loan shark

A loan shark is a person or body who offers loans at extremely high interest rates. The term usually refers to illegal activity, but may also refer to predatory lending with extremely high interest rates such as payday or title loans. Loan sharks sometimes enforce repayment by blackmail or threats of violence. Historically, many moneylenders skirted between legal and extra-legal activity. In the recent western world, loan sharks have been a feature of the criminal underworld.