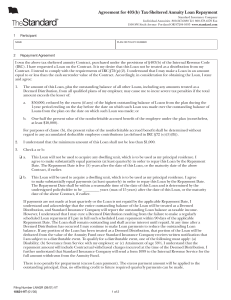

Tax-Sheltered Annuity Loan Repayment

... Distribution, and Standard Insurance Company will report the outstanding Loan balance as taxable income. However, I understand that I may cure a Deemed Distribution resulting from the failure to make a regularly scheduled Loan repayment if I pay in full such scheduled Loan repayment within 90 days o ...

... Distribution, and Standard Insurance Company will report the outstanding Loan balance as taxable income. However, I understand that I may cure a Deemed Distribution resulting from the failure to make a regularly scheduled Loan repayment if I pay in full such scheduled Loan repayment within 90 days o ...

Econ 111 – Monetary Economics

... • To articulate why these markets react so strongly to actions taken by the central bank • To evaluate the effectiveness of monetary policy in dealing with economic shocks and inflation • To analyze the effects of policy on interest rates and how different interest rates affect different actors in t ...

... • To articulate why these markets react so strongly to actions taken by the central bank • To evaluate the effectiveness of monetary policy in dealing with economic shocks and inflation • To analyze the effects of policy on interest rates and how different interest rates affect different actors in t ...

Digital Loan Marketplace

... By surrounding this data with loan analytics functionality, these technology vendors enable lenders to instantly determine the prices on all loans for which the prospective borrower is eligible and do so consistently throughout their organization. Some solutions even incorporate lock desk workflow fu ...

... By surrounding this data with loan analytics functionality, these technology vendors enable lenders to instantly determine the prices on all loans for which the prospective borrower is eligible and do so consistently throughout their organization. Some solutions even incorporate lock desk workflow fu ...

RBI IFRS Session - Impairment

... • breach of contract, such as a default or delinquency • the lender…granting to borrower a concession • probable that the borrower will enter bankruptcy or other financial reorganisation • observable data indicating that there is a measurable decrease in the estimated future cash flows (i) adverse c ...

... • breach of contract, such as a default or delinquency • the lender…granting to borrower a concession • probable that the borrower will enter bankruptcy or other financial reorganisation • observable data indicating that there is a measurable decrease in the estimated future cash flows (i) adverse c ...

Chapter One – Lecture Notes

... One last point – in the category of corporate distributions. A “dividend in kind”. Example, client – company has a car used in the business, worth ...

... One last point – in the category of corporate distributions. A “dividend in kind”. Example, client – company has a car used in the business, worth ...

COMMERCIAL INFORMATION AND CREDIT ANALYSIS

... The application (credit request) can take many forms but should include a plan for repaying the loan and an assessment of the contingencies, which might reasonably arise, and how the borrower would intend to deal with them. It might be in detailed written form, or not. 3. Review of the application; ...

... The application (credit request) can take many forms but should include a plan for repaying the loan and an assessment of the contingencies, which might reasonably arise, and how the borrower would intend to deal with them. It might be in detailed written form, or not. 3. Review of the application; ...

Personal Finance Notes 1

... probably wrong. People who want to open new businesses often have trouble obtaining credit from banks. Banks lend money if they are quite sure the money will be repaid. They usually require a pledge of assets or collateral to back up a ...

... probably wrong. People who want to open new businesses often have trouble obtaining credit from banks. Banks lend money if they are quite sure the money will be repaid. They usually require a pledge of assets or collateral to back up a ...

Weekly news. NBKR press-release №40/2013 (October 07

... Loans shall be repaid. The borrowers shall be aware of assumed obligations and repay a debt under loans. Otherwise, credit institutions shall be entitled to take measures stipulated by the contractual obligations. In case of any issues occurrence regarding loan repayment, the borrower can resolve th ...

... Loans shall be repaid. The borrowers shall be aware of assumed obligations and repay a debt under loans. Otherwise, credit institutions shall be entitled to take measures stipulated by the contractual obligations. In case of any issues occurrence regarding loan repayment, the borrower can resolve th ...

English

... interest rates sometimes upwards of 20%! In these cases the amount of interest you must pay can be very large. Simple Interest is calculated based on the loan amount. With simple interest problems we refer to the loan amount as the principal. The formula for calculating simple interest is given belo ...

... interest rates sometimes upwards of 20%! In these cases the amount of interest you must pay can be very large. Simple Interest is calculated based on the loan amount. With simple interest problems we refer to the loan amount as the principal. The formula for calculating simple interest is given belo ...

SimBank Presentation

... – Interest rates for loans and deposits – Promotional expenditures by type of loan and deposits – Compensating balances in commercial loans – Service fees in demand deposit and interest bearing transaction accounts – Average salary – Number of new branches ...

... – Interest rates for loans and deposits – Promotional expenditures by type of loan and deposits – Compensating balances in commercial loans – Service fees in demand deposit and interest bearing transaction accounts – Average salary – Number of new branches ...

1 - City of Port Hueneme

... thirty years or earlier if the property is sold, transferred, refinanced, or when a borrower who was an owner-occupant at the time the property was improved, moves out of the property. For low and moderate income owners who continuously occupy the property in full accordance with the terms of the Ci ...

... thirty years or earlier if the property is sold, transferred, refinanced, or when a borrower who was an owner-occupant at the time the property was improved, moves out of the property. For low and moderate income owners who continuously occupy the property in full accordance with the terms of the Ci ...

High street banks make way for Paxton fund

... High street banks make way for Paxton fund REAL's latest new scheme joins their stable of specialist property and debt funds, giving sophisticated investors access to expert niche managers like Paxton Private Finance specialising in short-term loans secured on UK property. The first closing was over ...

... High street banks make way for Paxton fund REAL's latest new scheme joins their stable of specialist property and debt funds, giving sophisticated investors access to expert niche managers like Paxton Private Finance specialising in short-term loans secured on UK property. The first closing was over ...

Agricultural finance for smallholder farmers

... Sometimes technical support/ agricultural advices ...

... Sometimes technical support/ agricultural advices ...

Fund or Die - Leasing News

... corporate paradise-a nonsmoking, health-savvy organization that paid its workers good salaries and benefits, catered lavish yearly parties, and kept itself tech-current. Recalled one manager, the indefatigable Fanghella loved computers. “He was a geek. He would buy software just for the sake of havi ...

... corporate paradise-a nonsmoking, health-savvy organization that paid its workers good salaries and benefits, catered lavish yearly parties, and kept itself tech-current. Recalled one manager, the indefatigable Fanghella loved computers. “He was a geek. He would buy software just for the sake of havi ...

Answers to Chapter 24 Questions

... recourse to the seller for any claims, transferring the credit risk entirely to the buyer. For the originator, it has completely eliminated this loan from its books. In the case of a sale with recourse, credit risk is still present for the originator because the buyer could transfer ownership of the ...

... recourse to the seller for any claims, transferring the credit risk entirely to the buyer. For the originator, it has completely eliminated this loan from its books. In the case of a sale with recourse, credit risk is still present for the originator because the buyer could transfer ownership of the ...

Repricings May Increase in Volatile Market

... vote, other than the lenders that are willing to provide the new repriced loans or that are willing to exchange their existing loans for new repriced loans. In addition, these provisions allow existing lenders that are not interested in participating in the new repriced facility to be repaid. If the ...

... vote, other than the lenders that are willing to provide the new repriced loans or that are willing to exchange their existing loans for new repriced loans. In addition, these provisions allow existing lenders that are not interested in participating in the new repriced facility to be repaid. If the ...

assisting the start-up and growing business

... tempted to venture into the apparently promising future of entrepreneurship. Small businesses are said to offer, among other features, greater flexibility, faster decision making, more efficient operation, and greater opportunities for individual satisfaction. In many cases entrepreneurs initially u ...

... tempted to venture into the apparently promising future of entrepreneurship. Small businesses are said to offer, among other features, greater flexibility, faster decision making, more efficient operation, and greater opportunities for individual satisfaction. In many cases entrepreneurs initially u ...

chap008-- - MCST-CS

... “To reduce the risk of an investment by making an offsetting investment. There are a large number of hedging strategies that one can use. To give an example, one may take a long position on a security and then sell short the same or a similar security. This means that one will profit (or at least av ...

... “To reduce the risk of an investment by making an offsetting investment. There are a large number of hedging strategies that one can use. To give an example, one may take a long position on a security and then sell short the same or a similar security. This means that one will profit (or at least av ...

AUSTIN COLLEGE GRANT/LOAN PROGRAM

... within five years of admission. Students withdrawing before graduation will be obligated to repay the full amount. Interest will not be charged while the student is enrolled full-time at Austin College. The Interest rate is variable and will be set at 3% over the ninety-one day Treasury Bill rate on ...

... within five years of admission. Students withdrawing before graduation will be obligated to repay the full amount. Interest will not be charged while the student is enrolled full-time at Austin College. The Interest rate is variable and will be set at 3% over the ninety-one day Treasury Bill rate on ...

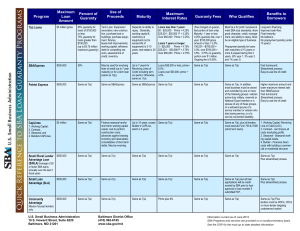

Program Maximum Loan Amount Percent of Guaranty Use of

... Same as 504 plus borrower must have been current on last 12 monthly payments. Can not refinance an existing federal government loan. ...

... Same as 504 plus borrower must have been current on last 12 monthly payments. Can not refinance an existing federal government loan. ...

Banks lend more as economy grows

... whole, are here to stay. Going forward, net yearly advances to agriculture, too, will grow though that has to remain far lower than other sectors simply because the bulk of agricultural loans are repaid the same year,” says head of one of the top five banks in the country. Bank credit to SMEs grew 2 ...

... whole, are here to stay. Going forward, net yearly advances to agriculture, too, will grow though that has to remain far lower than other sectors simply because the bulk of agricultural loans are repaid the same year,” says head of one of the top five banks in the country. Bank credit to SMEs grew 2 ...

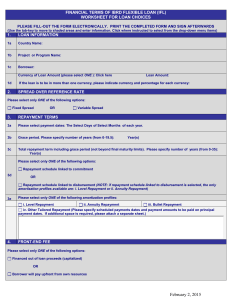

English - World Bank Treasury

... If Borrower chooses to have conversion options, please select ONLY one of the alternatives below for Caps/Collars: Cap/Collar premium to be financed out of the loan proceeds (as long as there are available funds to be disbursed) 5b Cap/Collar premium paid by the Borrower from own resources ...

... If Borrower chooses to have conversion options, please select ONLY one of the alternatives below for Caps/Collars: Cap/Collar premium to be financed out of the loan proceeds (as long as there are available funds to be disbursed) 5b Cap/Collar premium paid by the Borrower from own resources ...

Higher rates after Trump win mean good things for bank loan yields

... latest senior loan officer survey that standards had tightened on all types of CRE loans. Banks also reported strong demand for CRE loans, suggesting they could continue to attract borrowers even at higher rates. Higher rates in the residential mortgage market could deter some borrowers and at the v ...

... latest senior loan officer survey that standards had tightened on all types of CRE loans. Banks also reported strong demand for CRE loans, suggesting they could continue to attract borrowers even at higher rates. Higher rates in the residential mortgage market could deter some borrowers and at the v ...

Debt Financing in a Challenging Regulatory and Market Environment

... Less competition from CMBS lenders and higher demand for bank and life company money. Life companies will likely get through most of their allocations by late summer ...

... Less competition from CMBS lenders and higher demand for bank and life company money. Life companies will likely get through most of their allocations by late summer ...

Obtaining Finance Homework

... Perth Holdings Ltd is a Scottish-based company that makes drilling and other engineering equipment for the oil industry. It was set up in 2001 with £160 000 of share capital, a £40 000 bank loan and a £10 000 local authority grant. The shares were owned equally by Ella McDonald and Shane MacTaggart. ...

... Perth Holdings Ltd is a Scottish-based company that makes drilling and other engineering equipment for the oil industry. It was set up in 2001 with £160 000 of share capital, a £40 000 bank loan and a £10 000 local authority grant. The shares were owned equally by Ella McDonald and Shane MacTaggart. ...

Loan shark

A loan shark is a person or body who offers loans at extremely high interest rates. The term usually refers to illegal activity, but may also refer to predatory lending with extremely high interest rates such as payday or title loans. Loan sharks sometimes enforce repayment by blackmail or threats of violence. Historically, many moneylenders skirted between legal and extra-legal activity. In the recent western world, loan sharks have been a feature of the criminal underworld.