EMW09_Vincent

... financial services firm focused on select, niche international markets. By using its capital and expertise, INTL seeks to facilitate wholesale, cross-border financial flows through market making and trading of international financial instruments. ...

... financial services firm focused on select, niche international markets. By using its capital and expertise, INTL seeks to facilitate wholesale, cross-border financial flows through market making and trading of international financial instruments. ...

Products, services, customers, geography

... you money if you leave an item with them, such as jewelry, firearms, cameras or electronic devices. Usually, the shop must keep your item for 30 days. Within that time, you must repay the loan. If you don’t, the pawned item belongs to the store, and it is put up for sale. Loans from the pawnshop are ...

... you money if you leave an item with them, such as jewelry, firearms, cameras or electronic devices. Usually, the shop must keep your item for 30 days. Within that time, you must repay the loan. If you don’t, the pawned item belongs to the store, and it is put up for sale. Loans from the pawnshop are ...

how to avoid the pitfalls of the commercial mortgage application

... commercial mortgages since there is a maximum loan amount of $2-3 million for most Stated Income Commercial Mortgage Programs. 3. The third reason a commercial loan may be declined is due to property type or special requirements imposed that make the loan impractical for the commercial borrower. Not ...

... commercial mortgages since there is a maximum loan amount of $2-3 million for most Stated Income Commercial Mortgage Programs. 3. The third reason a commercial loan may be declined is due to property type or special requirements imposed that make the loan impractical for the commercial borrower. Not ...

Mortgage Lending Discrimination - Fair Housing Center of West

... As a result, between 1934 and 1968, 98% of the loans approved by the federal government were made to Whites Redlining still effects neighborhoods today In Hartford, neighborhoods that were redlined in the 1930s are the poorest in the region ...

... As a result, between 1934 and 1968, 98% of the loans approved by the federal government were made to Whites Redlining still effects neighborhoods today In Hartford, neighborhoods that were redlined in the 1930s are the poorest in the region ...

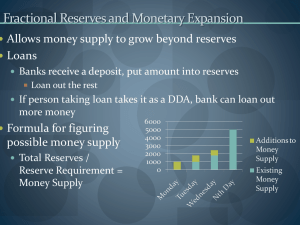

Money and Banking

... Tools of Monetary Policy Reserve Requirement Fed can change this rate Lower reserve requirement, more money can be loaned Open Market Operations Buying and selling of government securities in financial markets Operations conducted by Federal Open Market Committee Set targets, tell tra ...

... Tools of Monetary Policy Reserve Requirement Fed can change this rate Lower reserve requirement, more money can be loaned Open Market Operations Buying and selling of government securities in financial markets Operations conducted by Federal Open Market Committee Set targets, tell tra ...

stock loan fee increase - The Options Clearing Corporation

... Exchange Commission a proposed change to OCC’s Schedule of Fees in conjunction with enhancements to OCC’s Stock Loan Program, which encompasses both the Stock Hedge Program and Market Loan Program. The Stock Loan Program’s transaction volumes and notional values have increased significantly over the ...

... Exchange Commission a proposed change to OCC’s Schedule of Fees in conjunction with enhancements to OCC’s Stock Loan Program, which encompasses both the Stock Hedge Program and Market Loan Program. The Stock Loan Program’s transaction volumes and notional values have increased significantly over the ...

Financing a Small Business 4.00 Explain the fundamentals of

... 2) A line of credit that allows the businesses to borrow a stated amount of money at a stated interest rate to use as the business chooses. 3) Require that money be paid back on a regular basis according to the repayment plan specified. 4) Very conservative and not inclined to lend to businesses tha ...

... 2) A line of credit that allows the businesses to borrow a stated amount of money at a stated interest rate to use as the business chooses. 3) Require that money be paid back on a regular basis according to the repayment plan specified. 4) Very conservative and not inclined to lend to businesses tha ...

Student Loans: Should Some Indebtedness Be Forgiven?

... purchase homes—college grads and professionals—are graduating with mortgage-sized debts that they can neither live in, nor use as intended in today's job market? Are we content to live in a society where only the privileged few are able to obtain an education without sacrificing their future? Do we ...

... purchase homes—college grads and professionals—are graduating with mortgage-sized debts that they can neither live in, nor use as intended in today's job market? Are we content to live in a society where only the privileged few are able to obtain an education without sacrificing their future? Do we ...

After two slow years, mortgage refinancing market

... After very little activity in 2009-10, the refinancing market is just taking off, said Rashmi Airan-Pace, a partner in the realestate law firm Airan2, AiranPace & Crosa. Appraisals were slow, she said, and there was uncertainty as to the real market values of the properties. B ut now banks , ho ...

... After very little activity in 2009-10, the refinancing market is just taking off, said Rashmi Airan-Pace, a partner in the realestate law firm Airan2, AiranPace & Crosa. Appraisals were slow, she said, and there was uncertainty as to the real market values of the properties. B ut now banks , ho ...

Real Estate Finance: An Overview

... equity when their home values fell (by about half) in the early 1930s; they defaulted in large numbers when their incomes fell. One estimate shows about half of U.S. single-family mortgage loans in default in 1933. (Some states passed moratoria on foreclosures, but that just passed added problems al ...

... equity when their home values fell (by about half) in the early 1930s; they defaulted in large numbers when their incomes fell. One estimate shows about half of U.S. single-family mortgage loans in default in 1933. (Some states passed moratoria on foreclosures, but that just passed added problems al ...

S/CC Resource Disregards - page 327

... long as it is being used by the household. A second vehicle may be exempt if there is a medical need for it or it is being used for employment related activities. A third vehicle is also exempt if there is a child under 21 years of age in the household, and they are using this vehicle for school att ...

... long as it is being used by the household. A second vehicle may be exempt if there is a medical need for it or it is being used for employment related activities. A third vehicle is also exempt if there is a child under 21 years of age in the household, and they are using this vehicle for school att ...

Kiútprogram – A Social Microcredit Program for the Roma in Hungary

... With adequate social opportunities, individuals can effectively shape their own destiny and help each other. They need not be seen primarily as passive recipients of the benefits of cunning development programs. ...

... With adequate social opportunities, individuals can effectively shape their own destiny and help each other. They need not be seen primarily as passive recipients of the benefits of cunning development programs. ...

Economic Turmoil and Private Student Loans What it Means to Your Students

... What is an Alternative (or Private) Loan? • Private loans are those that exist outside the federal student loan system and are not guaranteed by the federal government. • Private loans may be provided by banks, non-profit agencies, or other financial institutions. • Private Loans for education were ...

... What is an Alternative (or Private) Loan? • Private loans are those that exist outside the federal student loan system and are not guaranteed by the federal government. • Private loans may be provided by banks, non-profit agencies, or other financial institutions. • Private Loans for education were ...

Federal Direct PLUS Loans The Direct Parent PLUS Loan is a

... •The amount borrowed is not to excess the student's Cost of Attendance minus financial aid resources. The parent must reapply each year they want the loan. •The student must also maintain Satisfactory Academic Progress (SAP), and at least half-time enrollment. Note: If you were selected for verifica ...

... •The amount borrowed is not to excess the student's Cost of Attendance minus financial aid resources. The parent must reapply each year they want the loan. •The student must also maintain Satisfactory Academic Progress (SAP), and at least half-time enrollment. Note: If you were selected for verifica ...

Adjustable Rate Mortgage

... Usually __________________ interest rate than fixed rate With lower rate borrower can qualify for __________________ loan BUT when interest rates rise, payment rises For Lender Allows lenders to better match long term loan interest rates to short term deposits __________________ rates Negative amort ...

... Usually __________________ interest rate than fixed rate With lower rate borrower can qualify for __________________ loan BUT when interest rates rise, payment rises For Lender Allows lenders to better match long term loan interest rates to short term deposits __________________ rates Negative amort ...

Atlas - Atlas - Paying for College

... 9.1.12.C.3 Compute and assess the accumulating effect of interest paid over time when using a variety of sources of credit. Copyright © State of New Jersey, 1996 - 2016. ...

... 9.1.12.C.3 Compute and assess the accumulating effect of interest paid over time when using a variety of sources of credit. Copyright © State of New Jersey, 1996 - 2016. ...

Third World Debt Default Announcements and Market Learning :

... Banks Co-authored with George Philippatos Managerial Finance, Volume 22 No. 7, 1996 ...

... Banks Co-authored with George Philippatos Managerial Finance, Volume 22 No. 7, 1996 ...

official - Government Printing Press

... (b) branches oUhe State Bank of India and its Associates as per -II. In case,for any particular issue, the receiving office/s is/are restricted to centres, irwill be armouncedas part of SpeCific Loan Notification. Oi) FIls, NRIs and Qverseas Corporate bodies predominantly owned should submit their a ...

... (b) branches oUhe State Bank of India and its Associates as per -II. In case,for any particular issue, the receiving office/s is/are restricted to centres, irwill be armouncedas part of SpeCific Loan Notification. Oi) FIls, NRIs and Qverseas Corporate bodies predominantly owned should submit their a ...

2016 Loan Generation Marketing Webinar Series

... A strategic approach to mortgage marketing can help you grow loans, control risk and develop member relationships with arguably the greatest potential to achieve Primary Financial Institution status by acquiring the member’s home loan! Learn how to refinance members from high mortgage rates, help ma ...

... A strategic approach to mortgage marketing can help you grow loans, control risk and develop member relationships with arguably the greatest potential to achieve Primary Financial Institution status by acquiring the member’s home loan! Learn how to refinance members from high mortgage rates, help ma ...

InnovFin Final Recipients 2014

... As agreed in the InnovFin Delegation Agreement between the European Commission and the European Investment Bank (EIB), the EIB will publish information on Financial Intermediaries and Final Recipients supported since the signature date of the Delegation Agreement (12/06/2014) until the end of the 20 ...

... As agreed in the InnovFin Delegation Agreement between the European Commission and the European Investment Bank (EIB), the EIB will publish information on Financial Intermediaries and Final Recipients supported since the signature date of the Delegation Agreement (12/06/2014) until the end of the 20 ...

GLOSSARY

... payment of a specified interest rate until a designated date in the future (p. 87) charge card allows a consumer to make purchases now and pay the account in full at the end of the month (p. 129) charitable remainder trust (CRT) an irrevocable trust designed to convert the highly appreciated assets ...

... payment of a specified interest rate until a designated date in the future (p. 87) charge card allows a consumer to make purchases now and pay the account in full at the end of the month (p. 129) charitable remainder trust (CRT) an irrevocable trust designed to convert the highly appreciated assets ...

Chapter 19 Residential Real Estate Finance: Mortgage

... practice of redlining is prohibited, i.e. the lender is not permitted to make blanket designations of geographic areas that are considered to be unacceptable loan risks “Real Estate Principles for the New Economy”: Norman G. Miller and David M. Geltner ...

... practice of redlining is prohibited, i.e. the lender is not permitted to make blanket designations of geographic areas that are considered to be unacceptable loan risks “Real Estate Principles for the New Economy”: Norman G. Miller and David M. Geltner ...

Investor Presentation May 2014

... • Community banks (e.g., Titan Bank and Congressional Bank) have begun purchasing loans through the Lending Club platform and Titan Bank started to offer personal loans to their customers through Lending Club. ...

... • Community banks (e.g., Titan Bank and Congressional Bank) have begun purchasing loans through the Lending Club platform and Titan Bank started to offer personal loans to their customers through Lending Club. ...

Downlaod File - Prince Mohammad Bin Fahd University

... 13.Why might you be willing to make a loan to your neighbor by putting funds in a savings account earning a 5% interest rate at the bank and having the bank lend her the funds at a 10% interest rate rather than lend her the funds yourself? Because the costs of making the loan to your neighbor are h ...

... 13.Why might you be willing to make a loan to your neighbor by putting funds in a savings account earning a 5% interest rate at the bank and having the bank lend her the funds at a 10% interest rate rather than lend her the funds yourself? Because the costs of making the loan to your neighbor are h ...

Loan shark

A loan shark is a person or body who offers loans at extremely high interest rates. The term usually refers to illegal activity, but may also refer to predatory lending with extremely high interest rates such as payday or title loans. Loan sharks sometimes enforce repayment by blackmail or threats of violence. Historically, many moneylenders skirted between legal and extra-legal activity. In the recent western world, loan sharks have been a feature of the criminal underworld.