Market Entry ServicesTM for unsecured personal loans

... As the economy rebounds, the personal loan market continues to gain popularity, becoming one of the fastest-growing consumer lending segments today. Increased consumer confidence and the advent of online marketplace lenders are helping the personal loan space attract new and established institutions ...

... As the economy rebounds, the personal loan market continues to gain popularity, becoming one of the fastest-growing consumer lending segments today. Increased consumer confidence and the advent of online marketplace lenders are helping the personal loan space attract new and established institutions ...

Bus 40-Chapter 9

... a. No limit to loans (generally California lenders will only loan up to $240,000). b. Usually a 30-year term. c. No down payment needed unless the purchase price exceeds the CRV appraisal or for some reason the lender requires one. ...

... a. No limit to loans (generally California lenders will only loan up to $240,000). b. Usually a 30-year term. c. No down payment needed unless the purchase price exceeds the CRV appraisal or for some reason the lender requires one. ...

Why use a cosigner for your private student loan?

... A cosigner agrees to assume equal responsibility for repaying the loan. The loan becomes a part of the cosigner’s credit history, even if the borrower is the one making all the loan payments. The cosigner should: • Understand how much the student intends to borrow, and how the money will be spent • ...

... A cosigner agrees to assume equal responsibility for repaying the loan. The loan becomes a part of the cosigner’s credit history, even if the borrower is the one making all the loan payments. The cosigner should: • Understand how much the student intends to borrow, and how the money will be spent • ...

The crisis

... 1. Poor borrowers go bankrupt, so houses are returned to lenders. 2. Central banks help to prevent system collapse. 3. Poor borrowers can no longer repay their loans. 4. Some financial institutions go bust as they cannot sell the property, and some lenders sell loan obligations to investors. 5. Poor ...

... 1. Poor borrowers go bankrupt, so houses are returned to lenders. 2. Central banks help to prevent system collapse. 3. Poor borrowers can no longer repay their loans. 4. Some financial institutions go bust as they cannot sell the property, and some lenders sell loan obligations to investors. 5. Poor ...

construction loans - Mt. McKinley Bank

... We will be happy to discuss your plans and answer any questions you may have regarding financing your construction project. Generally construction loans are for an 18 month period of time and require a 25% down payment or equity in the project before the construction loan is booked. Most owner build ...

... We will be happy to discuss your plans and answer any questions you may have regarding financing your construction project. Generally construction loans are for an 18 month period of time and require a 25% down payment or equity in the project before the construction loan is booked. Most owner build ...

Small Banks Gain Reprieve on Balloon Mortgages

... of contention for many lenders and was a requirement of the Dodd-Frank Act. The CFPB did not change a final rule in which loan officer compensation paid by a creditor to a mortgage broker must be included in points and fees, in addition to any origination charges paid by a consumer to a creditor. "I ...

... of contention for many lenders and was a requirement of the Dodd-Frank Act. The CFPB did not change a final rule in which loan officer compensation paid by a creditor to a mortgage broker must be included in points and fees, in addition to any origination charges paid by a consumer to a creditor. "I ...

Lecture / Chapter 3

... 3. Lender obtains credit reports of borrower from three sources 4. Borrower provides to the lender W-2 tax information, income statements, verification of employment and history, proof of assets (bank ...

... 3. Lender obtains credit reports of borrower from three sources 4. Borrower provides to the lender W-2 tax information, income statements, verification of employment and history, proof of assets (bank ...

New Economic Bubbles

... Property Taxes in California = $500 per month on $500,000 home Both interest & property taxes are tax deductible (lower your income tax) ...

... Property Taxes in California = $500 per month on $500,000 home Both interest & property taxes are tax deductible (lower your income tax) ...

New consumer needs require new, innovative financial products.

... unsecured, closed-end loans with small, fixed payments to Hispanics who lack access to traditions credit. Progreso’s loans have fixed payments, fixed APR’s and are easy to apply for. Progress makes sure that all consumers who apply for a loan can afford that loan and turn away those who can not. ...

... unsecured, closed-end loans with small, fixed payments to Hispanics who lack access to traditions credit. Progreso’s loans have fixed payments, fixed APR’s and are easy to apply for. Progress makes sure that all consumers who apply for a loan can afford that loan and turn away those who can not. ...

Commercial Mortgage Backed Securities (CMBS)

... – Subsidiaries of commercial banks – MGIC Investment Corp. – Residential Funding Corporation ...

... – Subsidiaries of commercial banks – MGIC Investment Corp. – Residential Funding Corporation ...

The crisis

... What is the chronology of the events below? Replace the red parts with the words from before: 1. Poor borrowers go bankrupt, so houses are returned to lenders. 2. Central banks help to prevent system collapse. 3. Poor borrowers can no longer repay their loans. 4. Some financial institutions go bust ...

... What is the chronology of the events below? Replace the red parts with the words from before: 1. Poor borrowers go bankrupt, so houses are returned to lenders. 2. Central banks help to prevent system collapse. 3. Poor borrowers can no longer repay their loans. 4. Some financial institutions go bust ...

Uganda Agricultural Credit Facility

... The Agricultural Credit Facility (ACF) was set up by the Government of Uganda (GoU) in partnership with Commercial Banks, Uganda Development Bank Ltd (UDBL), Micro Deposit Taking Institutions (MDIs) and Credit Institutions all referred to as Participating Financial Institutions (PFIs) to facilitate ...

... The Agricultural Credit Facility (ACF) was set up by the Government of Uganda (GoU) in partnership with Commercial Banks, Uganda Development Bank Ltd (UDBL), Micro Deposit Taking Institutions (MDIs) and Credit Institutions all referred to as Participating Financial Institutions (PFIs) to facilitate ...

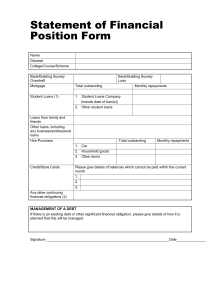

Statement of Financial Position Form

... In the case of married candidates who are applying or who have applied for a diocesan family maintenance grant, the candidate’s spouse is asked to jointly complete and sign the form or, if preferred, to complete a separate form. (1) STUDENT LOANS It should be noted that grants from Central Church Fu ...

... In the case of married candidates who are applying or who have applied for a diocesan family maintenance grant, the candidate’s spouse is asked to jointly complete and sign the form or, if preferred, to complete a separate form. (1) STUDENT LOANS It should be noted that grants from Central Church Fu ...

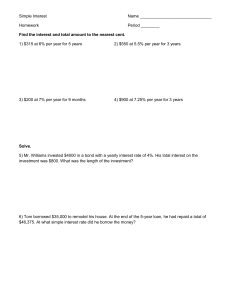

Simple Interest Name Homework Period ______ Find the interest

... 6) Tom borrowed $35,000 to remodel his house. At the end of the 5-year loan, he had repaid a total of $46,375. At what simple interest rate did he borrow the money? ...

... 6) Tom borrowed $35,000 to remodel his house. At the end of the 5-year loan, he had repaid a total of $46,375. At what simple interest rate did he borrow the money? ...

Why Can`t My Bank Help Me?

... their profits to cover bad loans or bad debt. If collateral is attached to a loan – for example, a car is used to secure an auto loan – the car can always be sold off to pay off as much of the loan as possible. A plan is then set up with the borrower to cover the difference. If the borrower cannot p ...

... their profits to cover bad loans or bad debt. If collateral is attached to a loan – for example, a car is used to secure an auto loan – the car can always be sold off to pay off as much of the loan as possible. A plan is then set up with the borrower to cover the difference. If the borrower cannot p ...

Mortgage Loans

... Programs to meet individual needs (most Fannie Mae loan programs available): • Comprehensive view of borrower’s creditworthiness; help with lower credit scores & financial assets • Potential portfolio mortgages for special situations • Home loans in Washington (new and existing members), Oregon and ...

... Programs to meet individual needs (most Fannie Mae loan programs available): • Comprehensive view of borrower’s creditworthiness; help with lower credit scores & financial assets • Potential portfolio mortgages for special situations • Home loans in Washington (new and existing members), Oregon and ...

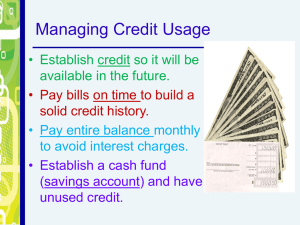

Personal Financial Literacy - Warren Hills Regional School District

... – People are optimistic about future income and buy more, interest rates tend to rise – This is a good time to save money and earn interest (bank/investments) In a bad economy – People are pessimistic about future income and buy less, interest rates tend to drop – This is a good time to buy because ...

... – People are optimistic about future income and buy more, interest rates tend to rise – This is a good time to save money and earn interest (bank/investments) In a bad economy – People are pessimistic about future income and buy less, interest rates tend to drop – This is a good time to buy because ...

Banks and Interest

... 3. Cost of Administration of the Loanthis is the costs of executing the loan agreement, monitoring the loan, and collecting payments. The relative cost of administering a loan declines as the size of the loan increases, thus reducing the interest rate for larger loans. ...

... 3. Cost of Administration of the Loanthis is the costs of executing the loan agreement, monitoring the loan, and collecting payments. The relative cost of administering a loan declines as the size of the loan increases, thus reducing the interest rate for larger loans. ...

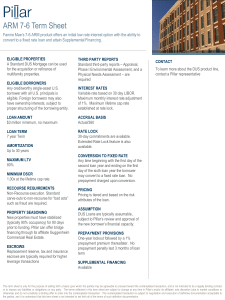

ARM 7-6 Term Sheet

... the parties, and it is understood that this term sheet is not intended to set forth all of the terms of such definitive documentation. ...

... the parties, and it is understood that this term sheet is not intended to set forth all of the terms of such definitive documentation. ...

Federal Direct Loans (Cont`d) - Sam Houston State University

... An institution's cohort default rate is calculated as the percentage of borrowers in the cohort who default before the end of the second fiscal year following the fiscal year in which the borrowers entered repayment. This extends the length of time in which a student can default from two to three ye ...

... An institution's cohort default rate is calculated as the percentage of borrowers in the cohort who default before the end of the second fiscal year following the fiscal year in which the borrowers entered repayment. This extends the length of time in which a student can default from two to three ye ...

Credit Risk

... Only considers two extreme cases (default/no default). Weights need not be stationary over time. Ignores hard to quantify factors including business cycle effects. Database of defaulted loans is not available to benchmark the model. Mortality rate models The probability of default is est ...

... Only considers two extreme cases (default/no default). Weights need not be stationary over time. Ignores hard to quantify factors including business cycle effects. Database of defaulted loans is not available to benchmark the model. Mortality rate models The probability of default is est ...

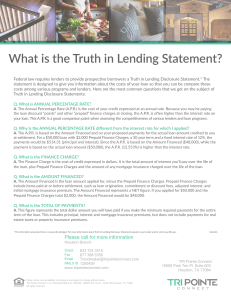

What is the Truth in Lending Statement?

... statement is designed to give you information about the costs of your loan so that you can be compare these costs among various programs and lenders. Here are the most common questions that we get on the subject of Truth in Lending Disclosure Statements: Q. What is ANNUAL PERCENTAGE RATE? ...

... statement is designed to give you information about the costs of your loan so that you can be compare these costs among various programs and lenders. Here are the most common questions that we get on the subject of Truth in Lending Disclosure Statements: Q. What is ANNUAL PERCENTAGE RATE? ...

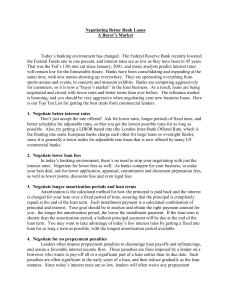

Negotiating Better Bank Loans

... Today’s banking environment has changed. The Federal Reserve Bank recently lowered the Federal Funds rate to one percent, and interest rates are as low as they have been in 45 years. That was the Fed’s 13th rate cut since January, 2001, and many analysts predict interest rates will remain low for th ...

... Today’s banking environment has changed. The Federal Reserve Bank recently lowered the Federal Funds rate to one percent, and interest rates are as low as they have been in 45 years. That was the Fed’s 13th rate cut since January, 2001, and many analysts predict interest rates will remain low for th ...

Small Business Financing at Big Banks and at

... analysis of 1,000 loan applications on Biz2Credit.com. Big banks ($10 billion+ in assets) approved 21.1% of small business loan requests in December, which is up from 20.8% in November and marks back-to-back months of increases. Further, a yearto-year comparison shows that lending approval rates at ...

... analysis of 1,000 loan applications on Biz2Credit.com. Big banks ($10 billion+ in assets) approved 21.1% of small business loan requests in December, which is up from 20.8% in November and marks back-to-back months of increases. Further, a yearto-year comparison shows that lending approval rates at ...

Loan shark

A loan shark is a person or body who offers loans at extremely high interest rates. The term usually refers to illegal activity, but may also refer to predatory lending with extremely high interest rates such as payday or title loans. Loan sharks sometimes enforce repayment by blackmail or threats of violence. Historically, many moneylenders skirted between legal and extra-legal activity. In the recent western world, loan sharks have been a feature of the criminal underworld.