This PDF is a selection from a published volume from... Bureau of Economic Research

... exchange rate fluctuation, for example). Fourth, in deriving the yield curve as an equilibrium of lender’s and borrower’s choices, it may be worthwhile to introduce uncertainties about ...

... exchange rate fluctuation, for example). Fourth, in deriving the yield curve as an equilibrium of lender’s and borrower’s choices, it may be worthwhile to introduce uncertainties about ...

CSS Slideshow for 1997-98 Counselor Workshops

... • Minimum Payment (generally $50) • 10 Year Repayment Term (other options) ...

... • Minimum Payment (generally $50) • 10 Year Repayment Term (other options) ...

Doral Financial Corp

... Doral’s loans are in lower end housing -‐ more stable market. Price decline has been ~10% since recession started; much greater in higher end of market. ...

... Doral’s loans are in lower end housing -‐ more stable market. Price decline has been ~10% since recession started; much greater in higher end of market. ...

CUTTING THROUGH THE JARGON: A Basic Primer on

... Boilerplate these are standard contract clauses which use universal language as a type of template. Usually found at the end of a contract, boilerplate clauses include insurance terms, arbitration clauses, notice provisions, jurisdictional and governing law clauses and force majeure clauses. In loan ...

... Boilerplate these are standard contract clauses which use universal language as a type of template. Usually found at the end of a contract, boilerplate clauses include insurance terms, arbitration clauses, notice provisions, jurisdictional and governing law clauses and force majeure clauses. In loan ...

S/CC Resource Disregards - pages 327

... AUTOMOBILES - One automobile of any value is exempt as long as it is being used by the household. A second vehicle may be exempt if there is a medical need for it or it is being used for employment related activities. BONA FIDE LOAN - A bona fide loan received by the A/R from an institution or perso ...

... AUTOMOBILES - One automobile of any value is exempt as long as it is being used by the household. A second vehicle may be exempt if there is a medical need for it or it is being used for employment related activities. BONA FIDE LOAN - A bona fide loan received by the A/R from an institution or perso ...

C3 Guidelines - University of California | Office of The President

... obligated to utilize the full amount; however, the full amount will be counted against a given Participant’s debt capacity until actual utilization is known. Hence, approval of the authorization is subject to debt financing feasibility metrics. 5. Loan Characteristics. Minimum amortization is three ...

... obligated to utilize the full amount; however, the full amount will be counted against a given Participant’s debt capacity until actual utilization is known. Hence, approval of the authorization is subject to debt financing feasibility metrics. 5. Loan Characteristics. Minimum amortization is three ...

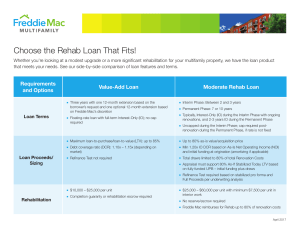

Mod Rehab vs Value-Add Chart

... rehabilitation and in the local market with sufficient financial capacity ...

... rehabilitation and in the local market with sufficient financial capacity ...

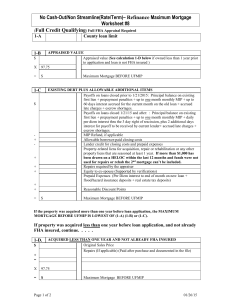

No Cash-Out/Non Streamline(Rate/Term)– Refinance Maximum

... of original borrowers and type of loan. Other credit verifications are also required (VOE, VOD, etc.) There is no holding period. Acquisition could be a limiting factor. Max CLTV is 97.75. Borrower may receive no more than $500.00 cash back at closing. Social Security Numbers must be verified for al ...

... of original borrowers and type of loan. Other credit verifications are also required (VOE, VOD, etc.) There is no holding period. Acquisition could be a limiting factor. Max CLTV is 97.75. Borrower may receive no more than $500.00 cash back at closing. Social Security Numbers must be verified for al ...

What are assets?

... there is no credit check and assessment. • Cash flow is secured and not affected because borrower can access to line of credit to pay for emergency situations. • No restriction for the use of fund while many financing options have a narrow list of uses such as purchase of property. • It is flexible ...

... there is no credit check and assessment. • Cash flow is secured and not affected because borrower can access to line of credit to pay for emergency situations. • No restriction for the use of fund while many financing options have a narrow list of uses such as purchase of property. • It is flexible ...

session_6_ne_yh_money_ecology_bs

... funding partners • Loan to value – up to 80% at any stage of the project, including purchase of land • No set stage payments – drawdown profile is agreed with borrower • No differentiation on rates from our other lending • BUT • Limits to levels development finance linked to our capital • Concentrat ...

... funding partners • Loan to value – up to 80% at any stage of the project, including purchase of land • No set stage payments – drawdown profile is agreed with borrower • No differentiation on rates from our other lending • BUT • Limits to levels development finance linked to our capital • Concentrat ...

China`s Stock Crash Is Spurring a Shakeout in Shadow Banks

... kinds of financing tied to the stock market flags the difficulty regulators have managing risks, said Stephen Schwartz, a senior vice president of credit policy at Moody’s. “There’s always a new form popping up when regulators crack down.” Chinese shadow banks’ push into Internet finance comes as th ...

... kinds of financing tied to the stock market flags the difficulty regulators have managing risks, said Stephen Schwartz, a senior vice president of credit policy at Moody’s. “There’s always a new form popping up when regulators crack down.” Chinese shadow banks’ push into Internet finance comes as th ...

When Banks Won`t Lend, There Are Alternatives, Though Often

... to make some 2,000 three- to five-year loans of up to $50,000 this year, at an average interest rate of about 8 percent. The rates can go as high as 14 percent. EXAMPLE “In the past, we would go to the local bank and get loans on signature,” said Christi Riggs, 40, co-owner of Lone Star Linen laund ...

... to make some 2,000 three- to five-year loans of up to $50,000 this year, at an average interest rate of about 8 percent. The rates can go as high as 14 percent. EXAMPLE “In the past, we would go to the local bank and get loans on signature,” said Christi Riggs, 40, co-owner of Lone Star Linen laund ...

adb applicable lending rates for standard non sovereign guaranteed

... Lending rate for FSL = Base Rate + Lending Spread Base Rates Floating Base Rate: (i) the six (6) month reference rate for USD, YEN (6m Libor) and EUR (6m Euribor) resets on 1 February and 1 August; (ii) the three (3) month reference rate for the ZAR (3m Jibar) resets on 1 February, 1 May, 1 August a ...

... Lending rate for FSL = Base Rate + Lending Spread Base Rates Floating Base Rate: (i) the six (6) month reference rate for USD, YEN (6m Libor) and EUR (6m Euribor) resets on 1 February and 1 August; (ii) the three (3) month reference rate for the ZAR (3m Jibar) resets on 1 February, 1 May, 1 August a ...

The Traditional Securitization Process Bank

... to making the loan in its entirety and then assembles participants to reduce its own loan exposure. Thus, the borrower is guaranteed the full face value of the loan. – Best Efforts deals: The size of the loan is determined by the commitments of banks that agree to participate in the syndication. The ...

... to making the loan in its entirety and then assembles participants to reduce its own loan exposure. Thus, the borrower is guaranteed the full face value of the loan. – Best Efforts deals: The size of the loan is determined by the commitments of banks that agree to participate in the syndication. The ...

Maryland Growers Might Benefit from Farm Energy Efficiency Loan

... help farms install equipment or make operational improvements that reduce the consumption of energy. This new “micro” loan program is being offered thanks to financial support provided by the Maryland Energy Administration (MEA). This program is also designed to complement existing farm energy audit ...

... help farms install equipment or make operational improvements that reduce the consumption of energy. This new “micro” loan program is being offered thanks to financial support provided by the Maryland Energy Administration (MEA). This program is also designed to complement existing farm energy audit ...

The Problem The Solution - Brazos Valley Affordable Housing

... such as car repairs, medical payments, education, rental deposits, etc. Lower-paid workers often don’t have the means to save even one thousand dollars as a reserve for these unexpected needs, so when the need arises, a loan is required. However, Texas has some of the most lenient payday and auto ti ...

... such as car repairs, medical payments, education, rental deposits, etc. Lower-paid workers often don’t have the means to save even one thousand dollars as a reserve for these unexpected needs, so when the need arises, a loan is required. However, Texas has some of the most lenient payday and auto ti ...

neophotonics corporation

... Documents contains financial covenants relating to minimum net assets, maximum ordinary loss and a dividends covenant. The Loan Documents also includes customary events of default, including but not limited to the nonpayment of principal or interest, violations of covenants, restraint on business, d ...

... Documents contains financial covenants relating to minimum net assets, maximum ordinary loss and a dividends covenant. The Loan Documents also includes customary events of default, including but not limited to the nonpayment of principal or interest, violations of covenants, restraint on business, d ...

Debt financing - Money Wise IFA Ltd

... borrowing money that you will have to pay back over time, with interest. A bank or other lender will assess the business’s ability to repay the amount borrowed plus interest during the application process. Typical characteristics of debt finance include: ...

... borrowing money that you will have to pay back over time, with interest. A bank or other lender will assess the business’s ability to repay the amount borrowed plus interest during the application process. Typical characteristics of debt finance include: ...

The Case for lending to Professional Services Firms

... businesses that have existed for decades suddenly are starved of one of their raw materials, capital. But the problem wasn’t that the assets or the loans were fundamentally flawed, the problem was that the banks didn’t know, and in many cases didn’t care, about how to underwrite them. So long as the ...

... businesses that have existed for decades suddenly are starved of one of their raw materials, capital. But the problem wasn’t that the assets or the loans were fundamentally flawed, the problem was that the banks didn’t know, and in many cases didn’t care, about how to underwrite them. So long as the ...

car/motorbike/bicycle loans and allowances

... Loans - Any employee can apply for a loan of between £50 and £500, repayable over 1 or 2 years, as long as they use the bike regularly to and from work. Loan can be used for purchase of bike and safety equipment. Mileage - Can claim same mileage as their car cc if they have one, otherwise 451 - 999c ...

... Loans - Any employee can apply for a loan of between £50 and £500, repayable over 1 or 2 years, as long as they use the bike regularly to and from work. Loan can be used for purchase of bike and safety equipment. Mileage - Can claim same mileage as their car cc if they have one, otherwise 451 - 999c ...

The Burgeoning Crisis of Student Loans: What to Do and Where to Go!

... Federation of America (CFA) released a recent study finding that millions of people had not made a payment on the more than $137 billion in federal student loans for at least nine months, a 14 percent increase in defaults from a year earlier. According to the CFA report, the average amount owed per ...

... Federation of America (CFA) released a recent study finding that millions of people had not made a payment on the more than $137 billion in federal student loans for at least nine months, a 14 percent increase in defaults from a year earlier. According to the CFA report, the average amount owed per ...

Teaching students how to manage money can pay off

... student lending in the UK,” he says, referring to the American publicly quoted student lender. Mr Norton also hopes that his company’s fresh approach to lending will help to change the mindset in the UK towards student borrowing, which lags far behind the US, where many parents set up college funds ...

... student lending in the UK,” he says, referring to the American publicly quoted student lender. Mr Norton also hopes that his company’s fresh approach to lending will help to change the mindset in the UK towards student borrowing, which lags far behind the US, where many parents set up college funds ...

Getting a Handle of our Agricultural Lending

... – One-third of the labor force is in agriculture. ...

... – One-third of the labor force is in agriculture. ...

Loan shark

A loan shark is a person or body who offers loans at extremely high interest rates. The term usually refers to illegal activity, but may also refer to predatory lending with extremely high interest rates such as payday or title loans. Loan sharks sometimes enforce repayment by blackmail or threats of violence. Historically, many moneylenders skirted between legal and extra-legal activity. In the recent western world, loan sharks have been a feature of the criminal underworld.