California Real Estate Finance, 10e - PowerPoint

... Develops land Sells to major investor Leases back property Could be used for just land, just improvements, or both ...

... Develops land Sells to major investor Leases back property Could be used for just land, just improvements, or both ...

Understanding Debt - UConn Financial Aid

... exists, typically after 30 days Credit Limit based on credit rating, FICO score Debit Card: Connected with a bank account. Comes directly out of the account balance. Account balance is $100. You make a purchase for $10, now your account then has $90 remaining ...

... exists, typically after 30 days Credit Limit based on credit rating, FICO score Debit Card: Connected with a bank account. Comes directly out of the account balance. Account balance is $100. You make a purchase for $10, now your account then has $90 remaining ...

Understanding Debt - UConn Financial Aid

... exists, typically after 30 days Credit Limit based on credit rating, FICO score Debit Card: Connected with a bank account. Comes directly out of the account balance. Account balance is $100. You make a purchase for $10, now your account then has $90 remaining ...

... exists, typically after 30 days Credit Limit based on credit rating, FICO score Debit Card: Connected with a bank account. Comes directly out of the account balance. Account balance is $100. You make a purchase for $10, now your account then has $90 remaining ...

How Higher Interest Rates Affect the Economy

... Even though interest rates remained comparatively low in nominal terms during the last years of the 1990s, inflation-adjusted or real rates ranged much higher than they did during periods of comparable price stability in the 1950s and 1960s. Indeed, the 1980s and 1990s witnessed the highest sustain ...

... Even though interest rates remained comparatively low in nominal terms during the last years of the 1990s, inflation-adjusted or real rates ranged much higher than they did during periods of comparable price stability in the 1950s and 1960s. Indeed, the 1980s and 1990s witnessed the highest sustain ...

CU Capital Market Solutions Workshop

... CU Capital Market Solutions Workshop The Federal Home Loan Bank System has been around since the 1930’s but it was not until 1989 that Credit Unions were able to gain access to the System. Since then, some 1300 Credit Unions have joined and are now using the services to fund their business. At the s ...

... CU Capital Market Solutions Workshop The Federal Home Loan Bank System has been around since the 1930’s but it was not until 1989 that Credit Unions were able to gain access to the System. Since then, some 1300 Credit Unions have joined and are now using the services to fund their business. At the s ...

Project Finance Overview

... In these circumstances, a project borrower with a reputable sponsor standing behind it might be able to secure loan financing from a bank at the bank’s prime rate plus a credit spread of 2 per cent per annum. Assuming the prime rate is currently 3 per cent per annum, the all-in interest rate payable ...

... In these circumstances, a project borrower with a reputable sponsor standing behind it might be able to secure loan financing from a bank at the bank’s prime rate plus a credit spread of 2 per cent per annum. Assuming the prime rate is currently 3 per cent per annum, the all-in interest rate payable ...

financial prudential norms

... c) group of members acting together means two or more members who are exposed to the same risk due to common activities, so as if one of them has troubles reimbursing the loan and/or paying related interest, one or several of them may have similar difficulties; d) investment in long-term tangible as ...

... c) group of members acting together means two or more members who are exposed to the same risk due to common activities, so as if one of them has troubles reimbursing the loan and/or paying related interest, one or several of them may have similar difficulties; d) investment in long-term tangible as ...

UK consumer credit

... Identified dealership car finance lending by UK monetary financial institutions (MFIs) and other lenders. Sterling net lending by UK MFIs and other lenders to UK individuals (excluding student loans). Non seasonally adjusted. Percentage change on a year earlier of quarterly nominal disposable househ ...

... Identified dealership car finance lending by UK monetary financial institutions (MFIs) and other lenders. Sterling net lending by UK MFIs and other lenders to UK individuals (excluding student loans). Non seasonally adjusted. Percentage change on a year earlier of quarterly nominal disposable househ ...

- Seckman High School

... making a payment using a money order? 4. What is the difference between a cashiers check and a personal check? 5. What is a prepayment penalty? Why might you still wish to pay off a loan early, even when there is a prepayment penalty? Slide 14 ...

... making a payment using a money order? 4. What is the difference between a cashiers check and a personal check? 5. What is a prepayment penalty? Why might you still wish to pay off a loan early, even when there is a prepayment penalty? Slide 14 ...

Summary - WikiLeaks

... to the reliability of China’s statistics than to the health of the banking industry— after all, the credit surge was predicated on financing corporations whose capital structures and earnings outlooks were both fundamentally weak China’s definition of NPLs is incredibly merciful by international sta ...

... to the reliability of China’s statistics than to the health of the banking industry— after all, the credit surge was predicated on financing corporations whose capital structures and earnings outlooks were both fundamentally weak China’s definition of NPLs is incredibly merciful by international sta ...

Information Asymmetry in Syndicated Loans

... The structure of a loan syndicate is related to the information asymmetries between the lead arranger and the participants in the syndicate or between the lenders and the borrowers. The characteristics of the lead arrangers have been shown to be significant determinants of syndicate structure. For e ...

... The structure of a loan syndicate is related to the information asymmetries between the lead arranger and the participants in the syndicate or between the lenders and the borrowers. The characteristics of the lead arrangers have been shown to be significant determinants of syndicate structure. For e ...

1 - Auburn School District

... professor at Columbia University and the author of the higher-education critique Crisis on Campus, "because you can't walk away from it." Given the dire consequences of defaulting, the government recently created an incomebased repayment plan for federal-student-loan borrowers whose debt at graduati ...

... professor at Columbia University and the author of the higher-education critique Crisis on Campus, "because you can't walk away from it." Given the dire consequences of defaulting, the government recently created an incomebased repayment plan for federal-student-loan borrowers whose debt at graduati ...

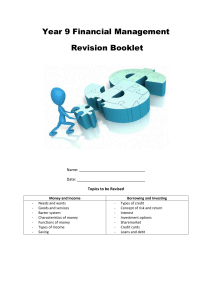

Year 9 Financial Management Revision Booklet Name: Date: Topics

... 22. Define the term credit. Credit is an agreement in which you receive goods and services now and pay for it later generally with interest. 23. List and briefly describe the four main types of credit. a) Mortgage – specific loan to purchase property. Term of the mortgage between 2030 years with low ...

... 22. Define the term credit. Credit is an agreement in which you receive goods and services now and pay for it later generally with interest. 23. List and briefly describe the four main types of credit. a) Mortgage – specific loan to purchase property. Term of the mortgage between 2030 years with low ...

Gearing Capital Funding

... SARB requires banks to allocate some of their equity or capital for each lending transactions. Basle II requires banks to calculate the capital it has to hold one each deal. Lending transactions are analysed according to transaction specific credit (and other) risk. More capital must be allocated to ...

... SARB requires banks to allocate some of their equity or capital for each lending transactions. Basle II requires banks to calculate the capital it has to hold one each deal. Lending transactions are analysed according to transaction specific credit (and other) risk. More capital must be allocated to ...

Partner for Success (Brown)

... Report, population and median household income of the area to be served, audits or financial information for the past three years, evidence of outstanding indebtedness, organizational documents, the applicant's IRS tax identification number, DUNS number, a proposed operating budget, and some certifi ...

... Report, population and median household income of the area to be served, audits or financial information for the past three years, evidence of outstanding indebtedness, organizational documents, the applicant's IRS tax identification number, DUNS number, a proposed operating budget, and some certifi ...

Credit Risk: Individual Loan Risk Chapter 11

... loans. More recently, credit card loans and auto loans. • In mid-90s, improvements in NPLs for large banks. • New types of credit risk related to loan guarantees and off-balance-sheet activities. • Increased emphasis on credit risk evaluation. ...

... loans. More recently, credit card loans and auto loans. • In mid-90s, improvements in NPLs for large banks. • New types of credit risk related to loan guarantees and off-balance-sheet activities. • Increased emphasis on credit risk evaluation. ...

Businessworld - STAY AHEAD EVERY WEEK

... under CDR are standard assets," says Siby Antony, chief general manager, IDBI. Banks account for such restructured debts as standard assets though they are classified in a separate category from the other assets. Only a small portion of the loans which have been restructured so far (numbers aren't a ...

... under CDR are standard assets," says Siby Antony, chief general manager, IDBI. Banks account for such restructured debts as standard assets though they are classified in a separate category from the other assets. Only a small portion of the loans which have been restructured so far (numbers aren't a ...

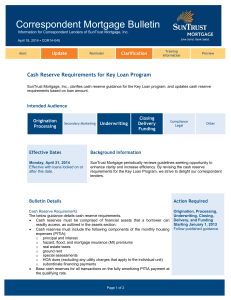

Bulletin COR 14-045: Cash Reserve Requirements

... SunTrust Mortgage, Inc. does not guarantee or assume liability for any third-party products or services. ©2011 SunTrust Banks, Inc. SunTrust, SunTrust Mortgage and Live Solid. Bank Solid. are federally registered service marks of SunTrust Banks, Inc. ...

... SunTrust Mortgage, Inc. does not guarantee or assume liability for any third-party products or services. ©2011 SunTrust Banks, Inc. SunTrust, SunTrust Mortgage and Live Solid. Bank Solid. are federally registered service marks of SunTrust Banks, Inc. ...

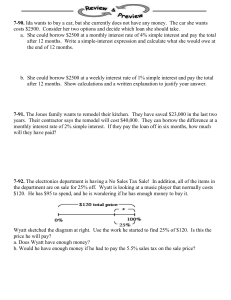

7-95.

... 7-93. For each equation below, solve for x. Show the process you use to check your answer. ...

... 7-93. For each equation below, solve for x. Show the process you use to check your answer. ...

2010 - Impact Real Estate

... Have We Reached The Bottom? Some sectors of the economy have reached their bottom. Others have reached a bottom . . . for now… but may not have reached the bottom. Here is a look at some current issues: The Economy Think of it as a car. When the financial mess hit, we lost one tire. Then Fannie Mae ...

... Have We Reached The Bottom? Some sectors of the economy have reached their bottom. Others have reached a bottom . . . for now… but may not have reached the bottom. Here is a look at some current issues: The Economy Think of it as a car. When the financial mess hit, we lost one tire. Then Fannie Mae ...

Mortgage/Banking

... that tells the bank how much money you are adding to your account. Depending on whether you deposit cash, a payroll check or a check drawn on an out-ofstate bank, you may not have immediate use of the funds. The bank first must make sure there are funds at the originating bank to cover your check. Y ...

... that tells the bank how much money you are adding to your account. Depending on whether you deposit cash, a payroll check or a check drawn on an out-ofstate bank, you may not have immediate use of the funds. The bank first must make sure there are funds at the originating bank to cover your check. Y ...

Amendment

... • Willingness and ability to align loan-making with OEDIT strategies and programs such as CDBG revolving loan funds, outdoor recreation and tourism offices, SBDC, Minority Business Office (MBO), Advanced Industries, Creative Districts and Creative Industries Programs, Historic Preservation Tax Credi ...

... • Willingness and ability to align loan-making with OEDIT strategies and programs such as CDBG revolving loan funds, outdoor recreation and tourism offices, SBDC, Minority Business Office (MBO), Advanced Industries, Creative Districts and Creative Industries Programs, Historic Preservation Tax Credi ...

US Loans Scheme

... on the course and does not guarantee the outcome of the student’s course. Satisfactory Academic progress will be checked before any loan funds are released to a student. Financial Aid Probation and/or suspension Should a student not meet the above mentioned procedures for Satisfactory Academic Progr ...

... on the course and does not guarantee the outcome of the student’s course. Satisfactory Academic progress will be checked before any loan funds are released to a student. Financial Aid Probation and/or suspension Should a student not meet the above mentioned procedures for Satisfactory Academic Progr ...

Credit Rationing by Loan Size in Commercial Loan Markets

... has the following properties. It indicates that the loan size, qi, offered to borrowers of type i = 1,...,n -,l is strictly less than the size available in a perfectly competitive market for all groups except the largest. To see why, observe that equation (4) indicates that the profit-maximizing loa ...

... has the following properties. It indicates that the loan size, qi, offered to borrowers of type i = 1,...,n -,l is strictly less than the size available in a perfectly competitive market for all groups except the largest. To see why, observe that equation (4) indicates that the profit-maximizing loa ...

Loan shark

A loan shark is a person or body who offers loans at extremely high interest rates. The term usually refers to illegal activity, but may also refer to predatory lending with extremely high interest rates such as payday or title loans. Loan sharks sometimes enforce repayment by blackmail or threats of violence. Historically, many moneylenders skirted between legal and extra-legal activity. In the recent western world, loan sharks have been a feature of the criminal underworld.