Europe`s bank loan funds – where now?

... billion by the end of the month. That compares with a total of $12.3 billion for the whole of 2011. Over the three months to end-April 2012, the volume of CLO issuance in the US hit its highest level since late 2007, shortly before the bottom fell out of the market. The roster of issuers features a ...

... billion by the end of the month. That compares with a total of $12.3 billion for the whole of 2011. Over the three months to end-April 2012, the volume of CLO issuance in the US hit its highest level since late 2007, shortly before the bottom fell out of the market. The roster of issuers features a ...

ALGEBRA 2

... c. How much money will she save if she takes a 4 year loan as opposed to a 5 year loan? ...

... c. How much money will she save if she takes a 4 year loan as opposed to a 5 year loan? ...

8.3 Credit Terms

... Annual Percentage Rate (APR) describe the interest rate for a whole year rather than a monthly interest rate on a loan. Credit Rating - evaluates the credit worthiness of an issuer of specific types of debt, specifically, debt issued by a business enterprise such as a corporation or a government ...

... Annual Percentage Rate (APR) describe the interest rate for a whole year rather than a monthly interest rate on a loan. Credit Rating - evaluates the credit worthiness of an issuer of specific types of debt, specifically, debt issued by a business enterprise such as a corporation or a government ...

here - Reverse Market Insight

... Negative subsidy means NPV of expected revenues exceeds NPV of expected costs HECM subsidy rate projected for FY2008 is negative 1.68 ...

... Negative subsidy means NPV of expected revenues exceeds NPV of expected costs HECM subsidy rate projected for FY2008 is negative 1.68 ...

Cost of a Car Loan

... Cost of a Car Loan When you are buying a new car, there are many things you must consider. One major consideration is the loan. Banks and other lending institutions charge you interest for the privilege of using their money to buy a car. A down payment of 10% to 20% is generally required. The down p ...

... Cost of a Car Loan When you are buying a new car, there are many things you must consider. One major consideration is the loan. Banks and other lending institutions charge you interest for the privilege of using their money to buy a car. A down payment of 10% to 20% is generally required. The down p ...

Loans Classified by Special Provision

... being purchased, stating its current market value based on a VAapproved appraisal. The appraiser uses a form called a URAR (Uniform Residential Appraisal Report) to present the appraisal results to the lender. The CRV places a ceiling on the amount the VA loan allows for the property; if the purchas ...

... being purchased, stating its current market value based on a VAapproved appraisal. The appraiser uses a form called a URAR (Uniform Residential Appraisal Report) to present the appraisal results to the lender. The CRV places a ceiling on the amount the VA loan allows for the property; if the purchas ...

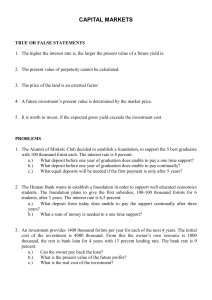

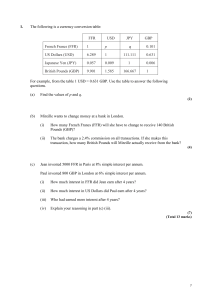

capital markets

... forints. He wants to finance it from bank loan. He can choose a 3-year loan with 16 percent interest rate or he can pay back 1 million in every year (three times). In this case the lending rate is 20 percent. The expected yield is 1,5 million per year. Interest rate is 10 percent. a.) Which loan wou ...

... forints. He wants to finance it from bank loan. He can choose a 3-year loan with 16 percent interest rate or he can pay back 1 million in every year (three times). In this case the lending rate is 20 percent. The expected yield is 1,5 million per year. Interest rate is 10 percent. a.) Which loan wou ...

Key Terms - Chapter 1

... to the user Specific tasks or procedures a person can do to complete a job A name given to a particular job ...

... to the user Specific tasks or procedures a person can do to complete a job A name given to a particular job ...

The Charlotte Regional Commercial Real Estate Capital Conference

... get back off the ground, and what do you think it will take in order for that to happen? When? What will the deals look like? ...

... get back off the ground, and what do you think it will take in order for that to happen? When? What will the deals look like? ...

SMALL BUSINESS ADMINISTRATION CHECK LIST OF REQUIRED

... 5. Detailed one (1) year projection of Income & Finances (please attach written explanation as to how you expect to achieve same). 6. A list of names and addresses of any subsidiaries and affiliates, including concerns in which the applicant holds a controlling (but not necessarily a majority) inter ...

... 5. Detailed one (1) year projection of Income & Finances (please attach written explanation as to how you expect to achieve same). 6. A list of names and addresses of any subsidiaries and affiliates, including concerns in which the applicant holds a controlling (but not necessarily a majority) inter ...

Lesson Plan for College Debt The goal of this activity is to increase

... post-secondary schools has grown faster than inflation for decades. As a result, many students must borrow substantial amounts of money to pay for education. They and their parents should make informed decisions. For example, borrowers should understand the terms of any loan they take out, including ...

... post-secondary schools has grown faster than inflation for decades. As a result, many students must borrow substantial amounts of money to pay for education. They and their parents should make informed decisions. For example, borrowers should understand the terms of any loan they take out, including ...

The Great Liquidity Squeeze of 2017: Cash dries up as loan

... borrowers’ rate (“Gross WAC”) to improve the chances that there will be some prepayment activity. Currently, a 15-year MBS with a Gross WAC of 4.00 percent or higher could see some near-term refinancing. Your brokers can find some candidates that check these boxes. Other home-grown sources You also ...

... borrowers’ rate (“Gross WAC”) to improve the chances that there will be some prepayment activity. Currently, a 15-year MBS with a Gross WAC of 4.00 percent or higher could see some near-term refinancing. Your brokers can find some candidates that check these boxes. Other home-grown sources You also ...

Debt and Easy Access Credit - Missouri Council for Economic

... high risk, an asset essential to the well-being of working families – their car. Typical car title loans have annual interest rates of 300% and the loan amount is no higher than 30 to 50 percent of what the lender says is the value of the car. Like payday loans, car title loans are usually made with ...

... high risk, an asset essential to the well-being of working families – their car. Typical car title loans have annual interest rates of 300% and the loan amount is no higher than 30 to 50 percent of what the lender says is the value of the car. Like payday loans, car title loans are usually made with ...

Module 9

... • It should be noted that, as sated in EVS2, such valuations do not meet the definition of Market Value • Any circumstances where a valuer is requested to provide valuations on a basis other than Market Value, the valuer should proceed only if that valuation is not in breach of local laws or ...

... • It should be noted that, as sated in EVS2, such valuations do not meet the definition of Market Value • Any circumstances where a valuer is requested to provide valuations on a basis other than Market Value, the valuer should proceed only if that valuation is not in breach of local laws or ...

Summary Results 3Q 2011

... Total loan delinquency declined to 1.16% compared to 1.59% at 3Q10. Likewise, commercial loan delinquency also decreased to 2.25% from 2.96% during the past 12 months. Loan Mix ...

... Total loan delinquency declined to 1.16% compared to 1.59% at 3Q10. Likewise, commercial loan delinquency also decreased to 2.25% from 2.96% during the past 12 months. Loan Mix ...

commercial analytical services

... Prior to the recession and recovery, now in its fourth year, small business lending, which includes credit cards, lines of credit, term loans and trade credit, was more abundant. In addition to business-specific financing, small business owners could access personal capital or wealth with rising hom ...

... Prior to the recession and recovery, now in its fourth year, small business lending, which includes credit cards, lines of credit, term loans and trade credit, was more abundant. In addition to business-specific financing, small business owners could access personal capital or wealth with rising hom ...

Directors` Guide to Credit - Federal Reserve Bank of Atlanta

... reviewed for any concentrations (accounts representing more than 10 percent or more of total receivables), which represent a higher degree of risk, even with a low DOH ratio. The accounts receivables aging schedule should be reviewed for receivables past due 90–120 days or more, which present a grea ...

... reviewed for any concentrations (accounts representing more than 10 percent or more of total receivables), which represent a higher degree of risk, even with a low DOH ratio. The accounts receivables aging schedule should be reviewed for receivables past due 90–120 days or more, which present a grea ...

Five Ways to Ramp Up Fee Income

... rural areas to access capital to consolidated or refinance debts, improve existing facilities, purchase or construct new facilities, purchase equipment and purchase inventory. USDA guaranteed loans feature up to 25 year term and amortization, with rates starting at 5.50%. The maximum LTV is 80% and ...

... rural areas to access capital to consolidated or refinance debts, improve existing facilities, purchase or construct new facilities, purchase equipment and purchase inventory. USDA guaranteed loans feature up to 25 year term and amortization, with rates starting at 5.50%. The maximum LTV is 80% and ...

Financial Maths Questions File

... The table below shows the deposits, in Australian dollars (AUD), made by Vicki in an investment account on the first day of each month for the first four months in 1999. The interest rate is 0.75% per month compounded monthly. The interest is added to the account at the end of each month. ...

... The table below shows the deposits, in Australian dollars (AUD), made by Vicki in an investment account on the first day of each month for the first four months in 1999. The interest rate is 0.75% per month compounded monthly. The interest is added to the account at the end of each month. ...

Chap 19-20

... How does the bank realized loan yield (RLY) affected by credit policies? If a bank has low ROE (or ROA), what strategies might it pursue? What determines the ability of a bank to expand loan activity? What is meant by Adverse Selection? How does it affect bank operations? How have banks responded to ...

... How does the bank realized loan yield (RLY) affected by credit policies? If a bank has low ROE (or ROA), what strategies might it pursue? What determines the ability of a bank to expand loan activity? What is meant by Adverse Selection? How does it affect bank operations? How have banks responded to ...

Overview

... Although capital adequacy ratios declined by almost 200 basis points during the year due to the significant increase in risk-weighted assets, they are high enough to cover losses that might be incurred under various shock scenarios. ...

... Although capital adequacy ratios declined by almost 200 basis points during the year due to the significant increase in risk-weighted assets, they are high enough to cover losses that might be incurred under various shock scenarios. ...

What Lenders Want in a Credit Crunch

... – Reduce your more expensive interest rate debt first – Reduce your fixed expenses, outsource where you can – Don’t forget about friends and family financing – Start your banking search earlier – Let time take care of this situation – Don’t panic! ...

... – Reduce your more expensive interest rate debt first – Reduce your fixed expenses, outsource where you can – Don’t forget about friends and family financing – Start your banking search earlier – Let time take care of this situation – Don’t panic! ...

page one economics - Federal Reserve Bank of St. Louis

... (sold) to the public (investors) who are paid interest on their investment. The value of these instruments is derived from the monthly payments of the underlying mortgage pool, and the instruments lose value if the mortgagees default. In this system, loans are not funded by deposits at banks. Instea ...

... (sold) to the public (investors) who are paid interest on their investment. The value of these instruments is derived from the monthly payments of the underlying mortgage pool, and the instruments lose value if the mortgagees default. In this system, loans are not funded by deposits at banks. Instea ...

Why the Fed`s rate cuts won`t help you

... But its effort will have little effect on the ability of the average American to get a cheap loan for a new home, car or college education even as it has a large effect on U.S. banks' ability to fix their balance sheets by racking up fat profits. If that sounds unfair, welcome to the latest episode ...

... But its effort will have little effect on the ability of the average American to get a cheap loan for a new home, car or college education even as it has a large effect on U.S. banks' ability to fix their balance sheets by racking up fat profits. If that sounds unfair, welcome to the latest episode ...

Loan shark

A loan shark is a person or body who offers loans at extremely high interest rates. The term usually refers to illegal activity, but may also refer to predatory lending with extremely high interest rates such as payday or title loans. Loan sharks sometimes enforce repayment by blackmail or threats of violence. Historically, many moneylenders skirted between legal and extra-legal activity. In the recent western world, loan sharks have been a feature of the criminal underworld.