15 Mosec

... Outcome of Mosec I • Significant reduction in overall cost of funding: – Cost to MFI reduced between 200 to 500 bps. – As investors understand the sector better, rates are expected to drop even further. • Opening up new sources of funding: – The senior tranche was purchased by the treasury departme ...

... Outcome of Mosec I • Significant reduction in overall cost of funding: – Cost to MFI reduced between 200 to 500 bps. – As investors understand the sector better, rates are expected to drop even further. • Opening up new sources of funding: – The senior tranche was purchased by the treasury departme ...

solve(A*m^NR*(m^N-1)/(m

... Now consider what happens with each monthly payment. Some of the payment is applied to interest on the outstanding principal amount, P, and some of the payment is applied to reduce the principal owed. The total amount, R, of the monthly payment, remains constant over the life of the loan. So if J de ...

... Now consider what happens with each monthly payment. Some of the payment is applied to interest on the outstanding principal amount, P, and some of the payment is applied to reduce the principal owed. The total amount, R, of the monthly payment, remains constant over the life of the loan. So if J de ...

1) - - Prince Sultan University

... Using gap analysis, what is the effect of a 4 percent increase in interest rates? What is the effect of a 3 percent decrease in rates? Why is knowledge of interest-rate risk important? How might banks respond if rates are expected to change unfavorably? (18.33 Answer: The gap is –$40 million. A 4 pe ...

... Using gap analysis, what is the effect of a 4 percent increase in interest rates? What is the effect of a 3 percent decrease in rates? Why is knowledge of interest-rate risk important? How might banks respond if rates are expected to change unfavorably? (18.33 Answer: The gap is –$40 million. A 4 pe ...

Specialist finance providers and other sources

... a share of the principal, even if the latter can sometimes be delayed for a set period of time from the date the loan was awarded. 4. Interest rate: Interest rates can be fixed or they can be variable, in which case they are tied to some reference rate (for example, LIBOR) or a central bank rate. Th ...

... a share of the principal, even if the latter can sometimes be delayed for a set period of time from the date the loan was awarded. 4. Interest rate: Interest rates can be fixed or they can be variable, in which case they are tied to some reference rate (for example, LIBOR) or a central bank rate. Th ...

Una declinazione attuale del campo di impegno

... Big agricultural potential in a poverty trap • Agricultural potential; 84% of population is rural . • Lack of infrastructure: transport, TLC, health, etc. • Natural calamities (drought) in some areas, ...

... Big agricultural potential in a poverty trap • Agricultural potential; 84% of population is rural . • Lack of infrastructure: transport, TLC, health, etc. • Natural calamities (drought) in some areas, ...

Demystifying the Federal Home Loan Banks:

... same rate as stronger members. However, the amount of the required collateral may be increased, and the method of securing it may be heightened, such as by listing or by requiring physical delivery of the documents. Beyond advances, the FHLBanks also offer products such as letters of credit that pro ...

... same rate as stronger members. However, the amount of the required collateral may be increased, and the method of securing it may be heightened, such as by listing or by requiring physical delivery of the documents. Beyond advances, the FHLBanks also offer products such as letters of credit that pro ...

Document

... Less risk adverse than GSE’s, but will want similar protections, still perceive many problems Probably will partner with GSE’s, which would provide substantial increased liquidity Both have lost their MH naivete ...

... Less risk adverse than GSE’s, but will want similar protections, still perceive many problems Probably will partner with GSE’s, which would provide substantial increased liquidity Both have lost their MH naivete ...

General Information - Bank of Ireland Mortgage

... You may incur additional costs when taking out a mortgage which are not included in the Total Cost of Credit. This will include costs such as solicitor fees, a more detailed valuation report, insurance and stamp duty. If you have chosen a product that offers fees-assisted legal work there may be dis ...

... You may incur additional costs when taking out a mortgage which are not included in the Total Cost of Credit. This will include costs such as solicitor fees, a more detailed valuation report, insurance and stamp duty. If you have chosen a product that offers fees-assisted legal work there may be dis ...

We analyze the business-cycle dynamics of commercial bank

... increase during recessions and decrease during economic expansions—and the reason for this is that loan markups (over some benchmark interest rate) have a marked countercyclical component. The baseline hypothesis is based on the financial accelerator theory developed by Bernanke et al. (1996) and Ki ...

... increase during recessions and decrease during economic expansions—and the reason for this is that loan markups (over some benchmark interest rate) have a marked countercyclical component. The baseline hypothesis is based on the financial accelerator theory developed by Bernanke et al. (1996) and Ki ...

Sustainability Bites? The Impact of Minimum Energy Efficiency

... Major REITs and fund managers are starting to get to grips with the impacts these regulations will have on the property portfolios they own. However, with many institutional and private equity investors increasingly focused on lending as an additional form of real estate exposure, such sustainabilit ...

... Major REITs and fund managers are starting to get to grips with the impacts these regulations will have on the property portfolios they own. However, with many institutional and private equity investors increasingly focused on lending as an additional form of real estate exposure, such sustainabilit ...

UMMSession_Engels - e-MFP

... Definition(s) of Mission Drift "In essence, it’s a concern about for-profit investors overriding the interest of other stakeholders, mainly the interest of clients, by inevitably pressuring management for higher interest rates and quick profits, therefore drifting from the mission of serving the ...

... Definition(s) of Mission Drift "In essence, it’s a concern about for-profit investors overriding the interest of other stakeholders, mainly the interest of clients, by inevitably pressuring management for higher interest rates and quick profits, therefore drifting from the mission of serving the ...

Falling US Mortgage Rates

... through to their lenders -- and may even find their lenders reaching out to them. "Our loan officers are pretty hungry now," says Robert Couch, president and chief executive officer of New South Federal Savings Bank in Birmingham, Ala. "They will be dusting off files" of would-be borrowers who didn' ...

... through to their lenders -- and may even find their lenders reaching out to them. "Our loan officers are pretty hungry now," says Robert Couch, president and chief executive officer of New South Federal Savings Bank in Birmingham, Ala. "They will be dusting off files" of would-be borrowers who didn' ...

MBS Note

... are less than the cash flow from the underlying mortgage due to: – Servicing fees – Guaranteeing fees – Investors receive CF on a pro rata basis ...

... are less than the cash flow from the underlying mortgage due to: – Servicing fees – Guaranteeing fees – Investors receive CF on a pro rata basis ...

Chapter 12.1: Bankruptcy

... You can contact your creditor and work out an adjusted repayment plan. You can also get a consolidated loan Combines all your debt into one loan with lower payments Credit cards, car payments, student loans etc. ...

... You can contact your creditor and work out an adjusted repayment plan. You can also get a consolidated loan Combines all your debt into one loan with lower payments Credit cards, car payments, student loans etc. ...

Markets Defy Fed`s Bond-Buying Push

... and it hasn't occurred yet," he said. Rates on 30-year mortgages now average 4.61%, their highest in six months, according to Freddie Mac. Lowering rates can't put money in the pockets of many others because banks won't lend to them. About 11 million homeowners owe more on their mortgages than their ...

... and it hasn't occurred yet," he said. Rates on 30-year mortgages now average 4.61%, their highest in six months, according to Freddie Mac. Lowering rates can't put money in the pockets of many others because banks won't lend to them. About 11 million homeowners owe more on their mortgages than their ...

Cooking the Books Workbook - Association of Certified Fraud

... • Requiring buyers to deposit extra money in escrow accounts if they refuse to use an affiliated lender. • Coercing buyers into using a designated lender with the threat of withdrawing a seller’s credit toward closing costs. Manufactured Housing Dealer Manufactured housing is now considered real pro ...

... • Requiring buyers to deposit extra money in escrow accounts if they refuse to use an affiliated lender. • Coercing buyers into using a designated lender with the threat of withdrawing a seller’s credit toward closing costs. Manufactured Housing Dealer Manufactured housing is now considered real pro ...

Refinancing of 700 million euros for ARC Fund

... The refinancing of the Amvest Residential Core Fund was completed on 30 September by means of a new 700 million euros loan. The new facility replaces the 6-year financing arrangement for 320 million euros. The financing coincides with the extension of the Fund term and is necessary because of the sp ...

... The refinancing of the Amvest Residential Core Fund was completed on 30 September by means of a new 700 million euros loan. The new facility replaces the 6-year financing arrangement for 320 million euros. The financing coincides with the extension of the Fund term and is necessary because of the sp ...

REAL ESTATE JUMBO JUNGLE Many home buyers sell stock

... of America Merrill Lynch has a “loan-management account” that offers clients a line of credit based on their Merrill Lynch taxable brokerage portfolio holdings. The funds can go toward numerous uses, including a mortgage down payment. Customers with substantial holdings currently may get interest ra ...

... of America Merrill Lynch has a “loan-management account” that offers clients a line of credit based on their Merrill Lynch taxable brokerage portfolio holdings. The funds can go toward numerous uses, including a mortgage down payment. Customers with substantial holdings currently may get interest ra ...

View/Open

... The second possible outcome is the presence of statistical evidence that race affected hire/purchase lending. The policy implication depends on the way race affected hire/purchase lending. On the one hand, there may have been statistical discrimination: lenders were not bigots, but race may be corre ...

... The second possible outcome is the presence of statistical evidence that race affected hire/purchase lending. The policy implication depends on the way race affected hire/purchase lending. On the one hand, there may have been statistical discrimination: lenders were not bigots, but race may be corre ...

Personal Finance for College Students Use Money Wisely

... • Job, student loans, grants, scholarships, financial support • Determine monthly amount: • Divide periodic income by number of months • Make cash last • Consider savings from seasonal work ...

... • Job, student loans, grants, scholarships, financial support • Determine monthly amount: • Divide periodic income by number of months • Make cash last • Consider savings from seasonal work ...

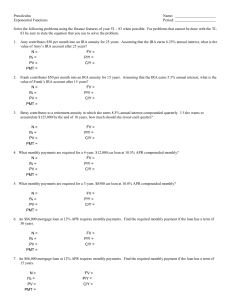

Solve the following problems using the finance

... 4. What monthly payments are required for a 4-year, $12,000 car loan at 10.5% APR compounded monthly? N= FV = I% = P/Y = PV = C/Y = PMT = 5. What monthly payments are required for a 3-year, $8500 car loan at 10.0% APR compounded monthly? ...

... 4. What monthly payments are required for a 4-year, $12,000 car loan at 10.5% APR compounded monthly? N= FV = I% = P/Y = PV = C/Y = PMT = 5. What monthly payments are required for a 3-year, $8500 car loan at 10.0% APR compounded monthly? ...

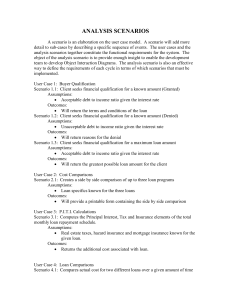

Document

... A scenario is an elaboration on the user case model. A scenario will add more detail to sub-cases by describing a specific sequence of events. The user cases and the analysis scenarios together constitute the functional requirements for the system. The object of the analysis scenario is to provide e ...

... A scenario is an elaboration on the user case model. A scenario will add more detail to sub-cases by describing a specific sequence of events. The user cases and the analysis scenarios together constitute the functional requirements for the system. The object of the analysis scenario is to provide e ...

Progress Towards Creating more Effective Resolution Regimes

... Interest Rate: LIBOR+1.8%( CBJ to banks) ...

... Interest Rate: LIBOR+1.8%( CBJ to banks) ...

CEMA LOAN FAQ - Adams Law Group LLC

... most refinance transactions, the existing loan is paid in full and that payoff bank in turn provides a satisfaction of mortgage. This sometimes called a discharge of mortgage or release of mortgage. In NY, if you satisfy a loan on payoff and then record the new mortgage, you will incur the mortgage ...

... most refinance transactions, the existing loan is paid in full and that payoff bank in turn provides a satisfaction of mortgage. This sometimes called a discharge of mortgage or release of mortgage. In NY, if you satisfy a loan on payoff and then record the new mortgage, you will incur the mortgage ...

Loan shark

A loan shark is a person or body who offers loans at extremely high interest rates. The term usually refers to illegal activity, but may also refer to predatory lending with extremely high interest rates such as payday or title loans. Loan sharks sometimes enforce repayment by blackmail or threats of violence. Historically, many moneylenders skirted between legal and extra-legal activity. In the recent western world, loan sharks have been a feature of the criminal underworld.