MA162: Finite mathematics - Financial Mathematics

... What is the total amount of interest that Murray pays? Murray makes 48 payments of $258.34, so in total he pays back 48 · 258.34 = 12, 400.32. He borrowed $11,000, so $12, 400.32 − $11, 000 = $1, 400.32 was paid to interest. How much of Murray’s first payment is due to interest? The first payment is ...

... What is the total amount of interest that Murray pays? Murray makes 48 payments of $258.34, so in total he pays back 48 · 258.34 = 12, 400.32. He borrowed $11,000, so $12, 400.32 − $11, 000 = $1, 400.32 was paid to interest. How much of Murray’s first payment is due to interest? The first payment is ...

Loan Loss Provision (Allowances)

... allowance established against it. In some banks, when an impaired loan is carried at the present value of expected future cash flows, interest may be accrued and reported in net income to reflect updated present values based on the effective interest rate inherent in the original loan agreement. An ...

... allowance established against it. In some banks, when an impaired loan is carried at the present value of expected future cash flows, interest may be accrued and reported in net income to reflect updated present values based on the effective interest rate inherent in the original loan agreement. An ...

Beginner`s Guide to Bridging Finance

... starting to recognise how they can apply the short term loan, and are utilising the funding to benefit their property transactions and their businesses. Popular for a number of purposes, bridging loans are being used to support commercial and residential property transactions, auction purchases and ...

... starting to recognise how they can apply the short term loan, and are utilising the funding to benefit their property transactions and their businesses. Popular for a number of purposes, bridging loans are being used to support commercial and residential property transactions, auction purchases and ...

Can Fin Homes Limited

... Can Fin Homes is a 26 year old housing finance company registered with the NHB and headquartered in Bangalore. The company is promoted by Canara Bank in the year 1987 which owns 42.38% shareholding of Can Fin homes. It predominantly lends to individuals which comprises of 93% of loan book with an av ...

... Can Fin Homes is a 26 year old housing finance company registered with the NHB and headquartered in Bangalore. The company is promoted by Canara Bank in the year 1987 which owns 42.38% shareholding of Can Fin homes. It predominantly lends to individuals which comprises of 93% of loan book with an av ...

SENATE RULES COMMITTEE - SENATE FLOOR ANALYSIS

... this information when deciding whether a finder should be disqualified from performing services for one or more pilot program lenders. Background: Relatively few installment loans are made in California with principal amounts under $2,500. This represents a challenge to the significant population of ...

... this information when deciding whether a finder should be disqualified from performing services for one or more pilot program lenders. Background: Relatively few installment loans are made in California with principal amounts under $2,500. This represents a challenge to the significant population of ...

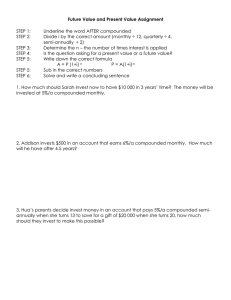

Future Value and Present Value Assignment

... 3. Hua’s parents decide invest money in an account that pays 5%/a compounded semiannually when she turns 13 to save for a gift of $20 000 when she turns 20, how much should they invest to make this possible? ...

... 3. Hua’s parents decide invest money in an account that pays 5%/a compounded semiannually when she turns 13 to save for a gift of $20 000 when she turns 20, how much should they invest to make this possible? ...

Partner with a Leading Finance Company Ascentium Capital LLC

... Soft Costs: Soft costs such as sales tax, shipping, installation, training and software generally are not financed by a bank. Leasing may cover 100% financing so you avoid substantial out of pocket costs. Down Payment: Banks typically require 20% - 30% down on equipment financing due to concerns abo ...

... Soft Costs: Soft costs such as sales tax, shipping, installation, training and software generally are not financed by a bank. Leasing may cover 100% financing so you avoid substantial out of pocket costs. Down Payment: Banks typically require 20% - 30% down on equipment financing due to concerns abo ...

Did moral hazard and adverse selection affect CMBS loan quality?

... • Outcome: whether a loan ever becomes delinquent. • Variation: distinguish between regular on-time payment and prepayment. • Older loans have had more time over which to become delinquent. Control for this using vintage. • Regress on underwriting variables, originator type, vintage (originator type ...

... • Outcome: whether a loan ever becomes delinquent. • Variation: distinguish between regular on-time payment and prepayment. • Older loans have had more time over which to become delinquent. Control for this using vintage. • Regress on underwriting variables, originator type, vintage (originator type ...

Risk Management of Personal Lending Business

... The HKMA considers it important for AIs to maintain prudent underwriting standards for personal loans despite competitive pressures. AIs should continue to adopt the prudent principles set out in the HKMA’s Supervisory Policy Manual Module CR-G-1 “General Principles of Credit Risk” for their persona ...

... The HKMA considers it important for AIs to maintain prudent underwriting standards for personal loans despite competitive pressures. AIs should continue to adopt the prudent principles set out in the HKMA’s Supervisory Policy Manual Module CR-G-1 “General Principles of Credit Risk” for their persona ...

Chapter 3 Interbank Lending Interbank lending forms a critical

... those that could be converted easily and cheaply into the means of payment – across the entire financial system. Rather than lend them out, anxious banks preferred to hold additional liquid assets just in case their own needs might increase. Banks also grew concerned about the safety of their tra ...

... those that could be converted easily and cheaply into the means of payment – across the entire financial system. Rather than lend them out, anxious banks preferred to hold additional liquid assets just in case their own needs might increase. Banks also grew concerned about the safety of their tra ...

KfW-Vorlage

... The investments financed from 2006 until 2008 achieved a permanent reduction of 2,4 million tons per annum in CO2 emissions1 ...

... The investments financed from 2006 until 2008 achieved a permanent reduction of 2,4 million tons per annum in CO2 emissions1 ...

Titan Europe 2007-2 Limited Quarterly Surveillance Report for the

... This document is provided for information purposes to holders of the relevant notes from time to time and prospective investors who may lawfully receive, and have read, the prospectus for such notes. The information contained herein must be read in conjunction with, and is qualified by, such prospec ...

... This document is provided for information purposes to holders of the relevant notes from time to time and prospective investors who may lawfully receive, and have read, the prospectus for such notes. The information contained herein must be read in conjunction with, and is qualified by, such prospec ...

Conduit loan servicing: Who`s who and what`s what?

... the Controlling Class Representative (CCR), who is a fiduciary for all the certificate holders. The CCR was designated when the REMIC was created and the PSA was signed. The largest class of certificate holders is always the AAA rated tranche who aren't likely to lose any money if the deal gets fore ...

... the Controlling Class Representative (CCR), who is a fiduciary for all the certificate holders. The CCR was designated when the REMIC was created and the PSA was signed. The largest class of certificate holders is always the AAA rated tranche who aren't likely to lose any money if the deal gets fore ...

Characteristics of Money Market Instruments

... loans, floating-rate loans, or bankers’ acceptances. Except for the most creditworthy corporations, most bank lending is secured by the corporation’s physical assets or receivables. Credit facilities are tailored to suit the needs of the borrower. At any given time, a borrower does not usually requi ...

... loans, floating-rate loans, or bankers’ acceptances. Except for the most creditworthy corporations, most bank lending is secured by the corporation’s physical assets or receivables. Credit facilities are tailored to suit the needs of the borrower. At any given time, a borrower does not usually requi ...

The Treatment of Nonperforming Loans

... Would it be more consistent to treat loan write-offs as price changes rather than other changes in volume? Should national accounts cease to record interest accrual on impaired loans? Should the manuals define an income concept including “expected” or actual losses on financial claims? If, so should ...

... Would it be more consistent to treat loan write-offs as price changes rather than other changes in volume? Should national accounts cease to record interest accrual on impaired loans? Should the manuals define an income concept including “expected” or actual losses on financial claims? If, so should ...

CMHC Newcomer

... Newcomers with non-permanent resident status have access to CMHC-insured financing of up to 90% loan-to-value ratio for the purchase of a 1 unit owner-occupied residential property. No additional fees or premiums as a result of residency status – standard product specific premiums apply. No minimum ...

... Newcomers with non-permanent resident status have access to CMHC-insured financing of up to 90% loan-to-value ratio for the purchase of a 1 unit owner-occupied residential property. No additional fees or premiums as a result of residency status – standard product specific premiums apply. No minimum ...

Wrong turn for microcredit

... one of my goals was to eliminate the presence of loan sharks who grow rich by preying on the poor. In 1983, I founded Grameen Bank to provide small loans that people, especially poor women, could use to bring themselves out of poverty. At that time, I never imagined that one day microcredit would gi ...

... one of my goals was to eliminate the presence of loan sharks who grow rich by preying on the poor. In 1983, I founded Grameen Bank to provide small loans that people, especially poor women, could use to bring themselves out of poverty. At that time, I never imagined that one day microcredit would gi ...

Interest rates on mortgages 2. Fixed Rate Mortgage

... Mortgages are no different from loans, credit cards, savings and current accounts in that lenders are competing for your custom. Lending institutions often attract borrowers by offering discounted rate mortgages. A 6% loan might be discounted to 5% for the first three years. Such deals might attract ...

... Mortgages are no different from loans, credit cards, savings and current accounts in that lenders are competing for your custom. Lending institutions often attract borrowers by offering discounted rate mortgages. A 6% loan might be discounted to 5% for the first three years. Such deals might attract ...

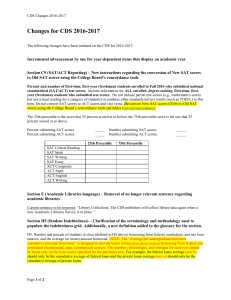

Changes for CDS 2016-2017 - Common Data Set Initiative

... Section C9 (SAT/ACT Reporting) – New instructions regarding the conversion of New SAT scores to Old SAT scores using the College Board’s concordance tools Percent and number of first-time, first-year (freshman) students enrolled in Fall 2016 who submitted national standardized (SAT/ACT) test scores. ...

... Section C9 (SAT/ACT Reporting) – New instructions regarding the conversion of New SAT scores to Old SAT scores using the College Board’s concordance tools Percent and number of first-time, first-year (freshman) students enrolled in Fall 2016 who submitted national standardized (SAT/ACT) test scores. ...

More Financial Services for Small Businesses

... More Financial Services for Small Businesses The Challenge ...

... More Financial Services for Small Businesses The Challenge ...

Restructuring & Insolvency

... and frequently represent internationally-based clients in Canadian and cross-border restructurings and insolvencies. Our numerous domestic relationships with leading insolvency professionals and lenders involve us in a wide range of matters. We have represented Canadian, US, and international financ ...

... and frequently represent internationally-based clients in Canadian and cross-border restructurings and insolvencies. Our numerous domestic relationships with leading insolvency professionals and lenders involve us in a wide range of matters. We have represented Canadian, US, and international financ ...

Real estate terms and definitions

... notary public swear to the fact that the persons named in the documents did, in fact, sign them. Points: Also known as a loan's origination fee, points are interest charges paid upfront when closing a loan. Points are a percentage of the total loan amount (one point is equal to 1 percent of the loan ...

... notary public swear to the fact that the persons named in the documents did, in fact, sign them. Points: Also known as a loan's origination fee, points are interest charges paid upfront when closing a loan. Points are a percentage of the total loan amount (one point is equal to 1 percent of the loan ...

NPL resolution - World Bank Group

... Another drawback in most of CEE jurisdictions is that they are rather debtorfriendly and it is not unusual that debtors are granted extensive options to contest and delay the bankruptcy or enforcement procedure and in some cases – even to avoid its initiation. Moreover, companies often choose to ent ...

... Another drawback in most of CEE jurisdictions is that they are rather debtorfriendly and it is not unusual that debtors are granted extensive options to contest and delay the bankruptcy or enforcement procedure and in some cases – even to avoid its initiation. Moreover, companies often choose to ent ...

Loan shark

A loan shark is a person or body who offers loans at extremely high interest rates. The term usually refers to illegal activity, but may also refer to predatory lending with extremely high interest rates such as payday or title loans. Loan sharks sometimes enforce repayment by blackmail or threats of violence. Historically, many moneylenders skirted between legal and extra-legal activity. In the recent western world, loan sharks have been a feature of the criminal underworld.