* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Topics – Student Loan Market – Financial Risk – Enrollment Risk

Survey

Document related concepts

Household debt wikipedia , lookup

Peer-to-peer lending wikipedia , lookup

United States housing bubble wikipedia , lookup

Financial economics wikipedia , lookup

Moral hazard wikipedia , lookup

History of the Federal Reserve System wikipedia , lookup

Securitization wikipedia , lookup

Systemic risk wikipedia , lookup

Continuous-repayment mortgage wikipedia , lookup

Interest rate ceiling wikipedia , lookup

Interbank lending market wikipedia , lookup

Yield spread premium wikipedia , lookup

Federal takeover of Fannie Mae and Freddie Mac wikipedia , lookup

Financialization wikipedia , lookup

Public finance wikipedia , lookup

Transcript

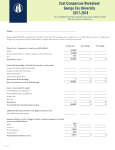

Topics • FOCUS 2011 • JWU Approach to Enterprise Risk Management – Student Loan Market – Financial Risk – Enrollment Risk FOSTERING STUDENT SUCCESS AT JOHNSON & WALES UNIVERSITY • External Conditions • JWU Assessment and Proposal Tom Dwyer & Marie Bernardo December 3, 2008 JWU Strategic Plan • 2 Strengthening Student Potential FOCUS 2011 Johnson & Wales University will be the destination of choice for individuals seeking career education who are highly motivated and demonstrably capable of success in J&W programs. The university will endeavor to establish tuition at affordable levels, and offer financial assistance that support improvement of retention and graduation rates. – Strengthening the EXPERIENCE • Academic and Student Life – Extensive program assessment • Strengthening STUDENT POTENTIAL – Admissions and Enrollment • • • Selectivity • Affordability International Recruitment Strengthening CAREER OPPORTUNITIES – Career Development • • Career Progression Study Strengthening the FOUNDATION – Resource Development • Organized to achieve objectives 3 4 1 Concentration of Risk Reputation Portfolio Risk Graduation Rates / Retention Academic Rigor Pricing / Debt Burden Career Progression Food Safety Succession Planning External Validation Student Enrollment Team Investment Policy Market Risk Asset Allocation External Validation • Business Continuity Enterprise Risk Management At JWU Concentration of Risk Policies & Procedures Financial Controls Segregation of Duties External Validation Loan Generated Revenue – $143,142,152 system wide Internal Controls • • Net Billable $267,580,757 system wide Loan Summary – Stafford Subsidized and Unsubsidized Financial Security Data Security Network Security Business Continuity Plan External Validation • $79,473,828 0708 vs 0809 Changes in Borrowing – Perkins Overall • $11,498,911 Regulatory Concerns – Federal Plus Crisis Contingency Plan Title IV Accreditations 501 (c) 3 State Licensing FERPA External Validation Financial Market Turmoil Natural Disasters Security Concerns Insurance Integrated Contingency Plan External Validation 75% 70% 65% Stafford – Private Private -30% • $26,610,942 5 80% PLUS • $25,558,471 -20% Charlotte -10% Denver 0% 10% North Miami 20% Providence 30% 40% University 6 Cumulative Change in Inflation Adjusted College Cost of Attendance, Family Income, and Financial Need Cumulative Change in Inflation Adjusted Dollars 20.0% Family Income COA Remaining Need Tuition and Fees Financial Need Remaining Need After Grant, Work, Achievement Loan and EFC Remaining Cost 15.0% 60% 55% 50% 45% Financial Need 10.0% 40% Cost of Attendance 35% 30% 5.0% Tuition and Fees 25% 20% Family Adjusted Gross Income Cost of Attendance 15% Financial Need 0.0% 2004 10% 2005 2006 2007 2008* 5% Family income 0% -5.0% -5% 7 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 8 Source: Bureau of Labor Statistics - CPI 2 JWU Average Family Adjusted Gross Income Band Comparisons to National Average Financing the GAP • 40% 35% 30% 25% 20% 15% 10% 5% 0% Less then 30k Charlotte 9 30,00 59,999k Denver 60,000 99,999k North Miami • 100,000 - Greater 149,999k then 150k Providence University USA Federal Loans – Stafford (Subsidized and Unsubsidized) • No Credit Check • Based on need amounts range from $3500 - $5500 subsidized • Interest rate 6% subsidized, 6.8% unsubsidized • Additional Unsubsidized $2,000 – PLUS LOAN • Credit qualification loosened until December 2010 • No 180 day delinquency on mortgage or medical bills • No 90 day delinquency on all other credit worthy accounts • Interest rate 8.5% • Deferment options Private Loans • 2009-20010 loan access unknown due to liquidity issues • Expect increase in FICO score minimums in 0910 • Lender specific credit qualifications 10 Source: Census.gov - American Community Survey – USA Households 45-64 Distribution of Student Aid Distribution of Student Aid 0708 Distribution of Undergraduate Aid - JWU Federal WorkStudy 4% State Grants 2% 0809 Distribution of Undergraduate Aid - JWU Outside Grants 1% Pell 6% Private Loans 15% Federal Loans 39% Federal WorkStudy 4% Institutional Aid 31% Private Loans 10% Federal Grants - other than Pell 2% Federal Loans 43% 0708 Distribution of Undergraduate Aid - Nationwide Pell 12% Federal WorkStudy 1% State Grants 7% Private Loans 14% 11 State Grants 2% Outside Grants 1% Pell 6% Institutional Aid 33% Federal Grants - other than Pell 1% Outside Grants 6% Institutional Aid 20% Federal Grants - other than Pell 3% Federal Loans 37% 12 3 Picture of a Private Loan Borrower at JWU Retention of a Private/PLUS Loan Borrower one year retention model – not official calculation • Undergraduate enrollment 14,372 – Private borrowers account for 15% of our student population (2107) – Average annual loan is $12,608 • Median EFC is $10,656 which is $5000 more than the median EFC at JWU • Median AGI is $88,543 which is $16,624 more than the median AGI at JWU – At risk $17,702,673 in federal aid 13 Entering Class of Sept. ’06 Entering Class of Sept. ’07 PLUS Private 69.3% 68.7% 73.1% 74.4% +3.8% +5.7% No PLUS or Private 63.5% 68.3% +4.8% Overall 67.3% 73.1 +5.8% Difference 14 Legislative Impact on Student Loans Access to Education Legislation Signed as of 5/7/08 extended through 2009 • College Cost Reduction Act of 07 (HR 2669) • H.R. 5715 – extended for an additional year – Increase of Stafford by $2000 – Created a less desirable market for lenders (increased origination fees, percentage of federal guarantee reduced; a cut of 20 billion in federal subsidies) • Independent students; Plus Denial • New Amounts will range from – $5,500 -7,500 – Increase in aggregate loan amount from $23,000 $31,000 – PLUS Qualification adjusted until December 2009 • Volatility in the Student loan market – – – – 15 Liquidity concerns A smaller marketplace Borrower benefits limited or non existent A movement towards direct lending • No more than 180 days delinquent on a mortgage payment • No more than 180 days delinquent on a medical bills • No more than 90 days delinquent on any other debt – Deferment options – Impact on Study on College Costs - GAO 16 4 Focus 2011 Awarding Strategies Institutional Grant Total – University Freshmen $9,000 $8,067 • Freshman and Sophomore $8,215 $8,177 – Increase affordability by maintaining 4 year awards at a consistent level – Awards are determined based on a family’s need – Awards include: Academic/Merit, Johnson & Wales Grant, Pell, SEOG, Stafford Loan and State grants (each is set to meet a percentage of need) – Average institutional awards for freshmen $8215 • Junior and senior awards determined based on need, EFC, and scholarships • Average discount rate of 30.7% for tuition and fees 17 $7,911 $7,877 $8,000 $7,301 $7,557 $7,322 $7,000 $6,133 $6,000 $5,653 $5,359 $5,157 $5,000 2006 2007 2008 $4,000 $3,000 $2,000 $1,000 $0 yr1 yr2 yr3 yr4 On average the freshman class in 0809 received $2856 more in total Institutional grant aid than in September 2006. 18 What we thought was going to happen Projected Student Debt by Total Enrollment University $40,000 $35,140 $35,627 $40,000 $35,000 $34,495 $35,000 $35,312 $30,000 $25,955 $25,704 $30,000 $25,000 $24,596 $25,324 $25,000 $17,107 $20,000 $17,107 $18,851 $15,629 $20,000 $8,487 $15,000 $8,487 $12,614 $25,506 $16,638 $15,000 $6,413 $10,000 $6,413 $10,000 $5,000 $7,189 2006 $5,000 2006 2007 $yr1 $- 2007 yr2 yr1 yr3 yr4 19 20 2008 yr2 yr3 2008 2007 yr4 2006 5 Solutions to Mitigate Enrollment Risks Strengthening the EXPERIENCE • Award Adjustments ($2.4 million) – Maximize Perkins awards – Increase awards by $1000 - $4000 for students <75k previously denied PLUS • Financial Planning Grants ($2 million) – Customized planning grants ranging from $1,000 - $6000 – Increase institutional caps – Discount for annual payers • Access to Education Grants ($2 million) – Reports on loan denials will be run on a daily basis – Institutional funds will be provided to reduce individual balances to minimum of $3,000 Entering Class of Sept. ’06 Entering Class of Sept. ’07 PVD NMI DEN CLT 68.4% 62.6% 64.2% 69.4% 73.2% 67.8% 74.5% 75.7% +4.8% +5.2% +10.3% +6.3% University 67.3% 73.1% +5.8% Difference • These awards will be reviewed for renewability in 2009 21 22 6