tutor2u worksheet on stakeholders

... Degree of influence of stakeholders will vary depending on nature of business activities and who holds power! E.g. customers may have great influence if business is dependent on them Shareholders (as stakeholders) typically exert high influence - voting on key company decisions Government / regulato ...

... Degree of influence of stakeholders will vary depending on nature of business activities and who holds power! E.g. customers may have great influence if business is dependent on them Shareholders (as stakeholders) typically exert high influence - voting on key company decisions Government / regulato ...

CF Canlife Asia Pacific Fund

... steel. The result of this has been numerous closures in loss-making steel mills and coal mines. This gave rise to better profitability in both coal and steel companies. On the other hand, it is pushing through additional infrastructure spending to support growth. As a result, public investment picked ...

... steel. The result of this has been numerous closures in loss-making steel mills and coal mines. This gave rise to better profitability in both coal and steel companies. On the other hand, it is pushing through additional infrastructure spending to support growth. As a result, public investment picked ...

Chapter 11: Reporting and Analyzing Stockholders` Equity

... 1. Net income that is retained in the business. 2. The amount per share of stock that must be retained in the business for the protection of corporate creditors. 3. Capital stock that has contractual preferences over common stock in certain areas. 4. A corporation that may have thousands of stockhol ...

... 1. Net income that is retained in the business. 2. The amount per share of stock that must be retained in the business for the protection of corporate creditors. 3. Capital stock that has contractual preferences over common stock in certain areas. 4. A corporation that may have thousands of stockhol ...

Cash flows from operating activities

... arise from issuing long-term debt or equity securities. Cash outflows from financing activities normally include paying cash dividends, repaying long-term debt, and acquiring treasury stock. ...

... arise from issuing long-term debt or equity securities. Cash outflows from financing activities normally include paying cash dividends, repaying long-term debt, and acquiring treasury stock. ...

Later-Stage Growth Companies

... of privately-owned middle market companies. We work closely with management teams to help them accomplish their strategic objectives whether it is a recapitalization to reduce the company’s level of leverage or refinance current institutional capital, a change-ofcontrol or management buyout financin ...

... of privately-owned middle market companies. We work closely with management teams to help them accomplish their strategic objectives whether it is a recapitalization to reduce the company’s level of leverage or refinance current institutional capital, a change-ofcontrol or management buyout financin ...

CWC Well Services Corp. Announces Closing of Bought Deal Equity Financing Including Exercise of Over-Allotment Option

... READER ADVISORY - Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This press release is not an offer of the securities for sale in the United S ...

... READER ADVISORY - Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This press release is not an offer of the securities for sale in the United S ...

The Market for Corporate Control

... Table 1 shows that target lirms in successful takeovers experience statistically significant abnormal stock price changes of 20% in mergers and 30% in tender offers. Bidding firms realize statistically significant abnormal gains of 4% in tender offers and zero in mergers. Table 2 shows that both bid ...

... Table 1 shows that target lirms in successful takeovers experience statistically significant abnormal stock price changes of 20% in mergers and 30% in tender offers. Bidding firms realize statistically significant abnormal gains of 4% in tender offers and zero in mergers. Table 2 shows that both bid ...

What is Accounting?

... Generally Accepted Accounting Principles Generally Accepted Accounting Principles (GAAP) - A set of rules and practices, having substantial authoritative support, that the accounting profession recognizes as a general guide for ...

... Generally Accepted Accounting Principles Generally Accepted Accounting Principles (GAAP) - A set of rules and practices, having substantial authoritative support, that the accounting profession recognizes as a general guide for ...

Filed by The Dow Chemical Company Pursuant to Rule 425 under

... This communication is not intended to and shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote of approval, nor shall there be any sale of securities in any jurisdiction in which such offer, ...

... This communication is not intended to and shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote of approval, nor shall there be any sale of securities in any jurisdiction in which such offer, ...

NewsRelease - Lydall Inc.

... economy and other future conditions. Forward-looking statements generally can be identified through the use of words such as “believes,” “anticipates,” “may,” “should,” “will,” “plans,” “projects,” “expects,” “expectations,” “estimates,” “forecasts,” “predicts,” “targets,” “prospects,” “strategy,” “ ...

... economy and other future conditions. Forward-looking statements generally can be identified through the use of words such as “believes,” “anticipates,” “may,” “should,” “will,” “plans,” “projects,” “expects,” “expectations,” “estimates,” “forecasts,” “predicts,” “targets,” “prospects,” “strategy,” “ ...

McGraw-Hill/Irwin

... marginal tax rates? Which should we use when making financial decisions? • How do we determine a firm’s cash flows? What are the equations and where do we find the information? ...

... marginal tax rates? Which should we use when making financial decisions? • How do we determine a firm’s cash flows? What are the equations and where do we find the information? ...

Downloable-Solution-Manual-for-Accounting-Tools-for

... 6. Measures of the income or operating success of an enterprise for a given period of time ...

... 6. Measures of the income or operating success of an enterprise for a given period of time ...

New Activist Weapon-- The Rise of Delaware Appraisal

... shareholders seeking appraisal rights. In the Dell going private transaction, for example, the threat by Carl Icahn and others to seek appraisal of the shares they had amassed after announcement of the deal effectively blocked the required shareholder vote (a majority of the minority shares outstand ...

... shareholders seeking appraisal rights. In the Dell going private transaction, for example, the threat by Carl Icahn and others to seek appraisal of the shares they had amassed after announcement of the deal effectively blocked the required shareholder vote (a majority of the minority shares outstand ...

Ch 16

... • The free cash flow hypothesis says that an increase in dividends should benefit the stockholders by reducing the ability of managers to pursue wasteful activities. • The free cash flow hypothesis also argues that an increase in debt will reduce the ability of managers to pursue wasteful activities ...

... • The free cash flow hypothesis says that an increase in dividends should benefit the stockholders by reducing the ability of managers to pursue wasteful activities. • The free cash flow hypothesis also argues that an increase in debt will reduce the ability of managers to pursue wasteful activities ...

Capital Structure of Private Pharmaceutical Companies in Russia

... Hypotheses on capital structure of private pharmaceutical companies in Russia are based on the review of recent studies. Hypotheses are as follows: H1 : The larger the size of the firm the higher the total debt/ total assets ratio. Generally, large firms are more financially stable and have better ...

... Hypotheses on capital structure of private pharmaceutical companies in Russia are based on the review of recent studies. Hypotheses are as follows: H1 : The larger the size of the firm the higher the total debt/ total assets ratio. Generally, large firms are more financially stable and have better ...

Success or struggle: ROA as a true measure of business performance

... to how their products and services provide greater value for their customers. Within this context, companies must question whether they are making the investments needed to prepare for the long term. The lasting legacy of this short-term focus is not increased certainty, but rather, greater uncertai ...

... to how their products and services provide greater value for their customers. Within this context, companies must question whether they are making the investments needed to prepare for the long term. The lasting legacy of this short-term focus is not increased certainty, but rather, greater uncertai ...

The Revolving Door

... 3. Promotions: the presence of internal promotions (members of governing bodies of Central Banks who came from the CB itself, number of those remaining at the Central Bank after a ...

... 3. Promotions: the presence of internal promotions (members of governing bodies of Central Banks who came from the CB itself, number of those remaining at the Central Bank after a ...

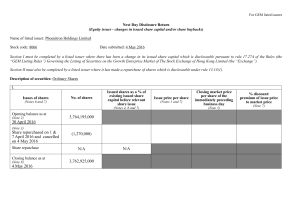

Next Day Disclosure Returns

... Please set out all changes in issued share capital requiring disclosure pursuant to rule 17.27A together with the relevant dates of issue. Each category will need to be disclosed individually with sufficient information to enable the user to identify the relevant category in the listed issuer’s Mont ...

... Please set out all changes in issued share capital requiring disclosure pursuant to rule 17.27A together with the relevant dates of issue. Each category will need to be disclosed individually with sufficient information to enable the user to identify the relevant category in the listed issuer’s Mont ...

leaseurope index results: q2 2011 - NVL

... Return on equity index: Indexation of the weighted average of all companies’ net profit (annualised) as a percentage of 8% of average risk weighted assets over the period. The weight used is the average portfolio over the period. Average portfolio is calculated as the mean of the value of the portfo ...

... Return on equity index: Indexation of the weighted average of all companies’ net profit (annualised) as a percentage of 8% of average risk weighted assets over the period. The weight used is the average portfolio over the period. Average portfolio is calculated as the mean of the value of the portfo ...

“If you have any queries about this document, you may consult your

... As per provision of the Depository Act, 1999, and regulations made there under, shares will only be issued in dematerialized condition. All transfers/transmission/splitting will take place in the Central Depository Bangladesh Limited’s (CDBL) system and any further issuance of shares (rights/bonus) ...

... As per provision of the Depository Act, 1999, and regulations made there under, shares will only be issued in dematerialized condition. All transfers/transmission/splitting will take place in the Central Depository Bangladesh Limited’s (CDBL) system and any further issuance of shares (rights/bonus) ...

GNRX VanEck Vectors Generic Drugs ETF

... Fund shares are not individually redeemable and will be issued and redeemed at their NAV only through certain authorized broker-dealers in large, specified blocks of shares called "creation units" and otherwise can be bought and sold only through exchange trading. Shares may trade at a premium or di ...

... Fund shares are not individually redeemable and will be issued and redeemed at their NAV only through certain authorized broker-dealers in large, specified blocks of shares called "creation units" and otherwise can be bought and sold only through exchange trading. Shares may trade at a premium or di ...

assets = liabilities + equity

... liquidity: ability to meet current obligations from liquid assets. Related to the probability of business failure. mix of assets held: current vs non current. Given their long term nature, an over-investment in non current assets can cause cash shortages. financial structure: reliance on exter ...

... liquidity: ability to meet current obligations from liquid assets. Related to the probability of business failure. mix of assets held: current vs non current. Given their long term nature, an over-investment in non current assets can cause cash shortages. financial structure: reliance on exter ...

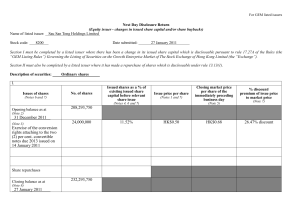

appendix 8a - Sau San Tong

... Please set out all changes in issued share capital requiring disclosure pursuant to rule 17.27A together with the relevant dates of issue. Each category will need to be disclosed individually with sufficient information to enable the user to identify the relevant category in the listed issuer’s Mont ...

... Please set out all changes in issued share capital requiring disclosure pursuant to rule 17.27A together with the relevant dates of issue. Each category will need to be disclosed individually with sufficient information to enable the user to identify the relevant category in the listed issuer’s Mont ...

Is the accounting equation in balance?

... economic resources. Stockholders’ Equity: financing provided by owners and business operations. Revenue: increase in assets or settlement of liabilities from ongoing operations. Expense: decrease in assets or increase in liabilities from ongoing operations. Gain: increase in assets or settlement of ...

... economic resources. Stockholders’ Equity: financing provided by owners and business operations. Revenue: increase in assets or settlement of liabilities from ongoing operations. Expense: decrease in assets or increase in liabilities from ongoing operations. Gain: increase in assets or settlement of ...