Liquidity vs Profitability - Futuregrowth Asset Management

... The return on asset (RoA) calculation based on annual operating profits is not a fair measure for comparison, as it does not take into account risk, capital gain or time value of money. Unfortunately there are a number of operator agreements that have been altered in the landowners’ favor because of ...

... The return on asset (RoA) calculation based on annual operating profits is not a fair measure for comparison, as it does not take into account risk, capital gain or time value of money. Unfortunately there are a number of operator agreements that have been altered in the landowners’ favor because of ...

Ind AS 113- Fair Value Measurement

... disaggregated in an Ind AS for recognition purposes and is determined under the IFRS applicable to the asset or liability (or group of assets and liabilities) that requires FV measurement. The determination of the unit of account must be established prior to determining FV In some cases, the uni ...

... disaggregated in an Ind AS for recognition purposes and is determined under the IFRS applicable to the asset or liability (or group of assets and liabilities) that requires FV measurement. The determination of the unit of account must be established prior to determining FV In some cases, the uni ...

Strategia zmian dla firmy EUROsport:

... All new ventures and investments are becoming even more attractive with low risk level ...

... All new ventures and investments are becoming even more attractive with low risk level ...

The Balance Sheet: Assets, Debts and Equity

... Total liabilities is the sum of shortand long-term liabilities. This figure should not equal total assets (or worse yet, exceed total assets), as that would imply that shareholders have no assets to lay claim to. Stockholder’s Equity Equity is the balancing amount after taking liabilities from asset ...

... Total liabilities is the sum of shortand long-term liabilities. This figure should not equal total assets (or worse yet, exceed total assets), as that would imply that shareholders have no assets to lay claim to. Stockholder’s Equity Equity is the balancing amount after taking liabilities from asset ...

The remainder of the paper is as follows

... combined entity. Although it may make sense for firms to counteract some of the risk reduction induced by asset diversification by taking greater advantage of the tax shield provided by debt (Lewellen, 1971) or recapture wealth from bondholders (Kim and McConnell, 1977), theories have thus far not p ...

... combined entity. Although it may make sense for firms to counteract some of the risk reduction induced by asset diversification by taking greater advantage of the tax shield provided by debt (Lewellen, 1971) or recapture wealth from bondholders (Kim and McConnell, 1977), theories have thus far not p ...

FREE Sample Here - We can offer most test bank and

... where the initial price, P1, is equivalent to the initial investment by the shareholder, and P2 is the price of the share at the end of period. The shareholder theoretically receives income from both components. For example, over the past 50 or 60 years in the U.S. marketplace, a diversified investo ...

... where the initial price, P1, is equivalent to the initial investment by the shareholder, and P2 is the price of the share at the end of period. The shareholder theoretically receives income from both components. For example, over the past 50 or 60 years in the U.S. marketplace, a diversified investo ...

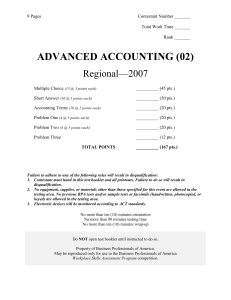

ADVANCED ACCOUNTING (02)

... 13. The total of the balances in the creditor’s accounts should agree with the balance of _______. A. purchase account in general ledger B. accounts Receivable account in general ledger C. accounts Payable account in general ledger D. should not agree with any general ledger accounts 14. Long lived ...

... 13. The total of the balances in the creditor’s accounts should agree with the balance of _______. A. purchase account in general ledger B. accounts Receivable account in general ledger C. accounts Payable account in general ledger D. should not agree with any general ledger accounts 14. Long lived ...

Certain statements in the below referenced discussion

... differ materially from those expressed in these forward-looking statements, including, among others, our ability to consummate any of future acquisitions; risks of regulatory approvals, if any required; competitive responses to future acquisitions; uncertainty of our expected financial performance f ...

... differ materially from those expressed in these forward-looking statements, including, among others, our ability to consummate any of future acquisitions; risks of regulatory approvals, if any required; competitive responses to future acquisitions; uncertainty of our expected financial performance f ...

Did Canada Survive the Financial Crisis Better than the United States?

... higher compared to Canadian firms. Regarding other descriptive ratios, U.S. firms maintain more current assets, such as cash and current assets, while Canadian firms keep more long-term assets, including fixed assets. U.S. firms also have better liquidity, shown by higher current ratio, and much hig ...

... higher compared to Canadian firms. Regarding other descriptive ratios, U.S. firms maintain more current assets, such as cash and current assets, while Canadian firms keep more long-term assets, including fixed assets. U.S. firms also have better liquidity, shown by higher current ratio, and much hig ...

Higher Economics – Assignment Candidate Evidence for

... be lucrative and successful will attract new firms as they will want to set up there in order to gain profit. This means that this will increase competition as there will now be more firms in the market. This will be good for the market as increased competition means that consumers will receive the ...

... be lucrative and successful will attract new firms as they will want to set up there in order to gain profit. This means that this will increase competition as there will now be more firms in the market. This will be good for the market as increased competition means that consumers will receive the ...

A Study on the Relationship between Relative Bargaining Power

... acquiring company. In addition, we introduce variables of relative bargaining powers in the explanation for market expected net synergy. We find that their explanations are quite significant in several time points during an M&A process (announcement date, completion date, and the month following com ...

... acquiring company. In addition, we introduce variables of relative bargaining powers in the explanation for market expected net synergy. We find that their explanations are quite significant in several time points during an M&A process (announcement date, completion date, and the month following com ...

session22test

... maintain their dividends per share over time. They change dividends infrequently, and when they do, it is more likely to be an increase than a decrease. 2. d. Companies feel much less secure or certain about future earnings. The tax disadvantage associated with dividends has actually decreased over ...

... maintain their dividends per share over time. They change dividends infrequently, and when they do, it is more likely to be an increase than a decrease. 2. d. Companies feel much less secure or certain about future earnings. The tax disadvantage associated with dividends has actually decreased over ...

ACG 2021

... On April 1 of the current year, a company traded an old machine that originally cost $32,000 and that had accumulated depreciation of $24,000 for a similar new machine that had a cash price of $40,000. 1. Give the entry to record the exchange under the assumption that a $5,000 trade-in allowance was ...

... On April 1 of the current year, a company traded an old machine that originally cost $32,000 and that had accumulated depreciation of $24,000 for a similar new machine that had a cash price of $40,000. 1. Give the entry to record the exchange under the assumption that a $5,000 trade-in allowance was ...

Chapter 5- Valuation Concepts

... paid each period, generally each six months, on a bond. Coupon Interest Rate: The stated annual rate of interest paid on a bond. Maturity Date: A specified date on which the par value of a bond must be repaid. Original Maturity: The number of years to maturity at the time the bond is issued. ...

... paid each period, generally each six months, on a bond. Coupon Interest Rate: The stated annual rate of interest paid on a bond. Maturity Date: A specified date on which the par value of a bond must be repaid. Original Maturity: The number of years to maturity at the time the bond is issued. ...

NWL Group Inc Form 8-K Reorganization 10-01-2015

... of NWLI Delaware, and the conversion of each share of Class A common stock, par value $1.00 per share, of NWLI Colorado (“Oldco Class A Stock”) and each share of Class B common stock, par value $1.00 per share, of NWLI Colorado (“Oldco Class B Stock”) issued and outstanding immediately prior to the ...

... of NWLI Delaware, and the conversion of each share of Class A common stock, par value $1.00 per share, of NWLI Colorado (“Oldco Class A Stock”) and each share of Class B common stock, par value $1.00 per share, of NWLI Colorado (“Oldco Class B Stock”) issued and outstanding immediately prior to the ...

1. Accountants refer to an economic event as a a. purchase. b. sale

... The information for preparing a trial balance on a worksheet is obtained from a. financial statements. b. general ledger accounts. c. general journal entries. d. business documents. ...

... The information for preparing a trial balance on a worksheet is obtained from a. financial statements. b. general ledger accounts. c. general journal entries. d. business documents. ...

launch of share buyback programme to service the moleskine spa

... Plan for employees of Moleskine S.p.A. and its subsidiaries. The share purchases relating to the implementation of the programme will be carried out in accordance with the procedures and within the time limits established by the abovementioned resolutions, specifically: a maximum of 5.160.000 ordi ...

... Plan for employees of Moleskine S.p.A. and its subsidiaries. The share purchases relating to the implementation of the programme will be carried out in accordance with the procedures and within the time limits established by the abovementioned resolutions, specifically: a maximum of 5.160.000 ordi ...

The analysis of company failure and financial distress is the subject

... web sites than it is for traditional shopping venues since the Internet removes geographical constraints from its users. The authors recommend that a web site should offer clear information, a quick response, interesting products and, if possible, financial incentives if it is to retain customers. I ...

... web sites than it is for traditional shopping venues since the Internet removes geographical constraints from its users. The authors recommend that a web site should offer clear information, a quick response, interesting products and, if possible, financial incentives if it is to retain customers. I ...

Administration of Member General Meetings - CS Isaac Nduru

... It can be defined as a long term incentive plan (LTIP) designed for key employees or staff whose role is key to drive both financial and social deliverables of the business and whose strategic input is key. Key staff may be defined to include CEO C- level roles (CEO reportees) and a mixture of sc ...

... It can be defined as a long term incentive plan (LTIP) designed for key employees or staff whose role is key to drive both financial and social deliverables of the business and whose strategic input is key. Key staff may be defined to include CEO C- level roles (CEO reportees) and a mixture of sc ...

Differences in target-firm characteristics and premiums paid by

... surpasses that of public equity. They find that private equity firms do not outperform the S&P 500 but in contrary underperform in the time period 1980-1993. They question whether the private equity asset class is misevaluated in regard to the increase in performance of acquired firms by LBO’s. On t ...

... surpasses that of public equity. They find that private equity firms do not outperform the S&P 500 but in contrary underperform in the time period 1980-1993. They question whether the private equity asset class is misevaluated in regard to the increase in performance of acquired firms by LBO’s. On t ...

Government Review of State Assets

... 2. To assess how the use and disposition of such assets can best help restore growth and contribute to national investment priorities. 3. To review where appropriate, relevant investment and financing plans, commercial practices and regulatory requirements affecting the use ...

... 2. To assess how the use and disposition of such assets can best help restore growth and contribute to national investment priorities. 3. To review where appropriate, relevant investment and financing plans, commercial practices and regulatory requirements affecting the use ...

Value relevance of accounting information and share price: A study

... between accounting information such as EPS, ROE, Earning Yield (EY) and Market Price per Share (MPS). Germon et al, 2000 conducted another analysis of NSM consisting top 30 companies from 2001 to 2004. They found that the relationship between share price and EPS is high but the ROE is very low. Sven ...

... between accounting information such as EPS, ROE, Earning Yield (EY) and Market Price per Share (MPS). Germon et al, 2000 conducted another analysis of NSM consisting top 30 companies from 2001 to 2004. They found that the relationship between share price and EPS is high but the ROE is very low. Sven ...

chapter_1-guidedoutlinestud

... The business entity concept means that: The owner is part of the business entity An entity is organized according to state or federal statutes An entity is organized according to the rules set by the FASB The entity is an individual economic unit for which data are recorded, analyzed, and reported ...

... The business entity concept means that: The owner is part of the business entity An entity is organized according to state or federal statutes An entity is organized according to the rules set by the FASB The entity is an individual economic unit for which data are recorded, analyzed, and reported ...

Financial Statements

... § Financial Statements give us a way to measure the economic performance of a company § To provide information to investors and stakeholders to give insight into management’s performance § “Management’s report card” § There are three important statements, each of which provide different insi ...

... § Financial Statements give us a way to measure the economic performance of a company § To provide information to investors and stakeholders to give insight into management’s performance § “Management’s report card” § There are three important statements, each of which provide different insi ...