Imperfect price discrimination, market structure, and efficiency

... customer-specific information of a certain quality and set their prices. This information, modelled as a partition of the characteristics space, helps firms to segment the consumers into different groups and charge each group a different price.2 Information of a higher quality is translated into a r ...

... customer-specific information of a certain quality and set their prices. This information, modelled as a partition of the characteristics space, helps firms to segment the consumers into different groups and charge each group a different price.2 Information of a higher quality is translated into a r ...

Checklist for shareholders` agreement

... Is there to be an initial period during which the transfer of shares will be prohibited? ...

... Is there to be an initial period during which the transfer of shares will be prohibited? ...

CHAPTER 21 - MONEY AND BANKING

... The stability of the value of money in the global marketplace is important because if the value of money is not stable, other countries will not accept that money in trade. In other words, if the marketplace believes your money will not be valuable to use, the market will not accept your money as pa ...

... The stability of the value of money in the global marketplace is important because if the value of money is not stable, other countries will not accept that money in trade. In other words, if the marketplace believes your money will not be valuable to use, the market will not accept your money as pa ...

AOL case - in class

... activities of the entity that resulted in future benefits. Such evidence should include verifiable historical patterns of results for the entity. Attributes to consider in determining whether the responses will be similar include (a) the demographics of the audience, (b) the method of advertising, ( ...

... activities of the entity that resulted in future benefits. Such evidence should include verifiable historical patterns of results for the entity. Attributes to consider in determining whether the responses will be similar include (a) the demographics of the audience, (b) the method of advertising, ( ...

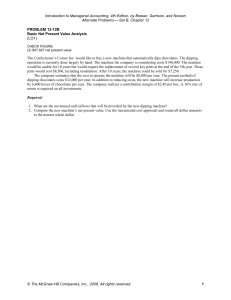

Exercises - McGraw

... of his property. Otthar has gathered the following information about the slide: a. Water slide equipment could be purchased and installed at a cost of $640,000. The slide would be usable for 5 years after which it would have no salvage value. b. Otthar would use straight-line depreciation on the sli ...

... of his property. Otthar has gathered the following information about the slide: a. Water slide equipment could be purchased and installed at a cost of $640,000. The slide would be usable for 5 years after which it would have no salvage value. b. Otthar would use straight-line depreciation on the sli ...

Unit R061 - Different types of business - Activity

... the work done as well as paying any debts if the business folds. However all the profits belong to the owner, who must then pay personal income tax on that money. Partnership The set up of a partnership is similar to that of a sole trader, however, the business is owned by two or more people. In a p ...

... the work done as well as paying any debts if the business folds. However all the profits belong to the owner, who must then pay personal income tax on that money. Partnership The set up of a partnership is similar to that of a sole trader, however, the business is owned by two or more people. In a p ...

Regime of Capital Gain Tax

... Any Person/Investor, if Not Satisfied with the Computation of Capital Gain or Tax thereon, such Person/Investor may Re-Compute the Capital Gain and Lodge Claim of Refund, if any, with the Commissioner of FBR. ...

... Any Person/Investor, if Not Satisfied with the Computation of Capital Gain or Tax thereon, such Person/Investor may Re-Compute the Capital Gain and Lodge Claim of Refund, if any, with the Commissioner of FBR. ...

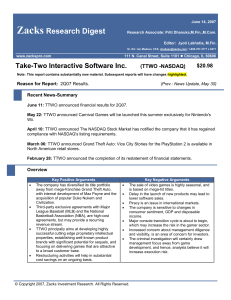

TTWO -NASDAQ

... On June 11, 2007, TTWO announced financial results for 2Q07. In 2Q07, revenue was $205.4 million, and reported loss per share was $0.71. The results continued to be adversely impacted by the video game industry's transition from current generation to next-generation platforms. On May 22, 2007, TTWO ...

... On June 11, 2007, TTWO announced financial results for 2Q07. In 2Q07, revenue was $205.4 million, and reported loss per share was $0.71. The results continued to be adversely impacted by the video game industry's transition from current generation to next-generation platforms. On May 22, 2007, TTWO ...

F. Peter Boer[*] - Tiger Scientific Inc

... by investing in alternative securities of comparable risk. The capital charge makes an enormous difference in a company's outlook: Under conventional accounting, most projects or companies appear profitable but many in fact are not. Estimating the cost of capital is critical to measuring Economic Va ...

... by investing in alternative securities of comparable risk. The capital charge makes an enormous difference in a company's outlook: Under conventional accounting, most projects or companies appear profitable but many in fact are not. Estimating the cost of capital is critical to measuring Economic Va ...

Know Your Real Estate Experts Agents

... Escrow company: A licensed and bonded company, used in most states, that serves as a neutral third party at the request of the buyer or buyer's agent after a seller accepts a buyer's offer. The company receives all funds, ensures the proper execution of all documents, and ensures that all of the con ...

... Escrow company: A licensed and bonded company, used in most states, that serves as a neutral third party at the request of the buyer or buyer's agent after a seller accepts a buyer's offer. The company receives all funds, ensures the proper execution of all documents, and ensures that all of the con ...

PDF

... The future promises to be even more exciting thanks to technology that will enable The Economist to reach a growing number of “globally curious” readers around the world in existing and new ways. 2015 was extremely encouraging in this respect: digital sales are up 31%, their social media following r ...

... The future promises to be even more exciting thanks to technology that will enable The Economist to reach a growing number of “globally curious” readers around the world in existing and new ways. 2015 was extremely encouraging in this respect: digital sales are up 31%, their social media following r ...

GOLDCORP INC.

... warrant entitles the holder to purchase one Goldcorp share for US$25 up until April 30, 2007. Net proceeds of this equity financing will increase Goldcorp’s cash balance to more than US$225 million providing one of the strongest balance sheets in the gold industry. It will enhance the company’s comp ...

... warrant entitles the holder to purchase one Goldcorp share for US$25 up until April 30, 2007. Net proceeds of this equity financing will increase Goldcorp’s cash balance to more than US$225 million providing one of the strongest balance sheets in the gold industry. It will enhance the company’s comp ...

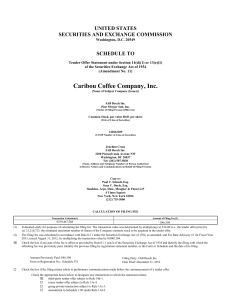

united states securities and exchange commission - corporate

... MINNEAPOLIS, MN – January 23, 2013 —JAB Beech Inc. (“JAB”), a member of the Joh. A Benckiser Group today announced the successful completion of the tender offer by its wholly-owned subsidiary, Pine Merger Sub, Inc. (“Purchaser”), for all of the outstanding shares of common stock of Caribou Coffee Co ...

... MINNEAPOLIS, MN – January 23, 2013 —JAB Beech Inc. (“JAB”), a member of the Joh. A Benckiser Group today announced the successful completion of the tender offer by its wholly-owned subsidiary, Pine Merger Sub, Inc. (“Purchaser”), for all of the outstanding shares of common stock of Caribou Coffee Co ...

stock

... consistent history of paying high dividends. Investors choose income stocks in order to receive current income in the form of dividends. Preferred stocks pay the mast certain and predictable dividends ...

... consistent history of paying high dividends. Investors choose income stocks in order to receive current income in the form of dividends. Preferred stocks pay the mast certain and predictable dividends ...

Strategic segmentation of a market

... target their direct marketing activities towards specific consumers – in this case, informing them about their existence. Consumers have unit demand i.e. buy either 0 or 1 unit of the commodity. The gross surplus from consuming a unit is u . 0. A consumer who becomes aware of the existence of only o ...

... target their direct marketing activities towards specific consumers – in this case, informing them about their existence. Consumers have unit demand i.e. buy either 0 or 1 unit of the commodity. The gross surplus from consuming a unit is u . 0. A consumer who becomes aware of the existence of only o ...

of Repairs Completed in Target

... because of the number of repairs being queries by customers and partly because their call centre is not fully staffed. This has a knock on effect as callers call use repeatedly some giving up with 30 seconds. Any caller who wants a call back is however offered one automatic ally and we can get back ...

... because of the number of repairs being queries by customers and partly because their call centre is not fully staffed. This has a knock on effect as callers call use repeatedly some giving up with 30 seconds. Any caller who wants a call back is however offered one automatic ally and we can get back ...

Financial Statements for the period ending November

... and will be amortized on a straight-line basis over the estimated useful life of the underlying technologies with finite lives. Once the Company commences research and development activities, the intangible assets will be amortized on a straight-line basis over 10 years. The Company reviews the esti ...

... and will be amortized on a straight-line basis over the estimated useful life of the underlying technologies with finite lives. Once the Company commences research and development activities, the intangible assets will be amortized on a straight-line basis over 10 years. The Company reviews the esti ...

Brookfield Business Partners LP (Form: 6-K, Received: 10

... Although we believe that the forward-looking statements we make are based upon reasonable assumptions and expectations, the reader should not place undue reliance on them or any other forward-looking statements or information in this news release. The future performance and prospects of Brookfield ...

... Although we believe that the forward-looking statements we make are based upon reasonable assumptions and expectations, the reader should not place undue reliance on them or any other forward-looking statements or information in this news release. The future performance and prospects of Brookfield ...

The Capital Structure Puzzle

... realizabletax shield from a future deduction of one dollar of interest paid. For some firms this numberis 46 cents, or close to it. At the other extreme, there are firms with large unused loss carryforwardswhich pay no immediate taxes. An extra dollar of interest paid by these firms would create onl ...

... realizabletax shield from a future deduction of one dollar of interest paid. For some firms this numberis 46 cents, or close to it. At the other extreme, there are firms with large unused loss carryforwardswhich pay no immediate taxes. An extra dollar of interest paid by these firms would create onl ...

CFIN

... the DSO—would affect the stock price. For example, if the company could improve its collection procedures and thereby lower the DSO from 37.6 days to 27.6 days, how would that change “ripple through” the financial statements (shown in thousands below) and influence the stock price? ...

... the DSO—would affect the stock price. For example, if the company could improve its collection procedures and thereby lower the DSO from 37.6 days to 27.6 days, how would that change “ripple through” the financial statements (shown in thousands below) and influence the stock price? ...

principles of accounting i

... investment potential (would this company be a worthy stock investment, reasoning?), profitability, financial flexibility, and social responsibility. As you consider these issues for each company compare the two companies to determine which one might be a better investment opportunity and more popula ...

... investment potential (would this company be a worthy stock investment, reasoning?), profitability, financial flexibility, and social responsibility. As you consider these issues for each company compare the two companies to determine which one might be a better investment opportunity and more popula ...

Will high-tech CFOs adapt to slower growth

... up a fact-based performance system. Productivity is a popular platform for extending the role of the CFO, who usually analyzes movements in the company's share price to determine what raises value. This understanding, in turn, informs the focus of the productivity-improvement program: operating expe ...

... up a fact-based performance system. Productivity is a popular platform for extending the role of the CFO, who usually analyzes movements in the company's share price to determine what raises value. This understanding, in turn, informs the focus of the productivity-improvement program: operating expe ...

Off-Balance Sheet Financing Off-balance sheet

... Leases often require much less equity investment than bank financing. That is, banks may only lend a portion of the asset’s cost and require the borrower to make up the difference form its available cash. Leases, on the other hand, usually only require that the first lease payment be made at the i ...

... Leases often require much less equity investment than bank financing. That is, banks may only lend a portion of the asset’s cost and require the borrower to make up the difference form its available cash. Leases, on the other hand, usually only require that the first lease payment be made at the i ...

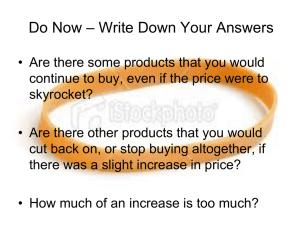

Elasticity of Demand

... - How much of your budget do you spend on the good? The higher the jump in price, the more you will have to adjust your purchases ...

... - How much of your budget do you spend on the good? The higher the jump in price, the more you will have to adjust your purchases ...

Building Up a Clean Corporate Culture In an Era of Economic

... companies are required to publish un-audited quarterly reports as well. We have recently revised our rules to simplify and streamline the format of these reports so that it would be more readable and easily understandable by investors. ...

... companies are required to publish un-audited quarterly reports as well. We have recently revised our rules to simplify and streamline the format of these reports so that it would be more readable and easily understandable by investors. ...

![F. Peter Boer[*] - Tiger Scientific Inc](http://s1.studyres.com/store/data/009350141_1-531c978e6c31e2929ca66042817b077a-300x300.png)