Chapter 3 Financial Instruments, Financial Markets, and Financial

... industrialized nations from 1997-2000. This bubble began because of easy credit availability in 1997-1998. These startup companies wanted to establish a high market share by establishing more coverage. This meant that many of the services were freely provided, and large operational losses were actua ...

... industrialized nations from 1997-2000. This bubble began because of easy credit availability in 1997-1998. These startup companies wanted to establish a high market share by establishing more coverage. This meant that many of the services were freely provided, and large operational losses were actua ...

Chapter 19 slides - McGraw

... Shareholder can recognize up to $50,000 per year of ordinary loss ($100,000 if married joint) on sale of the stock (excess is capital loss) ...

... Shareholder can recognize up to $50,000 per year of ordinary loss ($100,000 if married joint) on sale of the stock (excess is capital loss) ...

Chapter 1 Handbook requirements for service

... (a) in SUP 3 (Auditors), only sections 3.1, 3.2, and 3.7 apply to a service company (and only if it has an auditor) and only sections 3.1, 3.2 and 3.8 apply to its auditor (if it has one): see SUP 3.1.2 R; (b) SUP 4 (Actuaries) does not apply: see SUP 4.1.1 R; (c) in SUP 10 (Approved persons), if a ...

... (a) in SUP 3 (Auditors), only sections 3.1, 3.2, and 3.7 apply to a service company (and only if it has an auditor) and only sections 3.1, 3.2 and 3.8 apply to its auditor (if it has one): see SUP 3.1.2 R; (b) SUP 4 (Actuaries) does not apply: see SUP 4.1.1 R; (c) in SUP 10 (Approved persons), if a ...

Glosarry of Business Terms

... or top while liabilities and capital are listed on the right side or bottom. The total of all numbers on the left side or top must equal or balance the total of all numbers on the right side or bottom. A balance sheet balances according to this equation: Assets = Liabilities + Capital. Bond ‐‐ a wri ...

... or top while liabilities and capital are listed on the right side or bottom. The total of all numbers on the left side or top must equal or balance the total of all numbers on the right side or bottom. A balance sheet balances according to this equation: Assets = Liabilities + Capital. Bond ‐‐ a wri ...

Elements of the Income Statement

... each of the company’s stockholders’ equity accounts, including the change in the retained earnings balance caused by net income and dividends during the reporting period. STATEMENT OF CASH FLOWS – reports inflows and outflows of cash during the accounting period in the categories of operating, inves ...

... each of the company’s stockholders’ equity accounts, including the change in the retained earnings balance caused by net income and dividends during the reporting period. STATEMENT OF CASH FLOWS – reports inflows and outflows of cash during the accounting period in the categories of operating, inves ...

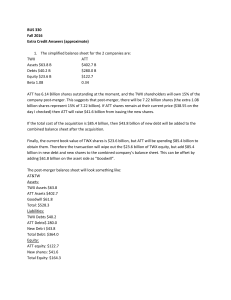

Bonus Assignment solution

... “if”) – then this would be a $2.4 billion cost savings per year, or an additional $2.4 billion of pretax income. Income tax is currently about 30% of its income, so that would leave $1.7 billion of additional net income. This amount would increase TWX earnings per share by 44%. Therefore cost saving ...

... “if”) – then this would be a $2.4 billion cost savings per year, or an additional $2.4 billion of pretax income. Income tax is currently about 30% of its income, so that would leave $1.7 billion of additional net income. This amount would increase TWX earnings per share by 44%. Therefore cost saving ...

Short-term investments - McGraw Hill Higher Education

... INTERNATIONAL OPERATIONS Two major accounting challenges arise when companies have international operations: ...

... INTERNATIONAL OPERATIONS Two major accounting challenges arise when companies have international operations: ...

Presentation Paolo Cerini

... the long term (EBITDA at regime condition about 20% of Revenues) with two major issues: Long break-even period that requires a significant start-up financial stress (cumulative FCF positive after 10 years) High Sensitivity to price change • Monthly end-user fees are by far the most important sou ...

... the long term (EBITDA at regime condition about 20% of Revenues) with two major issues: Long break-even period that requires a significant start-up financial stress (cumulative FCF positive after 10 years) High Sensitivity to price change • Monthly end-user fees are by far the most important sou ...

Summary Report on Japan`s Changing FDI and

... financial sector has attracted more FDI than any other sector. He also summarized some of the key reforms in the tax system, such as lowering the corporate income tax rate and the proposal to shift to a consolidated corporate tax system. Mr. Bowman Cutter, Managing Director, Warburg Pincus Mr. Cutte ...

... financial sector has attracted more FDI than any other sector. He also summarized some of the key reforms in the tax system, such as lowering the corporate income tax rate and the proposal to shift to a consolidated corporate tax system. Mr. Bowman Cutter, Managing Director, Warburg Pincus Mr. Cutte ...

Chapter 11 Financial Reconstruction

... 2.4.1 A second way of changing its capital is to issue a debt/equity or an equity/debt swap. 2.4.2 In the case of an equity/debt swap, all specified shareholders are given the right to exchange their stock for a predetermined amount of debt (ie bonds) in the same company. 2.4.3 A debt/equity swap wo ...

... 2.4.1 A second way of changing its capital is to issue a debt/equity or an equity/debt swap. 2.4.2 In the case of an equity/debt swap, all specified shareholders are given the right to exchange their stock for a predetermined amount of debt (ie bonds) in the same company. 2.4.3 A debt/equity swap wo ...

Bankruptcy and Firm Value

... When buyers and sellers have different information, the average quality of assets in the market will differ from the average quality overall A classic example of adverse selection is the used car market. ...

... When buyers and sellers have different information, the average quality of assets in the market will differ from the average quality overall A classic example of adverse selection is the used car market. ...

Lesson 1 PowerPoint

... shareholders’ equity or stockholders’ equity for a corporation. Increases in equity of a particular business enterprise resulting from transfers to it from other entities of something of value to obtain or increase ownership interests in it. Decreases in equity of a particular enterprise resulting f ...

... shareholders’ equity or stockholders’ equity for a corporation. Increases in equity of a particular business enterprise resulting from transfers to it from other entities of something of value to obtain or increase ownership interests in it. Decreases in equity of a particular enterprise resulting f ...

THE INS AND OUTS OF “ACCELERATION OUT” CLAUSES IN

... options accelerate upon the consummation of an acquisition. An acquirer will understand that if all options accelerate, it will be necessary for the acquirer to develop new “handcuffs” in order to assure that the employees are suitably incentivized. Thus, if all of the target company’s options accel ...

... options accelerate upon the consummation of an acquisition. An acquirer will understand that if all options accelerate, it will be necessary for the acquirer to develop new “handcuffs” in order to assure that the employees are suitably incentivized. Thus, if all of the target company’s options accel ...

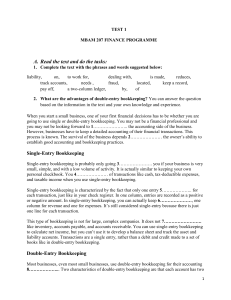

TEST 1

... current assets, fixed assets, intangible assets, liquid assets, net assets 1. ......................are anything that can quickly be turned into cash. 2. ......................are those which will be consumed or turned into cash in the ordinary course of business. 3. .................... are those w ...

... current assets, fixed assets, intangible assets, liquid assets, net assets 1. ......................are anything that can quickly be turned into cash. 2. ......................are those which will be consumed or turned into cash in the ordinary course of business. 3. .................... are those w ...

Change of location of the company records to the single alternative

... We may return forms completed incorrectly or with information missing. Please make sure you have remembered the following: The company name and number match the information held on the public Register. You have ticked the relevant boxes in section 2. You have signed the form. ...

... We may return forms completed incorrectly or with information missing. Please make sure you have remembered the following: The company name and number match the information held on the public Register. You have ticked the relevant boxes in section 2. You have signed the form. ...

The Main Agency Problems and Their Consequences

... agreed. To limit agency conflicts some special costs, called agency costs, have to be incurred. They may be defined in several ways. Ross, Westerfield and Jaffe (2005) define them as additional costs resulting from the existence of conflict situations among stakeholders, which are incurred by the ow ...

... agreed. To limit agency conflicts some special costs, called agency costs, have to be incurred. They may be defined in several ways. Ross, Westerfield and Jaffe (2005) define them as additional costs resulting from the existence of conflict situations among stakeholders, which are incurred by the ow ...

THE EFFECT OF COMMODITY PRICE CHANGES ON FIRM VALUE

... of stock prices, Earnings and total assets of relevant companies are used for analysis in this study. A business that is planned to attain growth and maximise revenue, will not charge minimum price for its products or services. This is because that price may not yield above the margin or break-even- ...

... of stock prices, Earnings and total assets of relevant companies are used for analysis in this study. A business that is planned to attain growth and maximise revenue, will not charge minimum price for its products or services. This is because that price may not yield above the margin or break-even- ...

PDF

... – Whole-business securitisations, where the entire business is subject to the securitisation regime. This is based on the assignment of a fixed and floating charge over the entire regulated part of the business (loosely speaking, these ‘charges’ can be understood as certain legal rights over key ass ...

... – Whole-business securitisations, where the entire business is subject to the securitisation regime. This is based on the assignment of a fixed and floating charge over the entire regulated part of the business (loosely speaking, these ‘charges’ can be understood as certain legal rights over key ass ...

Small Business Management 14e.

... 1. Signals to investors that a firm is a quality business and will likely perform well in the future. 2. Provides access to more investors when the firm needs to raise capital to grow the business. 3. Helps create ongoing interest in the company and its continued development. 4. Makes firm’s stock m ...

... 1. Signals to investors that a firm is a quality business and will likely perform well in the future. 2. Provides access to more investors when the firm needs to raise capital to grow the business. 3. Helps create ongoing interest in the company and its continued development. 4. Makes firm’s stock m ...

Opening vignette

... ends on a day other than the end of a pay period. Deferred revenues are the opposite of accrued revenues; as when an insurance company receives cash before providing service to its customers. Prepaid expenses, such as supplies, involve paying for an asset and then using it up over a fiscal year. ...

... ends on a day other than the end of a pay period. Deferred revenues are the opposite of accrued revenues; as when an insurance company receives cash before providing service to its customers. Prepaid expenses, such as supplies, involve paying for an asset and then using it up over a fiscal year. ...

flow of funds - WordPress.com

... A bank has agreed to underwrite an issue of 50 million shares by ABC Corporation. In negotiations between the bank and the corporation the target net price to be received by the corporation has been set at $30 per share. This means that the corporation is expecting to raise 30 × 50 million dollars o ...

... A bank has agreed to underwrite an issue of 50 million shares by ABC Corporation. In negotiations between the bank and the corporation the target net price to be received by the corporation has been set at $30 per share. This means that the corporation is expecting to raise 30 × 50 million dollars o ...

Newly Created Types of FDI

... innovating enterprise might be eroded or eliminated by the superior competence of firms in other countries to produce the products based on them. ...

... innovating enterprise might be eroded or eliminated by the superior competence of firms in other countries to produce the products based on them. ...

Essay on Agent-Principal Conflicts in Corporations

... With pay, stock and options and human capital tied to the company, executives have limited opportunities to diversify. Managers can diversify (and thereby reduce their risk exposure) by making diversifying acquisitions. Broadening the firm’s product lines or expanding into other industries enables t ...

... With pay, stock and options and human capital tied to the company, executives have limited opportunities to diversify. Managers can diversify (and thereby reduce their risk exposure) by making diversifying acquisitions. Broadening the firm’s product lines or expanding into other industries enables t ...