Transactions Related to Shares

... represents a claim on the company's assets and earnings. As you acquire more stock, your ownership stake in the company becomes greater. Whether you say “shares”, “equity”, or “stock”, it all means the same thing. ...

... represents a claim on the company's assets and earnings. As you acquire more stock, your ownership stake in the company becomes greater. Whether you say “shares”, “equity”, or “stock”, it all means the same thing. ...

The Investment Association Guidelines for New Issue Transactions

... 1. The purpose of this note is to provide some practical information on investor meeting, presounding, bookbuilding and allocation processes (and related disclosure), as often used in the prevalent ‘pot’ context of the European cross-border syndicated institutional primary debt markets today. Market ...

... 1. The purpose of this note is to provide some practical information on investor meeting, presounding, bookbuilding and allocation processes (and related disclosure), as often used in the prevalent ‘pot’ context of the European cross-border syndicated institutional primary debt markets today. Market ...

30. Earnings Per Share

... key executives of the Group. The 2010 Share Plans are intended to increase the Company’s flexibility and effectiveness in its continuing efforts to attract, retain and incentivise participants to higher standards of performance and encourage greater dedication and loyalty by enabling the Company to ...

... key executives of the Group. The 2010 Share Plans are intended to increase the Company’s flexibility and effectiveness in its continuing efforts to attract, retain and incentivise participants to higher standards of performance and encourage greater dedication and loyalty by enabling the Company to ...

Consider the risks - Guinness Asset Management

... An Enterprise Investment Scheme (EIS) is a government initiative to encourage investment in smaller, higherrisk companies by offering a range of tax reliefs to investors. EIS-qualifying companies can be unlisted smaller companies (companies whose shares are not quoted on any recognised stock exchang ...

... An Enterprise Investment Scheme (EIS) is a government initiative to encourage investment in smaller, higherrisk companies by offering a range of tax reliefs to investors. EIS-qualifying companies can be unlisted smaller companies (companies whose shares are not quoted on any recognised stock exchang ...

SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C.

... Exchange Act of 1934, as amended, the Transaction Valuation was calculated assuming that 6,666,666 outstanding shares of common stock, par value $0.01 per share, are being purchased at the tender offer price of $7.50 per share. ...

... Exchange Act of 1934, as amended, the Transaction Valuation was calculated assuming that 6,666,666 outstanding shares of common stock, par value $0.01 per share, are being purchased at the tender offer price of $7.50 per share. ...

The Firm and the Industry under Perfect Competition The decisions

... Monopoly is at the other extreme with one firm. The intermediate cases are monopolistic competition involving many small sellers producing slightly differentiated products and oligopoly, which has a few large firms. Question: Can you give an example for each type of market? To which market do most U ...

... Monopoly is at the other extreme with one firm. The intermediate cases are monopolistic competition involving many small sellers producing slightly differentiated products and oligopoly, which has a few large firms. Question: Can you give an example for each type of market? To which market do most U ...

Foreign Investment in the United States

... U.S. (including Hawaii, Alaska, Puerto Rico and other Territories). REGISTRY – Includes trade between a point in the U.S. and a foreign point or transportation between foreign points (foreign trade). FISHERIES – Includes the processing, storing, transporting, planting, cultivating, catching, taking, ...

... U.S. (including Hawaii, Alaska, Puerto Rico and other Territories). REGISTRY – Includes trade between a point in the U.S. and a foreign point or transportation between foreign points (foreign trade). FISHERIES – Includes the processing, storing, transporting, planting, cultivating, catching, taking, ...

Spring 2004 - The Owen Graduate School of Management

... 8. Assume Ann Taylor introduces a new line of products that target the consumer interested in low prices. The product line is a big hit and within months of introduction the product makes up one-half of all sales for the company. Assume that the sales of this product amount to $793,854,000 for the ...

... 8. Assume Ann Taylor introduces a new line of products that target the consumer interested in low prices. The product line is a big hit and within months of introduction the product makes up one-half of all sales for the company. Assume that the sales of this product amount to $793,854,000 for the ...

FAIR VALUE IN FINANCIAL STATEMENTS – ADVANTAGES AND

... utility, form and features and the market environment and the assets value in the market environment at the time. A ´willing´ buyer is defined as someone who wants to buy but is not in any way compelled to do so. Although a buyer is motivated, he is not prepared to overpay in a transaction. Also, he ...

... utility, form and features and the market environment and the assets value in the market environment at the time. A ´willing´ buyer is defined as someone who wants to buy but is not in any way compelled to do so. Although a buyer is motivated, he is not prepared to overpay in a transaction. Also, he ...

Chapter 9 The Economics of Valuation

... In recent years we have seen a renewed effort to empirically attack the EMH and offer explanations for certain anomalies identified in the markets. We have seen that much of this renewed effort has stemmed from participants and academics that fall under the category of Behavioral Finance. Thus far, ...

... In recent years we have seen a renewed effort to empirically attack the EMH and offer explanations for certain anomalies identified in the markets. We have seen that much of this renewed effort has stemmed from participants and academics that fall under the category of Behavioral Finance. Thus far, ...

The changing role of multinational companies in the global banana

... product do not imply the expression of any opinion whatsoever on the part of the Food and Agriculture Organization of the United Nations (FAO) concerning the legal or development status of any country, territory, city or area or of its authorities, or concerning the delimitation of its frontiers or ...

... product do not imply the expression of any opinion whatsoever on the part of the Food and Agriculture Organization of the United Nations (FAO) concerning the legal or development status of any country, territory, city or area or of its authorities, or concerning the delimitation of its frontiers or ...

Corporate Financial Theory

... There are natural clients for high-payout stocks, but it does not follow that any particular firm can benefit by increasing its dividends. The high dividend clientele already have plenty of high dividend stock to ...

... There are natural clients for high-payout stocks, but it does not follow that any particular firm can benefit by increasing its dividends. The high dividend clientele already have plenty of high dividend stock to ...

A Fresh Look at the Required Return

... to under-invest. The milking of old assets usually provides the false signal that value is being created as returns almost automatically rise when the assets depreciate away on the accounting ledger. Gross Business Return was introduced as an improved version of return on capital in “Postmodern Corp ...

... to under-invest. The milking of old assets usually provides the false signal that value is being created as returns almost automatically rise when the assets depreciate away on the accounting ledger. Gross Business Return was introduced as an improved version of return on capital in “Postmodern Corp ...

this review sheet is intended to *supplement* your reading of the hill

... i. Know that the trend is moving away from just considering foreign production sites as “low-cost” factories. The new model looks at foreign production sites as globally dispersed centers of excellence. III. Once you have decided where to locate your production facilities abroad, and decided whether ...

... i. Know that the trend is moving away from just considering foreign production sites as “low-cost” factories. The new model looks at foreign production sites as globally dispersed centers of excellence. III. Once you have decided where to locate your production facilities abroad, and decided whether ...

DETERMINANTS OF PREMIUMS PAID IN EUROPEAN BANKING

... unit due to synergies arising from the commercialization of different products by the same institution. In this sense, the price paid for a M&A can depend on the capacity of the acquirer to reduce the costs of the new organization. Such reduction is easier when acquiring small institutions (Thompson ...

... unit due to synergies arising from the commercialization of different products by the same institution. In this sense, the price paid for a M&A can depend on the capacity of the acquirer to reduce the costs of the new organization. Such reduction is easier when acquiring small institutions (Thompson ...

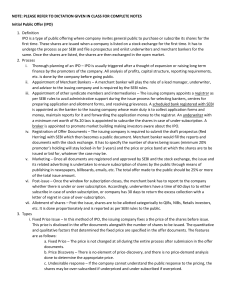

to View

... ii. Book Building Method – In this method, unlike a fixed price issue, the price band is specified within which bids are accepted from the public. It is a price discovery mechanism. As per SEBI guidelines, an issuer company can issue securities to the public though prospectus in the following manner ...

... ii. Book Building Method – In this method, unlike a fixed price issue, the price band is specified within which bids are accepted from the public. It is a price discovery mechanism. As per SEBI guidelines, an issuer company can issue securities to the public though prospectus in the following manner ...

Unit 4: Supply and Demand

... 1.How much the supply is affected by a price change 2. Ex. 100 IPods at $50 or 1000 IPods at $100 ...

... 1.How much the supply is affected by a price change 2. Ex. 100 IPods at $50 or 1000 IPods at $100 ...

pacgen signs share purchase agreement to acquire xphase

... the successful completion of its clinical trials and pre-clinical studies, the time and process required to obtain regulatory approval for commercialization of its product, the ability of Pacgen to raise additional capital in future on favourable terms, the impact of competitive products and pricing ...

... the successful completion of its clinical trials and pre-clinical studies, the time and process required to obtain regulatory approval for commercialization of its product, the ability of Pacgen to raise additional capital in future on favourable terms, the impact of competitive products and pricing ...

New Venture Creation

... • To raise more capital with less dilution than occurs with private placements or venture capital • To improve the balance sheet • To reduce or eliminate debt (thereby enhancing the company’s net worth • To obtain cash for pursuing opportunities that would otherwise be unaffordable ...

... • To raise more capital with less dilution than occurs with private placements or venture capital • To improve the balance sheet • To reduce or eliminate debt (thereby enhancing the company’s net worth • To obtain cash for pursuing opportunities that would otherwise be unaffordable ...

PSA 510: Initial Engagements * Opening Balances

... consistently applied or changes in accounting policies have been properly accounted for and adequately disclosed. ...

... consistently applied or changes in accounting policies have been properly accounted for and adequately disclosed. ...

What is due diligence? Due Diligence is the name given to the work

... management. It is, however, unlikely to have detailed information. 2. To understand the target's business Even if the purchaser and the target are in the same general area of business, the purchaser is unlikely to have detailed knowledge of how the target operates. Where the purchaser is acquiring t ...

... management. It is, however, unlikely to have detailed information. 2. To understand the target's business Even if the purchaser and the target are in the same general area of business, the purchaser is unlikely to have detailed knowledge of how the target operates. Where the purchaser is acquiring t ...

of Power (Continued) The Abuse

... rather than through horizontal acquisition strategies that improperly diversify the systematic risk associated with stock ownership. Without that added source of capital, risky projects or more vertically integrated acquisitive strategies may go unfunded or be replaced with less risky projects that ...

... rather than through horizontal acquisition strategies that improperly diversify the systematic risk associated with stock ownership. Without that added source of capital, risky projects or more vertically integrated acquisitive strategies may go unfunded or be replaced with less risky projects that ...

Module_4D_1val_EN

... a) Definition • Value is based on the transactions of other purchasers & sellers in the marketplace • Licensee/buyer is not willing to pay more than others have paid for similar IPRs ...

... a) Definition • Value is based on the transactions of other purchasers & sellers in the marketplace • Licensee/buyer is not willing to pay more than others have paid for similar IPRs ...

FOLIO INVESTMENTS, INC. (formerly FOLIOfn Investments, Inc.) (A

... condition. However, it is the opinion of management, after consultation with legal counsel, that the ultimate outcome of any such matters foreseeable at this time will not have a material adverse impact on the financial condition of the Company. The Company also provides guarantees to securities cle ...

... condition. However, it is the opinion of management, after consultation with legal counsel, that the ultimate outcome of any such matters foreseeable at this time will not have a material adverse impact on the financial condition of the Company. The Company also provides guarantees to securities cle ...

Mergers and collaborations

... is in best interests of the charity’s beneficiaries will not expose the charity’s assets or beneficiaries to undue risk ...

... is in best interests of the charity’s beneficiaries will not expose the charity’s assets or beneficiaries to undue risk ...