The owner- operator advantage

... They have an established reputation and track record, so they’re less anxious to show signs of immediate activity. The trust they’ve built with the firm’s stakeholders enables patient, farsighted decision making. As for the investment bankers, they may as well not bother. Owner-operators are not lik ...

... They have an established reputation and track record, so they’re less anxious to show signs of immediate activity. The trust they’ve built with the firm’s stakeholders enables patient, farsighted decision making. As for the investment bankers, they may as well not bother. Owner-operators are not lik ...

Strategic Management: Text and Cases

... • Most common type of synergy • Savings obtained through • Eliminating duplicate jobs • Eliminating duplicate facilities • Eliminating related expenses ...

... • Most common type of synergy • Savings obtained through • Eliminating duplicate jobs • Eliminating duplicate facilities • Eliminating related expenses ...

here - HLNDV

... Long-term debt to fixed asset = long-term debt fixed assets owned Long-term debt to equity = long-term debt equity Debt Service Coverage = (rev-exp) + interest exp + deprec exp Interest expense + principal payments ...

... Long-term debt to fixed asset = long-term debt fixed assets owned Long-term debt to equity = long-term debt equity Debt Service Coverage = (rev-exp) + interest exp + deprec exp Interest expense + principal payments ...

Chapter 5 - Tamu.edu

... management discussion and analysis. Annual reports are often elaborate reports including extensive discussions and color photos. The financial section includes: (1) summarized financial data for a 5- or 10-year period; (2) management’s discussion and analysis of financial condition and results of op ...

... management discussion and analysis. Annual reports are often elaborate reports including extensive discussions and color photos. The financial section includes: (1) summarized financial data for a 5- or 10-year period; (2) management’s discussion and analysis of financial condition and results of op ...

REFERENCES:

... will go where it is most appreciated. From the 1980s onwards, managers understand that for their companies to survive and grow they must be competitive in terms of operating costs. But, as recent events demonstrated, this is no longer enough and managers must also learn to compete in the market for ...

... will go where it is most appreciated. From the 1980s onwards, managers understand that for their companies to survive and grow they must be competitive in terms of operating costs. But, as recent events demonstrated, this is no longer enough and managers must also learn to compete in the market for ...

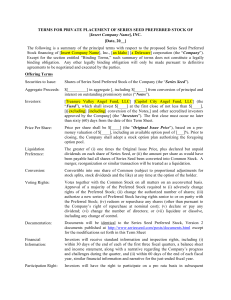

TERMS FOR PRIVATE PLACEMENT OF SERIES SEED

... Price per share shall be $[____] (the “Original Issue Price”), based on a premoney valuation of $[____], including an available option pool of [___]%. Prior to closing, the Company shall adopt a stock option plan authorizing the foregoing option pool. ...

... Price per share shall be $[____] (the “Original Issue Price”), based on a premoney valuation of $[____], including an available option pool of [___]%. Prior to closing, the Company shall adopt a stock option plan authorizing the foregoing option pool. ...

How the deficiencies of the financial system reduce spending on

... this shows a way in which institutional shareholders may thus augment their strategy of making money simply through skilled trading: with very little engagement they can still understand a firm’s situation well enough to see that it can increase its profits by exploiting global labour markets, and m ...

... this shows a way in which institutional shareholders may thus augment their strategy of making money simply through skilled trading: with very little engagement they can still understand a firm’s situation well enough to see that it can increase its profits by exploiting global labour markets, and m ...

Pro-Forma Financials and Business Cycles: Wal

... important income report figures along with a ratio analysis of the balance sheet. Carrying out this evaluation will let a manager to discover weaknesses as well as strengths in the firm’s financial performance and make rational decisions regarding how to improve efficiency. For an investor, a fiscal ...

... important income report figures along with a ratio analysis of the balance sheet. Carrying out this evaluation will let a manager to discover weaknesses as well as strengths in the firm’s financial performance and make rational decisions regarding how to improve efficiency. For an investor, a fiscal ...

International Financial Reporting Standards (IFRS)

... Revenue shall be measured at the fair value of the consideration received or receivable taking into account the amount of any trade discounts and volume rebates allowed by the entity. In most cases, the consideration is in the form of cash or cash equivalents and the amount of revenue is the amount ...

... Revenue shall be measured at the fair value of the consideration received or receivable taking into account the amount of any trade discounts and volume rebates allowed by the entity. In most cases, the consideration is in the form of cash or cash equivalents and the amount of revenue is the amount ...

The Discounted Cash Flow (DCF) Model -- Chart School

... Once the financial model is built to forecast free cash flow and earnings, a second set of assumptions is required to derive a valuation. (Note: Though definitions may vary, free cash flow equals after-tax operating earnings plus non-cash charges, less investments in working capital or other assets. ...

... Once the financial model is built to forecast free cash flow and earnings, a second set of assumptions is required to derive a valuation. (Note: Though definitions may vary, free cash flow equals after-tax operating earnings plus non-cash charges, less investments in working capital or other assets. ...

International Marketing

... • Carefully consider concessions that reduce price or profitability; example: discounts, payment terms, product features. • Revisit competitive prices to ascertain that the price reflects market conditions accurately. • Focus negotiations first on substantive issues (quality and delivery), then on p ...

... • Carefully consider concessions that reduce price or profitability; example: discounts, payment terms, product features. • Revisit competitive prices to ascertain that the price reflects market conditions accurately. • Focus negotiations first on substantive issues (quality and delivery), then on p ...

Taxes and Bankruptcy Costs

... Structure Model with Taxes Holding other things constant, the logic of the model is sound; it provides useful information about optimal capital structure. The problem is that there are important variables that are not included in the model. As we examine firms in the real world, there seems to b ...

... Structure Model with Taxes Holding other things constant, the logic of the model is sound; it provides useful information about optimal capital structure. The problem is that there are important variables that are not included in the model. As we examine firms in the real world, there seems to b ...

Chapter 15 - How Corporations Issue Securities

... How Corporations Issue Securities The values shown in the solutions may be rounded for display purposes. However, the answers were derived using a spreadsheet without any intermediate rounding. ...

... How Corporations Issue Securities The values shown in the solutions may be rounded for display purposes. However, the answers were derived using a spreadsheet without any intermediate rounding. ...

The Enabling Act - A Single platform for banking and non banking

... of a non banking financial institution are defined to define the broad scope of financial sector activities, however these activities are not governed by RBI unless they are pursued as the primary business activity or deposits have been accepted from public. The Act has no intent of governing any no ...

... of a non banking financial institution are defined to define the broad scope of financial sector activities, however these activities are not governed by RBI unless they are pursued as the primary business activity or deposits have been accepted from public. The Act has no intent of governing any no ...

ING to sell 33 million shares in NN Group

... capital generated in excess of NN Group’s capital ambition is expected to be returned to shareholders unless it can be used for any other appropriate corporate purposes, including investments in value creating corporate opportunities. NN Group is committed to distributing excess capital in a form wh ...

... capital generated in excess of NN Group’s capital ambition is expected to be returned to shareholders unless it can be used for any other appropriate corporate purposes, including investments in value creating corporate opportunities. NN Group is committed to distributing excess capital in a form wh ...

Statement of Owners` Equity

... established in 1973 to promote worldwide consistency in financial reporting practices. The IASC soon developed its first set of accounting standards and interpretations and, in 2001, became the International Accounting Standards Board (IASB). International Financial Reporting Standards (IFRS) are th ...

... established in 1973 to promote worldwide consistency in financial reporting practices. The IASC soon developed its first set of accounting standards and interpretations and, in 2001, became the International Accounting Standards Board (IASB). International Financial Reporting Standards (IFRS) are th ...

Private Equity - Gilbert + Tobin Lawyers

... arrangement requires a report from an independent expert giving an opinion on the fairness of the scheme. A target board may choose to include a similar independent expert report in a target’s statement in the context of a takeover offer. If a bidder is given access to due diligence information, tha ...

... arrangement requires a report from an independent expert giving an opinion on the fairness of the scheme. A target board may choose to include a similar independent expert report in a target’s statement in the context of a takeover offer. If a bidder is given access to due diligence information, tha ...

Corporate Finance

... Sales are positive even when EPS is negative Sales are more stable than EPS, therefore P/S may be more meaningful when EPS is abnormally low or high ...

... Sales are positive even when EPS is negative Sales are more stable than EPS, therefore P/S may be more meaningful when EPS is abnormally low or high ...

An Application on Merton Model in the Non

... It can be observed that (2) is simply the payoff from holding a long position in a call option on firm’s assets with strike price B and maturity T .Using Black–Scholes formula for pricing call option we can derive a relationship between market value of firm’s equity and the market value of assets. I ...

... It can be observed that (2) is simply the payoff from holding a long position in a call option on firm’s assets with strike price B and maturity T .Using Black–Scholes formula for pricing call option we can derive a relationship between market value of firm’s equity and the market value of assets. I ...

Human Resource Management in Nigeria

... A review of industrial accident literature reveals that most studies have been carried out to analyze industrial accident in isolation from performance. Industrial accidents affect production and reduce productivity of both the workers and the organization (Ogbo, 2008). Accident does not only reduce ...

... A review of industrial accident literature reveals that most studies have been carried out to analyze industrial accident in isolation from performance. Industrial accidents affect production and reduce productivity of both the workers and the organization (Ogbo, 2008). Accident does not only reduce ...

19 PART II - PRICING IN PUBLIC ISSUE Pricing. 28. (1) An issuer

... (4) The cap on the price band shall be less than or equal to one hundred and twenty per cent. of the floor price. (5) The floor price or the final price shall not be less than the face value of the specified securities. Explanation: For the purposes of sub-regulation (4), the “cap on the price band ...

... (4) The cap on the price band shall be less than or equal to one hundred and twenty per cent. of the floor price. (5) The floor price or the final price shall not be less than the face value of the specified securities. Explanation: For the purposes of sub-regulation (4), the “cap on the price band ...

An Analysis of Food Companies

... In principle, the higher the EBITDA/Value ratio for an entity, the more capacity the company has to take on debt. Based on this principle, we can expect that the optimal debt ratio is most likely to be the highest for Tyson and lowest for Chipotle. Given the fact that the marginal investors for each ...

... In principle, the higher the EBITDA/Value ratio for an entity, the more capacity the company has to take on debt. Based on this principle, we can expect that the optimal debt ratio is most likely to be the highest for Tyson and lowest for Chipotle. Given the fact that the marginal investors for each ...

FREE Sample Here - We can offer most test bank and

... securities markets, which makes it easier to raise large amounts of capital, and the ease of ownership transfer. All the shareholders have to do is to call their broker to buy or sell shares of stock. And because a public corporation usually has many shares outstanding, large blocks of securities ca ...

... securities markets, which makes it easier to raise large amounts of capital, and the ease of ownership transfer. All the shareholders have to do is to call their broker to buy or sell shares of stock. And because a public corporation usually has many shares outstanding, large blocks of securities ca ...

Transferring Your Company to Key Employees White Paper

... Rewards and motivates employee/buyer because part of the business can be acquired at a reduced price. ...

... Rewards and motivates employee/buyer because part of the business can be acquired at a reduced price. ...