BALANCE SHEET RESTRUCTURING AND INVESTMENT 1

... GRAPH 6 In the short term, some focus on financial restructuring may remain. A few firms are still highly geared and have problems to work through. For many firms, however, the process of restructuring appears to have advanced a long way (though the extent to which it has been completed is conjectur ...

... GRAPH 6 In the short term, some focus on financial restructuring may remain. A few firms are still highly geared and have problems to work through. For many firms, however, the process of restructuring appears to have advanced a long way (though the extent to which it has been completed is conjectur ...

Finance Notes 2008 Size: 351.5kb Last modified

... Option Pricing (ROV): DCF applicable for traditional firms with cash cow characteristics (i.e. relatively predictable cash flows). Firms with high risk characteristics from either financial difficulty (telecom) or growth firms (Internet) have unpredictable cash flows that are difficult to evaluate u ...

... Option Pricing (ROV): DCF applicable for traditional firms with cash cow characteristics (i.e. relatively predictable cash flows). Firms with high risk characteristics from either financial difficulty (telecom) or growth firms (Internet) have unpredictable cash flows that are difficult to evaluate u ...

1 Mr./Ms. de Gestión de los Sistemas de Registro, Compensación y

... in charge of the shareholder registry the original authorisation demonstrating that the natural person is entitled to act on behalf of the corporate shareholder. ...

... in charge of the shareholder registry the original authorisation demonstrating that the natural person is entitled to act on behalf of the corporate shareholder. ...

Document

... • “What if” questions can help gauge sensitivity of revenues, costs, and earnings • Management may indicate appropriateness of earnings estimates • Discuss the industry’s major issues • Review the planning process • Talk to more than just the top managers ...

... • “What if” questions can help gauge sensitivity of revenues, costs, and earnings • Management may indicate appropriateness of earnings estimates • Discuss the industry’s major issues • Review the planning process • Talk to more than just the top managers ...

Establishing a Business Entity in Ireland.

... individual who sets him or herself up in business. Sole traders do not enjoy separate legal personality and are therefore liable for any losses accruing to their business. Persons engaged in business as sole traders may protect themselves to some extent from certain categories of loss which the busi ...

... individual who sets him or herself up in business. Sole traders do not enjoy separate legal personality and are therefore liable for any losses accruing to their business. Persons engaged in business as sole traders may protect themselves to some extent from certain categories of loss which the busi ...

The impact of Agency Problem in Firm value and the Greek Stock

... hypothesis examined is twofold. Firstly the nature of the agency problem that Greek listed firms faced is examined. Was it the classical conflict of interests caused by the separation of ownership and control as Bearle and Means identified in 1932, or the expropriation of minority shareholders from ...

... hypothesis examined is twofold. Firstly the nature of the agency problem that Greek listed firms faced is examined. Was it the classical conflict of interests caused by the separation of ownership and control as Bearle and Means identified in 1932, or the expropriation of minority shareholders from ...

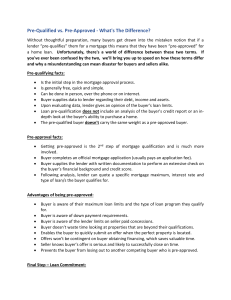

Pre-Qualified vs. Pre-Approved - What`s The

... Once a buyer’s offer is accepted and fully executed, the buyer will complete their loan application and move towards the final step which is the “loan commitment”. Home is appraised at this point. Appraisal price must come in at or above the property’s sale price. If the appraisal brings up issues s ...

... Once a buyer’s offer is accepted and fully executed, the buyer will complete their loan application and move towards the final step which is the “loan commitment”. Home is appraised at this point. Appraisal price must come in at or above the property’s sale price. If the appraisal brings up issues s ...

Think Insurance When Considering Mergers, Acquisitions and Spinoffs

... In addition to determining the value of insurance assets, an insurance audit can identify problems that may arise when the acquiring company attempts to collect under those policies. Often, two or more surviving entities have the right to claim under the same historic insurance policies after a merg ...

... In addition to determining the value of insurance assets, an insurance audit can identify problems that may arise when the acquiring company attempts to collect under those policies. Often, two or more surviving entities have the right to claim under the same historic insurance policies after a merg ...

Exercise of last warrants at specific issue price

... notification to exercise all outstanding warrants priced at 2.0p and 2.5p being, 625 000 warrants at a price of 2.0p (ZAR32.52c) and 500 000 warrants at a price of 2.5p (ZAR40.65) per warrant share. The exercise of the warrant shares amounts, in aggregate, to a cash value of £ 25,000 (ZAR 406,500). ...

... notification to exercise all outstanding warrants priced at 2.0p and 2.5p being, 625 000 warrants at a price of 2.0p (ZAR32.52c) and 500 000 warrants at a price of 2.5p (ZAR40.65) per warrant share. The exercise of the warrant shares amounts, in aggregate, to a cash value of £ 25,000 (ZAR 406,500). ...

Memorandum of principles with Gamma Management and Clearing

... The parties also intend to sign a detailed agreement which inter alia contains arrangements with respect to the rights and obligations of the Gamma shareholders (such as rights of refusal, tagalong rights, etc.). The closing of the transaction is conditional on the fulfillment of various suspensive ...

... The parties also intend to sign a detailed agreement which inter alia contains arrangements with respect to the rights and obligations of the Gamma shareholders (such as rights of refusal, tagalong rights, etc.). The closing of the transaction is conditional on the fulfillment of various suspensive ...

Accounting for Business Combinations Executive Summary

... The measurement principle applied in the accounting for a business combination is fair value. With only limited exceptions, the assets and liabilities recognized (including working capital accounts such as accounts receivable and payable), along with any noncontrolling interest recognized, are measu ...

... The measurement principle applied in the accounting for a business combination is fair value. With only limited exceptions, the assets and liabilities recognized (including working capital accounts such as accounts receivable and payable), along with any noncontrolling interest recognized, are measu ...

L04: Homework Assignment

... increasing in value, this is usually reflected in an increase in the price per share of the stock. Bonds are used by the U.S. Government to raise money. When a bond is issued, the government promises to pay the purchase price of the bond plus an additional amount as interest at some future date (whe ...

... increasing in value, this is usually reflected in an increase in the price per share of the stock. Bonds are used by the U.S. Government to raise money. When a bond is issued, the government promises to pay the purchase price of the bond plus an additional amount as interest at some future date (whe ...

File

... ◦ Example: Buyer agrees on the option to buy 100 shares of stock XYZ for $5 in the future. The stock’s value on that particular date turns out to be $10. If the buyer exercises his right to buy at $5, then his stock value is much greater than what he actually paid for it. ...

... ◦ Example: Buyer agrees on the option to buy 100 shares of stock XYZ for $5 in the future. The stock’s value on that particular date turns out to be $10. If the buyer exercises his right to buy at $5, then his stock value is much greater than what he actually paid for it. ...

AT1- 1 Achievement Test 1 Achievement Test 1: Chapters 1 and 2

... b. Selecting the economic activities relevant to a particular organization. c. Preparing accounting reports, including financial statements. d. Quantifying events in dollars and cents. ____ 9. The current source of "GAAP" in the private sector is the a. Accounting Principles Board. b. Internal Reven ...

... b. Selecting the economic activities relevant to a particular organization. c. Preparing accounting reports, including financial statements. d. Quantifying events in dollars and cents. ____ 9. The current source of "GAAP" in the private sector is the a. Accounting Principles Board. b. Internal Reven ...

Valuation premiums and discounts - Hong Kong Institute of Certified

... studies generally give a higher level of DLOM than restricted stock studies do. The reason is that the trading price of restricted stock is based on the premise of short term restriction typically in a range of two to five years and this stock will finally become liquid. As it is difficult to tell w ...

... studies generally give a higher level of DLOM than restricted stock studies do. The reason is that the trading price of restricted stock is based on the premise of short term restriction typically in a range of two to five years and this stock will finally become liquid. As it is difficult to tell w ...

Why Do Companies Go Public? Evidence From

... 4.2.3 Number of years in existence.........................................................................21 4.2.4 Ownership o f the firm.....................................................................................21 4.2.5 Turnover per annual reports before going public..................... ...

... 4.2.3 Number of years in existence.........................................................................21 4.2.4 Ownership o f the firm.....................................................................................21 4.2.5 Turnover per annual reports before going public..................... ...

Reclaiming Specific-Intent Under Section 2 of the Sherman Antitrust

... economic systems were debated—even Marxist solutions.22 Most recently, the SarbanesOxley legislation was passed, which requires new corporate governance standards and increases criminal penalties for securities laws violations. Sound familiar? It makes sense that mergers and acquisitions may be the ...

... economic systems were debated—even Marxist solutions.22 Most recently, the SarbanesOxley legislation was passed, which requires new corporate governance standards and increases criminal penalties for securities laws violations. Sound familiar? It makes sense that mergers and acquisitions may be the ...

A Top Fund Makes the Value Case

... with steady earnings, have become overvalued, without anything really changing in their businesses. An emotional response to the scarcity of yield has driven these stocks. People have been reaching for yield wherever they can get it. There has also been a massive flow of money into passive index fun ...

... with steady earnings, have become overvalued, without anything really changing in their businesses. An emotional response to the scarcity of yield has driven these stocks. People have been reaching for yield wherever they can get it. There has also been a massive flow of money into passive index fun ...

ch_1_intro_to_accoun..

... Increase in a liability Increase in an asset Decrease in another liability Decrease in owners equity Increase in owners equity Increase in an asset Decrease in liability ...

... Increase in a liability Increase in an asset Decrease in another liability Decrease in owners equity Increase in owners equity Increase in an asset Decrease in liability ...

A Partnership for Performance - OSU CSE

... Characterizing the 5 Forces - Rivalry • Numerous, balanced competitors => Less competition ...

... Characterizing the 5 Forces - Rivalry • Numerous, balanced competitors => Less competition ...

Preliminary Information Pack for General Corporates

... (Check as many reasons as possible for the necessity of CGIF support. Also, indicate reasons/challenges faced when considering the bond market as a source of financing as well as attempts to issue previously and reasons for not proceeding) ...

... (Check as many reasons as possible for the necessity of CGIF support. Also, indicate reasons/challenges faced when considering the bond market as a source of financing as well as attempts to issue previously and reasons for not proceeding) ...

Why do companies go public?

... 3. But relative partial effect is certain. The ratio of the partial effects for SIZE and ROA is α1/α4 4. The largest partial effect of SIZE occurs when z=0. When z=o, φ(z) reaches the maximum = (2π)-0.5 = 0.4 or so. ...

... 3. But relative partial effect is certain. The ratio of the partial effects for SIZE and ROA is α1/α4 4. The largest partial effect of SIZE occurs when z=0. When z=o, φ(z) reaches the maximum = (2π)-0.5 = 0.4 or so. ...

New Accounting - The Computer Science Department

... the blurring of the boundaries between the firm and its customers, suppliers and even competitors. The traditional accounting model, recognizing primarily tangibles as assets, dealing asymmetrically with uncertainty (recognizing expected losses but ignoring expected gains), and focusing on legally-b ...

... the blurring of the boundaries between the firm and its customers, suppliers and even competitors. The traditional accounting model, recognizing primarily tangibles as assets, dealing asymmetrically with uncertainty (recognizing expected losses but ignoring expected gains), and focusing on legally-b ...