What is a rights issue of shares?

... A company will offer more shares to its shareholders to raise extra money for the company. Companies with a poor cash flow will often use a rights issue to increase cash flow and pay off existing debts. Rights issues however are sometimes issued by companies with healthy balance sheets in order to f ...

... A company will offer more shares to its shareholders to raise extra money for the company. Companies with a poor cash flow will often use a rights issue to increase cash flow and pay off existing debts. Rights issues however are sometimes issued by companies with healthy balance sheets in order to f ...

dividend policy - SIF Banat

... of Shareholders (GMS) and consider the sustainability of the decision, the economic context and the current yields on the market. Should the GMS of SIF Banat-Crișana decide on the distribution of dividends, all shareholders registered in the consolidated register as at the record date set by the GMS ...

... of Shareholders (GMS) and consider the sustainability of the decision, the economic context and the current yields on the market. Should the GMS of SIF Banat-Crișana decide on the distribution of dividends, all shareholders registered in the consolidated register as at the record date set by the GMS ...

REPORT TO THE ANNUAL GENERAL MEETING

... This authorization gives the company more flexibility. In particular, it enables shares to be issued specifically to business partners or financial investors, even when they are not used for corporate mergers, the acquisition of companies, parts of companies or shares of companies. Due regard is gi ...

... This authorization gives the company more flexibility. In particular, it enables shares to be issued specifically to business partners or financial investors, even when they are not used for corporate mergers, the acquisition of companies, parts of companies or shares of companies. Due regard is gi ...

Buying, Selling, Merging and Valuation

... objectives, and then compare to other arrangements On an item specific basis, assess the relative worth of each task/objective, and determine necessary adjustments to the comparable arrangements. The cost and market valuation methodologies described above must be reconciled to arrive at a final co ...

... objectives, and then compare to other arrangements On an item specific basis, assess the relative worth of each task/objective, and determine necessary adjustments to the comparable arrangements. The cost and market valuation methodologies described above must be reconciled to arrive at a final co ...

Limited Partnership

... Taxation: Once, but not many breaks Bureaucratic BS: Some - Partnership agreements, more stringent records Cost: Very little ...

... Taxation: Once, but not many breaks Bureaucratic BS: Some - Partnership agreements, more stringent records Cost: Very little ...

Pre-emptive rights in joint stock companies

... only to new issue of shares and does not apply to a transfer of existing shares. Existing shares in a joint stock company are sold and purchased in the Muscat Securities Market and are subject to the provisions of the Capital Market Law issued pursuant to Royal Decree 80/1990 (the “Capital Market La ...

... only to new issue of shares and does not apply to a transfer of existing shares. Existing shares in a joint stock company are sold and purchased in the Muscat Securities Market and are subject to the provisions of the Capital Market Law issued pursuant to Royal Decree 80/1990 (the “Capital Market La ...

Intragroup services caught the attention of the tax authority

... Due to the international environment, increasing competition and for efficiency reasons, it is quite common that multinational enterprises provide different services within the group. In addition, the creation of intragroup service centers to centralize the service offering in the group has been the ...

... Due to the international environment, increasing competition and for efficiency reasons, it is quite common that multinational enterprises provide different services within the group. In addition, the creation of intragroup service centers to centralize the service offering in the group has been the ...

Let`s Make a Deal - Society of Actuaries

... The calculation of the value of "existing structure" is done just like the PVFP on your inforce business. You might, and probably should, use a higher discount rate to reflect the higher uncertainty of delivering the new sales. Sometimes a buyer will look at this much more favorably, for example, i ...

... The calculation of the value of "existing structure" is done just like the PVFP on your inforce business. You might, and probably should, use a higher discount rate to reflect the higher uncertainty of delivering the new sales. Sometimes a buyer will look at this much more favorably, for example, i ...

Application for an additional listing

... Beirut Stock Exchange Application for An Additional Listing Approval On the BSE ...

... Beirut Stock Exchange Application for An Additional Listing Approval On the BSE ...

Bankruptcy and Miller Channels

... buying more bonds. They are owed 100 or ¼ of the firm’s debt. When the firm gets 350, the new bondholders collect ¼*350 = 87.5. They lose. New shareholders contribute the 100: They get 50 / 1.1 - 100 = -54.55 ...

... buying more bonds. They are owed 100 or ¼ of the firm’s debt. When the firm gets 350, the new bondholders collect ¼*350 = 87.5. They lose. New shareholders contribute the 100: They get 50 / 1.1 - 100 = -54.55 ...

C1w

... Internal users - users within the organization. Marketing managers, production supervisors, finance directors and company officers Questions asked by internal users – What is the cost of manufacturing each unit of product? Which product is the most profitable? External users - users who are ...

... Internal users - users within the organization. Marketing managers, production supervisors, finance directors and company officers Questions asked by internal users – What is the cost of manufacturing each unit of product? Which product is the most profitable? External users - users who are ...

Great demand for Hemtex shares. The Offer price set to SEK

... 994,074 shares to cover possible over-allotment of shares. The over-allotment option may be utilised until, and including, November 4, 2005. ...

... 994,074 shares to cover possible over-allotment of shares. The over-allotment option may be utilised until, and including, November 4, 2005. ...

Intro - What trendy items have you seen that

... Quantities of a particular good or service that people are willing and able to buy at different possible prices. ...

... Quantities of a particular good or service that people are willing and able to buy at different possible prices. ...

Wheeler Real Estate Investment Trust, Inc. (Form: 8-K

... major tenant; constructing properties or expansions that produce a desired yield on investment; the Company’s ability to renew or enter into new leases at favorable rates; to buy or sell assets on commercially reasonable terms; to complete acquisitions or dispositions of assets under contract, to se ...

... major tenant; constructing properties or expansions that produce a desired yield on investment; the Company’s ability to renew or enter into new leases at favorable rates; to buy or sell assets on commercially reasonable terms; to complete acquisitions or dispositions of assets under contract, to se ...

Economic Efficiency

... Economic efficiency refers to how well productive resources are allocated with respect to the costs and benefits of using those resources. One definition of an efficient allocation of resources is a situation in which all resources are employed and no person can be made better off by shifting resour ...

... Economic efficiency refers to how well productive resources are allocated with respect to the costs and benefits of using those resources. One definition of an efficient allocation of resources is a situation in which all resources are employed and no person can be made better off by shifting resour ...

Economies of Scale and Merger Efficiencies

... the industry and use this information to simulate the merger using an imperfect competition model. Finally, we estimate its welfare effects. The net effect of the merger depends on the relative strength of two opposing forces: on one hand, there are fewer firms in the market (which softens competiti ...

... the industry and use this information to simulate the merger using an imperfect competition model. Finally, we estimate its welfare effects. The net effect of the merger depends on the relative strength of two opposing forces: on one hand, there are fewer firms in the market (which softens competiti ...

Corporate Actions Events

... Similar to stock splits where the share nominal value is changed which normally results in a change in the number of shares held. Scheme of Arrangement – Occurs when a parent company takes over its subsidiaries and distributes proceeds to its shareholders. Scrip Dividend – No stock dividends / coupo ...

... Similar to stock splits where the share nominal value is changed which normally results in a change in the number of shares held. Scheme of Arrangement – Occurs when a parent company takes over its subsidiaries and distributes proceeds to its shareholders. Scrip Dividend – No stock dividends / coupo ...

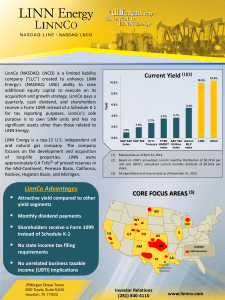

LinnCo Advantages CORE FOCUS AREAS (3) Current Yield (1)(2)

... statements are based on certain assumptions and expectations made by the Companies which reflect management’s experience, estimates and perception of historical trends, current conditions, anticipated future developments, potential for reserves and drilling, completion of current and future acquisit ...

... statements are based on certain assumptions and expectations made by the Companies which reflect management’s experience, estimates and perception of historical trends, current conditions, anticipated future developments, potential for reserves and drilling, completion of current and future acquisit ...

FORM 8-K - corporate

... As previously announced, on November 18, 2015, Celladon Corporation (“Celladon”), Celladon Merger Sub, Inc. (“ Merger Sub ”) and Eiger BioPharmaceuticals, Inc. (“ Eiger ”) entered into an Agreement and Plan of Merger and Reorganization (“ Merger Agreement ”), pursuant to which, among other things, s ...

... As previously announced, on November 18, 2015, Celladon Corporation (“Celladon”), Celladon Merger Sub, Inc. (“ Merger Sub ”) and Eiger BioPharmaceuticals, Inc. (“ Eiger ”) entered into an Agreement and Plan of Merger and Reorganization (“ Merger Agreement ”), pursuant to which, among other things, s ...

an analysis of the price/book ratio of two maltese

... Fama and French (1992) found that after sorting all non-financial companies listed on the U.S. stock exchanges between 1963 and 1990 according to their capitalisation, shares with low P/B values provided the best returns (Fama and French, 1992). They concluded that the Beta (ß) used in the Capital A ...

... Fama and French (1992) found that after sorting all non-financial companies listed on the U.S. stock exchanges between 1963 and 1990 according to their capitalisation, shares with low P/B values provided the best returns (Fama and French, 1992). They concluded that the Beta (ß) used in the Capital A ...

Australian Corporate Bond Price Tables

... If a bond is purchased in the secondary market at less than $100, the running yield, which is the per annum yield for each year the bond is held, is more than 5% because the coupon is paid on face value. The yield to maturity is also more than the coupon as less than $100 is paid to receive $100 bac ...

... If a bond is purchased in the secondary market at less than $100, the running yield, which is the per annum yield for each year the bond is held, is more than 5% because the coupon is paid on face value. The yield to maturity is also more than the coupon as less than $100 is paid to receive $100 bac ...

DUPONT ANALYSIS OF THE EFFICIENCY AND INVESTMENT

... The main range of products within the industry is standardized and has similar characteristics among all the manufacturers. This circumstance results in 2 sequences: (1) low level of brand loyalty and brand influence at the company’s market value; (2) low level of R&D intensity (the latter is measur ...

... The main range of products within the industry is standardized and has similar characteristics among all the manufacturers. This circumstance results in 2 sequences: (1) low level of brand loyalty and brand influence at the company’s market value; (2) low level of R&D intensity (the latter is measur ...

Finance - Leeds Beckett University

... The equity capital of a business is the owners' interest in it, consisting of the share capital invested by them plus retained profits. Purpose Ensures that the company is properly capitalised. The debt: equity ratio should not exceed 1:1. Advantages Maintains the capital base upon which more de ...

... The equity capital of a business is the owners' interest in it, consisting of the share capital invested by them plus retained profits. Purpose Ensures that the company is properly capitalised. The debt: equity ratio should not exceed 1:1. Advantages Maintains the capital base upon which more de ...

Bankruptcy and Miller Channels

... buying more bonds. They are owed 100 or ¼ of the firm’s debt. When the firm gets 350, the new bondholders collect ¼*350 = 87.5. They ...

... buying more bonds. They are owed 100 or ¼ of the firm’s debt. When the firm gets 350, the new bondholders collect ¼*350 = 87.5. They ...