Definition of Pricing PP

... Companies can use the prices of products to create an image for the product or company. Some consumers believe that price and quality are related, that higher prices mean better quality while lower prices suggest poorer quality. Also, companies trying to appeal to costconscious customers need to kee ...

... Companies can use the prices of products to create an image for the product or company. Some consumers believe that price and quality are related, that higher prices mean better quality while lower prices suggest poorer quality. Also, companies trying to appeal to costconscious customers need to kee ...

Shearman & Sterling - NYU Stern School of Business

... and operating targets and, to help meet these, have aligned the interests of management and employees with those of our shareholders and customers. Our incentive systems are linked to key aspects of shareholder value, such as margins and asset productivity. Our strategic focus is centred on profitab ...

... and operating targets and, to help meet these, have aligned the interests of management and employees with those of our shareholders and customers. Our incentive systems are linked to key aspects of shareholder value, such as margins and asset productivity. Our strategic focus is centred on profitab ...

download

... {ASSETS = LIABILITIES + STOCKHOLDERS’ EQUITY} Dated as of a specific date Format o ...

... {ASSETS = LIABILITIES + STOCKHOLDERS’ EQUITY} Dated as of a specific date Format o ...

File

... happened in the past can possibly prevent this type of event from occurring in the future. ...

... happened in the past can possibly prevent this type of event from occurring in the future. ...

Form 4 Statement of Changes in Beneficial Ownership of Securities

... group that collectively beneficially owns more than 10% of the Issuer's outstanding shares of Common Stock. The Reporting Person disclaims beneficial ownership of the securities reported herein except to the extent of its pecuniary interest therein. * Signed by: ______________________________Elliot ...

... group that collectively beneficially owns more than 10% of the Issuer's outstanding shares of Common Stock. The Reporting Person disclaims beneficial ownership of the securities reported herein except to the extent of its pecuniary interest therein. * Signed by: ______________________________Elliot ...

The Elapsed Time Between Acquisitions

... profit, acquirers trade CAR against the probability of doing the deal, which is a rational. A similar argument can be made with respect to toeholds. Toeholds are profitable for acquirers: they represent target shares bought at a lower price than the price paid once the deal is announced. But, surpri ...

... profit, acquirers trade CAR against the probability of doing the deal, which is a rational. A similar argument can be made with respect to toeholds. Toeholds are profitable for acquirers: they represent target shares bought at a lower price than the price paid once the deal is announced. But, surpri ...

July 29, 2008 THE PERFORMANCE OF BUSINESS GROUP FIRMS

... institutions are poorly developed, business groups may produce better economic performance also by mobilizing intangible and human resources across companies. They are, in fact, in a better strategic position to control key resources of product and factor markets necessary for smooth functioning of ...

... institutions are poorly developed, business groups may produce better economic performance also by mobilizing intangible and human resources across companies. They are, in fact, in a better strategic position to control key resources of product and factor markets necessary for smooth functioning of ...

Schedule 14D-9 - Piedmont Office Realty Trust, Inc.

... Chicago, Washington, D.C., and the New York metropolitan area; ...

... Chicago, Washington, D.C., and the New York metropolitan area; ...

instruction to the survey

... Financial derivatives are financial contracts between an issuer and a holder. They are mostly used to reduce financial risks, but can also be used for speculative purposes. Examples of financial derivatives are futures contracts, share options, and interest rate swaps. With futures and options, the ...

... Financial derivatives are financial contracts between an issuer and a holder. They are mostly used to reduce financial risks, but can also be used for speculative purposes. Examples of financial derivatives are futures contracts, share options, and interest rate swaps. With futures and options, the ...

Benefits Accruing to Companies Listed at the

... which a business owned by one or several individuals is converted into a business owned by many. It involves the offering of part ownership of the company to the public through the sale of debt or more commonly, equity securities (stock). A stock exchange is a highly competitive centralized marketpl ...

... which a business owned by one or several individuals is converted into a business owned by many. It involves the offering of part ownership of the company to the public through the sale of debt or more commonly, equity securities (stock). A stock exchange is a highly competitive centralized marketpl ...

Download attachment

... In terms of balance sheet values, where prices are rising the fair value model will have higher asset and shareholders’ equity values relative to the cost method. In contrast, the cost method defers gains until realized and hence the amount of any gain (loss) on disposal is likely to be larger than ...

... In terms of balance sheet values, where prices are rising the fair value model will have higher asset and shareholders’ equity values relative to the cost method. In contrast, the cost method defers gains until realized and hence the amount of any gain (loss) on disposal is likely to be larger than ...

The valuation of specialised operational assets

... the valuation of a business, however, when it becomes necessary to determine the value of the individual assets used to generate those cash flows, valuers typically consider that either a market comparison or cost approach should be applied. This is because income-based valuation approaches, such as ...

... the valuation of a business, however, when it becomes necessary to determine the value of the individual assets used to generate those cash flows, valuers typically consider that either a market comparison or cost approach should be applied. This is because income-based valuation approaches, such as ...

The Ultimate Takeover Defense? RiskMetrics` new View on net

... Hardly anyone has been immune to the recent devastating effects on equity values and many companies have watched their share price drop more than 50% over the past year. These factors tend to lead companies with cash on hand and driven by the never ending pressure to find new growth and increase sha ...

... Hardly anyone has been immune to the recent devastating effects on equity values and many companies have watched their share price drop more than 50% over the past year. These factors tend to lead companies with cash on hand and driven by the never ending pressure to find new growth and increase sha ...

Chapter 3 - McGraw Hill Higher Education

... flows that is divided into three categories: O - Operating activities primarily with customers and suppliers, and interest payments and earnings on investments. I - Investing activities include buying and selling noncurrent assets and investments. F - Financing activities include borrowing and repay ...

... flows that is divided into three categories: O - Operating activities primarily with customers and suppliers, and interest payments and earnings on investments. I - Investing activities include buying and selling noncurrent assets and investments. F - Financing activities include borrowing and repay ...

Risk, Cost of Capital, and Capital Budgeting

... If equity beta is not directly estimable, we need to use comparable firms to estimate a firm’s cost of equity. Recall that a firm’s equity faces both business risk and financial risk. The equity beta that depends only on the business risk is called asset beta (basset or b0). This is the equity beta ...

... If equity beta is not directly estimable, we need to use comparable firms to estimate a firm’s cost of equity. Recall that a firm’s equity faces both business risk and financial risk. The equity beta that depends only on the business risk is called asset beta (basset or b0). This is the equity beta ...

How Does Business Dynamism Link to Productivity Growth?

... Directly measuring market shares for firms is difficult because the required sales and revenue data are not generally available for new firms. However, because higher sales generally correlate well with a larger workforce, we can use readily available data on employment counts to infer market share. ...

... Directly measuring market shares for firms is difficult because the required sales and revenue data are not generally available for new firms. However, because higher sales generally correlate well with a larger workforce, we can use readily available data on employment counts to infer market share. ...

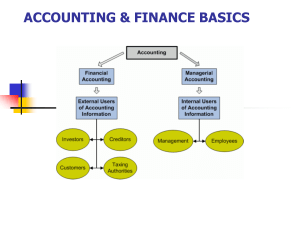

ACCOUNTING

... information to users to help them in their economic decisions the financial statements are expected to provide information about the future cash flows of an entity, its financial structure, profitability and liquidity, and its financial position and changes in financial position financial statements ...

... information to users to help them in their economic decisions the financial statements are expected to provide information about the future cash flows of an entity, its financial structure, profitability and liquidity, and its financial position and changes in financial position financial statements ...

1 The Capital Structure Choice in Tax Contrasting

... trading activities on the secondary market. In common with other markets, for example, ten listed companies on the ASM account for more than 50% of the total trading volume. Moreover, if we consider the fact that about 6-8 companies only account for at least 50% of the capitalization of the whole ma ...

... trading activities on the secondary market. In common with other markets, for example, ten listed companies on the ASM account for more than 50% of the total trading volume. Moreover, if we consider the fact that about 6-8 companies only account for at least 50% of the capitalization of the whole ma ...

SEC Shines a Spotlight on Short-Term Borrowings

... This is a change from Guide 3 which only requires bank holding companies to provide month-end maximum amounts. Guide 3 also does not require the above quantitative information for any category of short-term borrowings for which the average balance outstanding during the period was less than 30 perce ...

... This is a change from Guide 3 which only requires bank holding companies to provide month-end maximum amounts. Guide 3 also does not require the above quantitative information for any category of short-term borrowings for which the average balance outstanding during the period was less than 30 perce ...

chapter 2 - CSUN.edu

... Conservatism - allows the accountant to choose the accounting method that will be the least likely to overstate assets and income. Many times items in inventory become obsolete or damaged. In this instance inventory items should be listed at market value if it is lower than cost. ...

... Conservatism - allows the accountant to choose the accounting method that will be the least likely to overstate assets and income. Many times items in inventory become obsolete or damaged. In this instance inventory items should be listed at market value if it is lower than cost. ...

Screening for Growth and Value Based on “What Works on Wall

... which exceeds the database average. One does not normally screen a single period per share item across a cross section of firms. Per share items are normally studied over time or converted into ratios that can be meaningfully compared across firms. O’Shaughnessy does not reveal if other tests of div ...

... which exceeds the database average. One does not normally screen a single period per share item across a cross section of firms. Per share items are normally studied over time or converted into ratios that can be meaningfully compared across firms. O’Shaughnessy does not reveal if other tests of div ...

Michael S. Taht

... (4) Surplus and Related Assets provide for adverse deviation over and above that absorbed by policyholder dividends ...

... (4) Surplus and Related Assets provide for adverse deviation over and above that absorbed by policyholder dividends ...

WIS ACCOUNTING BASICS

... at a specific date. A balance sheet is also called Statement of Financial Position. A cash flow statement summarizes information about cash outflows (payments) and inflows (receipts). This statement may also include certain information not related to actual cash flows. ...

... at a specific date. A balance sheet is also called Statement of Financial Position. A cash flow statement summarizes information about cash outflows (payments) and inflows (receipts). This statement may also include certain information not related to actual cash flows. ...

***** 1

... values at that date. Any difference between the cost of the business combination and the acquirer’s interest in the net fair value of the identifiable assets, liabilities and provisions for contingent liabilities so recognized shall be accounted as ‘negative goodwill’ or gain from bargain purchase. ...

... values at that date. Any difference between the cost of the business combination and the acquirer’s interest in the net fair value of the identifiable assets, liabilities and provisions for contingent liabilities so recognized shall be accounted as ‘negative goodwill’ or gain from bargain purchase. ...