Insys Therapeutics, Inc. (Form: 8-A12B, Received: 08

... equal to 100 times the aggregate amount to be distributed per share to holders of common stock. Each Preferred Share will have 100 votes, voting together with the common stock. Finally, in the event of any merger, consolidation or other transaction in which shares of common stock are exchanged, eac ...

... equal to 100 times the aggregate amount to be distributed per share to holders of common stock. Each Preferred Share will have 100 votes, voting together with the common stock. Finally, in the event of any merger, consolidation or other transaction in which shares of common stock are exchanged, eac ...

Managing Financial Aspects of a Business

... accounting? What is cash basis? Effects of transactions and other events are recognised when they occur ( not when cash or cash equivalents received or paid) ...

... accounting? What is cash basis? Effects of transactions and other events are recognised when they occur ( not when cash or cash equivalents received or paid) ...

Lecture 8a Ch 19 Investment Banks Security Brokers and

... maybe the entire company), enlisting the aid of an investment banker. – Assists in determining the value of the division or firm and find potential buyers – Develop confidential financial statements for the division for prospective buyer (confidential memorandum) – Prepare a letter of intent to cont ...

... maybe the entire company), enlisting the aid of an investment banker. – Assists in determining the value of the division or firm and find potential buyers – Develop confidential financial statements for the division for prospective buyer (confidential memorandum) – Prepare a letter of intent to cont ...

lecture-notes-2-1

... firm or an individual can obtain funds in a financial market in two ways. The most common method is to issue a debt instrument, such as a bond or a mortgage, which is a contractual agreement by the borrower to pay the holder of the instrument fixed dollar amounts at regular intervals (interest and p ...

... firm or an individual can obtain funds in a financial market in two ways. The most common method is to issue a debt instrument, such as a bond or a mortgage, which is a contractual agreement by the borrower to pay the holder of the instrument fixed dollar amounts at regular intervals (interest and p ...

Screening for Cash-Rich Firms That Will Put Their Money to Good Use

... strategically to broaden their product lines or diversify into new areas. This can be accomplished either through direct capital investment or the outright purchase of another firm. Cash-rich firms can also be attractive acquisition candidates. While much more common in the leveraged buyout craze of ...

... strategically to broaden their product lines or diversify into new areas. This can be accomplished either through direct capital investment or the outright purchase of another firm. Cash-rich firms can also be attractive acquisition candidates. While much more common in the leveraged buyout craze of ...

Special Comment US Executive Pay Structure and Metrics

... that some boards are reluctant to see their executives punished when options fail to deliver value. This negative effect on retention would not be so worrisome if the outcomes were simply a matter of poor performance for shareholders, since presumably a change of management is appropriate in those s ...

... that some boards are reluctant to see their executives punished when options fail to deliver value. This negative effect on retention would not be so worrisome if the outcomes were simply a matter of poor performance for shareholders, since presumably a change of management is appropriate in those s ...

Dividend and Payout Policy (for you to read) Dividend Policy (aka

... •Everything! A change in dividend policy does not change the size of the pie and hence does not affect value. •The popularity of this fallacy is based on the intuition that investors would rather receive the cash than have managers invest it into negative NPV projects. •But note that any increase in ...

... •Everything! A change in dividend policy does not change the size of the pie and hence does not affect value. •The popularity of this fallacy is based on the intuition that investors would rather receive the cash than have managers invest it into negative NPV projects. •But note that any increase in ...

Financial Statements Basics - Duke`s Fuqua School of Business

... Provides a summary of what has happened to each of the major shareholders’ equity accounts during the period. ...

... Provides a summary of what has happened to each of the major shareholders’ equity accounts during the period. ...

Allianz Global Investors Fund Société d`Investissement à Capital

... sentence of this letter and index certificates and other certificates whose risk profile typically correlates with the assets listed in the first sentence of this letter or with the investment markets to which these assets can be allocated may also be acquired. b) Subject in particular to the provis ...

... sentence of this letter and index certificates and other certificates whose risk profile typically correlates with the assets listed in the first sentence of this letter or with the investment markets to which these assets can be allocated may also be acquired. b) Subject in particular to the provis ...

Accounting Methods - Cash Basis and Accrual Basis

... accessibility of financial data. Financial transactions should be recorded in such a way that a bookkeeper or successor treasurer will be able to both understand historical data and consistently process new transactions. Additionally, financial statements should be presented in such a way that they ...

... accessibility of financial data. Financial transactions should be recorded in such a way that a bookkeeper or successor treasurer will be able to both understand historical data and consistently process new transactions. Additionally, financial statements should be presented in such a way that they ...

Understanding Financ.. - Loughborough University

... For example, the training budget in your workbook, for ...

... For example, the training budget in your workbook, for ...

Basics Of Accounting

... increasing our knowledge & getting deeper in our study, to know all about this powerful 8letter word ‘A C C O U N T S’ There are 3 RULES OF ACCOUNTING on which entire accounts depends upon. Understanding the rules of Accounting is making your foundation in Accounts strong, whereby any transaction ca ...

... increasing our knowledge & getting deeper in our study, to know all about this powerful 8letter word ‘A C C O U N T S’ There are 3 RULES OF ACCOUNTING on which entire accounts depends upon. Understanding the rules of Accounting is making your foundation in Accounts strong, whereby any transaction ca ...

Dividends - McGraw Hill Higher Education - McGraw

... maximum amount each year. The maximum is usually the stated dividend rate. (Normal case) ...

... maximum amount each year. The maximum is usually the stated dividend rate. (Normal case) ...

New issue market

... increase its subscribed capital by allotment of further shares after two years from date of its formation or one year after date of first allotment. It should offer shares at first to the existing share holders in proportion to the shares held by them at the time of offer. ...

... increase its subscribed capital by allotment of further shares after two years from date of its formation or one year after date of first allotment. It should offer shares at first to the existing share holders in proportion to the shares held by them at the time of offer. ...

Here

... 50%. We believe this supports an increased dividend above profit growth moving forward, as strong cash generation and a strong balance sheet allow Colgate Palmolive to move their payout ratio closer to that of their peers. Additionally, Colgate Palmolive has purchased shares in every quarter since 2 ...

... 50%. We believe this supports an increased dividend above profit growth moving forward, as strong cash generation and a strong balance sheet allow Colgate Palmolive to move their payout ratio closer to that of their peers. Additionally, Colgate Palmolive has purchased shares in every quarter since 2 ...

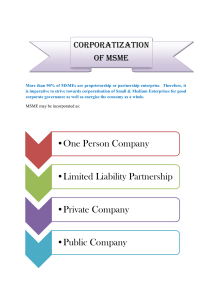

One Person Company •Limited Liability Partnership •Private

... A limited liability partnership can at best be described as a hybrid between a company and partnership that provides the benefit of limited liability but allows its members the flexibility of organising their internal structure as a partnership based on a ...

... A limited liability partnership can at best be described as a hybrid between a company and partnership that provides the benefit of limited liability but allows its members the flexibility of organising their internal structure as a partnership based on a ...

Ownership structure and the performance of firms

... Some works showed a linear relation (Cole and Mehran, 1998) whereas other more recent studies highlighted a non-linear relation (Morck et al., 1988; McConnell and Servaes, 1990 and 1995; Kole, 1995; Short and Keasey, 1999). Using Tobin’s Q as a measurement of performance and the percentage of shares ...

... Some works showed a linear relation (Cole and Mehran, 1998) whereas other more recent studies highlighted a non-linear relation (Morck et al., 1988; McConnell and Servaes, 1990 and 1995; Kole, 1995; Short and Keasey, 1999). Using Tobin’s Q as a measurement of performance and the percentage of shares ...

topic 1 - WordPress.com

... Generally Accepted Accounting Principles Assumptions Monetary Unit – include in the accounting records only transaction data that can be expressed in terms of money. ...

... Generally Accepted Accounting Principles Assumptions Monetary Unit – include in the accounting records only transaction data that can be expressed in terms of money. ...

Sample title for chapter 1

... • Valuation of a financial asset is based on determining the present value of future cash flows. – Required rate of return (the discount rate) • Depends on the market’s perceived level of risk associated with the individual security. • It is also competitively determined among companies seeking fina ...

... • Valuation of a financial asset is based on determining the present value of future cash flows. – Required rate of return (the discount rate) • Depends on the market’s perceived level of risk associated with the individual security. • It is also competitively determined among companies seeking fina ...

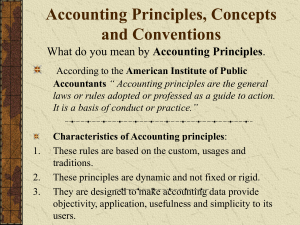

Accounting Principles, Concepts and Conventions

... Classification: All the transactions recorded in the journal are sorted into different accounts. The information pertaining to particular individual or party or item in different dates are recorded under one head identified by the name of the person, party or item concern, (also called as account). ...

... Classification: All the transactions recorded in the journal are sorted into different accounts. The information pertaining to particular individual or party or item in different dates are recorded under one head identified by the name of the person, party or item concern, (also called as account). ...

canadian imperial bank of commerce - Investor Relations

... Certain statements contained in this communication may be deemed to be forward-looking statements under certain securities laws. All such statements are made pursuant to the “safe harbor” provisions of, and are intended to be forward-looking statements under applicable Canadian and U.S. securities l ...

... Certain statements contained in this communication may be deemed to be forward-looking statements under certain securities laws. All such statements are made pursuant to the “safe harbor” provisions of, and are intended to be forward-looking statements under applicable Canadian and U.S. securities l ...

To propose the issuance plan of private placement for

... proposed to authorize the Company’s Board to determine the specific parties for private placement. C. The necessity of private placement: (a) The reasons for not taking a public offering: Considering the capital market status, effectiveness, feasibility and costs to raise capital, and the no-trading ...

... proposed to authorize the Company’s Board to determine the specific parties for private placement. C. The necessity of private placement: (a) The reasons for not taking a public offering: Considering the capital market status, effectiveness, feasibility and costs to raise capital, and the no-trading ...

medical properties trust, inc. mpt operating - corporate

... may differ materially. Words such as “expects,” “believes,” “anticipates,” “intends,” “will,” “should” and variations of such words and similar expressions are intended to identify such forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other fa ...

... may differ materially. Words such as “expects,” “believes,” “anticipates,” “intends,” “will,” “should” and variations of such words and similar expressions are intended to identify such forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other fa ...

Stock Return Response Modeling 10.8

... investments), if present in the measure of performance, reduce its information content. Extraordinary items have different dynamic properties than cash flows from operations. Specifically, they are unlikely to persist in the future. The market realizes that extraordinary items are transitory and va ...

... investments), if present in the measure of performance, reduce its information content. Extraordinary items have different dynamic properties than cash flows from operations. Specifically, they are unlikely to persist in the future. The market realizes that extraordinary items are transitory and va ...

Word - corporate

... decisions may differ materially from those expressed or implied by such forward-looking statements. Important factors, among others, that could cause the Company’s actual results and future actions to differ materially from those described in forward-looking statements include, but are not limited t ...

... decisions may differ materially from those expressed or implied by such forward-looking statements. Important factors, among others, that could cause the Company’s actual results and future actions to differ materially from those described in forward-looking statements include, but are not limited t ...