Chapter 1 - Universidade do Minho

... Shareholders vote for the board of directors, who in turn hire the management team. Contracts can be carefully constructed to be incentive compatible. There is a market for managerial talent—this may provide market discipline to the managers—they can be replaced. If the managers fail to maximize sha ...

... Shareholders vote for the board of directors, who in turn hire the management team. Contracts can be carefully constructed to be incentive compatible. There is a market for managerial talent—this may provide market discipline to the managers—they can be replaced. If the managers fail to maximize sha ...

Learning Objectives

... which they are incurred. Capital expenditures are spared out over multiple periods and deducted as an expense in each period. These expenses are called depreciation (for a tangible asset) or amortization (for an intangible asset). Since the actual cash outlay occurs at the beginning when the capital ...

... which they are incurred. Capital expenditures are spared out over multiple periods and deducted as an expense in each period. These expenses are called depreciation (for a tangible asset) or amortization (for an intangible asset). Since the actual cash outlay occurs at the beginning when the capital ...

Cenovus prices US$2.9 billion offering of senior

... consideration of certain risks and uncertainties, some of which are specific to Cenovus and others that apply to the industry and the capital markets generally. The factors or assumptions on which the forward-looking information is based include: timing and receipt of applicable regulatory approvals ...

... consideration of certain risks and uncertainties, some of which are specific to Cenovus and others that apply to the industry and the capital markets generally. The factors or assumptions on which the forward-looking information is based include: timing and receipt of applicable regulatory approvals ...

IMPROVING THE HEALTH OF FINANCIAL INSTITUTIONS

... Commercial real estate – sub and non-performing. Typically this type of paper would be under water in terms of LTV and with sporadic or no payments at all. We are most interested in the owner occupied space where we would also have UCC’s on business assets. ...

... Commercial real estate – sub and non-performing. Typically this type of paper would be under water in terms of LTV and with sporadic or no payments at all. We are most interested in the owner occupied space where we would also have UCC’s on business assets. ...

Using Financial Ratios to Predict Financial Distress of Jordanian

... The study population consists of all industrial companies listed on the Amman Financial Market during the period (19952005), of which there are 94 companies, but 39 companies were excluded due to the lack of sufficient financial statements for these companies, being the exercise began its work after ...

... The study population consists of all industrial companies listed on the Amman Financial Market during the period (19952005), of which there are 94 companies, but 39 companies were excluded due to the lack of sufficient financial statements for these companies, being the exercise began its work after ...

2015-230 Presentation of Financial Statements of Not-for

... b. Composition of net assets with donor restrictions at the end of the period and how the restrictions affect the use of resources. Disagree in part – narrative about how the composition affects the use of resources is subjective, may be duplicative of information already in the financials and adds ...

... b. Composition of net assets with donor restrictions at the end of the period and how the restrictions affect the use of resources. Disagree in part – narrative about how the composition affects the use of resources is subjective, may be duplicative of information already in the financials and adds ...

chapter 1

... detrimental to those stockholders who sell and beneficial to those who do not. There might also be tax benefits to conducting share repurchases versus issuing dividends. Putting these issues aside, it is difficult to see how this could be beneficial to the firm. ...

... detrimental to those stockholders who sell and beneficial to those who do not. There might also be tax benefits to conducting share repurchases versus issuing dividends. Putting these issues aside, it is difficult to see how this could be beneficial to the firm. ...

Jeopardy - Cloudfront.net

... Surpluses, Storage Problems Disposal Problems, and rise in Product quantity. ...

... Surpluses, Storage Problems Disposal Problems, and rise in Product quantity. ...

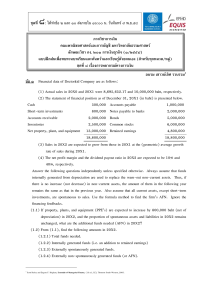

อบรม เชาวน์เลิศ รวบรวม1 ข้อ ๑ Financial data of Doctorkid Company

... ข้อ ๖ At year-end 20X0, total assets for Shome Inc. were THB1.2 million and accounts payable were THB375,000. Sales, which in 20X0 were THB2.5 million, are expected to increase by 25 percent in 20X1. Total assets and accounts payable are proportional to sales, and that relationship will be maintaine ...

... ข้อ ๖ At year-end 20X0, total assets for Shome Inc. were THB1.2 million and accounts payable were THB375,000. Sales, which in 20X0 were THB2.5 million, are expected to increase by 25 percent in 20X1. Total assets and accounts payable are proportional to sales, and that relationship will be maintaine ...

Examining market efficiency in India

... In testing the market efficiency of the Bombay Stock Exchange, an autocorrelations and runs test is employed. Both the autocorrelations test and run test examine if time series data exhibits randomness. The methodology used in this study is similar to Thomas and Kumar (2010) and Khan, Ikkram, and Me ...

... In testing the market efficiency of the Bombay Stock Exchange, an autocorrelations and runs test is employed. Both the autocorrelations test and run test examine if time series data exhibits randomness. The methodology used in this study is similar to Thomas and Kumar (2010) and Khan, Ikkram, and Me ...

Financial Statement Analysis

... assets are more liquid than others. While the book defines the quick ratio’s numerator as being the Current Assets less Inventories, the general definition used in practice excludes other current assets that are not liquid in nature, such as prepaid expenses. The idea behind excluding inventories is ...

... assets are more liquid than others. While the book defines the quick ratio’s numerator as being the Current Assets less Inventories, the general definition used in practice excludes other current assets that are not liquid in nature, such as prepaid expenses. The idea behind excluding inventories is ...

Notice Concerning Introduction of Stock Options as

... on or after the effective date in the case of a consolidation of shares. However, if a share split is carried out based on the condition that an agenda item to decrease surplus and increase capital or reserves is approved in a General Shareholders’ Meeting and if the record date of the share split i ...

... on or after the effective date in the case of a consolidation of shares. However, if a share split is carried out based on the condition that an agenda item to decrease surplus and increase capital or reserves is approved in a General Shareholders’ Meeting and if the record date of the share split i ...

Allotment of Stock Acquisition Rights issued as stock options

... 9. Policy regarding cancellation of the Stock Acquisition Rights in the event of reorganization and issuance of Stock Acquisition Rights of a subject company of reorganization If the Company conducts a merger (but only when the Company is the dissolving company), an absorption-type split, an incorpo ...

... 9. Policy regarding cancellation of the Stock Acquisition Rights in the event of reorganization and issuance of Stock Acquisition Rights of a subject company of reorganization If the Company conducts a merger (but only when the Company is the dissolving company), an absorption-type split, an incorpo ...

Effect of Leverage on Performance of Non

... Shareholders return is reflected by a measure of how well a firm can use its’ assets from its’ primary business to generate revenues (Abor, 2005). Managers should emphasize on the optimum level of capital structure and efficient utilization and allocation of resources in order to increase the compan ...

... Shareholders return is reflected by a measure of how well a firm can use its’ assets from its’ primary business to generate revenues (Abor, 2005). Managers should emphasize on the optimum level of capital structure and efficient utilization and allocation of resources in order to increase the compan ...

Financial Distress, Managerial Incentives, and Information

... effort and may lead to lower firm values • Debt financing in this case provides the manager with the incentives to exert effort to increase firm value ...

... effort and may lead to lower firm values • Debt financing in this case provides the manager with the incentives to exert effort to increase firm value ...

Villegas y Villegas Mexico Joins Alliott Group Press Release

... Villegas y Villegas is an accounting firm founded by Guillermo Villegas in 1982. The firm is located in one of Mexico's main industrial cities, and their clients have been expanding rapidly reflecting the scope of services offered by Villegas y Villegas Currently the focus of Villegas y Villegas mai ...

... Villegas y Villegas is an accounting firm founded by Guillermo Villegas in 1982. The firm is located in one of Mexico's main industrial cities, and their clients have been expanding rapidly reflecting the scope of services offered by Villegas y Villegas Currently the focus of Villegas y Villegas mai ...

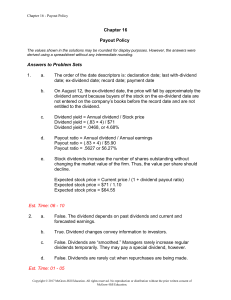

ch 16

... 250,000$. EBIT are projected to be 28,000$ if economic conditions are normal. If there is strong expansion in the economy, then EBIT will be 30 percent higher. If there is a recession, then EBIT will be 50 percent lower. Maynard is considering a 90,000$ debt issue with a 7 percent interest rate. The ...

... 250,000$. EBIT are projected to be 28,000$ if economic conditions are normal. If there is strong expansion in the economy, then EBIT will be 30 percent higher. If there is a recession, then EBIT will be 50 percent lower. Maynard is considering a 90,000$ debt issue with a 7 percent interest rate. The ...

CHAPTER 9 The Cost of Capital

... Therefore, preferred stock often has a lower B-T yield than the B-T yield on debt. The A-T yield to an investor, and the A-T cost to the issuer, are higher on preferred stock than on debt. Consistent with higher risk of preferred stock. ...

... Therefore, preferred stock often has a lower B-T yield than the B-T yield on debt. The A-T yield to an investor, and the A-T cost to the issuer, are higher on preferred stock than on debt. Consistent with higher risk of preferred stock. ...

Dividends and Other Payouts

... of dividends. Cum-Dividend Date: Buyer of stock still receives the dividend. Ex-Dividend Date: Seller of the stock retains the dividend. Record Date: The corporation prepares a list of all individuals believed to be stockholders as of 5 November. ...

... of dividends. Cum-Dividend Date: Buyer of stock still receives the dividend. Ex-Dividend Date: Seller of the stock retains the dividend. Record Date: The corporation prepares a list of all individuals believed to be stockholders as of 5 November. ...

Stakeholder orientation vs. shareholder value

... problem is to be guided by considerations about efficiency. It is argued that when a firm’s relationship with it stakeholders can be characterized as pure contractual a duty of loyalty towards only shareholders coincides with economic efficiency i.e. the hypothetical perfect contract. This is becaus ...

... problem is to be guided by considerations about efficiency. It is argued that when a firm’s relationship with it stakeholders can be characterized as pure contractual a duty of loyalty towards only shareholders coincides with economic efficiency i.e. the hypothetical perfect contract. This is becaus ...

How can I sell my Share Certificates? - Trop-X

... represents your ownership in that company. As a shareholder you can go on to sell your shares in one of two ways: Firstly you can search for someone who is willing to buy the shares from you (normally a family member, friend or colleague), then give or sell them the certificate. Once the shares have ...

... represents your ownership in that company. As a shareholder you can go on to sell your shares in one of two ways: Firstly you can search for someone who is willing to buy the shares from you (normally a family member, friend or colleague), then give or sell them the certificate. Once the shares have ...

Making Sense of a Complex World: IAS 36 Impairment of

... CGUs is becoming more complex. Thus, there is an increasing tendency in the market for telecom companies to aggregate mobile and fixed business8. Some, for example Swisscom, avoid this complexity altogether by differentiating their CGUs based on customer type, for example: consumers, small and mediu ...

... CGUs is becoming more complex. Thus, there is an increasing tendency in the market for telecom companies to aggregate mobile and fixed business8. Some, for example Swisscom, avoid this complexity altogether by differentiating their CGUs based on customer type, for example: consumers, small and mediu ...

Negotiated Shareholder Value: the German Variant of an Anglo

... coalition, measures designed to achieve shareholder value are typically modified during the process of negotiation to take into account the interests of other stakeholder groups. Many shareholder value measures, such as remuneration incentives designed to align the interests of shareholders, manager ...

... coalition, measures designed to achieve shareholder value are typically modified during the process of negotiation to take into account the interests of other stakeholder groups. Many shareholder value measures, such as remuneration incentives designed to align the interests of shareholders, manager ...

Sports/Entertainment Straight Talk About Sports

... protect trademarks, ensure brands are established as revenue-generating assets, protect and maximize the value of trademarks and copyrighted works, and manage the legal issues involved in creating, distributing or using all manner of marks, merchandise and original content. We also help organization ...

... protect trademarks, ensure brands are established as revenue-generating assets, protect and maximize the value of trademarks and copyrighted works, and manage the legal issues involved in creating, distributing or using all manner of marks, merchandise and original content. We also help organization ...

Aleksy Pocztowski, Beata Buchelt Trends and Issues in Human

... through subdivision among business partners, increased access to new technologies and specialized knowhow, concentration on key human resource management processes, the ones that add value, access to advanced technologies, and improvement of customer services. The major trend in personnel function ...

... through subdivision among business partners, increased access to new technologies and specialized knowhow, concentration on key human resource management processes, the ones that add value, access to advanced technologies, and improvement of customer services. The major trend in personnel function ...