* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download assets = liabilities + equity

Microsoft Dynamics GP wikipedia , lookup

Going concern wikipedia , lookup

International Financial Reporting Standards wikipedia , lookup

Edward P. Moxey wikipedia , lookup

Natural capital accounting wikipedia , lookup

Mergers and acquisitions wikipedia , lookup

History of accounting wikipedia , lookup

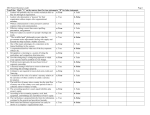

Module 3 The process of Accounting & The Balance Sheet 1 The characteristics of business transactions A business transaction is recorded when there has been an exchange of resources between one business and another person or business in monetary terms The exchange must be at arm’s length. Entity concept must be kept intact – i.e. business records must be kept separate from the owner’s personal records Personal expenditure from the entity’s funds are known as drawings. Transactions can be either in cash or credit. Source documents provide evidence of the business transactions. 2 Examples of Source Documents 3 Business transaction versus a business event Personal transactions are ones that do not involve an exchange between the business entity and another entity. Negotiations between the entity and outsiders will not be recorded as a business transaction until an exchange of resources actually takes place. Negotiations are considered as simply a business event: These must not be included in the entity’s records until a source document evidences an exchange of resource/s 4 The accounting equation – process of double entry The accounting equation is known as the relationship between assets (whether owned or controlled by the entity) liabilities and equity Assets = Liabilities + Equity Liabilities and equity represent the claims against the entity’s assets. Business transactions are analysed by examining the dual effect of each business transaction and the impact on the accounting equation 5 Part A: Double entry explained 6 The Accounting Equation ASSETS = LIABILITIES + (external claims) OWNER’S EQUITY (internal claims) Uses of funds Sources of funds Owns/control Owes DEBIT (dr) the left hand side DEBIT side (dr) CREDIT (cr) the right hand side CREDIT side (cr) Explain bank statements then! 7 Double Entry (Duality) DEBIT (dr) CREDIT (cr) Business transactions are analysed by examining the dual effect of each business transaction and the impact on the accounting equation Duality means that every business transaction will affect the accounting equation – the result of which leaves the equation in balance! This requires at least TWO entries (double entry) Assets = Liabilities + Equity 8 We will be using a practical example Teresa and her carpet business (Handout) 9 Transaction analysis – April 1 Business transactions are analysed by examining the dual effect of each business transaction and the impact on the accounting equation TRANSACTION: Teresa starts business with $20,000 of her own money and a $50,000 loan from her aunt Cash $70,000 = Loan $50,000 (dr) + Capital $20,000 (cr) Duality = at least TWO entries equation in balance! (double entry) 10 Balance Sheet – April 1 – complete this! TRANSACTION: Teresa starts business with $20,000 of her own money and a $50,000 loan from her aunt Assets Balance Sheet as at 1 April Liabilities Cash Loan Equity Capital Contributed Assets = (dr) Liabilities + Owner’s Equity (cr) 11 Double Entry (Duality) DEBIT (dr) CREDIT (cr) the traditional general ledger (accounting record book) is also divided into 2 sides: (dr) (cr) “T” account 12 What is an ‘Account’? a device to record individual items in the financial statements Anything you want a separate record of needs its own account (it’s own page/ledger account) vehicle There are different types of accounts depending on where they ‘fit’ in the accounting equation (A = L + OE) Dr nature Cr nature (left) (right) Bank 13 Loan Some examples of Accounts Asset accounts include: Cash, Debtors (Accounts Receivable), Inventory, Motor Vehicles etc. Liability accounts include: Bank Overdraft, Creditors (Accounts Payable), Bank Loans etc. Owner’s Equity accounts include: Capital (for sole traders, partnerships) Issued Share Capital; Reserves; Retained Profits (for companies) 14 Type/nature of account The type or nature of an accounts depends on the accounting equation (A = L + OE) A ledger account is INCREASED by an entry to it’s “usual side” Dr for asset; Cr for liability It is DECREASED by an entry on the opposite side decrease vehicle Asset, so debit nature – write an increase on the Left Side! increase decrease Liability, so credit nature – write an increase on the Right Side! Bank Loan 15 increase Ledger accounts in “T” Form Motor vehicle 31st March Loan $5,000 Bank Loan 31st March DEBIT (dr) A = L + OE Motor vehicle CREDIT (cr) $5,000 16 Normal Account Balances Account Assets Liabilities Owner’s equity Normal Balance Debit Credit Credit Debit Credit Credit Credit Debit Debit 17 Explaining Owner’s Equity What changes the amount an owner has invested in the business – or the amount the business “owes” the owner? Owner invests more capital Owner takes out money or value (drawings) Any net profit/loss (Income – expenses) belongs to the owner Which are increases/decreases to OE? 18 Increases/decreases to OE What changes the amount an owner has invested in the business – or the amount the business “owes” the owner? Owner invests more capital – increase OE Owner takes out drawings – decrease OE Any net profit/loss (Income/revenue – expenses) belongs to the owner Profit i.e. Income increases OE Loss i.e. Expenses decrease OE 19 Equity A = L + OE Equity is Credit nature Inside OE Owner’s Equity Drawings Expenses/Loss Capital Income/Profit Increases (cr) Expanding OE in the equation A + E + D = L + R + OE DEBIT (dr) CREDIT (cr) 20 Explaining Owner’s Equity A + E + D = L + R + OE The Equity section of the accounting equation can be expanded to analyse the effects of income (revenue) and expenses – determines net profit/loss for the period. Reported on the Income Statement Net profit/loss is then added to the entity’s equity on the Balance Sheet. 21 Reports Make-a-Buck Income Statement For the year ended 30 June 2007 Revenue Service Fees 20,000 Make-a-Buck Balance Sheet As at 30 June 2007 ASSETS Cash Trade Debtors Machinery Expenses Wages Electricity LIABILITIES Trade Creditors Bank Loan 17,000 500 17,500 Profit/Loss 2,500 5,000 6,000 11,000 9,000 20,000 6,000 5,000 11,000 EQUITY Opening Balance of Capital 5,500 Add: additional funds from owner 1,500 7,000 Minus: drawings (500) Add: Profit (or deduct loss) 2,500 Closing balance of capital (OE) 9,000 TOTAL LIABILITIES & EQUITY 20,000 ASSETS = LIABILITIES + EQUITY 22 Teresa and her carpet business – Day 2 2 Apr Teresa signs the lease and writes a cheque for $10 000. Lease ↑A ↑(Debit) (left) Dr Cash ↓A ↓(Credit) (right) Cr A Cash Both are asset accounts Assets = Liabilities + Owner’s Equity Lease How would the general ledger accounts look? Cash at bank = L + OE Apr 2 $10.000 Lease 23 Teresa and her carpet business – Day 2 – fill in the Balance Sheet Lease ↑A ↑(Debit) (left) Dr Cash ↓A ↓(Credit) (right) Cr Balance Sheet as at 2 April Liabilities Assets Current Cash Non-Current $ Loan $ Equity $ Non-Current Lease Capital Contributed $ $ $ 24 Finish example to 5th April Balance Sheet Teresa and her carpet business (Handout) 25 Part B: Process overview 26 General ledger Traditionally a book containing the collection of accounts – with its own index the “Chart of Accounts” (dr) “T” accounts (cr) Now probably contained in a computer package e.g. MYOB 27 Journals and Ledger Ledger ‘pages’ fill quickly! So similar transactions often listed chronologically first in a JOURNAL and only the total posted to (entered in) the relevant ledger account.. e.g. Sales Journal – credit sales Each entry will have: •the date of transaction •name of accounts affected and •the corresponding debit and credit amount. 28 Journals Ledger e.g. Sales Journal – credit sales 1 Apr Joe Smith 5 Apr Mary Lim $500 $1,000 11th Apr Tina James $3,000 TOTAL $4,500 Accounts Receivable Apr Duality starts in the ledger account Sales Revenue Apr $4.500 A = Accounts Receivable L+ $4.500 OE Revenue 29 Steps in the Basic Accounting Cycle Source documents Journal Ledger Trial Balance Financial statements 30 Back to the steps in the basic accounting cycle… Source Documents E.g. invoices Journal chronological transaction recording impacts on particular Accounts identified Ledger the place where all the Accounts are kept together – duality (double entry) starts here Trial Balance a list of all the Accounts & balances (dr and cr) – checks duality Financial Statements Income Statement, Cash Flow Statement, Balance Sheet; Statement of Changes in Equity 31 What’s a Worksheet? Summarises the duality of business transactions It is a tool to help prepare the reports like a trial balance The worksheet (like the Balance Sheet) is based on the accounting equation (A = L + E) May take a number of formats (internal use) 32 Example of a Worksheet Assets = Liabilities Balance Sheet + Equity Income Statement Profit/loss Common Errors in the Worksheet transposition errors Occurs when one of the digits recorded is transposed for another digit, e.g. $2309 for one entry and the dual entry recorded as $2039 Quick test – is the difference of the error divisible by 9? single-entry errors e.g. cash sales of $500 recorded in revenue (as a plus) column but with no ‘dual’ effect recorded in asset Bank (also a plus) account. incorrect entries when an increase is recorded on one side of the equation and a decrease on the other side when it should have been an increase (and vice versa) 34 Income Statement Used to calculate net profit (or loss) It is the difference between revenue and expense transactions Net profit (or loss) is then transferred to the Balance Sheet 35 Income statement format Income (e.g. sales; fees) Less Expenses (e.g. wages; rent; electricity; gas) = Net Profit (or loss) 36 Example of an Income Statement Service 37 Example of an Income Statement Income Statement For the month ended 30th April Sales Less: Cost of Goods Sold GROSS Profit $40 000 $20 000 $20 000 Less other expenses Depreciation exp Lease Rent payments Interest Expense NET Profit $ 1 584 $18 416 334 1 000 250 Retailer/trader/merchandiser 38 Balance Sheet It is a statement of the entity’s assets and liabilities The accounting equation holds true within the Balance Sheet (i.e. A = L + E) 39 Example of a Balance Sheet Note: A - L = OE 40 Common Balance Sheet format ASSETS Current (e.g. cash) and Non-current (e.g. machinery) Less LIABILITIES Current (e.g. creditors) and Non-current (e.g. loan) equals NET ASSETS which also equals EQUITY 41 Teresa and her carpet business Continue with the example up to unadjusted balance sheet at 30th April (page 4) A + E + D = L + R + OE Debit Credit 42 Part C -Balance Sheet 43 The Balance Sheet The financial position of an entity at a particular point in time Lists Assets What the business owns or controls Liabilities External claims on the entity’s assets Owner’s equity Internal claims on the entity’s assets 44 Accounting Equation Assets = Liabilities + Owner’s Equity 45 Assets ‘A resource controlled by the entity as a result of past transactions or other past events and from which future economic benefits are expected to flow to the entity.’ Future economic benefit Controlled by the entity Result of past transaction or event 46 Asset Recognition ‘It is probable that any future economic benefits associated with the asset will flow to the entity and the asset has a cost or other value that can be measured reliably.’ 47 Assets Examples cash receivables (debtors) prepayments inventories property tangible vs intangible 48 Tangible vs. Intangible Assets Tangible assets: assets that you can touch e.g. furniture Intangible assets: do not have physical substance, e.g. patents, copyrights held, etc 49 Liabilities ‘A present obligation of the entity arising from past events, the settlement of which is expected to result in an outflow from the entity of resources embodying economic benefits.’ A future sacrifice of economic benefits A present obligation to another entity A result of a past transaction or other past events 50 Liabilities Recognition ‘It is probable that the outflow of resources embodying economic benefits will result and can be measured reliably.’ 51 Liabilities Examples payables (creditors) tax liabilities mortgages loans 52 Equity ‘The residual interest in the assets of the entity after deduction of its liabilities.’ Equity = Assets – Liabilities Categories of Owner’s equity Owner’s equity contributed Owner’s equity retained Reserves Equity cannot be defined independently 53 Equity Categories contributed equity Reserves Asset Revaluation reserve General Reserve Foreign currency translation reserve retained profits outside interests in controlled entities 54 Shareholders’ equity - company Total shareholders’ equity Issued share capital Ordinary shares Preference shares Reserves Retained profits Other types of reserves Summary of asset and liability definition and recognition criteria 56 Balance Sheet Format ‘T’ Format/Horizontal Narrative Format/Vertical Remember: Balance Sheet balances i.e. Assets = Liabilities + Equity Generally presented in order of liquidity Comparative Information (2 years) Parent entity and consolidated entity 57 Balance Sheet: alternative formats Choice 1: Horizontal or Vertical (narrative)? Choice 2: Which version of the balance sheet equation will you use? Entity approach A = L + OE Proprietary approach A-L = OE 58 Entity Approach (A=L+OE):Horizontal 59 Entity Approach (A=L+OE) : narrative 60 Which is the most common? Why? •Narrative (vertical) – columns •Proprietary – investors A – L = OE 61 Classification of Items Current and Non-current Current Assets – expected to be consumed or converted to cash in next 12 months eg. cash, inventory, debtors Non-Current Assets – normally held on a continuing basis to generate wealth eg. Land and buildings Current Liabilities – due and payable within 12 months eg. Trade creditors Non-current Liabilities – payable beyond 12 months eg. Long term loan 62 Conventions Business entity convention Money measurement Valuation Going Concern (continuity) Dual aspect Conservatism (Prudence) Stable Monetary Unit Objectivity/reliability 63 The Business Entity Convention the business is treated as separate from its owners for accounting purposes this means, for example, that the owner’s personal assets and liabilities should not be included on the business’ Balance Sheet 64 The Money Measurement Convention accounting records only those items that are able to be expressed in monetary terms underpins one of the 2 recognition criteria – which one? 65 Valuation The dollar value assigned to assets and liabilities is called their carrying or book value The carrying value can either be: Historical cost – i.e. original cost • Current cost Market value • Present value So which one do we choose? 66 Valuation The one that ensures the information is relevant and reliable For example Debtors: net realisable value i.e. expected collection value NRV = expected selling price minus any costs involved in the sale Inventory: lower of cost or net realisable value Non-Current Assets: lower of cost or recoverable amount (selling price or value in use - i.e. amount expected to be recovered through use and/or sale) Benefits consumed each period are recorded as an expense of the business for that period Depreciation – for tangible non-current assets Amortisation – for intangible non-current assets Goodwill - purchased goodwill only 67 The Going Concern/Continuity Convention it is assumed that the business will continue into the future (rather than liquidate) this has implications in particular for valuation of assets on the balance sheet 68 The Dual Aspect Convention results in “double-entry accounting” every business transaction has at least two “aspects” and both are recorded eg. buying inventory on credit: the 2 aspects are the increase in inventory which is recorded as an asset, and the increase in a liability (accounts payable or creditors) 69 The Conservatism/Prudence Convention actual and anticipated losses are recorded in full, but profits are not recognised until there is a reasonable certainty that they will be received results in the financial reports taking a cautious or pessimistic perspective counteracts management’s optimism about trading results? 70 The Stable Monetary Unit Convention money is assumed to retain the same value over time (inflation is ignored) departures from this convention are common, and accepted, through the practice of asset revaluation 71 Objectivity/Reliability Items included in the financial statements should be verifiable and non-subjective Preferable to have independent evidence 72 Balance Sheet Analysis liquidity: ability to meet current obligations from liquid assets. Related to the probability of business failure. mix of assets held: current vs non current. Given their long term nature, an over-investment in non current assets can cause cash shortages. financial structure: reliance on external vs internal sources of finance. Important because external finance involves legal obligations 73 Limitations of the Balance Sheet 1. 2. Asset, Liability and Entity values are at a particular point in time only (these values will change over time) The entity’s value is not really reflected in balance sheet due to 3. Items that generate future benefits or involve future sacrifices not satisfying definition/recognition criteria The historical nature (or combinations of cost and fair values) of the Balance Sheet Preparing a Balance Sheet involves – • • • management choices judgements and estimations The Historical Cost Convention assets are recorded at a value based on their cost of acquisition supports the money measurement convention, prudence (conservatism) & is reliable criticism ‘relevance’ vs ‘reliability’ debate Try the crossword! 76 Trading and its effect on the Balance Sheet Profits (increases in wealth) or losses (decreases in wealth) will alter the owner’s claim against the business Example: Teresa sold $20 000 worth of inventory for $40000. Interest expense was $250 for the month and depreciation on fixtures was $334. The monthly rent was $1000. Ignore the lease for simplicity. Profit/(Loss) = $40000-$20000-$250-$334-$1000 = $18416. 77 Balance Sheet as at 30 April, 2006 Assets Liabilities Current Cash* Inventory Non-Current Lease Shop Fixtures $20 000 Less depreciation $ 334 Current Accounts Payable Non-Current Loan $78 750 $15 000 $ 10 000 $19 666 $35 000 $50 000 Equity Capital Contrib. $20 000 + Retain. Prof. $18 416 $123 416 $38 416 $123 416 *Cash $40000 + $40000 - $1000 - $250 #Inventory $35000 - $20000 78