chapter 6

... 2. Explain the accounting for inventories, and apply the inventory cost flow methods. The primary basis of accounting for inventories is cost. Cost includes all expenditures necessary to acquire goods and place them in condition ready for sale. Cost of goods available for sale includes (a) cost of b ...

... 2. Explain the accounting for inventories, and apply the inventory cost flow methods. The primary basis of accounting for inventories is cost. Cost includes all expenditures necessary to acquire goods and place them in condition ready for sale. Cost of goods available for sale includes (a) cost of b ...

- TestbankU

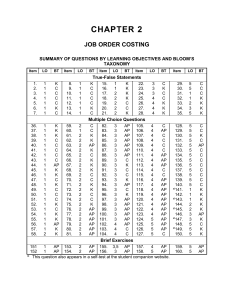

... involves the procedures for measuring, recording, and reporting product costs. From the data accumulated, companies determine the total cost and the unit cost of each product. The two basic types of cost accounting systems are job order cost and process cost. In job order costing, companies first ac ...

... involves the procedures for measuring, recording, and reporting product costs. From the data accumulated, companies determine the total cost and the unit cost of each product. The two basic types of cost accounting systems are job order cost and process cost. In job order costing, companies first ac ...

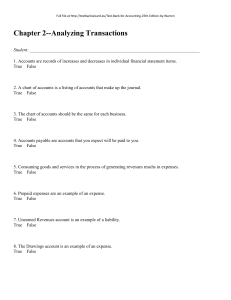

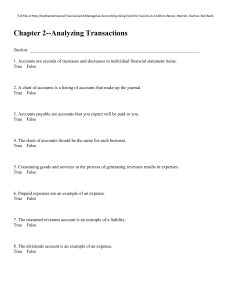

chapter 2

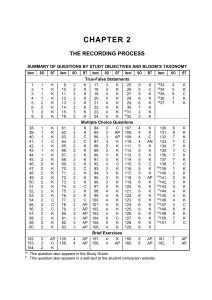

... 7. Prepare a trial balance and explain its purposes. A trial balance is a list of accounts and their balances at a given time. Its primary purpose is to prove the equality of debits and credits after posting. A trial balance also uncovers errors in journalizing and posting and is useful in preparing ...

... 7. Prepare a trial balance and explain its purposes. A trial balance is a list of accounts and their balances at a given time. Its primary purpose is to prove the equality of debits and credits after posting. A trial balance also uncovers errors in journalizing and posting and is useful in preparing ...

Free sample of

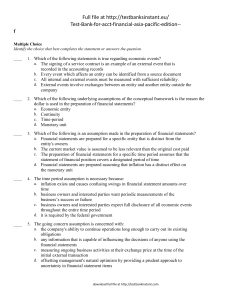

... each of its three shareholders. During the year ending 30 June 2013 Davis Construction had profit of $125 000 and paid dividends of $50 000. If Davis Construction's revenues were $500 000 for the year ended 30 June 2013, how much were total expenses? a. $300 000 b. $375 000 c. $325 000 d. $625 000 _ ...

... each of its three shareholders. During the year ending 30 June 2013 Davis Construction had profit of $125 000 and paid dividends of $50 000. If Davis Construction's revenues were $500 000 for the year ended 30 June 2013, how much were total expenses? a. $300 000 b. $375 000 c. $325 000 d. $625 000 _ ...

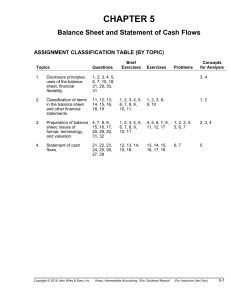

assignment classification table (by topic)

... development (new products that are being developed but which are not yet marketable), the value of the “intellectual capital” of its workforce (the ability of the companies’ employees to come up with new ideas and products in the fast changing technology industry), and the value of the company reput ...

... development (new products that are being developed but which are not yet marketable), the value of the “intellectual capital” of its workforce (the ability of the companies’ employees to come up with new ideas and products in the fast changing technology industry), and the value of the company reput ...

Document

... (a) Under the time period assumption, an accountant is required to determine the relevance of each business transaction to specific accounting periods. (b) An accounting time period of one year in length is referred to as a fiscal year. A fiscal year that extends from January 1 to December 31 is ref ...

... (a) Under the time period assumption, an accountant is required to determine the relevance of each business transaction to specific accounting periods. (b) An accounting time period of one year in length is referred to as a fiscal year. A fiscal year that extends from January 1 to December 31 is ref ...

Substantive Tests of Transactions and Balances

... transaction documents, it is important to be specific about the purpose of particular procedures. Dual-purpose tests should be narrowly defined to include only those tests that are specifically planned to provide direct evidence of both controls and substantive matters. In a broad sense, all audit t ...

... transaction documents, it is important to be specific about the purpose of particular procedures. Dual-purpose tests should be narrowly defined to include only those tests that are specifically planned to provide direct evidence of both controls and substantive matters. In a broad sense, all audit t ...

FREE Sample Here

... 117. Proof that the dollar amount of the debits equals the dollar amount of the credits in the ledger means A. all of the information from the journal was correctly transferred to the ledger B. all accounts have their correct balances in the ledger C. only the journal is accurate; the ledger may be ...

... 117. Proof that the dollar amount of the debits equals the dollar amount of the credits in the ledger means A. all of the information from the journal was correctly transferred to the ledger B. all accounts have their correct balances in the ledger C. only the journal is accurate; the ledger may be ...

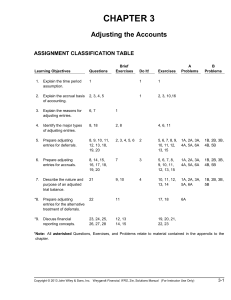

Wey Fin 7e Ch03 chapterspecific

... Should companies accrue for environmental cleanup costs as liabilities on their financial statements? YES: As more states impose laws holding companies responsible, and as more courts levy pollution-related fines, it becomes increasingly likely that companies will have to pay large amounts in the f ...

... Should companies accrue for environmental cleanup costs as liabilities on their financial statements? YES: As more states impose laws holding companies responsible, and as more courts levy pollution-related fines, it becomes increasingly likely that companies will have to pay large amounts in the f ...

FREE Sample Here - We can offer most test bank and

... A. do not reflect money amounts B. are not used by entities that manufacture products C. are records of increases and decreases in individual financial statement items D. are only used by large entities with many transactions ...

... A. do not reflect money amounts B. are not used by entities that manufacture products C. are records of increases and decreases in individual financial statement items D. are only used by large entities with many transactions ...

Accounts Receivable

... note. A promissory note is a written promise to pay a specified amount of money on demand or at a definite time. Promissory notes may be used 1. when individuals and companies lend or borrow money, 2. when amount of transaction and credit period exceed normal limits, or 3. in settlement of accounts ...

... note. A promissory note is a written promise to pay a specified amount of money on demand or at a definite time. Promissory notes may be used 1. when individuals and companies lend or borrow money, 2. when amount of transaction and credit period exceed normal limits, or 3. in settlement of accounts ...

Chapter 3 - Bellevue College

... Should companies accrue for environmental cleanup costs as liabilities on their financial statements? YES: As more states impose laws holding companies responsible, and as more courts levy pollution-related fines, it becomes increasingly likely that companies will have to pay large amounts in the f ...

... Should companies accrue for environmental cleanup costs as liabilities on their financial statements? YES: As more states impose laws holding companies responsible, and as more courts levy pollution-related fines, it becomes increasingly likely that companies will have to pay large amounts in the f ...

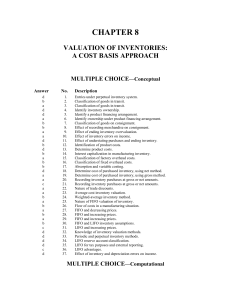

chapter 8 - Csulb.edu

... Which of the following statements is not valid as it applies to inventory costing methods? a. If inventory quantities are to be maintained, part of the earnings must be invested (plowed back) in inventories when FIFO is used during a period of rising prices. b. LIFO tends to smooth out the net incom ...

... Which of the following statements is not valid as it applies to inventory costing methods? a. If inventory quantities are to be maintained, part of the earnings must be invested (plowed back) in inventories when FIFO is used during a period of rising prices. b. LIFO tends to smooth out the net incom ...

Preparing and Using Financial Accounting`s Reports

... invented, the lists of resources and sources were now connected to each other. Now a balance sheet of the modern kind could be prepared. Double-entry bookkeeping, which might be seen as a pretty humdrum sort of activity, turns out to have a solid conceptual basis and a long and important history. On ...

... invented, the lists of resources and sources were now connected to each other. Now a balance sheet of the modern kind could be prepared. Double-entry bookkeeping, which might be seen as a pretty humdrum sort of activity, turns out to have a solid conceptual basis and a long and important history. On ...

A The framework of uniform chart of accounts

... correct operating results of certain period (or periods), correct accounting entries should be made at the beginning and end of the period (or periods). Sales and income of a certain period should be matched with the cost and expenses incurred, to generate them. In order to show costs and expenses a ...

... correct operating results of certain period (or periods), correct accounting entries should be made at the beginning and end of the period (or periods). Sales and income of a certain period should be matched with the cost and expenses incurred, to generate them. In order to show costs and expenses a ...

APPTICATION OF THE AUDIT PROCESS TO OTHER CYCTES

... - Ten typical accounts involved in the acquisition and payment cycle are shown by T accounts in Figure 18-1. For simplicity,^we show only the control accounts for the three major categories of expenses used by most companies. For each control account, examples of the subsidiary expense accounts are ...

... - Ten typical accounts involved in the acquisition and payment cycle are shown by T accounts in Figure 18-1. For simplicity,^we show only the control accounts for the three major categories of expenses used by most companies. For each control account, examples of the subsidiary expense accounts are ...

Accounting for Receivables

... Tasanee was the accounts receivable clerk for a large non-profit foundation that provided performance and exhibition space for the performing and visual arts. Her responsibilities included activities normally assigned to an accounts receivable clerk, such as recording revenues from various sources t ...

... Tasanee was the accounts receivable clerk for a large non-profit foundation that provided performance and exhibition space for the performing and visual arts. Her responsibilities included activities normally assigned to an accounts receivable clerk, such as recording revenues from various sources t ...

Fund - McGraw Hill Higher Education - McGraw

... entities. b. The FASB was created in 1972 and sets standards for governmental units. c. The Blue Book contains financial accounting standards for privately held governmental agencies and companies. d. The GASB is responsible for setting standards for state and local governments but not the federal g ...

... entities. b. The FASB was created in 1972 and sets standards for governmental units. c. The Blue Book contains financial accounting standards for privately held governmental agencies and companies. d. The GASB is responsible for setting standards for state and local governments but not the federal g ...

Guidance on the Determination of Realised Profits and

... With the exception of this Introduction, the Accounting Bulletin follows closely the text and paragraph numbering of TECH 01/09 to the extent applicable to Hong Kong, without any further amendment. Where whole paragraphs have been deleted as a result of the above modifications (for example, where UK ...

... With the exception of this Introduction, the Accounting Bulletin follows closely the text and paragraph numbering of TECH 01/09 to the extent applicable to Hong Kong, without any further amendment. Where whole paragraphs have been deleted as a result of the above modifications (for example, where UK ...

chapter 4 solutions version 1

... adjusted trial balance provides a second check in the model equalities (primarily Debits = Credits). It also provides data in a form convenient for further processing. 10. Closing entries are made at the end of the accounting period to transfer the balances in the temporary income statement accounts ...

... adjusted trial balance provides a second check in the model equalities (primarily Debits = Credits). It also provides data in a form convenient for further processing. 10. Closing entries are made at the end of the accounting period to transfer the balances in the temporary income statement accounts ...

General Ledger Overview

... You can create journal entries from existing standard journals or posted journals, and create multiple standard journals for each source journal. You can also allocate an amount from one account to another based on a predefined allocation. Any journal entered, but not yet updated, can be displayed a ...

... You can create journal entries from existing standard journals or posted journals, and create multiple standard journals for each source journal. You can also allocate an amount from one account to another based on a predefined allocation. Any journal entered, but not yet updated, can be displayed a ...

Unit 1 Consignment - ICAI Knowledge Gateway

... treated as part of the cost of purchase for valuing inventories on hand. That is why in the case given above, inventories has been valued ignoring godown rent and insurance. (Sometimes an examination problem states only that the consignor’s expenses amounted to such and such amount and that consigne ...

... treated as part of the cost of purchase for valuing inventories on hand. That is why in the case given above, inventories has been valued ignoring godown rent and insurance. (Sometimes an examination problem states only that the consignor’s expenses amounted to such and such amount and that consigne ...

Principles before standards | Information for Better

... Reporting Faculty through its Information for Better Markets thought leadership programme. In considering how best to tackle current problems it can be useful to look back and see what solutions were adopted in the past. This can both open our eyes to different ways of looking at things and help us ...

... Reporting Faculty through its Information for Better Markets thought leadership programme. In considering how best to tackle current problems it can be useful to look back and see what solutions were adopted in the past. This can both open our eyes to different ways of looking at things and help us ...

Assignment 1 is compulsory and due

... worked, materials used etc) that has been collected from different departments of entity cost recording – cost accounting system is part of basic accounting system of entity which gathers accounting info used for both management and financial accounting. Info needed is taken from various source do ...

... worked, materials used etc) that has been collected from different departments of entity cost recording – cost accounting system is part of basic accounting system of entity which gathers accounting info used for both management and financial accounting. Info needed is taken from various source do ...

File

... transactions to retailers. Banks usually charge the retailer a transaction fee for each debit card and a fee that averages 3.5% of the credit card sale. In both types of transaction the retailer’s bank will wait until the end of the day and make a deposit for the full day’s transactions. Fees for ba ...

... transactions to retailers. Banks usually charge the retailer a transaction fee for each debit card and a fee that averages 3.5% of the credit card sale. In both types of transaction the retailer’s bank will wait until the end of the day and make a deposit for the full day’s transactions. Fees for ba ...

Edward P. Moxey

Edward Preston Moxey, Jr. (Oct. 2, 1881 - April 6, 1943 ) was an American accountant, and the first Professor of Accounting at the Wharton School of Finance and Commerce at the University of Pennsylvania. He is known for his early works on cost keeping in factories, which describe the elementary principles of cost accounting.