4.2.2 Standard Costing - College of Education and External Studies

... According to Arora (1995), cost control techniques aims at improving efficiently by controlling and reducing costs to the lowest profitable figure. If the selling price remains constant, the reduction of costs involved results in a greater profit. When the commodities produced are sold, cost control ...

... According to Arora (1995), cost control techniques aims at improving efficiently by controlling and reducing costs to the lowest profitable figure. If the selling price remains constant, the reduction of costs involved results in a greater profit. When the commodities produced are sold, cost control ...

Accounting for Current Liabilities

... Reproduction or translation of this work beyond that permitted in Section 117 of the 1976 United States Copyright Act without the express written permission of the copyright owner is unlawful. Request for further information should be addressed to the Permissions Department, John Wiley & Sons, Inc. ...

... Reproduction or translation of this work beyond that permitted in Section 117 of the 1976 United States Copyright Act without the express written permission of the copyright owner is unlawful. Request for further information should be addressed to the Permissions Department, John Wiley & Sons, Inc. ...

UNIVERSITY OF WATERLOO School of Accounting and Finance

... 23. During 2008, Blue Corporation incurred operating expenses amounting to $100,000, of which $75,000 were paid in cash; the balance will be paid in January 2009. Transaction analysis of operating expenses for 2008, should reflect which of the following? A) decrease shareholders' equity, $75,000; de ...

... 23. During 2008, Blue Corporation incurred operating expenses amounting to $100,000, of which $75,000 were paid in cash; the balance will be paid in January 2009. Transaction analysis of operating expenses for 2008, should reflect which of the following? A) decrease shareholders' equity, $75,000; de ...

1. Paid rent for the next three months. 2. Paid property taxes that

... B. Amortization expense. C. Supplies expense. D. Cost of goods sold. 63. Dave's Duds reported cost of goods sold of $2,000,000 this year. The inventory account increased by $200,000 during the year to an ending balance of $400,000. What was the cost of merchandise that Dave purchased during the year ...

... B. Amortization expense. C. Supplies expense. D. Cost of goods sold. 63. Dave's Duds reported cost of goods sold of $2,000,000 this year. The inventory account increased by $200,000 during the year to an ending balance of $400,000. What was the cost of merchandise that Dave purchased during the year ...

Session 06 Production Costs

... 5.2: Short-Run Cost Curves and the Long-Run Planning Curve The appropriate size or scale for the new plant depends on how much the firm wants to produce. For example, if q is the desired rate of output in the long run, the average cost per unit is lowest with a small plant. If the desired output ra ...

... 5.2: Short-Run Cost Curves and the Long-Run Planning Curve The appropriate size or scale for the new plant depends on how much the firm wants to produce. For example, if q is the desired rate of output in the long run, the average cost per unit is lowest with a small plant. If the desired output ra ...

Chapter 7 short version

... Entities should assess at each statement of financial position date whether there is objective evidence that an account receivable may be impaired, and determine the amount of allowance that should be estimated based on the net realizable value or the discounted cash flow from such receivable TAX- w ...

... Entities should assess at each statement of financial position date whether there is objective evidence that an account receivable may be impaired, and determine the amount of allowance that should be estimated based on the net realizable value or the discounted cash flow from such receivable TAX- w ...

Preview Sample File

... financial statements. Retained earnings are the accumulated profits of the company that have not been distributed as dividends to shareholders and is available for future expansion. (Pg 22) a. b. c. *d. ...

... financial statements. Retained earnings are the accumulated profits of the company that have not been distributed as dividends to shareholders and is available for future expansion. (Pg 22) a. b. c. *d. ...

Using regulatory accounting in developing utility rate

... • GASB 62 (Regulated Operations) is the accounting tool used by public utilities where strictly following GASB does not necessarily meet their business model and the intent of certain accounting transactions that will benefit future periods or be charged against future periods. • All utilities are r ...

... • GASB 62 (Regulated Operations) is the accounting tool used by public utilities where strictly following GASB does not necessarily meet their business model and the intent of certain accounting transactions that will benefit future periods or be charged against future periods. • All utilities are r ...

CHAPTER 1 – Principles of Accounting

... For example, the capital projects fund (CPF) should not be established unless a capital project is planned. Once there is a firm commitment on the part of the board, the fund can be opened and revenue collected after the county treasurer is notified to establish the proper fund. Likewise, when all C ...

... For example, the capital projects fund (CPF) should not be established unless a capital project is planned. Once there is a firm commitment on the part of the board, the fund can be opened and revenue collected after the county treasurer is notified to establish the proper fund. Likewise, when all C ...

Chapter 8 powerpoint

... A trial balance prepared after the closing entries are posted Used to verify that debits still equal credits in the general ledger accounts after closing entries are made Only accounts with balances are included on this (unlike the Work Sheet which lists ALL accounts) so only assets, liabilities, an ...

... A trial balance prepared after the closing entries are posted Used to verify that debits still equal credits in the general ledger accounts after closing entries are made Only accounts with balances are included on this (unlike the Work Sheet which lists ALL accounts) so only assets, liabilities, an ...

Expenses

... What Is Accrual Accounting? Revenues and expenses are recorded in the periods in which they occur rather than in the periods when cash is received or paid Accrual accounting is accomplished by: Recording revenues when earned Recording expenses when incurred Adjusting the accounts ...

... What Is Accrual Accounting? Revenues and expenses are recorded in the periods in which they occur rather than in the periods when cash is received or paid Accrual accounting is accomplished by: Recording revenues when earned Recording expenses when incurred Adjusting the accounts ...

Apollo Revenue Cycle Flowchart

... form. The sales orders are then hand-carried to the credit manager, who is in the treasurer’s department. The credit manager checks the customers’ accounts receivable balances and other credit file information using a computer-based inquiry system. If credit is approved, the credit manager signs the ...

... form. The sales orders are then hand-carried to the credit manager, who is in the treasurer’s department. The credit manager checks the customers’ accounts receivable balances and other credit file information using a computer-based inquiry system. If credit is approved, the credit manager signs the ...

Chapter 3

... Explain what a journal is and how it helps in the recording process. Explain what a ledger is and how it helps in the recording process. Explain what posting is and how it helps in the recording process. Explain the purposes of a trial balance. ...

... Explain what a journal is and how it helps in the recording process. Explain what a ledger is and how it helps in the recording process. Explain what posting is and how it helps in the recording process. Explain the purposes of a trial balance. ...

Line 43a – Other Consulting and Contract

... approved by the board of the organization?” would encourage charities to adopt policies of getting board approval of Form 990. This action would be recorded in the board meeting minutes. IRS could also consider whether to require board approval of the Form 990 prior to submission. ...

... approved by the board of the organization?” would encourage charities to adopt policies of getting board approval of Form 990. This action would be recorded in the board meeting minutes. IRS could also consider whether to require board approval of the Form 990 prior to submission. ...

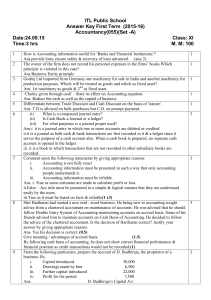

Ans key First term Acc XI

... What is a compound journal entry? (ii) Is Cash Book a Journal or a ledger? (iii) For what purposes is a journal proper used? Ans.i. it is a journal entry in which one or more accounts are debited or credited ii.it is a journal as both cash & bank transactions are first recorded in it & a ledger sinc ...

... What is a compound journal entry? (ii) Is Cash Book a Journal or a ledger? (iii) For what purposes is a journal proper used? Ans.i. it is a journal entry in which one or more accounts are debited or credited ii.it is a journal as both cash & bank transactions are first recorded in it & a ledger sinc ...

Document

... Inventory in process, July 1, 500 tons: Direct materials cost, 500 tons Conversion costs, 500 tons, 70% completed Total inventory in process, July 1 Direct materials cost for July, 1,000 tons Conversion costs for July Goods transferred to Casting in July, 1,100 tons Inventory in process, July 31, 40 ...

... Inventory in process, July 1, 500 tons: Direct materials cost, 500 tons Conversion costs, 500 tons, 70% completed Total inventory in process, July 1 Direct materials cost for July, 1,000 tons Conversion costs for July Goods transferred to Casting in July, 1,100 tons Inventory in process, July 31, 40 ...

Performance measures, pay and accountability: A Field Study in an

... choices are related to available performance measures in terms of their degree of sensitivity, precision and verifiablility. The more (less) that performance measures exhibit these characteristics the greater (lesser) the degree of delegation. There has also been much research examining the potenti ...

... choices are related to available performance measures in terms of their degree of sensitivity, precision and verifiablility. The more (less) that performance measures exhibit these characteristics the greater (lesser) the degree of delegation. There has also been much research examining the potenti ...

Transparency, accountability and economic policy for governments

... IPSAS or IPSAS based, with different approaches taken. The UK whole of government report uses IFRS, whereas the financial reports of the governments of Canada and the US use locally written public sector accounting standards. The Australian Government whole of government report uses the accounting s ...

... IPSAS or IPSAS based, with different approaches taken. The UK whole of government report uses IFRS, whereas the financial reports of the governments of Canada and the US use locally written public sector accounting standards. The Australian Government whole of government report uses the accounting s ...

The Accounting Information System

... The equation must be in balance after every transaction. For every Debit there must be a Credit. ...

... The equation must be in balance after every transaction. For every Debit there must be a Credit. ...

Counting Nonmarket, Ecological Public Goods: The Elements of a

... With quantities and prices clearly differentiated, one of the quantity/price sets can be held constant. Real GDP, for example, is a measure of quantity, in which prices are held constant over time. With prices held constant, movements in the output index meaningfully describe changes in quantity pro ...

... With quantities and prices clearly differentiated, one of the quantity/price sets can be held constant. Real GDP, for example, is a measure of quantity, in which prices are held constant over time. With prices held constant, movements in the output index meaningfully describe changes in quantity pro ...

2015 Accounting Solutions Higher Finalised Marking

... Business must be in the same industry (1) The results must be compared with firms of equal size or the ratios are meaningless (1) The results must be compared with the previous year’s ratios – the ratios on their own are meaningless (1) If being used for comparison purposes from year to year then th ...

... Business must be in the same industry (1) The results must be compared with firms of equal size or the ratios are meaningless (1) The results must be compared with the previous year’s ratios – the ratios on their own are meaningless (1) If being used for comparison purposes from year to year then th ...

Assets = Liabilities + Owner`s Equity

... Rp150,000,000. On September 3, Bengkel Agung Jaya accepted the seller’s counteroffer of Rp137,000,000. On October 20, the land was assessed at a value of Rp98,000,000 for property tax purposes. On December 4, Bengkel Agung Jaya was offered Rp160,000,000 for the land by a national retail chain. At wh ...

... Rp150,000,000. On September 3, Bengkel Agung Jaya accepted the seller’s counteroffer of Rp137,000,000. On October 20, the land was assessed at a value of Rp98,000,000 for property tax purposes. On December 4, Bengkel Agung Jaya was offered Rp160,000,000 for the land by a national retail chain. At wh ...

Document

... Expenses are the using up of assets or consuming of services to generate revenue. Rent Expense Salary Expense ...

... Expenses are the using up of assets or consuming of services to generate revenue. Rent Expense Salary Expense ...

Fixed Asset Policy

... assets from all funding sources. This policy applies to all property for which the College is accountable, including property that has been purchased with outside funding. It further covers the acquisition, valuation, donation, salvaging, record keeping, custodianship, use, transfer, loan, retiremen ...

... assets from all funding sources. This policy applies to all property for which the College is accountable, including property that has been purchased with outside funding. It further covers the acquisition, valuation, donation, salvaging, record keeping, custodianship, use, transfer, loan, retiremen ...

Edward P. Moxey

Edward Preston Moxey, Jr. (Oct. 2, 1881 - April 6, 1943 ) was an American accountant, and the first Professor of Accounting at the Wharton School of Finance and Commerce at the University of Pennsylvania. He is known for his early works on cost keeping in factories, which describe the elementary principles of cost accounting.