Chapter 9

... Chapter 10 uses the rate of return concepts covered in previous chapters, along with the concept of the weighted average cost of capital (WACC), to develop a corporate cost of capital for use in capital budgeting. We begin by describing the logic of the WACC, and why it should be used in capital bud ...

... Chapter 10 uses the rate of return concepts covered in previous chapters, along with the concept of the weighted average cost of capital (WACC), to develop a corporate cost of capital for use in capital budgeting. We begin by describing the logic of the WACC, and why it should be used in capital bud ...

Understanding Short-termism: the Role of Corporate Governance.

... despite the fact that it is clearly inferior from the long-term view. Here short-termism reflects a suboptimal decision made by a manager. Narayanan argues that managers may make decisions “sacrificing the long-term interests of the shareholders” and thus links short-termism to the agency problems b ...

... despite the fact that it is clearly inferior from the long-term view. Here short-termism reflects a suboptimal decision made by a manager. Narayanan argues that managers may make decisions “sacrificing the long-term interests of the shareholders” and thus links short-termism to the agency problems b ...

Middle Market Leverage Multiples

... Growing Private Capital Investment in Dermatology Practices Dermatology practices continue to attract private equity interest and outside capital investment. Beginning with Audax Group’s October 2011 recapitalization of Advanced Dermatology & Cosmetic Surgery, six dermatology platform investments h ...

... Growing Private Capital Investment in Dermatology Practices Dermatology practices continue to attract private equity interest and outside capital investment. Beginning with Audax Group’s October 2011 recapitalization of Advanced Dermatology & Cosmetic Surgery, six dermatology platform investments h ...

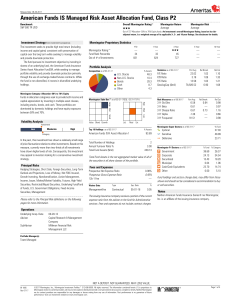

American Funds IS Managed Risk Asset Allocation Fund

... typically trade at higher multiples of current earnings than do other securities and may lose value if it appears their earnings expectations may not be met. Nondiversification A nondiversified investment, as defined under the Investment Act of 1940, may have an increased potential for loss because ...

... typically trade at higher multiples of current earnings than do other securities and may lose value if it appears their earnings expectations may not be met. Nondiversification A nondiversified investment, as defined under the Investment Act of 1940, may have an increased potential for loss because ...

how hedge funds are structured

... Funds must secure their loans with collateral to gain margin and execute trades. In turn, each broker (usually a large securities firm) uses its own risk matrix to determine how much to lend to each of its clients. Brokers are also subject to federal regulations, which act as indirect regulations on ...

... Funds must secure their loans with collateral to gain margin and execute trades. In turn, each broker (usually a large securities firm) uses its own risk matrix to determine how much to lend to each of its clients. Brokers are also subject to federal regulations, which act as indirect regulations on ...

Active Management Performance Cycles

... Fee assumptions are based on eVestment Alliance peer group median given the mandate size of $500 million for US large cap, core fixed income, and non-US large cap, and $200 million for US small cap and emerging markets. For clients with smaller mandates, the excess return would be reduced as a resul ...

... Fee assumptions are based on eVestment Alliance peer group median given the mandate size of $500 million for US large cap, core fixed income, and non-US large cap, and $200 million for US small cap and emerging markets. For clients with smaller mandates, the excess return would be reduced as a resul ...

Participating convertible preferred stock in venture capital

... My model works as follows. In the presence of PCP, the VC investing in a good firm would prefer not to convert. Although the IPO exit route suffers from greater informational asymmetry than the TS route, the latter does have the advantage of allowing VC not to convert. This means that a IPO is costl ...

... My model works as follows. In the presence of PCP, the VC investing in a good firm would prefer not to convert. Although the IPO exit route suffers from greater informational asymmetry than the TS route, the latter does have the advantage of allowing VC not to convert. This means that a IPO is costl ...

SPIVA® Institutional Scorecard–How Much Do Fees Affect the Active

... Scorecard. The scorecard measures the performance of actively managed equity funds, investing in domestic and international equity, as well as fixed income funds against their respective benchmarks. The University of Chicago’s Center for Research in Security Prices (CRSP) Survivor-Bias-Free US Mutua ...

... Scorecard. The scorecard measures the performance of actively managed equity funds, investing in domestic and international equity, as well as fixed income funds against their respective benchmarks. The University of Chicago’s Center for Research in Security Prices (CRSP) Survivor-Bias-Free US Mutua ...

proposed post card text - University of North Carolina

... available--a “deselected fund.” Beginning July 1, 2006, visit your ORP carrier’s website or contact your ORP carrier directly to redirect ORP future contributions and, if you so choose, reallocate your existing balances among the new investment funds. You will have until December 31, 2006, to redire ...

... available--a “deselected fund.” Beginning July 1, 2006, visit your ORP carrier’s website or contact your ORP carrier directly to redirect ORP future contributions and, if you so choose, reallocate your existing balances among the new investment funds. You will have until December 31, 2006, to redire ...

Beginning Governmental Accounting

... they are incurred. For a business invoicing for an item sold, or work done, the corresponding amount will appear in the accounting records even though no payment has yet been received - and debts owed by the business show as they are incurred, even though they may not be paid until much later. ...

... they are incurred. For a business invoicing for an item sold, or work done, the corresponding amount will appear in the accounting records even though no payment has yet been received - and debts owed by the business show as they are incurred, even though they may not be paid until much later. ...

chapter 2 estimating discount rates

... assumption we are making when we do this is that past returns are good indicators of future return distributions. When this assumption is violated, as is the case when the asset’s characteristics have changed significantly over time, the historical estimates may not be good measures of risk. Step 2: ...

... assumption we are making when we do this is that past returns are good indicators of future return distributions. When this assumption is violated, as is the case when the asset’s characteristics have changed significantly over time, the historical estimates may not be good measures of risk. Step 2: ...

Mutual fund intermediation, equity issues, and the real

... The mutual fund industry has grown immensely over the past 20 years. As the largest group of institutional investors, the industry’s total assets under management has grown from only $134 billion in 1980 to about $12 trillion at the end of 2007, accounting for approximately 33% of the total value of ...

... The mutual fund industry has grown immensely over the past 20 years. As the largest group of institutional investors, the industry’s total assets under management has grown from only $134 billion in 1980 to about $12 trillion at the end of 2007, accounting for approximately 33% of the total value of ...

Operating Endowment Fund - Second Presbyterian Church

... The primary mission of the Endowment Committee is to establish a platform for and to encourage planned giving support for activities of the Church in order to provide for the longevity, sustenance and on-going support of the Church. Establishment of this Endowment acknowledges the responsibility to ...

... The primary mission of the Endowment Committee is to establish a platform for and to encourage planned giving support for activities of the Church in order to provide for the longevity, sustenance and on-going support of the Church. Establishment of this Endowment acknowledges the responsibility to ...

trading hours euronext amsterdam, brussels, lisbon and

... Trading arrangements for the period 24 December 2013 to 3 January 2014 for the Amsterdam, Brussels, Lisbon and Paris Derivatives Markets are detailed below. The trading hours of the Amsterdam, Brussels, Lisbon and Paris Derivatives Markets during the period of 24 December 2013 to 3 January 2014, inc ...

... Trading arrangements for the period 24 December 2013 to 3 January 2014 for the Amsterdam, Brussels, Lisbon and Paris Derivatives Markets are detailed below. The trading hours of the Amsterdam, Brussels, Lisbon and Paris Derivatives Markets during the period of 24 December 2013 to 3 January 2014, inc ...

15-1 CHAPTER 15 Capital Structure: Basic Concepts

... changing the capital structure if and only if the value of the firm increases only to the benefits the debtholders. d. changing the capital structure if and only if the value of the firm increases although it decreases the stockholders' value. e. changing the capital structure if and only if the val ...

... changing the capital structure if and only if the value of the firm increases only to the benefits the debtholders. d. changing the capital structure if and only if the value of the firm increases although it decreases the stockholders' value. e. changing the capital structure if and only if the val ...

Mutual Funds - Cornerstone Retirement

... When someone buys a share of a publicly traded mutual fund, he or she is buying a share of an existing company that owns many individual investments, each with its own pre-existing tax liabilities. Whether or not that person ever sells those shares, he or she is responsible for a proportional share ...

... When someone buys a share of a publicly traded mutual fund, he or she is buying a share of an existing company that owns many individual investments, each with its own pre-existing tax liabilities. Whether or not that person ever sells those shares, he or she is responsible for a proportional share ...

Private Equity Investment in India: Efficiency vs Expansion

... Imperfect competition is important here to derive predictions for revenue total factor productivity. Foster et al. (2008) explain the distinction between revenue total factor productivity (TFPR) and quantity total factor productivity (TFPQ) and highlight the importance of distinguishing between the ...

... Imperfect competition is important here to derive predictions for revenue total factor productivity. Foster et al. (2008) explain the distinction between revenue total factor productivity (TFPR) and quantity total factor productivity (TFPQ) and highlight the importance of distinguishing between the ...

Investments

... The investment is initially recorded at cost. 2. It is subsequently reported at fair value. 3. Unrealized holding gains and losses are reported as a component of other comprehensive income. 4. Interest and dividend revenue, as well as realized gains and losses on sales, are included in net income fo ...

... The investment is initially recorded at cost. 2. It is subsequently reported at fair value. 3. Unrealized holding gains and losses are reported as a component of other comprehensive income. 4. Interest and dividend revenue, as well as realized gains and losses on sales, are included in net income fo ...

Accounting for transaction costs incurred in initial public offerings

... personnel while working on the IPO project may be incremental costs that are directly attributable to the IPO project. In practice, few internal costs will be regarded as “incremental costs that are directly attributable to an equity transaction” because the incremental part of the test will be diff ...

... personnel while working on the IPO project may be incremental costs that are directly attributable to the IPO project. In practice, few internal costs will be regarded as “incremental costs that are directly attributable to an equity transaction” because the incremental part of the test will be diff ...

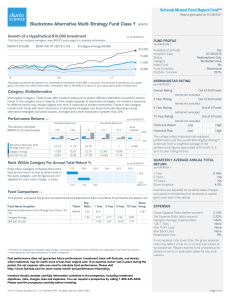

Blackstone Alternative Multi-Strategy Fund Class Y BXMYX

... the funds will fluctuate up to and after the target dates. There is no guarantee the funds will provide adequate income at or through retirement. Fixed income securities are subject to increased loss of principal during periods of rising interest rates. Lower rated securities are subject to greater ...

... the funds will fluctuate up to and after the target dates. There is no guarantee the funds will provide adequate income at or through retirement. Fixed income securities are subject to increased loss of principal during periods of rising interest rates. Lower rated securities are subject to greater ...

Private Placements, Regulatory Restrictions and Firm

... a sample of 164 private placements issued in the Indian capital markets during 2001-2009 and report empirical evidence largely consistent with the model. We also find that: (8) firms affiliated to business groups experience lower but statistically insignificantly different announcement period return ...

... a sample of 164 private placements issued in the Indian capital markets during 2001-2009 and report empirical evidence largely consistent with the model. We also find that: (8) firms affiliated to business groups experience lower but statistically insignificantly different announcement period return ...

Does Financial Constraint Affect Shareholder Taxes and the

... investors’ supply of capital as an increasing function of required expected return by investors, i.e., S rr 0 . To focus on the effect of changes in tax rate, we assume there is no asymmetric information. To illustrate the effect of taxes on investment income, we start with no taxation of inves ...

... investors’ supply of capital as an increasing function of required expected return by investors, i.e., S rr 0 . To focus on the effect of changes in tax rate, we assume there is no asymmetric information. To illustrate the effect of taxes on investment income, we start with no taxation of inves ...

NBER WORKING PAPER SERIES COST OF EQUITY CAPITAL?

... investors’ supply of capital as an increasing function of required expected return by investors, i.e., S rr 0 . To focus on the effect of changes in tax rate, we assume there is no asymmetric information. To illustrate the effect of taxes on investment income, we start with no taxation of inves ...

... investors’ supply of capital as an increasing function of required expected return by investors, i.e., S rr 0 . To focus on the effect of changes in tax rate, we assume there is no asymmetric information. To illustrate the effect of taxes on investment income, we start with no taxation of inves ...

Exempt Private Activity Bonds (PABs) from the Alternative Minimum

... significant changes after the presidential election. While some may emphasize the cost of an AMT exemption for PABs, the return on such an exemption far outweighs the expenditure. By making PABs more attractive to private investors, an AMT exemption can promote private and public sector involvement, ...

... significant changes after the presidential election. While some may emphasize the cost of an AMT exemption for PABs, the return on such an exemption far outweighs the expenditure. By making PABs more attractive to private investors, an AMT exemption can promote private and public sector involvement, ...

SMChap010 wo homework

... Most corporations first raise money by selling stock to the founders of the business and their friends and family. As the equity financing needs of the corporation grow, companies prepare a business plan and seek outside investment from “angel” investors and venture capital firms. Angel investors ar ...

... Most corporations first raise money by selling stock to the founders of the business and their friends and family. As the equity financing needs of the corporation grow, companies prepare a business plan and seek outside investment from “angel” investors and venture capital firms. Angel investors ar ...

Private equity in the 2000s

Private equity in the 2000s relates to one of the major periods in the history of private equity and venture capital. Within the broader private equity industry, two distinct sub-industries, leveraged buyouts and venture capital experienced growth along parallel although interrelated tracks.The development of the private equity and venture capital asset classes has occurred through a series of boom and bust cycles since the middle of the 20th century. As the 20th century ended, so, too, did the dot-com bubble and the tremendous growth in venture capital that had marked the previous five years. In the wake of the collapse of the dot-com bubble, a new ""Golden Age"" of private equity ensued, as leveraged buyouts reach unparalleled size and the private equity firms achieved new levels of scale and institutionalization, exemplified by the initial public offering of the Blackstone Group in 2007.