Babson Capital Management presentation

... • Global growth below trend – U.S., Euro zone, China and Japan expected to grow below long term average rate • Central bank intervention in markets – Fed, ECB, BOE and BOJ balance sheets total nearly $9 trillion • Extended low rate environment – major developed economy policy rates at all-time lows ...

... • Global growth below trend – U.S., Euro zone, China and Japan expected to grow below long term average rate • Central bank intervention in markets – Fed, ECB, BOE and BOJ balance sheets total nearly $9 trillion • Extended low rate environment – major developed economy policy rates at all-time lows ...

WORKING CAPITAL FINANCING PREFERENCES: THE CASE OF

... overdrafts, own funds/savings, loans from family or friends, and equity funding. However, non-traditional sources of finance also exist that entrepreneurs can use in the financing of their businesses; these have been described by many researchers as bootstrapping finance. Working capital is a signif ...

... overdrafts, own funds/savings, loans from family or friends, and equity funding. However, non-traditional sources of finance also exist that entrepreneurs can use in the financing of their businesses; these have been described by many researchers as bootstrapping finance. Working capital is a signif ...

File ch21 Type: Multiple Choice 1. Which of the following is NOT one

... b) A middle-aged parent needs to accumulate funds for college and retirement, so he seeks safer, less lucrative investments. c) A person approaching retirement finds he has little or no retirement assets, so he shifts into riskier investments to build up retirement assets. d) A retired person needs ...

... b) A middle-aged parent needs to accumulate funds for college and retirement, so he seeks safer, less lucrative investments. c) A person approaching retirement finds he has little or no retirement assets, so he shifts into riskier investments to build up retirement assets. d) A retired person needs ...

ESG - Mondrian Investment Partners

... Across all of Mondrian’s equity investment products, the research process is driven by extensive, bottom-up fundamental company analysis which includes a comprehensive program of meeting with representatives from current and prospective holdings. We believe that the value of any equity security is e ...

... Across all of Mondrian’s equity investment products, the research process is driven by extensive, bottom-up fundamental company analysis which includes a comprehensive program of meeting with representatives from current and prospective holdings. We believe that the value of any equity security is e ...

Recuperation and repair

... before investing. Share values and investment returns for the Funds will fluctuate. The performance data provided assumes reinvestment of distributions and does not take into account sales or fees (excludes Asset Management Service Portfolios), redemption, distribution or income taxes payable by any ...

... before investing. Share values and investment returns for the Funds will fluctuate. The performance data provided assumes reinvestment of distributions and does not take into account sales or fees (excludes Asset Management Service Portfolios), redemption, distribution or income taxes payable by any ...

Credit Suisse Mid-Year Survey of Hedge Fund Investor Sentiment

... recycle that capital to other hedge fund managers rather than other asset classes (9% reported being undecided as to where to allocate the recycled capital). Looking ahead, 76% of US investors said that they would likely make allocations to hedge funds during the second half of the year. 86% of APAC ...

... recycle that capital to other hedge fund managers rather than other asset classes (9% reported being undecided as to where to allocate the recycled capital). Looking ahead, 76% of US investors said that they would likely make allocations to hedge funds during the second half of the year. 86% of APAC ...

Determinants of Firm`s Financial Leverage: A Critical

... leverage is negatively related to production fle xibi lity but positively related to investment flexibility. In this context, the author argued that production flexibility can increase debt capacity by allowing a firm to adjust its factor intensity, product mix, or production level to changing marke ...

... leverage is negatively related to production fle xibi lity but positively related to investment flexibility. In this context, the author argued that production flexibility can increase debt capacity by allowing a firm to adjust its factor intensity, product mix, or production level to changing marke ...

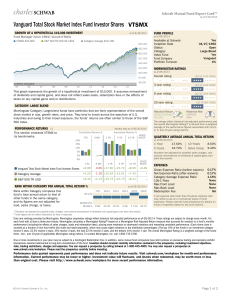

Vanguard Total Stock Market Index Fund Investor Shares

... Data and rankings provided by Morningstar. Morningstar proprietary ratings reflect historical risk-adjusted performance as of 09/30/14. These ratings are subject to change every month. For each fund with at least a three-year history, Morningstar calculates a Morningstar Rating™ based on a Morningst ...

... Data and rankings provided by Morningstar. Morningstar proprietary ratings reflect historical risk-adjusted performance as of 09/30/14. These ratings are subject to change every month. For each fund with at least a three-year history, Morningstar calculates a Morningstar Rating™ based on a Morningst ...

III.11 Guidelines on Spread Requirements

... aggregation manner for the purposes of section 2(1A) of Schedule 1 to the ...

... aggregation manner for the purposes of section 2(1A) of Schedule 1 to the ...

UPE client letter

... For UPEs arising between 16 December 2009 and 30 June 2010 affected trusts and private companies had until 30 June 2011 to either invest the subsisting UPE in an appropriate asset or enter into a loan arrangement covered under Options 1 and 2. If a separate investment is made in these circumstances, ...

... For UPEs arising between 16 December 2009 and 30 June 2010 affected trusts and private companies had until 30 June 2011 to either invest the subsisting UPE in an appropriate asset or enter into a loan arrangement covered under Options 1 and 2. If a separate investment is made in these circumstances, ...

Telstra Financial and Economic Profit Analysis

... investment spend. In 1999 Telstra’s cash outflows for investments were AUD112m. 2000 investment outflows were five times this. 2001 was five times again at AUD3.2bn/USD1.6bn. Total capital expenditure outflows have risen from AUD4.4bn in 1999 to AUD7.6bn in 2001 on a stable operating cashflow base o ...

... investment spend. In 1999 Telstra’s cash outflows for investments were AUD112m. 2000 investment outflows were five times this. 2001 was five times again at AUD3.2bn/USD1.6bn. Total capital expenditure outflows have risen from AUD4.4bn in 1999 to AUD7.6bn in 2001 on a stable operating cashflow base o ...

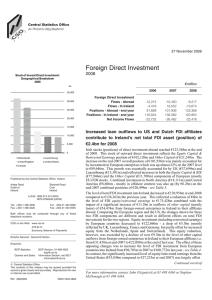

Foreign Direct Investment Annual (PDF 239KB)

... by the increased level of other capital outflows of €26,693m from foreign-owned (including US-owned) enterprises in Ireland to their US affiliates, i.e. more than treble the end-2007 Other Capital figure (€7,702m). This arose largely from other capital outflow transactions of €21,864m to US affiliat ...

... by the increased level of other capital outflows of €26,693m from foreign-owned (including US-owned) enterprises in Ireland to their US affiliates, i.e. more than treble the end-2007 Other Capital figure (€7,702m). This arose largely from other capital outflow transactions of €21,864m to US affiliat ...

2006 Financing Report

... • In the 42 nations participating in the 2006 GEM study, 208 million informal investors provided $600 billion to entrepreneurs’ businesses. • The average prevalence rate of informal investors among the adult population of the GEM nations is 4.0%, and the total sum of money that informal investors ...

... • In the 42 nations participating in the 2006 GEM study, 208 million informal investors provided $600 billion to entrepreneurs’ businesses. • The average prevalence rate of informal investors among the adult population of the GEM nations is 4.0%, and the total sum of money that informal investors ...

the role of gender in entrepreneur-investor relationships: a signaling

... how ventures are presented, as well as due to stereotypical prescriptions. Human capital-wise, the occupational segregation by industry and managerial level result in women having less of the types of experiences which are highly valued by investors. Further, women may have fewer professional role m ...

... how ventures are presented, as well as due to stereotypical prescriptions. Human capital-wise, the occupational segregation by industry and managerial level result in women having less of the types of experiences which are highly valued by investors. Further, women may have fewer professional role m ...

Emerging markets` alpha beta soup

... This document is intended only for Professional Clients and Financial Advisers in Continental Europe, for Professional Clients in Dubai, Guernsey, Ireland, the Isle of Man, Jersey and the UK; in Hong Kong for Professional Investors, in Japan for Qualified Institutional Investors; in Switzerland for ...

... This document is intended only for Professional Clients and Financial Advisers in Continental Europe, for Professional Clients in Dubai, Guernsey, Ireland, the Isle of Man, Jersey and the UK; in Hong Kong for Professional Investors, in Japan for Qualified Institutional Investors; in Switzerland for ...

ETF managed portfolio assets expected to

... EMPs predicted to account for 19% of MAS assets by 2020, up from 12.5% currently New York, March 1, 2016 – The ETF managed portfolio (EMP)* segment is expected to experience rapid growth in the coming years, driven by increased ETF adoption by multi-asset strategies (MAS) and the growth of the MAS c ...

... EMPs predicted to account for 19% of MAS assets by 2020, up from 12.5% currently New York, March 1, 2016 – The ETF managed portfolio (EMP)* segment is expected to experience rapid growth in the coming years, driven by increased ETF adoption by multi-asset strategies (MAS) and the growth of the MAS c ...

Case No. 8731phii - Maryland Public Service Commission

... Sharpe, Alexander and Bailey state that: “Over the last 30 years, dividend discount models (DDMs) have achieved broad acceptance among professional common stock investors. … Valuing common stock with a DDM technically requires an estimate of future dividends over an infinite time horizon. Given tha ...

... Sharpe, Alexander and Bailey state that: “Over the last 30 years, dividend discount models (DDMs) have achieved broad acceptance among professional common stock investors. … Valuing common stock with a DDM technically requires an estimate of future dividends over an infinite time horizon. Given tha ...

The Role of ,,Business Angels“ in the Financial Market

... meeting point of capital and good ideas in one place, and effective exchange of all information related to the promotion and development of innovative entrepreneurship. The methods used in the paper are quantitative and qualitative methods as well as methods of comparison of spatial and temporal fe ...

... meeting point of capital and good ideas in one place, and effective exchange of all information related to the promotion and development of innovative entrepreneurship. The methods used in the paper are quantitative and qualitative methods as well as methods of comparison of spatial and temporal fe ...

2015 Year-End Dermatology Update

... equity groups have typically gone below their typical investment size, aggregated several practices into one unified platform, or approached other private equity-backed practices for an acquisition. This strong demand has generated premium valuations for practices. Looking into 2016, Provident expec ...

... equity groups have typically gone below their typical investment size, aggregated several practices into one unified platform, or approached other private equity-backed practices for an acquisition. This strong demand has generated premium valuations for practices. Looking into 2016, Provident expec ...

MFS MERIDIAN ® FUNDS ― GLOBAL - fund

... other asset-backed securities, as well as investment grade and below investment grade debt instruments. The fund may invest a relatively large percentage of its assets in a small number of countries or a particular geographic region. The fund is expected to use derivatives extensively for hedging an ...

... other asset-backed securities, as well as investment grade and below investment grade debt instruments. The fund may invest a relatively large percentage of its assets in a small number of countries or a particular geographic region. The fund is expected to use derivatives extensively for hedging an ...

The Morningstar® Diversified Alternatives IndexSM

... Contact Us [email protected] Americas +1 312 384 -3735 Europe/Middle East/Africa ...

... Contact Us [email protected] Americas +1 312 384 -3735 Europe/Middle East/Africa ...

discount rates

... Survivorship Bias: Using historical data from the U.S. equity markets over the twentieth century does create a sampling bias. After all, the US economy and equity markets were among the most successful of the global economies that you could have invested in early in the ...

... Survivorship Bias: Using historical data from the U.S. equity markets over the twentieth century does create a sampling bias. After all, the US economy and equity markets were among the most successful of the global economies that you could have invested in early in the ...

The New Theory of Foreign Direct Investment: Merging micro

... given the increasing returns to firm scale and the cost of shipping exports, some firms from each country will be able to profit from investing abroad. Just as Krugman 1979 (with an endogenous markup) has a scale effect from increasing market size and Krugman 1980 (with a constant CES-based markup) ...

... given the increasing returns to firm scale and the cost of shipping exports, some firms from each country will be able to profit from investing abroad. Just as Krugman 1979 (with an endogenous markup) has a scale effect from increasing market size and Krugman 1980 (with a constant CES-based markup) ...

NBER WORKING THEY WANT TO REDUCE HOUSING EQUITY Steven

... of the predetermined ratio is a way to control directly for Seterogeneity; otherwise it would be concentrated to a greater extent in the disturbance term. Because the estimation procedure does not integrate over possible values of desired housing equity, given the right-hand variables in equation (1 ...

... of the predetermined ratio is a way to control directly for Seterogeneity; otherwise it would be concentrated to a greater extent in the disturbance term. Because the estimation procedure does not integrate over possible values of desired housing equity, given the right-hand variables in equation (1 ...

High Yield Bonds in a Rising Rate Environment

... lost 4.6%. High grade corporates had a positive return too, but well behind high yield’s 27.1%. The seven months between December 2008 and June 2009 were among the most prosperous ever for high yield investors, with a total return of 30.6% despite the 189 basis point rise in the rate on the 10-year ...

... lost 4.6%. High grade corporates had a positive return too, but well behind high yield’s 27.1%. The seven months between December 2008 and June 2009 were among the most prosperous ever for high yield investors, with a total return of 30.6% despite the 189 basis point rise in the rate on the 10-year ...

Private equity in the 2000s

Private equity in the 2000s relates to one of the major periods in the history of private equity and venture capital. Within the broader private equity industry, two distinct sub-industries, leveraged buyouts and venture capital experienced growth along parallel although interrelated tracks.The development of the private equity and venture capital asset classes has occurred through a series of boom and bust cycles since the middle of the 20th century. As the 20th century ended, so, too, did the dot-com bubble and the tremendous growth in venture capital that had marked the previous five years. In the wake of the collapse of the dot-com bubble, a new ""Golden Age"" of private equity ensued, as leveraged buyouts reach unparalleled size and the private equity firms achieved new levels of scale and institutionalization, exemplified by the initial public offering of the Blackstone Group in 2007.