Materials

... However, with perhaps the exception of the Great Depression, the current period is unprecedented in its severity of impact on the economy in general and specifically on institutions of higher education, both public and private. Governor Kaine has responded to state revenue shortfalls totaling $7.1 b ...

... However, with perhaps the exception of the Great Depression, the current period is unprecedented in its severity of impact on the economy in general and specifically on institutions of higher education, both public and private. Governor Kaine has responded to state revenue shortfalls totaling $7.1 b ...

what should a financial market dealer licence

... Even from the corporate finance origination stand point; ...

... Even from the corporate finance origination stand point; ...

Public –Private Partnerships A New Catalyst for Economic

... Transportation projects are also considered a public good, which makes them less attractive to private investors, except when the projects are supported by a high number of guarantees; they are also extremely expensive in terms of initial capital. However, as long-term investments with a stable, dep ...

... Transportation projects are also considered a public good, which makes them less attractive to private investors, except when the projects are supported by a high number of guarantees; they are also extremely expensive in terms of initial capital. However, as long-term investments with a stable, dep ...

View PDF - Dolphin Capital Investors

... the most innovative high-end hotel companies in the world. Its name is synonymous with luxury, elegant design, the highest standards of service and environmental awareness. Aman currently operates 24 of the world’s most elite boutique hotels spread over five continents. Aman Resorts has collected ov ...

... the most innovative high-end hotel companies in the world. Its name is synonymous with luxury, elegant design, the highest standards of service and environmental awareness. Aman currently operates 24 of the world’s most elite boutique hotels spread over five continents. Aman Resorts has collected ov ...

January 2012

... Says Will Goodhart, chief executive of CFA UK: “Investor sentiment has shifted in the last quarter, with a proportion of investment professionals changing their views on three of the five asset classes covered in CFA UK’s research. Expectations that central banks may delay interest rate rises, given ...

... Says Will Goodhart, chief executive of CFA UK: “Investor sentiment has shifted in the last quarter, with a proportion of investment professionals changing their views on three of the five asset classes covered in CFA UK’s research. Expectations that central banks may delay interest rate rises, given ...

Reinvestment Behavior of Large Repatriating Firms

... and dividends) in 2005 is $103.3. Thus, with respect to these largest 29 repatriators, at least 51% of the amounts repatriated cannot have been spent on shareholder payouts during 2005.2 To my knowledge, I am the first to make this point, and it stands in contrast to a common interpretation of the ...

... and dividends) in 2005 is $103.3. Thus, with respect to these largest 29 repatriators, at least 51% of the amounts repatriated cannot have been spent on shareholder payouts during 2005.2 To my knowledge, I am the first to make this point, and it stands in contrast to a common interpretation of the ...

3.56 MB - Financial System Inquiry

... The PFA welcomes the introduction of the mFunds platform by the ASX and believes the concept should be extended to the creation of a trading platform for interests in unlisted property funds. The mFunds platform provides investors with the ability to apply for and redeem units in managed funds throu ...

... The PFA welcomes the introduction of the mFunds platform by the ASX and believes the concept should be extended to the creation of a trading platform for interests in unlisted property funds. The mFunds platform provides investors with the ability to apply for and redeem units in managed funds throu ...

US Equity International Equity Real Estate Aggregate Bond

... Step 3 Revisit the Emergency Fund – building it to an amount equal to 6-12 months worth of living expenses. Step 2 Pay off High Interest Rate (credit card type) Debt – using the “debt snowball” (paying off smallest balance account first) or concentrating on the highest rate debt first – whichever pr ...

... Step 3 Revisit the Emergency Fund – building it to an amount equal to 6-12 months worth of living expenses. Step 2 Pay off High Interest Rate (credit card type) Debt – using the “debt snowball” (paying off smallest balance account first) or concentrating on the highest rate debt first – whichever pr ...

1 Quarterly Statistical Release March 2010, N° 40 This release and

... Total net assets of UCITS increased by 2.8 percent in the fourth quarter to reach EUR 5,299 billion at end of 2009. Equity funds experienced the strongest asset increase (EUR 98 billion or 7 percent). Balanced and bond funds also saw their assets increase by 4 percent and 3 percent, respectively. On ...

... Total net assets of UCITS increased by 2.8 percent in the fourth quarter to reach EUR 5,299 billion at end of 2009. Equity funds experienced the strongest asset increase (EUR 98 billion or 7 percent). Balanced and bond funds also saw their assets increase by 4 percent and 3 percent, respectively. On ...

Press release / 1 November 2011

... Dubai, United Arab Emirates: The Vontobel Group is establishing a Private Banking presence in Dubai with the aim of providing service and advice directly to wealthy private clients in the region. Through a team of specialists, the independent wealth and asset manager and leading Swiss provider of fi ...

... Dubai, United Arab Emirates: The Vontobel Group is establishing a Private Banking presence in Dubai with the aim of providing service and advice directly to wealthy private clients in the region. Through a team of specialists, the independent wealth and asset manager and leading Swiss provider of fi ...

Competition for Investment: Best Practice in Investor Targeting

... FDI promotion is a sales business. What we are selling are locationspecific investment propositions and products. We are selling to senior decision-makers in multinational companies and investment multipliers. The “numbers game” as it is commonly known is an expensive and inefficient way of developi ...

... FDI promotion is a sales business. What we are selling are locationspecific investment propositions and products. We are selling to senior decision-makers in multinational companies and investment multipliers. The “numbers game” as it is commonly known is an expensive and inefficient way of developi ...

Working in partnership with financial intermediaries

... Our discretionary services Managed portfolio solutions Our risk rated models offer a fully transparent portfolio provided via a variety of marketleading platforms and wrappers. With six models, including an income option, there is a solution to suit most risk appetites. Portfolios will provide expo ...

... Our discretionary services Managed portfolio solutions Our risk rated models offer a fully transparent portfolio provided via a variety of marketleading platforms and wrappers. With six models, including an income option, there is a solution to suit most risk appetites. Portfolios will provide expo ...

A CRITICAL ANALYSIS OF INVESTMENT OPTIONS IN NIGERIA

... This refers to land and improvements and the rights to own or use them (Harwood, 1980). Real property as an investment is made up of interest and rights on land which can be compared with stocks and shares. Property generally is a profitable investment option and they are considered as much secured ...

... This refers to land and improvements and the rights to own or use them (Harwood, 1980). Real property as an investment is made up of interest and rights on land which can be compared with stocks and shares. Property generally is a profitable investment option and they are considered as much secured ...

The EFFECTS of THE IAS/IFRS ADOPTION in EUROPE on the

... significant risk factor. It is therefore unlikely that this approach would provide a powerful test of the hypothesis stated in this research. The second approach is based on the assumption that investors demand a higher expected return for taking additional systematic risk. Following the CAPM or an ...

... significant risk factor. It is therefore unlikely that this approach would provide a powerful test of the hypothesis stated in this research. The second approach is based on the assumption that investors demand a higher expected return for taking additional systematic risk. Following the CAPM or an ...

What if crowdfunding becomes the leading source of finance for

... promises to be a big year for crowdfunding in terms of the role it may play in getting entrepreneurial ventures off the ground. What might that world look like if it became the leading source of finance for companies starting out? To that end, one has to better understand the phenomenon and its ra ...

... promises to be a big year for crowdfunding in terms of the role it may play in getting entrepreneurial ventures off the ground. What might that world look like if it became the leading source of finance for companies starting out? To that end, one has to better understand the phenomenon and its ra ...

Dividends and Dividend Policy

... • IPOs and underpricing • New equity sales and the value of the firm • The cost of issuing securities • Issuing long-term debt Copyright © 2011 McGraw-Hill Australia Pty Ltd PPTs t/a Essentials of Corporate Finance 2e by Ross et al. Slides prepared by David E. Allen and Abhay K. Singh ...

... • IPOs and underpricing • New equity sales and the value of the firm • The cost of issuing securities • Issuing long-term debt Copyright © 2011 McGraw-Hill Australia Pty Ltd PPTs t/a Essentials of Corporate Finance 2e by Ross et al. Slides prepared by David E. Allen and Abhay K. Singh ...

control premiums and the eeeectiveness oe corporate governance

... some adjustments (discussed below), this difference can be used as a measure of the private benefits for the controlling shareholder. In a study that was published this year in the Journal of Finance, we used the Barclay and Holdemess method to infer the value of private benefits of control in compa ...

... some adjustments (discussed below), this difference can be used as a measure of the private benefits for the controlling shareholder. In a study that was published this year in the Journal of Finance, we used the Barclay and Holdemess method to infer the value of private benefits of control in compa ...

information circular: northern lights fund trust iv

... assigning Inspire Impact Scores to a company. The 400 securities with the highest Inspire Impact Scores are included in the Index and are equally weighted. The Index will typically be comprised of 50% domestic securities, 40% in developed foreign securities, and 10% in emerging market securities. Th ...

... assigning Inspire Impact Scores to a company. The 400 securities with the highest Inspire Impact Scores are included in the Index and are equally weighted. The Index will typically be comprised of 50% domestic securities, 40% in developed foreign securities, and 10% in emerging market securities. Th ...

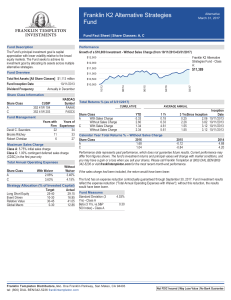

Franklin K2 Alternative Strategies Fund Fact Sheet

... The Fund may shift allocations among strategies at any time. Further, K2 may determine in its sole discretion to not allocate to one or more of the strategies and/or to add new strategies. Accordingly the above target allocations are presented for illustrative purposes only, and should not be viewed ...

... The Fund may shift allocations among strategies at any time. Further, K2 may determine in its sole discretion to not allocate to one or more of the strategies and/or to add new strategies. Accordingly the above target allocations are presented for illustrative purposes only, and should not be viewed ...

BSL 4: Corporate finance

... money in the firm’s bank account, liquid securities) that firm receives during specified period, less cash or equivalents that firm pays during same period • Earnings: revenues - expenses, based on accounting rules • Why do cashflow & earnings differ? – Revenues are recorded when a sale is made (not ...

... money in the firm’s bank account, liquid securities) that firm receives during specified period, less cash or equivalents that firm pays during same period • Earnings: revenues - expenses, based on accounting rules • Why do cashflow & earnings differ? – Revenues are recorded when a sale is made (not ...

An analysis of financial ratios for the Oslo Stock

... issues and the financial reports of listed companies may provide us with information about cyclical developments. Second, this information provides indications of general developments in the Norwegian corporate sector. This is important for banks’ earnings and therefore for financial stability. Thir ...

... issues and the financial reports of listed companies may provide us with information about cyclical developments. Second, this information provides indications of general developments in the Norwegian corporate sector. This is important for banks’ earnings and therefore for financial stability. Thir ...

Download attachment

... where they are located, what types of products will be offered, whether to actively manage or follow an index, the practical application of Shariah principles in fund management, and how the fund will be distributed to the Islamic community. All of these questions raise issues, the successful addre ...

... where they are located, what types of products will be offered, whether to actively manage or follow an index, the practical application of Shariah principles in fund management, and how the fund will be distributed to the Islamic community. All of these questions raise issues, the successful addre ...

Fundamentals of Corporate Finance, 2/e

... This problem may be overcome by identifying a “comparable” company with publicly traded stock that is in the same business and that has a similar amount of debt. When a good comparable company cannot be identified, it is sometimes possible to use an average of the betas for the public firms in the s ...

... This problem may be overcome by identifying a “comparable” company with publicly traded stock that is in the same business and that has a similar amount of debt. When a good comparable company cannot be identified, it is sometimes possible to use an average of the betas for the public firms in the s ...

Baltic Property Fund Quarterly Report April - June 2016

... construction are built-to-suit as this sector enjoys the highest demand in the market. A slight growth in rental rates and minor decrease in vacancy were observed in 2Q 2016. Total known investment volume in Estonia for the period JanMay 2016 amounted to EUR 180m. The most notable deals in 2Q 2016 i ...

... construction are built-to-suit as this sector enjoys the highest demand in the market. A slight growth in rental rates and minor decrease in vacancy were observed in 2Q 2016. Total known investment volume in Estonia for the period JanMay 2016 amounted to EUR 180m. The most notable deals in 2Q 2016 i ...

Outsourced investment management: what it offers the long

... utsourced investment management can be a confusing term. The implications of the concept have certainly changed over the years, and many different kinds of firms now tout their outsourcing capabilities. However, their services can vary markedly from each other, leading to valid questions about what ...

... utsourced investment management can be a confusing term. The implications of the concept have certainly changed over the years, and many different kinds of firms now tout their outsourcing capabilities. However, their services can vary markedly from each other, leading to valid questions about what ...

Private equity in the 2000s

Private equity in the 2000s relates to one of the major periods in the history of private equity and venture capital. Within the broader private equity industry, two distinct sub-industries, leveraged buyouts and venture capital experienced growth along parallel although interrelated tracks.The development of the private equity and venture capital asset classes has occurred through a series of boom and bust cycles since the middle of the 20th century. As the 20th century ended, so, too, did the dot-com bubble and the tremendous growth in venture capital that had marked the previous five years. In the wake of the collapse of the dot-com bubble, a new ""Golden Age"" of private equity ensued, as leveraged buyouts reach unparalleled size and the private equity firms achieved new levels of scale and institutionalization, exemplified by the initial public offering of the Blackstone Group in 2007.