Monetizing Medical Device Research

... successful fledgling medical devices.vii Devices aimed at treating diseases with broad commercial appeal (e.g., cardiac stents) are much more likely to receive funding than those which are aimed at rare diseases (e.g., braces for patients suffering from elephantitis). A corollary to this dynamic is ...

... successful fledgling medical devices.vii Devices aimed at treating diseases with broad commercial appeal (e.g., cardiac stents) are much more likely to receive funding than those which are aimed at rare diseases (e.g., braces for patients suffering from elephantitis). A corollary to this dynamic is ...

Mandatory IFRS adoption and the cost of equity

... have a significantly lower cost of capital (Hail & Leuz, 2006). The belief that higher mandate disclosure of accounting information by firms should reduce its cost of equity capital has led many countries to adopt International Financial Reporting Standards (IFRS) as a new and unique set of accounti ...

... have a significantly lower cost of capital (Hail & Leuz, 2006). The belief that higher mandate disclosure of accounting information by firms should reduce its cost of equity capital has led many countries to adopt International Financial Reporting Standards (IFRS) as a new and unique set of accounti ...

Foreign Market Servicing Strategies In The NAFTA Area

... adoption of policies of deregulation means that more aggressive management policies can introduce increasing flexibility to labour management. In capital markets, the rising number and greater capitalisation of stock markets creates an increasing threat of hostile acquisition, which in turn puts mor ...

... adoption of policies of deregulation means that more aggressive management policies can introduce increasing flexibility to labour management. In capital markets, the rising number and greater capitalisation of stock markets creates an increasing threat of hostile acquisition, which in turn puts mor ...

Click here to add a title

... • Highly imperfect credit markets seem to be a factor behind high informality rates. • The evidence suggests that improved access to credit has led to higher formalization. • Much of reduction of informality takes place via “within” effects: holding relative sector size constant, firms within each s ...

... • Highly imperfect credit markets seem to be a factor behind high informality rates. • The evidence suggests that improved access to credit has led to higher formalization. • Much of reduction of informality takes place via “within” effects: holding relative sector size constant, firms within each s ...

lifeplan icfs financial advice satisfaction index

... 3. Investors with lower wealth levels are typically younger, higher proportion of female investors, and have been taking advice for a shorter period of time. This cohort had a statistically significant lower perception of technical abilities of their adviser. The cohort with the highest levels of i ...

... 3. Investors with lower wealth levels are typically younger, higher proportion of female investors, and have been taking advice for a shorter period of time. This cohort had a statistically significant lower perception of technical abilities of their adviser. The cohort with the highest levels of i ...

AVI Goodhart Press Announcement 30 SEP 2015

... Goodhart is an asset management group, based in London and founded in 2009. It offers a range of differentiated investment strategies, managed in-house or in partnership with affiliated boutiques. Goodhart partners with genuinely investment-driven teams – teams with the passion, patience and special ...

... Goodhart is an asset management group, based in London and founded in 2009. It offers a range of differentiated investment strategies, managed in-house or in partnership with affiliated boutiques. Goodhart partners with genuinely investment-driven teams – teams with the passion, patience and special ...

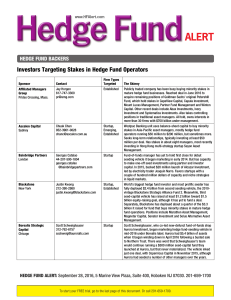

Hedge Fund Backers

... After buying Jefferies in 2013, formed asset-management division that seeks to acquire stakes in new and emerging alternativeinvestment businesses including hedge fund managers and commodity-trading advisors. In 2014, reached deal with former SAC Capital executive Sol Kumin to seed his Folger Hill A ...

... After buying Jefferies in 2013, formed asset-management division that seeks to acquire stakes in new and emerging alternativeinvestment businesses including hedge fund managers and commodity-trading advisors. In 2014, reached deal with former SAC Capital executive Sol Kumin to seed his Folger Hill A ...

Al Beit Al Mali Fund Al-Beit Al Mali Fund

... weight causing a decline in other country weights. Also, important to note that the market’s -4.8% decline on the last trading day was driven by some last minute aggressive selling. Most of this was reversed on the following day. Looking at individual stocks, we find those with index weight decrease ...

... weight causing a decline in other country weights. Also, important to note that the market’s -4.8% decline on the last trading day was driven by some last minute aggressive selling. Most of this was reversed on the following day. Looking at individual stocks, we find those with index weight decrease ...

Identifying Speculative Bubbles: A Two-Pillar Surveillance

... closely monitor the number of property seminars held by finance companies targeting retail investors. ...

... closely monitor the number of property seminars held by finance companies targeting retail investors. ...

REIT Stocks: An Underutilized Portfolio Diversifier

... Relative weight % = percentage points. Average fund REIT weights are simple averages of the percentage of total assets invested in REIT securities for all equity funds categorized within the nine primary Morningstar U.S. equity fund categories that have reported holdings. Index weightings represente ...

... Relative weight % = percentage points. Average fund REIT weights are simple averages of the percentage of total assets invested in REIT securities for all equity funds categorized within the nine primary Morningstar U.S. equity fund categories that have reported holdings. Index weightings represente ...

Opportunistic Deep-Value Investing: A Multi-Asset Class

... historical valuation levels when compared to itself, peer asset classes, or the broader market. 2. The potential investment is cheap relative to future prospects; i.e., it has a reasonable chance of returning to an average valuation level. 3. The potential investment offers a prospective return that ...

... historical valuation levels when compared to itself, peer asset classes, or the broader market. 2. The potential investment is cheap relative to future prospects; i.e., it has a reasonable chance of returning to an average valuation level. 3. The potential investment offers a prospective return that ...

Financial Visibility and the Decision to Go Private

... and ultimately the franchise value of the firm. Chung and Jo (1996) document a positive relationship between analyst coverage and a firm’s value (measured by Tobin’s q). Boot, Gopalan, and Thakor (2005) develop a theoretical model contrasting the costs and benefits of public ownership. Their model ...

... and ultimately the franchise value of the firm. Chung and Jo (1996) document a positive relationship between analyst coverage and a firm’s value (measured by Tobin’s q). Boot, Gopalan, and Thakor (2005) develop a theoretical model contrasting the costs and benefits of public ownership. Their model ...

American Equity Investment Life

... To allow you greater flexibility in utilizing our interest crediting methods, American Equity’s offers 11 index choices and 1 fixed value choice. The annuity structure allows for annual transfer between different values. A Transfer of Values (TOV) letter and form are sent one month prior to the Cont ...

... To allow you greater flexibility in utilizing our interest crediting methods, American Equity’s offers 11 index choices and 1 fixed value choice. The annuity structure allows for annual transfer between different values. A Transfer of Values (TOV) letter and form are sent one month prior to the Cont ...

Passive Global Equity (inc. UK) Fund

... International Equities North American Equities Europe ex UK Equities Global Emerging Market Equities Japanese Equities UK Equities Asia Pacific Equities Middle East & African Equities ...

... International Equities North American Equities Europe ex UK Equities Global Emerging Market Equities Japanese Equities UK Equities Asia Pacific Equities Middle East & African Equities ...

The Predictive Ability of the Bond-Stock Earnings Yield Differential

... Exhibits A1–A10 in the appendix show the following for each of the five countries: stock market corrections (declines of more than 10%) and their durations, as well as the results of the strategies in terms of percent of time in the stock market, mean log return, standard deviation, Sharpe ratio, me ...

... Exhibits A1–A10 in the appendix show the following for each of the five countries: stock market corrections (declines of more than 10%) and their durations, as well as the results of the strategies in terms of percent of time in the stock market, mean log return, standard deviation, Sharpe ratio, me ...

CH 3 Objectives

... *How to compute and interpret important financial ratios *The determinants of a firm’s profitability and growth *Understand the problems and pitfalls in financial statement analysis ...

... *How to compute and interpret important financial ratios *The determinants of a firm’s profitability and growth *Understand the problems and pitfalls in financial statement analysis ...

JPMorgan Large Cap Growth Fund

... The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than original cost. Cur ...

... The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than original cost. Cur ...

High Yield Bond Basics

... performance at the issuing company. High Yield bonds are generally less sensitive to interest rate risk and, over the long run, tend to offer equity-like returns with less volatility. Who issues high yield bonds? The high yield market was created in the 1980s, when companies with below-investment gr ...

... performance at the issuing company. High Yield bonds are generally less sensitive to interest rate risk and, over the long run, tend to offer equity-like returns with less volatility. Who issues high yield bonds? The high yield market was created in the 1980s, when companies with below-investment gr ...

Why expenses matter - Charles Schwab Investment Management

... Investment returns will fluctuate and are subject to market volatility, so that an investor’s shares, when redeemed or sold, may be worth more or less than their original cost. Unlike mutual funds, shares of ETFs are not individually redeemable directly with the ETF. ETF shares are bought and sold a ...

... Investment returns will fluctuate and are subject to market volatility, so that an investor’s shares, when redeemed or sold, may be worth more or less than their original cost. Unlike mutual funds, shares of ETFs are not individually redeemable directly with the ETF. ETF shares are bought and sold a ...

Growth Strategies to Expand Role of Capital Market

... Historical trends suggest that underlying growth in equity market capitalisation is largely driven by long-term economic and corporate earnings growth. At the baseline level, it is projected that the size of equity market capitalisation will double from RM1.2 trillion to RM2.4 trillion by 2020 – bas ...

... Historical trends suggest that underlying growth in equity market capitalisation is largely driven by long-term economic and corporate earnings growth. At the baseline level, it is projected that the size of equity market capitalisation will double from RM1.2 trillion to RM2.4 trillion by 2020 – bas ...

NBER WORKING PAPER SERIES RATIONAL ASSET PRICES George M. Constantinides 8826

... In Section I, I re-examine the statistical evidence on the size of the unconditional mean of the aggregate equity return and premium. First, I draw a sharp distinction between conditional, short-term forecasts of the mean equity return and premium and estimates of the unconditional mean. I argue tha ...

... In Section I, I re-examine the statistical evidence on the size of the unconditional mean of the aggregate equity return and premium. First, I draw a sharp distinction between conditional, short-term forecasts of the mean equity return and premium and estimates of the unconditional mean. I argue tha ...

Adverse Selection and Risk Aversion in Capital Markets

... the types of financial contracts allowed in the economy, namely debt and equity. This restricted contract space is sometimes justified by the existence of transaction costs that would prevent general mechanisms that were contingent on truthful announcements about the hidden characteristics of the pr ...

... the types of financial contracts allowed in the economy, namely debt and equity. This restricted contract space is sometimes justified by the existence of transaction costs that would prevent general mechanisms that were contingent on truthful announcements about the hidden characteristics of the pr ...

What can company - Bank of England

... onset of the financial crisis. One is the sharp decline in corporate bond yields, particularly since the beginning of the Bank’s programme of asset purchases — ‘quantitative easing’ (QE) — in 2009. There are at least two ways in which QE affects corporate bond yields. One is directly, via the Bank’s ...

... onset of the financial crisis. One is the sharp decline in corporate bond yields, particularly since the beginning of the Bank’s programme of asset purchases — ‘quantitative easing’ (QE) — in 2009. There are at least two ways in which QE affects corporate bond yields. One is directly, via the Bank’s ...

Disentangling returns from hedged international equities

... or because of tactical asset allocation changes in the currency composition of the underlying assets. In addition, hedges are generally rebalanced around certain tolerance levels. These factors will create divergence between the hedge returns and the fx impact on the underlying assets. In addition d ...

... or because of tactical asset allocation changes in the currency composition of the underlying assets. In addition, hedges are generally rebalanced around certain tolerance levels. These factors will create divergence between the hedge returns and the fx impact on the underlying assets. In addition d ...

ASB Investment Funds World Fixed Interest Fund Update

... weighted sum of the asset class market index return, where the target investment mix and asset class market indices are each as described in the Statement of Investment Policy and Objectives (SIPO). Additional information about the market index is available on the offer register at http://www.busine ...

... weighted sum of the asset class market index return, where the target investment mix and asset class market indices are each as described in the Statement of Investment Policy and Objectives (SIPO). Additional information about the market index is available on the offer register at http://www.busine ...

Private equity in the 2000s

Private equity in the 2000s relates to one of the major periods in the history of private equity and venture capital. Within the broader private equity industry, two distinct sub-industries, leveraged buyouts and venture capital experienced growth along parallel although interrelated tracks.The development of the private equity and venture capital asset classes has occurred through a series of boom and bust cycles since the middle of the 20th century. As the 20th century ended, so, too, did the dot-com bubble and the tremendous growth in venture capital that had marked the previous five years. In the wake of the collapse of the dot-com bubble, a new ""Golden Age"" of private equity ensued, as leveraged buyouts reach unparalleled size and the private equity firms achieved new levels of scale and institutionalization, exemplified by the initial public offering of the Blackstone Group in 2007.