* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download CH 3 Objectives

Conditional budgeting wikipedia , lookup

Investment fund wikipedia , lookup

Financialization wikipedia , lookup

Negative gearing wikipedia , lookup

Investment management wikipedia , lookup

Household debt wikipedia , lookup

Mark-to-market accounting wikipedia , lookup

Global saving glut wikipedia , lookup

Private equity wikipedia , lookup

Business valuation wikipedia , lookup

Securitization wikipedia , lookup

Early history of private equity wikipedia , lookup

Private equity in the 2000s wikipedia , lookup

Private equity secondary market wikipedia , lookup

Private equity in the 1980s wikipedia , lookup

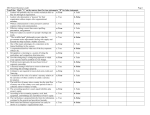

* Chapter 3 *How to standardize financial statements for comparison purposes *How to compute and interpret important financial ratios *The determinants of a firm’s profitability and growth *Understand the problems and pitfalls in financial statement analysis * * *Almost Everyone in the Business World * Bankers – analyze loans and cash flow * Portfolio Managers – projections of stock prices * Marketing Managers – market penetration and impacts to profitability * Human Resources – compensation analysis * Senior Management – corporate strategy * Sales Managers – commission rates on sales * Internal Financial Analysts – profitability analysis * Customer Service Managers – efficiency ratios 3 • Why does the firm want/need to borrow funds? • What is the firm’s capital structure? How leveraged are they? • How will they pay it back? What kind of cash flows are being generated by operations? * • How has the firm performed/what are future expectations? • How much RISK is inherent in the capital structure? • What are the expected returns from the firm? • What is firm’s competitive position? * * Need all info creditors and investors need PLUS: * What operating areas have contributed to success and which have not? * What are strengths/weaknesses of company’s financial position? * What changes are indicated to improve future performance? * * Financial statements (and notes) * Annual Report * 10K and 10Q reports filed with SEC (EDGAR) * Computerized data bases * Info on industry norms/ratios * Info on particular companies/industries/mutual funds * Websites * * Common size financial statements * Financial ratios * Trend analysis * Industry comparisons * * Firm A Firm B Sales 2531456.24 4561234.87 COGS 784564.54 1556456.24 1746891.70 3004778.63 Gr. Profit * Firm A Sales COGS Gr. Profit Firm B 2,531,456 4,561,234 784,564 1,556,456 1,746,891 3,004,778 * Firm A Sales COGS Gr. Profit Firm B 2,531,456 100% 4,561,234 100% 784,564 31% 1,556,456 34% 1,746,891 69% 3,004,778 66% * * Common-Size Balance Sheets * All accounts = percent of total assets (%TA) * Common-Size Income Statements * All line items = percent of sales (%SLS) * Standardized statements are useful for: * Comparing financial information year-to-year * Comparing companies of different sizes, particularly within the same industry * * Diameter * Earth 12,756 KM * Sun 1,392,000 KM * Mass * Earth 1 * Sun 330,000 * * * * Ratios need to be compared to something * Time-Trend Analysis * How the firm’s performance is changing through time * Internal and external uses * Peer Group Analysis * Compare to similar companies or within industries * SIC and NAICS codes * Liquidity ratios or Short-term solvency * Financial leverage ratios or Long-term solvency ratios * Asset management or Turnover ratios * Profitability ratios * Market value ratios * * Profitability Ratios * Measure the overall effectiveness of the firm’s management. 22 * Profitability Ratios Gross Profit Margin = Gross Profit Sales How effective is the firm at generating revenue in excess of its cost of goods sold? 23 Balance Sheet Excalibur Corporation Cash $175 Accounts Receivable 430 Inventories 625 Current Assets $1,230 Plant & Equipment $2,500 Less:Acc. Depr. (1,200) Net Fixed Assets $1,300 Total Assets $2,530 Income Statement Excalibur Corporation Sales $1,450 Cost of Goods Sold 875 Gross Profit $575 Operating Expenses 45 Depreciation 200 Net Operating Income $330 Interest Expense 60 Income Before Taxes $270 Taxes (40%) 108 Net Income $162 Common Dividends Paid 100 Addition to Retained Earnings $62 Gross Profit Margin = Accounts Payable $115 S-T Notes Payable 115 Current Liabilities $230 Bonds $600 Owner’s Equity Common Stock $300 Capital in Excess of Par 600 Retained Earnings 800 Total Owners’ Equity $1,700 Total Liabilities and Owners Equity $2,530 Gross Profit Sales Gross Profit Margin = $575 $1,450 = 39.7% Balance Sheet Excalibur Corporation Cash $175 Accounts Receivable 430 Inventories 625 Current Assets $1,230 Plant & Equipment $2,500 Less:Acc. Depr. (1,200) Net Fixed Assets $1,300 Total Assets $2,530 Income Statement Excalibur Corporation Sales $1,450 Cost of Goods Sold 875 Gross Profit $575 Operating Expenses 45 Depreciation 200 Operating Income $330 Interest Expense 60 Income Before Taxes $270 Taxes (40%) 108 Net Income $162 Common Dividends Paid 100 Addition to Retained Earnings $62 Accounts Payable $115 S-T Notes Payable 115 Current Liabilities $230 Long-term Debt $600 Owner’s Equity Common Stock $300 Capital in Excess of Par 600 Retained Earnings 800 Total Owners’ Equity $1,700 Total Liabilities and Owners Equity $2,530 Operating Operating Income Profit = Sales Margin Oper. Profit Margin = $330 $1,450 = 22.8% * Profitability Ratios Note: Net Income equals Earnings Available to CS when there is no preferred stock. Net Profit Margin or Profit Margin = Net Income Sales How much net profit is being generated from each dollar of sales? 26 Balance Sheet Excalibur Corporation Assets Liabilities Cash $175 Accounts Payable $115 Accounts Receivable 430 S-T Notes Payable 115 Inventories 625 Current Liabilities $230 Current Assets $1,230 Long-term Debt $600 Plant & Equipment $2,500 Owner’s Equity Less:Acc. Depr. (1,200) Common Stock $300 Net Fixed Assets $1,300 Capital in Excess of Par 600 Total Assets $2,530 Retained Earnings 800 Total Owners’ Equity $1,700 Income Statement Total Liabilities and Excalibur Corporation Owners Equity $2,530 Sales $1,450 Cost of Goods Sold Gross Profit Operating Expenses Depreciation Operating Income Interest Expense Income Before Taxes Taxes (40%) Net Income Common Dividends Paid Addition to Retained Earnings 875 $575 45 200 $330 60 $270 108 $162 100 $62 Net Profit Margin = Net Profit Margin = Net Income Sales $162 $1,450 = 11.2% 27 * Profitability Ratios Net Income Total Assets Return on Assets = How effectively is the firm generating net income from its assets ? 28 Balance Sheet Excalibur Corporation Assets Liabilities Cash $175 Accounts Payable $115 Accounts Receivable 430 S-T Notes Payable 115 Inventories 625 Current Liabilities $230 Current Assets $1,230 Long-term debt $600 Plant & Equipment $2,500 Owner’s Equity Less:Acc. Depr. (1,200) Common Stock $300 Net Fixed Assets $1,300 Capital in Excess of Par 600 Total Assets $2,530 Retained Earnings 800 Total Owners’ Equity $1,700 Total Liabilities and Income Statement Owners Equity $2,530 Excalibur Corporation Sales $1,450 Cost of Goods Sold 875 Gross Profit $575 Operating Expenses 45 Net Income Return on Depreciation 200 = Operating Income $330 Total Assets Assets Interest Expense 60 Income Before Taxes $270 Taxes (40) 108 $162 = 6.4% Net Income% $162 ROA = $2,530 Common Dividends Paid 100 29 Addition to Retained Earnings $62 * Profitability Ratios Net Income Equity Return on Equity = How well is the firm generating return to its equity providers? 30 Balance Sheet Excalibur Corporation Assets Liabilities Cash $175 Accounts Payable $115 Accounts Receivable 430 S-T Notes Payable 115 Inventories 625 Current Liabilities $230 Current Assets $1,230 Long-term Debt $600 Plant & Equipment $2,500 Owner’s Equity Less:Acc. Depr. (1,200) Common Stock $300 Net Fixed Assets $1,300 Capital in Excess of Par 600 Total Assets $2,530 Retained Earnings 800 Total Owners’ Equity $1,700 Income Statement Total Liabilities and Excalibur Corporation Owners Equity $2,530 Sales $1,450 Cost of Goods Sold Gross Profit Operating Expenses Depreciation Operating Income Interest Expense Income Before Taxes Taxes (40%) Net Income Common Dividends Paid Addition to Retained Earnings 875 $575 45 200 $330 60 $270 108 $162 100 $62 Return on Equity = ROE = $162 $1,700 Net Income Equity = 9.53% * Liquidity Ratios • Measure the ability of the firm to meet its short-term financial obligations. Current Assets Current Ratio = Current Liabilities Are there sufficient current assets to pay off current liabilities? What is the cushion of safety? 32 Balance Sheet Excalibur Corporation Assets Liabilities Cash $175 Accounts Payable $115 Accounts Receivable 430 S-T Notes Payable 115 Inventories 625 Current Liabilities $230 Current Assets $1,230 Long-term Debt $600 Plant & Equipment $2,500 Owner’s Equity Less:Acc. Depr. (1,200) Common Stock $300 Net Fixed Assets $1,300 Capital in Excess of Par 600 Total Assets $2,530 Retained Earnings 800 Total Owners’ Equity $1,700 Total Liabilities and Owners Equity $2,530 Current Ratio = Current Assets Current Liabilities Current Ratio = $1,230 = 5.35x $230 33 * Liquidity Ratios *Measure the ability of the firm to meet its short-term financial obligations. Quick Ratio = Current Assets - Inventory Current Liabilities What happens to the firm’s ability to repay current liabilities after what is usually the least liquid of the current assets is subtracted? 34 Balance Sheet Excalibur Corporation Assets Liabilities Cash $175 Accounts Payable $115 Accounts Receivable 430 S-T Notes Payable 115 Inventories 625 Current Liabilities $230 Current Assets $1,230 Long-term Debt $600 Plant & Equipment $2,500 Owner’s Equity Less:Acc. Depr. (1,200) Common Stock $300 Net Fixed Assets $1,300 Capital in Excess of Par 600 Total Assets $2,530 Retained Earnings 800 Total Owners’ Equity $1,700 Total Liabilities and Owners Equity $2,530 Quick Ratio = Current Assets - Inventory Current Liabilities Acid-Test Ratio = $1,230 -$625 = 2.63x $230 35 * Leverage Ratios • Measure the relative size of the firm’s debt load and the firm’s ability to pay off the debt. 36 * Debt Ratios Debt Ratio = Total Debt Total Assets What proportion of the firm’s assets is financed with debt? 37 Balance Sheet Excalibur Corporation Assets Liabilities Cash $175 Accounts Payable $115 Accounts Receivable 430 S-T Notes Payable 115 Inventories 625 Current Liabilities $230 Current Assets $1,230 Long-term Debt $600 Plant & Equipment $2,500 Owner’s Equity Less:Acc. Depr. (1,200) Common Stock $300 Net Fixed Assets $1,300 Capital in Excess of Par 600 Total Assets $2,530 Retained Earnings 800 Total Owners’ Equity $1,700 Income Statement Total Liabilities and Excalibur Corporation Owners Equity $2,530 Sales $1,450 Cost of Goods Sold Gross Profit Operating Expenses Depreciation Operating Income Interest Expense Income Before Taxes Taxes (40%) Net Income Common Dividends Paid Addition to Retained Earnings 875 $575 45 200 $330 60 $270 108 $162 100 $62 Debt Ratio = Total Debt Total Assets Debt Ratio = $230 + $600 = 33% $2,530 * Debt Ratios Times Interest Earned Ratio = Operating Income Interest Expense What is the firm’s ability to repay interest payments from its operating income? 39 Balance Sheet Excalibur Corporation Assets Liabilities Cash $175 Accounts Payable $115 Accounts Receivable 430 S-T Notes Payable 115 Inventories 625 Current Liabilities $230 Current Assets $1,230 Long-term Debt $600 Plant & Equipment $2,500 Owner’s Equity Less:Acc. Depr. (1,200) Common Stock $300 Net Fixed Assets $1,300 Capital in Excess of Par 600 Total Assets $2,530 Retained Earnings 800 Total Owners’ Equity $1,700 Income Statement Excalibur Corporation Total Liabilities and Sales $1,450 Owners Equity $2,530 Cost of Goods Sold 875 Gross Profit $575 Operating Expenses 45 Depreciation 200 Times Operating Income Operating Income $330 Interest = Interest Expense 60 Interest Expense Earned Ratio Income Before Taxes $270 Taxes (40%) 108 $330 Net Income $162 TIE Ratio = = 5.50x Common Dividends Paid 100 $60 Addition to Retained Earnings $62 40 * Debt Ratios Equity Multiplier = Total Assets Total Equity What is the firm’s investment in assets relative to it’s equity? 41 Balance Sheet Excalibur Corporation Assets Liabilities Cash $175 Accounts Payable $115 Accounts Receivable 430 S-T Notes Payable 115 Inventories 625 Current Liabilities $230 Current Assets $1,230 Long-term Debt $600 Plant & Equipment $2,500 Owner’s Equity Less:Acc. Depr. (1,200) Common Stock $300 Net Fixed Assets $1,300 Capital in Excess of Par 600 Total Assets $2,530 Retained Earnings 800 Total Owners’ Equity $1,700 Income Statement Excalibur Corporation Total Liabilities and Sales $1,450 Owners Equity $2,530 Cost of Goods Sold 875 Gross Profit $575 Operating Expenses 45 Depreciation 200 Equity Total Assets Operating Income $330 Multiplier = Interest Expense 60 Total Equity Income Before Taxes $270 Taxes (40%) 108 $2,530 Net Income $162 Eq Mult= Common Dividends Paid 100 $1,700 = 1.49x Addition to Retained Earnings $62 42 * Efficiency Ratios * Help assess how effectively the firm is using assets to generate sales. 43 * Efficiency Ratios 365 days Rec. turnover Days Sales in Receivables or Average Collection Period = How long does it take for the firm on average to collect its credit sales from customers? 44 Balance Sheet Excalibur Corporation Assets Liabilities Cash $175 Accounts Payable $115 Accounts Receivable 430 S-T Notes Payable 115 Inventories 625 Current Liabilities $230 Current Assets $1,230 Bonds $600 Plant & Equipment $2,500 Owner’s Equity Less:Acc. Depr. (1,200) Common Stock $300 Net Fixed Assets $1,300 Capital in Excess of Par 600 Total Assets $2,530 Retained Earnings 800 Total Owners’ Equity $1,700 Income Statement Total Liabilities and Excalibur Corporation Owners Equity $2,530 Sales $1,450 Cost of Goods Sold Gross Profit Operating Expenses Depreciation Operating Income Interest Expense Income Before Taxes Taxes (40%) Net Income Common Dividends Paid Addition to Retained Earnings 875 $575 45 200 $330 60 $270 108 $162 100 $62 Days’ sales in receivables DSR = 365 $1,450/430 365 days Rec turn = 108 days Days in a year * Efficiency Ratios Inventory Turnover Ratio = COGS Inventory Is inventory efficiently translating into sales for the firm? 46 Balance Sheet Excalibur Corporation Assets Liabilities Cash $175 Accounts Payable $115 Accounts Receivable 430 S-T Notes Payable 115 Inventories 625 Current Liabilities $230 Current Assets $1,230 Long-term Debt $600 Plant & Equipment $2,500 Owner’s Equity Less:Acc. Depr. (1,200) Common Stock $300 Net Fixed Assets $1,300 Capital in Excess of Par 600 Total Assets $2,530 Retained Earnings 800 Total Owners’ Equity $1,700 Income Statement Total Liabilities and Excalibur Corporation Owners Equity $2,530 Sales $1,450 Cost of Goods Sold Gross Profit Operating Expenses Depreciation Operating Income Interest Expense Income Before Taxes Taxes (40%) Net Income Common Dividends Paid Addition to Retained Earnings 875 $575 45 200 $330 60 $270 108 $162 100 $62 Inventory Turnover = Ratio Inventory Turnover = COGS Inventory $875 $625 = 1.4x * Efficiency Ratios Sales Fixed Asset Turnover Ratio = Net Fixed Assets How effective is the firm in using its fixed assets to help generate sales? 48 Balance Sheet Excalibur Corporation Assets Liabilities Cash $175 Accounts Payable $115 Accounts Receivable 430 S-T Notes Payable 115 Inventories 625 Current Liabilities $230 Current Assets $1,230 Long-term Debt $600 Plant & Equipment $2,500 Owner’s Equity Less:Acc. Depr. (1,200) Common Stock $300 Net Fixed Assets $1,300 Capital in Excess of Par 600 Total Assets $2,530 Retained Earnings 800 Total Owners’ Equity $1,700 Income Statement Total Liabilities and Excalibur Corporation Owners Equity $2,530 Sales $1,450 Cost of Goods Sold Gross Profit Operating Expenses Depreciation Operating Income Interest Expense Income Before Taxes Taxes (40%) Net Income Common Dividends Paid Addition to Retained Earnings 875 $575 45 200 $330 60 $270 108 $162 100 $62 Fixed Asset Turnover Ratio = Sales Net Fixed Assets Fixed Asset Turnover = $1,450 = 1.12x $1,300 * Efficiency Ratios Total Asset Turnover Ratio = Sales Total Assets How effective is the firm in using its overall assets to generate sales? 50 Balance Sheet Excalibur Corporation Assets Liabilities Cash $175 Accounts Receivable 430 Inventories 625 Current Assets $1,230 Plant & Equipment $2,500 Less:Acc. Depr. (1,200) Net Fixed Assets $1,300 Total Assets $2,530 Income Statement Excalibur Corporation Sales $1,450 Cost of Goods Sold 875 Gross Profit $575 Operating Expenses 45 Depreciation 200 Operating Income $330 Interest Expense 60 Income Before Taxes $270 Taxes (40%) 108 Net Income $162 Common Dividends Paid 100 Addition to Retained Earnings $62 Accounts Payable $115 S-T Notes Payable 115 Current Liabilities $230 Long-term Debt $600 Owner’s Equity Common Stock $300 Capital in Excess of Par 600 Retained Earnings 800 Total Owners’ Equity $1,700 Total Liabilities and Owners Equity $2,530 Total Asset Turnover = Total Asset Turnover = Sales Total Assets $1,450 $2,530 = 0.57x 51 * Market Value Ratios Price to Earnings Ratio = (PE) Price per Share Earnings per Share How much are investors willing to pay per dollar of earnings of the firm? (Indicator of investor’s attitudes toward future prospects of the firm and of the firm’s risk.) 52 Balance Sheet Excalibur Corporation Assets Liabilities Cash $175 Accounts Payable $115 Accounts Receivable 430 S-T Notes Payable 115 Inventories 625 Current Liabilities $230 Current Assets $1,230 Long-term Debt $600 Plant & Equipment $2,500 Owner’s Equity Less:Acc. Depr. (1,200) Common Stock $300 Net Fixed Assets $1,300 Capital in Excess of Par 600 Total Assets $2,530 Retained Earnings 800 Total Owners’ Equity $1,700 Income Statement Total Liabilities and Excalibur Corporation Owners Equity $2,530 Sales $1,450 Additional Info: 100 shares $20.00 per share Cost of Goods Sold Gross Profit Operating Expenses Depreciation Operating Income Interest Expense Income Before Taxes Taxes (40%) Net Income Common Dividends Paid Addition to Retained Earnings 875 $575 45 200 $330 60 $270 108 $162 100 $62 P/E = Ratio P/E ratio = Price/Share EPS $20 = 12.35x $162/100 53 * Market Value Ratios Market (price) to Book Ratio = Price per Share Book Value per Share How much are investors willing to pay per dollar of book value? 54 Additional Info: 100 shares $20 per share Balance Sheet Excalibur Corporation Assets Liabilities Cash $175 Accounts Receivable 430 Inventories 625 Current Assets $1,230 Plant & Equipment $2,500 Less:Acc. Depr. (1,200) Net Fixed Assets $1,300 Total Assets $2,530 Income Statement Excalibur Corporation Sales $1,450 Cost of Goods Sold 875 Gross Profit $575 Operating Expenses 45 Depreciation 200 Operating Income $330 Interest Expense 60 Income Before Taxes $270 Taxes (40%) 108 Net Income $162 Common Dividends Paid 100 Addition to Retained Earnings $62 Market to = Book M/B = Accounts Payable $115 S-T Notes Payable 115 Current Liabilities $230 Long-term Debt $600 Owner’s Equity Common Stock $300 Capital in Excess of Par 600 Retained Earnings 800 Total Owners’ Equity $1,700 Total Liabilities and Owners Equity $2,530 Price/Share Common Equity/ # shares $20 $1,700/100 = 1.18x * Market Value Ratios *Enterprise value = Total market value of the stock + Book value of all liabilities – Cash *EBITDA ratio = Enterprise value / EBITDA * EBITDA = EBIT + Depreciation & Amortization * * Dividend payout ratio (“1 – b”) = DPS / EPS = Cash dividends / Net income * Retention ratio (“b”) = (EPS – DPS) / EPS = (Addition to Retained Earnings) / Net income Summary of Excalibur Corporation Ratios Ratio Industry Excalibur Profitability Gross Profit Margin Operating Profit Margin Net Profit Margin Return on Assets Return on Equity 58 38% 20% 12% 9.0% 13.4% 40% 23% 11% 6.4% 9.5% Ratio Industry Liquidity Current Ratio Quick Ratio 5.00x 3.00x 59 Excalibur 5.35x 2.63x Ratio Industry Excalibur Debt Debt Ratio Times Interest Earned Equity Multiplier 60 35% 7.0x ?x 33% 5.5x 1.49x Ratio Industry Excalibur Asset Activity Avg. Collection Period Inventory Turnover Fixed Asset Turnover Total Asset Turnover 61 90 days 3.0x 1.0x 0.75x 108 days 1.4x 1.1x .57x Ratio Industry Excalibur Market Value PE Ratio Market to Book 18.0 5.3 62 12.4 4.2 * * * Ratio Analysis generally involves an examination of related ratios. * Comparison of these relationships over time helps to identify the company’s strengths and weaknesses. * Walmart ROE = 21% * Target ROE = 15% * Why is Walmart outperforming? 64 Return on Assets (ROA) Return on Assets Net Inc. Assets = Net x Profit Margin = Net Inc. Sales Total Asset Turnover x Sales Assets * Target Net Profit Asset Margin Turnover 4.0% 1.45 Wal-Mart 3.6% 2.40 Which would you prefer? * Return = on Equity Net Profit x Margin Net Inc. = Equity Net Inc. Sales Total x Asset Turnover x 67 Sales Assets Equity Multiplier x Assets Equity * Target Net Profit Asset ROA Margin Turnover 4.0% 1.45 5.8% Wal-Mart 3.6% 2.40 8.6% * Target Net Profit Margin 4.0% Wal-Mart 3.6% Asset Equity ROE Turnover Multiplier 1.45 2.5 15% 2.40 2.4 21% What is Target’s debt ratio? What debt ratio would Target need for ROE = 21%? *The DuPont approach is nice because it divides the firm into three tasks *expense management *(measured by the profit margin) *asset management *(measured by asset turnover) *debt management *(measured by the equity multiplier) Wal-Mart Sears Profit M. 4% 6% Ass.Turn. 3 1.5 ROA ? ? Eq. Mult. 1 2 ROE ? ? * Wal-Mart Sears Profit M. 4% 6% Ass.Turn. 3 1.5 ROA 12% 9% Eq. Mult. 1 2 ROE ? ? * Wal-Mart Sears Profit M. 4% 6% Ass.Turn. 3 1.5 ROA 12% 9% Eq. Mult. 1 2 ROE 12% 18% * * * Conglomerates * No readily available comparables * Global competitors * Different accounting procedures * Different fiscal year ends * Differences in capital structure * Seasonal variations and one-time events