ACCESS TO FINANCE OF CROATIAN SMEs

... enterprises in their start-up or the earliest development phases, because such enterprises usually do not posses assets worth at least as required amount of finance. Proof of further business opportunities is also a must. In order to finance a business, bank or other financial institutions require ...

... enterprises in their start-up or the earliest development phases, because such enterprises usually do not posses assets worth at least as required amount of finance. Proof of further business opportunities is also a must. In order to finance a business, bank or other financial institutions require ...

Paulson Confronts Goldman Fallout

... rating firms, and didn't do enough of their homework, investors say. The hedge-fund firm has a deadline next Friday for investors who want to withdraw money on June 30. Paulson allows most investors to pull out four times a year, but they need to give at least 60 days notice. Investors can cancel re ...

... rating firms, and didn't do enough of their homework, investors say. The hedge-fund firm has a deadline next Friday for investors who want to withdraw money on June 30. Paulson allows most investors to pull out four times a year, but they need to give at least 60 days notice. Investors can cancel re ...

Effect of Leverage on Performance of Non

... whereas decreases in leverage result in decreased return and risk (Imad, 2013). The debt level of different firms may be explained by the following factors. 2.2.1. Firm Size Firm size can either be measured by level of assets or magnitude of sales. Firm size was measured by natural logarithm of tota ...

... whereas decreases in leverage result in decreased return and risk (Imad, 2013). The debt level of different firms may be explained by the following factors. 2.2.1. Firm Size Firm size can either be measured by level of assets or magnitude of sales. Firm size was measured by natural logarithm of tota ...

Regulatory Notice 12-40

... Each member that sells a security in a non-public offering in reliance on an available exemption from registration under the Securities Act (“private placement”) must: (i) submit to FINRA, or have submitted on its behalf by a designated member, a copy of any private placement memorandum, term sheet ...

... Each member that sells a security in a non-public offering in reliance on an available exemption from registration under the Securities Act (“private placement”) must: (i) submit to FINRA, or have submitted on its behalf by a designated member, a copy of any private placement memorandum, term sheet ...

Download attachment

... ◊ Timing of Fundraising Needs. Any firm requiring additional funding in the near term is likely to face difficulties. As Exhibit 5 illustrates, the industry as a whole appears to have sufficient surplus funds, or dry powder. The median of dry powder as a proportion of total funds raised over the la ...

... ◊ Timing of Fundraising Needs. Any firm requiring additional funding in the near term is likely to face difficulties. As Exhibit 5 illustrates, the industry as a whole appears to have sufficient surplus funds, or dry powder. The median of dry powder as a proportion of total funds raised over the la ...

Regulatory Filings Refresher

... egulatory filings may not be the sexiest topic among compliance professionals. Even so, it is important to note that the U.S. Securities and Exchange Commission (“SEC” or “Commission”) has been giving them more attention of late. In September, for example, the Commission charged more than 30 individ ...

... egulatory filings may not be the sexiest topic among compliance professionals. Even so, it is important to note that the U.S. Securities and Exchange Commission (“SEC” or “Commission”) has been giving them more attention of late. In September, for example, the Commission charged more than 30 individ ...

Active Managers are Doing the Unexpected

... While it makes sense that large cap managers would have a tougher time beating the index given the heavy media and analyst coverage of large cap US stocks, this may not be cause for every large cap manager to update their LinkedIn profile. In fact, it may be a worthwhile exercise to consider why a g ...

... While it makes sense that large cap managers would have a tougher time beating the index given the heavy media and analyst coverage of large cap US stocks, this may not be cause for every large cap manager to update their LinkedIn profile. In fact, it may be a worthwhile exercise to consider why a g ...

impact on citizens` long term savings

... the iShares® exchange traded funds. BlackRock represents the interests of its clients by acting in every case as their agent. It is from this perspective that we engage on all matters of public policy. BlackRock supports policy changes and regulatory reform globally where it increases transparency, ...

... the iShares® exchange traded funds. BlackRock represents the interests of its clients by acting in every case as their agent. It is from this perspective that we engage on all matters of public policy. BlackRock supports policy changes and regulatory reform globally where it increases transparency, ...

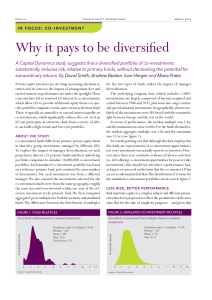

Why it pays to be diversified

... fees on the performance of primary funds. Figure 3 shows a side-by-side comparison of the return distributions of primary funds and simulated co-investment portfolios.The results show that, compared to primary funds, co-investment portfolio returns have a higher median and a fatter right tail. It al ...

... fees on the performance of primary funds. Figure 3 shows a side-by-side comparison of the return distributions of primary funds and simulated co-investment portfolios.The results show that, compared to primary funds, co-investment portfolio returns have a higher median and a fatter right tail. It al ...

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

... salary to be paid at a rate equal, on an annualized basis, to the highest annual salary (excluding any bonuses) in effect with respect to the Executive during the six-month period immediately preceding the termination date, and (ii) an aggregate amount equal to two times the target annual cash incen ...

... salary to be paid at a rate equal, on an annualized basis, to the highest annual salary (excluding any bonuses) in effect with respect to the Executive during the six-month period immediately preceding the termination date, and (ii) an aggregate amount equal to two times the target annual cash incen ...

Gideon I: the FTC equity strategy

... As promised, FTC’s trend-following fund-of-funds strategy has survived the crisis months on the world markets since 2008 much better in comparison with conventional equity funds. Since February 2009, FTC has been applying an additional longshort overlay in Gideon I. Read this issue of FTC.update to ...

... As promised, FTC’s trend-following fund-of-funds strategy has survived the crisis months on the world markets since 2008 much better in comparison with conventional equity funds. Since February 2009, FTC has been applying an additional longshort overlay in Gideon I. Read this issue of FTC.update to ...

28-2

... • The tax status of pension funds makes them favor assets with the largest spread between pretax and after-tax rates of return. • Pension funds make use of immunization. • Investing in equities occurs for both correct and wrong reasons. INVESTMENTS | BODIE, KANE, MARCUS ...

... • The tax status of pension funds makes them favor assets with the largest spread between pretax and after-tax rates of return. • Pension funds make use of immunization. • Investing in equities occurs for both correct and wrong reasons. INVESTMENTS | BODIE, KANE, MARCUS ...

2016 Preqin Global Real Estate Report

... As demonstrated by strong fundraising for opportunistic and value added funds in 2015 (see pages 31 and 32), there is considerable investor appetite for exposure to opportunities further up the risk/return spectrum. As shown in Fig. 5.11, there are many opportunities available to investors, with val ...

... As demonstrated by strong fundraising for opportunistic and value added funds in 2015 (see pages 31 and 32), there is considerable investor appetite for exposure to opportunities further up the risk/return spectrum. As shown in Fig. 5.11, there are many opportunities available to investors, with val ...

Emerging Markets – Income Opportunities

... This is a promotional document and as such the views contained herein are not to be taken as an advice or recommendation to buy or sell any investment or interest thereto. Reliance upon information in this material is at the sole discretion of the reader. Any research in this document has been obtai ...

... This is a promotional document and as such the views contained herein are not to be taken as an advice or recommendation to buy or sell any investment or interest thereto. Reliance upon information in this material is at the sole discretion of the reader. Any research in this document has been obtai ...

- PNC.com

... Ross Smotrich and Linda Tsai, Barclays, U.S. REITs: REITS 101, September 19, 2014. Equity Residential (EQR) owns or has an interest in more than 350 apartment communities in 11 states and the District of Columbia. ...

... Ross Smotrich and Linda Tsai, Barclays, U.S. REITs: REITS 101, September 19, 2014. Equity Residential (EQR) owns or has an interest in more than 350 apartment communities in 11 states and the District of Columbia. ...

NBER WORKING PAPER SERIES Kristin J. Forbes Working Paper 13908

... resident entities). 7 The USG data provides information on the stock of foreign holdings of U.S. equities and debt securities (both short- and long-term), and also includes reserves held by foreign official institutions. Significant penalties can be imposed for non-reporting, so compliance and data ...

... resident entities). 7 The USG data provides information on the stock of foreign holdings of U.S. equities and debt securities (both short- and long-term), and also includes reserves held by foreign official institutions. Significant penalties can be imposed for non-reporting, so compliance and data ...

newsletter - New York State Deferred Compensation Plan

... The principal value of the TRP Retirement Date Trusts is not guaranteed at any time, including at or after the target date, which is the approximate year an investor plans to retire (assumed to be age 65) and likely stop making new investments in the Trust. If an investor plans to retire significant ...

... The principal value of the TRP Retirement Date Trusts is not guaranteed at any time, including at or after the target date, which is the approximate year an investor plans to retire (assumed to be age 65) and likely stop making new investments in the Trust. If an investor plans to retire significant ...

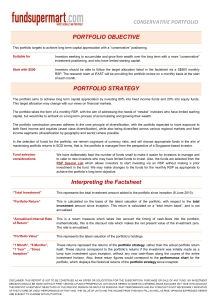

portfolio objective

... We have deliberately kept the number of funds small to make it easier for investors to manage and to cater to new investors who may have limited funds to invest. Also, the funds are selected from the RSP Special List which allows investors to start investing via an RSP without making a prior investm ...

... We have deliberately kept the number of funds small to make it easier for investors to manage and to cater to new investors who may have limited funds to invest. Also, the funds are selected from the RSP Special List which allows investors to start investing via an RSP without making a prior investm ...

CI LifeCycle Portfolios

... and recommendations are critical underpinnings of the program. SSgA, a global leader in institutional asset management, has more than US$2.3 trillion* in assets under management, including US$30 billion in target date solutions in North America as of December 31, 2014. CI Investment Consulting’s phi ...

... and recommendations are critical underpinnings of the program. SSgA, a global leader in institutional asset management, has more than US$2.3 trillion* in assets under management, including US$30 billion in target date solutions in North America as of December 31, 2014. CI Investment Consulting’s phi ...

Basics of Investment

... 2. Regular Review of Investment Policy At least once a year Adjust Risk Lower Towards Maturity 3. Regular Investments Avoid the need to time market Entry points are averaged over the long run Painful lump sum investment can be avoided ...

... 2. Regular Review of Investment Policy At least once a year Adjust Risk Lower Towards Maturity 3. Regular Investments Avoid the need to time market Entry points are averaged over the long run Painful lump sum investment can be avoided ...

Lesson 4 A cost ofcapital

... rate) paid to its bondholders Since interest is tax deductible to the firm, the actual cost of debt is less than the yield to maturity: After-tax cost of debt = yield x (1 - tax rate) ...

... rate) paid to its bondholders Since interest is tax deductible to the firm, the actual cost of debt is less than the yield to maturity: After-tax cost of debt = yield x (1 - tax rate) ...

January-March 2002

... The operating profit for the period was MSEK 96, a fall of MSEK 27 or 22% compared with the final quarter of 2001. The fall was due to lower prices which were only partly compensated for by volume increases. Compared with the previous year the operating profit was down by MSEK 11 or 10% despite sign ...

... The operating profit for the period was MSEK 96, a fall of MSEK 27 or 22% compared with the final quarter of 2001. The fall was due to lower prices which were only partly compensated for by volume increases. Compared with the previous year the operating profit was down by MSEK 11 or 10% despite sign ...

Dividend Increase Announcements and Stock Market Reaction

... In this study, there are 50 stocks selected randomly from 5 sectors (energy, industries, financial, utilities and materials) of the TSE composite index. This study will examine the effect of the announcement of dividend increase on these stocks during the period from 2001 to 2010. We will be using ...

... In this study, there are 50 stocks selected randomly from 5 sectors (energy, industries, financial, utilities and materials) of the TSE composite index. This study will examine the effect of the announcement of dividend increase on these stocks during the period from 2001 to 2010. We will be using ...

printmgr file - Goldman Sachs

... This press release contains “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements are not historical facts, but instead represent only the firm’s beliefs regarding future events, many of ...

... This press release contains “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements are not historical facts, but instead represent only the firm’s beliefs regarding future events, many of ...

Why the Mutual Fund Scandal Matters

... Mutual funds traditionally exist to offer small investors the advantages of professional money management and diversification. An investor with five thousand dollars cannot pay a professional manager a fee large enough to support the direct management of such a small amount. Mutual funds pool the in ...

... Mutual funds traditionally exist to offer small investors the advantages of professional money management and diversification. An investor with five thousand dollars cannot pay a professional manager a fee large enough to support the direct management of such a small amount. Mutual funds pool the in ...

Private equity in the 2000s

Private equity in the 2000s relates to one of the major periods in the history of private equity and venture capital. Within the broader private equity industry, two distinct sub-industries, leveraged buyouts and venture capital experienced growth along parallel although interrelated tracks.The development of the private equity and venture capital asset classes has occurred through a series of boom and bust cycles since the middle of the 20th century. As the 20th century ended, so, too, did the dot-com bubble and the tremendous growth in venture capital that had marked the previous five years. In the wake of the collapse of the dot-com bubble, a new ""Golden Age"" of private equity ensued, as leveraged buyouts reach unparalleled size and the private equity firms achieved new levels of scale and institutionalization, exemplified by the initial public offering of the Blackstone Group in 2007.