Valuation: Part I Discounted Cash Flow Valuation

... will be accented for companies that cannot move their production facilities (mining and petroleum companies, for instance)." Use of risk management products: Companies can use both options/futures markets and insurance to hedge some or a significant portion of country risk." ...

... will be accented for companies that cannot move their production facilities (mining and petroleum companies, for instance)." Use of risk management products: Companies can use both options/futures markets and insurance to hedge some or a significant portion of country risk." ...

going further to go farther

... the first few weeks of 2016, it can be easy to let emotions take over and focus only on short-term noise at the expense of long-term discipline. Although the start of the year has been weak, and we’ve seen a rise in pessimism and fear of the ‘R’ word, as investors we should continue to think long te ...

... the first few weeks of 2016, it can be easy to let emotions take over and focus only on short-term noise at the expense of long-term discipline. Although the start of the year has been weak, and we’ve seen a rise in pessimism and fear of the ‘R’ word, as investors we should continue to think long te ...

responsible investment for institutional investors in hedge funds

... There is increasing demand from pension funds (private and public), endowments and foundations to have a fully sustainable approach to their investment processes that incorporates RI practices. These investors are attracted to managers that comply with their RI demands and that consider all material ...

... There is increasing demand from pension funds (private and public), endowments and foundations to have a fully sustainable approach to their investment processes that incorporates RI practices. These investors are attracted to managers that comply with their RI demands and that consider all material ...

The Investment Process

... May also offer service to automatically move funds to an ISA each year ...

... May also offer service to automatically move funds to an ISA each year ...

(Debt/Equity Swap)? - G. William Schwert

... Exchange of equity for debt (to avoid default?) reveals bad news about the value of the firm Important to distinguish between: • recapitalization causing the drop in stock price price, and • speeding up the revelation of information that would have come out anyway ...

... Exchange of equity for debt (to avoid default?) reveals bad news about the value of the firm Important to distinguish between: • recapitalization causing the drop in stock price price, and • speeding up the revelation of information that would have come out anyway ...

The role of hedge funds (II)

... the semi-annual survey of London-based prime brokers by the Financial Services Authority (FSA) of the UK. However, as most hedge funds and their counterparties operate in the global financial markets, it is important for regulators of different jurisdictions to co-ordinate their monitoring efforts. ...

... the semi-annual survey of London-based prime brokers by the Financial Services Authority (FSA) of the UK. However, as most hedge funds and their counterparties operate in the global financial markets, it is important for regulators of different jurisdictions to co-ordinate their monitoring efforts. ...

Sources of finance

... profit after tax or if directors decide to reinvest profits. • However, raising finance by selling shares dilutes the control of the original owners. ...

... profit after tax or if directors decide to reinvest profits. • However, raising finance by selling shares dilutes the control of the original owners. ...

BH Chapter 9 The Cost of Capital

... kP = kRF + (kM - kRF)bP where bP is the project’s beta Note: investing in projects that have more or less beta (or market) risk than average will change the firm’s overall beta and required return. ...

... kP = kRF + (kM - kRF)bP where bP is the project’s beta Note: investing in projects that have more or less beta (or market) risk than average will change the firm’s overall beta and required return. ...

140225_Presentation_Intro_Update

... Note: the 11.69p could be spent on a guaranteed coupon stream, what would this be called? → A bank corporate bond ...

... Note: the 11.69p could be spent on a guaranteed coupon stream, what would this be called? → A bank corporate bond ...

The Myth of Diversification: Risk Factors vs. Asset Classes

... The Cambridge Associates U.S. Private Equity Index is based on returns data representing nearly two-thirds of leveraged buyout, subordinated debt, and specialsituations partnerships since 1986. The Cambridge Associates LLC U.S. Venture Capital Index is based on returns data compiled on funds represe ...

... The Cambridge Associates U.S. Private Equity Index is based on returns data representing nearly two-thirds of leveraged buyout, subordinated debt, and specialsituations partnerships since 1986. The Cambridge Associates LLC U.S. Venture Capital Index is based on returns data compiled on funds represe ...

MN20211A-2009 - people.bath.ac.uk

... Effort Level, Debt and bankruptcy (simple example). Debtholders are hard- if not paid, firm becomes bankrupt, manager loses job- manager does not like this. ...

... Effort Level, Debt and bankruptcy (simple example). Debtholders are hard- if not paid, firm becomes bankrupt, manager loses job- manager does not like this. ...

IEF 213 - Portfolio Management

... methodologies from a new perspective and reviews some of the new methodologies from a practical standpoint. At the heart of the discussions is the notion that analysts and investors must use not only their analytical skills but also their creative skills to determine whether a stock is fairly priced ...

... methodologies from a new perspective and reviews some of the new methodologies from a practical standpoint. At the heart of the discussions is the notion that analysts and investors must use not only their analytical skills but also their creative skills to determine whether a stock is fairly priced ...

Your pension is a team game

... • U.S. equities led the global market rally in the fourth quarter. The S&P 500 (+13.7%) was the best performing major global region in 2014. Seven out of 10 S&P 500 sectors improved during the fourth quarter, led by utilities (+13.2%) and consumer discretionary (+8.7%). Energy was the only sector t ...

... • U.S. equities led the global market rally in the fourth quarter. The S&P 500 (+13.7%) was the best performing major global region in 2014. Seven out of 10 S&P 500 sectors improved during the fourth quarter, led by utilities (+13.2%) and consumer discretionary (+8.7%). Energy was the only sector t ...

Type Title Here (20-pt Arial bold)

... This document shall be exclusively made available to, and directed at, investors domiciled in Switzerland as defined in the Swiss Collective Investment Schemes Act of 23 June 2006, as amended. Issued by BlackRock Investment Management (UK) Limited, authorised and regulated by the Financial Conduct A ...

... This document shall be exclusively made available to, and directed at, investors domiciled in Switzerland as defined in the Swiss Collective Investment Schemes Act of 23 June 2006, as amended. Issued by BlackRock Investment Management (UK) Limited, authorised and regulated by the Financial Conduct A ...

Explaining investor preference for cash dividends

... o Can manipulatae the doer’s opportunities by influencing their constraints o An indivdual who wishes to safeguard portfolio wealth may implement a rule that capital cannot be consumed, only dividends. Prospect theory (Kahnerman & Tversky) – The form in which alternatives are presented (the way de ...

... o Can manipulatae the doer’s opportunities by influencing their constraints o An indivdual who wishes to safeguard portfolio wealth may implement a rule that capital cannot be consumed, only dividends. Prospect theory (Kahnerman & Tversky) – The form in which alternatives are presented (the way de ...

Achieving the Investment Plan for Europe`s €315 billion

... across the whole of the economy. We invest into listed corporations and SMEs in all sectors, real estate, private equity funds and directly into infrastructure. Systemic risks such as climate change have a significant impact on our investments and liabilities. IIGCC has long emphasized the need for ...

... across the whole of the economy. We invest into listed corporations and SMEs in all sectors, real estate, private equity funds and directly into infrastructure. Systemic risks such as climate change have a significant impact on our investments and liabilities. IIGCC has long emphasized the need for ...

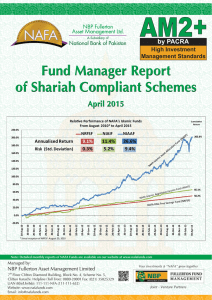

Islamic FMR- April 2015_(Complete)

... Banking, Construction and Materials, and Electricity sectors performed better than the market, while Oil and Gas, General Industrials, and Forestry & Paper sectors lagged behind. Healthy corporate earnings announcements and payouts and sanguine valuations resulted in the strong performance of bankin ...

... Banking, Construction and Materials, and Electricity sectors performed better than the market, while Oil and Gas, General Industrials, and Forestry & Paper sectors lagged behind. Healthy corporate earnings announcements and payouts and sanguine valuations resulted in the strong performance of bankin ...

The floating Greeks

... shares actually held steady in the first few days of trading, which also reflects the more upbeat tone emerging regarding tanker shares. Indeed, GMR, which had been battered in the market after a higher than expected launching price last summer, and then badmouthed at Yahoo!, has made a nice recover ...

... shares actually held steady in the first few days of trading, which also reflects the more upbeat tone emerging regarding tanker shares. Indeed, GMR, which had been battered in the market after a higher than expected launching price last summer, and then badmouthed at Yahoo!, has made a nice recover ...

Karoll Capital Management is a licensed asset manager established

... international investors to the local market. In 2012 we became the local partner of Schroders – one of the top global asset managers. The 5 Investment Pillars of Karoll Capital Management: Crisp focus on Eastern Europe ...

... international investors to the local market. In 2012 we became the local partner of Schroders – one of the top global asset managers. The 5 Investment Pillars of Karoll Capital Management: Crisp focus on Eastern Europe ...

Project finance: Transactional evidence from Australia

... for a term of years and unlike traditional procurement practices, a PPP is privately financed and requires the firm to carry responsibility for specific construction, lifecycle cost and operational risks. Risk is allocated to the party best able to manage it although this will generally be determine ...

... for a term of years and unlike traditional procurement practices, a PPP is privately financed and requires the firm to carry responsibility for specific construction, lifecycle cost and operational risks. Risk is allocated to the party best able to manage it although this will generally be determine ...

THE TRUTH ABOUT THE DIFFERENCE BETWEEN UNIT TRUSTS

... 1. Unit trusts always have a cash holding, which may vary between 0% and 25%. In a bull market such as this period where the market appreciated 16.9% p.a. well above its previous 40 year average of 12.6%, these cash holdings will reduce performance. 2. Over this five year period, resources outperfor ...

... 1. Unit trusts always have a cash holding, which may vary between 0% and 25%. In a bull market such as this period where the market appreciated 16.9% p.a. well above its previous 40 year average of 12.6%, these cash holdings will reduce performance. 2. Over this five year period, resources outperfor ...

THE TRUTH ABOUT THE DIFFERENCE BETWEEN

... 1. Unit trusts always have a cash holding, which may vary between 0% and 25%. In a bull market such as this period where the market appreciated 16.9% p.a. well above its previous 40 year average of 12.6%, these cash holdings will reduce performance. 2. Over this five year period, resources outperfor ...

... 1. Unit trusts always have a cash holding, which may vary between 0% and 25%. In a bull market such as this period where the market appreciated 16.9% p.a. well above its previous 40 year average of 12.6%, these cash holdings will reduce performance. 2. Over this five year period, resources outperfor ...

Boom and Bust of Equity Portfolio Flows to Emerging Markets A

... equities that have low R-squared values in relation to one another so as to spread his risk and diversify his investment portfolio. The results are quite interesting in that higher values are obtained for countries that are geographically close to one another. A regression encompassing Brazilian and ...

... equities that have low R-squared values in relation to one another so as to spread his risk and diversify his investment portfolio. The results are quite interesting in that higher values are obtained for countries that are geographically close to one another. A regression encompassing Brazilian and ...

MOSAX - MassMutual

... than less-flexible and/or less-concentrated investments and may be appropriate as only a minor component in an investor's overall portfolio. Participants with a large ownership interest in a company or employer stock investment may have the potential to manipulate the value of units of this investme ...

... than less-flexible and/or less-concentrated investments and may be appropriate as only a minor component in an investor's overall portfolio. Participants with a large ownership interest in a company or employer stock investment may have the potential to manipulate the value of units of this investme ...

Official PDF , 46 pages

... Bond and stock markets play a larger role and institutional investors have gained importance. Nonetheless, capital-raising activity has not expanded. A few large companies capture most of the issuances. Many secondary markets remain illiquid. The public sector captures a significant share of bond ma ...

... Bond and stock markets play a larger role and institutional investors have gained importance. Nonetheless, capital-raising activity has not expanded. A few large companies capture most of the issuances. Many secondary markets remain illiquid. The public sector captures a significant share of bond ma ...

Private equity in the 2000s

Private equity in the 2000s relates to one of the major periods in the history of private equity and venture capital. Within the broader private equity industry, two distinct sub-industries, leveraged buyouts and venture capital experienced growth along parallel although interrelated tracks.The development of the private equity and venture capital asset classes has occurred through a series of boom and bust cycles since the middle of the 20th century. As the 20th century ended, so, too, did the dot-com bubble and the tremendous growth in venture capital that had marked the previous five years. In the wake of the collapse of the dot-com bubble, a new ""Golden Age"" of private equity ensued, as leveraged buyouts reach unparalleled size and the private equity firms achieved new levels of scale and institutionalization, exemplified by the initial public offering of the Blackstone Group in 2007.