Chap021-Investors and the Investment Process

... • The tax status of pension funds makes them favor assets with the largest spread between pretax and after-tax rates of return. • Pension funds make use of immunization. • Investing in equities occurs for both correct and wrong reasons. INVESTMENTS | BODIE, KANE, MARCUS ...

... • The tax status of pension funds makes them favor assets with the largest spread between pretax and after-tax rates of return. • Pension funds make use of immunization. • Investing in equities occurs for both correct and wrong reasons. INVESTMENTS | BODIE, KANE, MARCUS ...

Transaction cost changes

... Any questions? If you have any questions or would like further information, please: > speak with your ANZ Financial Planner > email us at [email protected] or [email protected] for ANZ OneAnswer > call Customer Services on 13 38 63 weekdays 8am to 8pm (Sydney time). This information is cu ...

... Any questions? If you have any questions or would like further information, please: > speak with your ANZ Financial Planner > email us at [email protected] or [email protected] for ANZ OneAnswer > call Customer Services on 13 38 63 weekdays 8am to 8pm (Sydney time). This information is cu ...

Long-Term Investment Policy - American Speech

... represented by Moody’s) or A (as rated by Standard and Poor’s). b. There is no investment limitation on U.S. Government or U.S. Agency securities, which are direct legal obligations of the United States of America. c. The effective duration for each fixed income portfolio will not extend more than 2 ...

... represented by Moody’s) or A (as rated by Standard and Poor’s). b. There is no investment limitation on U.S. Government or U.S. Agency securities, which are direct legal obligations of the United States of America. c. The effective duration for each fixed income portfolio will not extend more than 2 ...

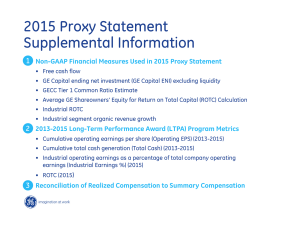

GE 2015 Proxy - Supplemental Information

... (a) Earnings-per-share amounts are computed independently. As a result, the sum of per share amounts may not equal the total. Operating earnings excludes non-service-related pension costs of our principal pension plans comprising interest cost, expected return on plan assets and amortization of actu ...

... (a) Earnings-per-share amounts are computed independently. As a result, the sum of per share amounts may not equal the total. Operating earnings excludes non-service-related pension costs of our principal pension plans comprising interest cost, expected return on plan assets and amortization of actu ...

investor sentiment indicator

... As part of our ongoing commitment to developing a deeper understanding of the attitudes, behaviours, needs and perspectives of high net worth (HNW) Australians, Westpac Private Bank is delighted to release the latest version of the quarterly Investor Sentiment Indicator. The Indicator is an aggregat ...

... As part of our ongoing commitment to developing a deeper understanding of the attitudes, behaviours, needs and perspectives of high net worth (HNW) Australians, Westpac Private Bank is delighted to release the latest version of the quarterly Investor Sentiment Indicator. The Indicator is an aggregat ...

How to Establish an Alternative Investment Fund in

... comprising one or more sub-funds. An AIF can currently take one of five forms: unit trust, investment company, common contractual fund (“CCF”), investment limited partnership and collective assetmanagement vehicle (“ICAV”). Each form of AIF may be established as an openended, closed-ended or limited ...

... comprising one or more sub-funds. An AIF can currently take one of five forms: unit trust, investment company, common contractual fund (“CCF”), investment limited partnership and collective assetmanagement vehicle (“ICAV”). Each form of AIF may be established as an openended, closed-ended or limited ...

Quarterly Investment Chartbook

... financial instrument. The investments and strategies discussed herein may not be suitable for all clients. The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations. Comerica’s Wealth Management team consists of various d ...

... financial instrument. The investments and strategies discussed herein may not be suitable for all clients. The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations. Comerica’s Wealth Management team consists of various d ...

Trends in shareholder activism

... Big-name support Perhaps one of the most significant developments is the increasing ‘activeness’ of long-term holders like the pension funds. These groups have traditionally not supported activist hedge fund campaigns on the grounds that the desired outcome of the hedge fund is a short-term capital ...

... Big-name support Perhaps one of the most significant developments is the increasing ‘activeness’ of long-term holders like the pension funds. These groups have traditionally not supported activist hedge fund campaigns on the grounds that the desired outcome of the hedge fund is a short-term capital ...

Sphere FTSE Emerging Markets Sustainable Yield Index ETF

... licensors for any errors or for any loss from use of this publication. Neither the London Stock Exchange Group companies nor any of their licensors make any claim, prediction, warranty or representation whatsoever, expressly or impliedly, either as to the results to be obtained from the use of the F ...

... licensors for any errors or for any loss from use of this publication. Neither the London Stock Exchange Group companies nor any of their licensors make any claim, prediction, warranty or representation whatsoever, expressly or impliedly, either as to the results to be obtained from the use of the F ...

Eurasia Drilling Co. 4Q12 preview – results and outlook known – but

... This report has been prepared by the analysts of Gazprombank (Open Joint Stock Company) (hereinafter – Gazprombank) and is based on information obtained from public sources believed to be reliable, but is not guaranteed as necessarily being accurate. With the exception of information directly pertai ...

... This report has been prepared by the analysts of Gazprombank (Open Joint Stock Company) (hereinafter – Gazprombank) and is based on information obtained from public sources believed to be reliable, but is not guaranteed as necessarily being accurate. With the exception of information directly pertai ...

The Trialogue on Key Information Documents for Investment Products

... such securities” (Art. 5 (2) PD). The requirements for such key information have been set by the delegated regulations changing the Regulation 809/2004 in 2012. Hence, it is the main function of the summary to provide the investor the key aspects of the financial instrument in a brief manner. In add ...

... such securities” (Art. 5 (2) PD). The requirements for such key information have been set by the delegated regulations changing the Regulation 809/2004 in 2012. Hence, it is the main function of the summary to provide the investor the key aspects of the financial instrument in a brief manner. In add ...

Hedge funds - Bank for International Settlements

... funds managed sums in the neighbourhood of $20 billion each at their peak in mid-1998. Yet the size of assets under management alone is not an accurate indicator of the potential impact of a single player on financial markets, since control over a much larger portfolio can be obtained through levera ...

... funds managed sums in the neighbourhood of $20 billion each at their peak in mid-1998. Yet the size of assets under management alone is not an accurate indicator of the potential impact of a single player on financial markets, since control over a much larger portfolio can be obtained through levera ...

Illiquid assets - Select Investment Partners

... In attempting to have the best of all worlds, we risk creating a model that may break under stress - and at the very time investors can least afford it. Some of the experiences we've had with less liquid assets over the last decade or so have also helped to refine these views. The problem with illiq ...

... In attempting to have the best of all worlds, we risk creating a model that may break under stress - and at the very time investors can least afford it. Some of the experiences we've had with less liquid assets over the last decade or so have also helped to refine these views. The problem with illiq ...

Scottish Equitable JPMorgan Mansart Risk Profile 10 Fund

... **The risk rating for each fund is based on its risk relative to other funds in our Full Fund Range. This is not the fund’s risk against industry benchmarks. We regularly review the risk ratings, so they can change. †The underlying fund gets its total return through a financial contract with JPMorga ...

... **The risk rating for each fund is based on its risk relative to other funds in our Full Fund Range. This is not the fund’s risk against industry benchmarks. We regularly review the risk ratings, so they can change. †The underlying fund gets its total return through a financial contract with JPMorga ...

Chapter 9 The Economics of Valuation

... In recent years we have seen a renewed effort to empirically attack the EMH and offer explanations for certain anomalies identified in the markets. We have seen that much of this renewed effort has stemmed from participants and academics that fall under the category of Behavioral Finance. Thus far, ...

... In recent years we have seen a renewed effort to empirically attack the EMH and offer explanations for certain anomalies identified in the markets. We have seen that much of this renewed effort has stemmed from participants and academics that fall under the category of Behavioral Finance. Thus far, ...

Power of Dividends - Investing in global dividend

... people continually consume. Moreover, they also have a20% strong brand, which is represented by customer loyalty and repeat business. These factors often translate into higher profit ...

... people continually consume. Moreover, they also have a20% strong brand, which is represented by customer loyalty and repeat business. These factors often translate into higher profit ...

schroders liquid alternatives br en

... returns throughout the market cycle by investing in large or mid-cap companies across Europe and the UK. Schroder ISF European Alpha Absolute Return aims to deliver consistent returns in all market conditions, from rising and falling equity prices. The fund invests primarily in medium-sized European ...

... returns throughout the market cycle by investing in large or mid-cap companies across Europe and the UK. Schroder ISF European Alpha Absolute Return aims to deliver consistent returns in all market conditions, from rising and falling equity prices. The fund invests primarily in medium-sized European ...

Read the report

... foreshadow private market real estate pricing. So with the equity capitalization of many REITs trading at prices well below the net asset value of their underlying real estate, private real estate valuations may need to pull back. ...

... foreshadow private market real estate pricing. So with the equity capitalization of many REITs trading at prices well below the net asset value of their underlying real estate, private real estate valuations may need to pull back. ...

Mercer Low Volatility Equity Fund M3 GBP

... Mercer Low Volatility Equity Fund M3 GBP (IE00B4607R74) (the "Fund") a sub-fund of MGI Funds plc This Fund is managed by Mercer Global Investments Management Limited OBJECTIVE AND INVESTMENT POLICY The investment objective of the Fund is to seek long-term growth of capital and income. The Fund will ...

... Mercer Low Volatility Equity Fund M3 GBP (IE00B4607R74) (the "Fund") a sub-fund of MGI Funds plc This Fund is managed by Mercer Global Investments Management Limited OBJECTIVE AND INVESTMENT POLICY The investment objective of the Fund is to seek long-term growth of capital and income. The Fund will ...

Reliance SIP Insure

... However, there will an Exit Load of 2%, if the accumulated units acquired or allotted under Reliance SIP Insure are redeemed or switched out to another scheme before the maturity of SIP tenure as opted in the respective scheme either by the SIP-Insure unitholder or by the nominee, as the case may be ...

... However, there will an Exit Load of 2%, if the accumulated units acquired or allotted under Reliance SIP Insure are redeemed or switched out to another scheme before the maturity of SIP tenure as opted in the respective scheme either by the SIP-Insure unitholder or by the nominee, as the case may be ...

Competitive Pressures - Morowitz Gaming Advisors

... spectacular rates for almost a decade, suddenly hit a wall. In fact, real growth (adjusted for inflation) from 1980 to 1984 was actually negative. As the country moved out of the early 1980s recession, the Las Vegas economy recovered, and the great wave of investment, starting with the Mirage openin ...

... spectacular rates for almost a decade, suddenly hit a wall. In fact, real growth (adjusted for inflation) from 1980 to 1984 was actually negative. As the country moved out of the early 1980s recession, the Las Vegas economy recovered, and the great wave of investment, starting with the Mirage openin ...

internationalizing the entrepreneurial firm

... Antifailure Bias versus EntrepreneurFriendly Bankruptcy Law One of the leading debates is how to treat failed entrepreneurs who file for bankruptcy. If entrepreneurship is to be encouraged, there is a need to ease the pain associated with bankruptcy by means such as allowing entrepreneurs to walk a ...

... Antifailure Bias versus EntrepreneurFriendly Bankruptcy Law One of the leading debates is how to treat failed entrepreneurs who file for bankruptcy. If entrepreneurship is to be encouraged, there is a need to ease the pain associated with bankruptcy by means such as allowing entrepreneurs to walk a ...

I_Ch03

... Dealer markets (自營商市場) – Dealers specialize in trading several assets, and make profits by purchasing these assets for their own accounts and sell them later – Dealers act as intermediate buyers/sellers – Bid (asked) price is the price at which a dealer is willing to buy (sell) the asset – Dealer ma ...

... Dealer markets (自營商市場) – Dealers specialize in trading several assets, and make profits by purchasing these assets for their own accounts and sell them later – Dealers act as intermediate buyers/sellers – Bid (asked) price is the price at which a dealer is willing to buy (sell) the asset – Dealer ma ...

Monthly Percentage Returns: Pro

... The information in this document is not to be construed as an offer to buy or sell or a solicitation of an offer to buy or sell any financial instrument or to participate in any trading strategy in any jurisdiction in which such an offer or solicitation would violate applicable laws or regulations. ...

... The information in this document is not to be construed as an offer to buy or sell or a solicitation of an offer to buy or sell any financial instrument or to participate in any trading strategy in any jurisdiction in which such an offer or solicitation would violate applicable laws or regulations. ...

Private equity in the 2000s

Private equity in the 2000s relates to one of the major periods in the history of private equity and venture capital. Within the broader private equity industry, two distinct sub-industries, leveraged buyouts and venture capital experienced growth along parallel although interrelated tracks.The development of the private equity and venture capital asset classes has occurred through a series of boom and bust cycles since the middle of the 20th century. As the 20th century ended, so, too, did the dot-com bubble and the tremendous growth in venture capital that had marked the previous five years. In the wake of the collapse of the dot-com bubble, a new ""Golden Age"" of private equity ensued, as leveraged buyouts reach unparalleled size and the private equity firms achieved new levels of scale and institutionalization, exemplified by the initial public offering of the Blackstone Group in 2007.